I've been in the SEO and traffic game for years, and if there's one thing that's universally true across industries, it's the grind. That endless, soul-sucking search for the next opportunity. For us, it’s a keyword. For a real estate investor, it’s a property. And for M&A folks, entrepreneurs, and private equity sharks, it’s a deal. For them, the grind involves sifting through stale listings, sending cold emails that never get a reply, and trying to get past the world's most stubborn gatekeepers. It’s exhausting.

We’ve all been there, right? Staring at a spreadsheet at 10 PM, fueled by lukewarm coffee, wondering if there’s a better way. What if you could spend less time hunting and more time... you know, actually making deals?

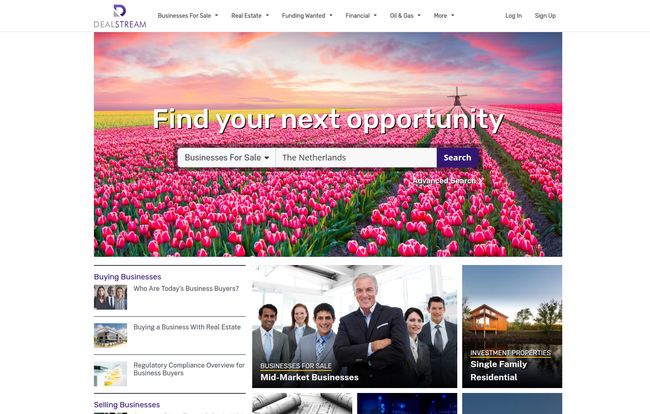

That’s the big, shiny promise of a platform I’ve been looking at called Dealstream. And I have to say, it’s not just another dusty business-for-sale directory. It’s trying to be something more.

So, What Exactly is Dealstream?

At first glance, Dealstream presents itself as the “#1 deal sourcing platform for dealmakers and entrepreneurs.” That’s a pretty bold claim in a crowded market. But as I dug in, I realized they're not just a listings board. Think of it more like a weird but potentially brilliant mashup: it's got the professional networking of LinkedIn, the deep-diving search power of a specialized search engine, and the exclusive access of a secret, well-guarded rolodex. All in one place.

The entire platform is built to connect the dots in the often-fragmented world of M&A. It’s for people looking to buy a business, people looking to sell one, and the investors who want to fund the whole operation. It’s an ecosystem, not just a tool.

Visit DealStream

The Three Pillars of Dealstream's Approach

From what I can gather, their whole strategy seems to rest on three core ideas. And honestly, they're the right ones to focus on.

Finding Deals Faster Than Your Morning Coffee

Dealstream talks about using “proprietary social intelligence” to search the “entire web for deals.” Okay, buzzwords aside, what does that likely mean? My guess is it's a sophisticated AI that scours not just public listings, but news articles, social media chatter, and financial reports for signals that a company might be ripe for a sale or seeking investment. It's about finding the breadcrumbs that lead to an opportunity before a “For Sale” sign ever goes up. This is a world away from refreshing teh same old websites and seeing listings that have been there for six months.

Tapping into the “Hidden” Market of Deals

This is the part that really got my attention. Dealstream claims to tap into the private market for deals you won’t find anywhere else. They’re talking about off-market deals, unique financial assets, and exclusive funding sources. For anyone in M&A or private equity, off-market opportunities are the holy grail. Why? Less competition, better terms and you get to feel like a genius.

I’ve always been a bit cynical about platforms promising this, because it's incredibly hard to deliver. But the way they talk about it—as a core function, not an afterthought—is compelling. If they can truly deliver a consistent stream of quality, non-public deals, that alone could be a game-changer.

It's Not Just What You Know, It's Who You Find

A database of deals is one thing. A network is something else entirely. Dealstream boasts a community of over 100,000 dealmakers—business owners, fund managers, private investors, you name it. This shifts the platform from a simple search tool to a networking powerhouse. You’re not just finding a listing; you’re finding the person behind it. The ability to cut through the noise and connect directly with a decision-maker is huge. It transforms a cold lead into a warm conversation, which is where real business gets done.

Who Is This Platform Actually For?

It's definitely not for everyone. This is a professional-grade tool. Based on its features and messaging, here’s who I think would get the most out of it:

- The Ambitious Entrepreneur: Someone looking to acquire their first business or expand their current empire through a strategic purchase. They need deal flow without hiring a whole team.

- The M&A Professional: I’m talking corporate development folks and investment bankers who live and die by their pipeline. The efficiency here could save them hundreds of hours.

- The Private Equity Investor: PE funds are always on the hunt for that undervalued asset. The promise of off-market deals is music to their ears.

- The Business Owner Eyeing an Exit: Even if you're not ready to sell, a platform like this is perfect for discreetly checking the market temperature, seeing what similar businesses are going for, and maybe even connecting with potential suitors on your own terms.

What's the Catch? A Look at Dealstream's Pricing

Alright, let's talk about the elephant in the room: the cost. If you go to their website, you won’t find a neat little pricing table. Nada. And based on the info I have, a public pricing page doesn't exist.

In my experience, this usually means one of two things. Either it’s a premium, enterprise-level tool with a price tag to match, or they use a consultative sales approach where they want to talk to you first to tailor a package. This is super common for high-value B2B services. They want to filter out the casual browsers from the serious players. Personally, I prefer transparent pricing, but I get the strategy. If your tool can help someone close a multi-million dollar deal, a subscription cost of a few thousand dollars is just a rounding error.

Beyond the Deals: A Surprising Content Hub

Here’s something that caught me off guard. When you look at their resources, it’s not all just dry analysis of M&A trends. They have articles on real estate, lifestyle topics like European travel, and even life hacks. At first I thought, what is this? But then it clicked. They understand their audience. The person looking to buy a $10 million company is also probably interested in alternative investments, optimizing their life, and what to do with their money. It's a smart content play that builds a brand around the entire lifestyle of a successful entrepreneur or investor, not just their 9-to-5 grind.

My Final Thoughts: Is Dealstream Worth a Look?

After crawling through what Dealstream offers, I’m genuinely intrigued. It’s an ambitious platform that’s trying to solve a very real, very expensive problem: inefficient deal sourcing.

The combination of AI-powered search, a focus on off-market deals, and a robust professional network is a powerful trifecta. It moves beyond being a simple database and becomes a strategic asset.

Of course, some might argue that no platform can ever replace a handshake and a good old-fashioned network built over decades. And they’re not wrong. But tools like this aren't meant to replace relationships; they're meant to accelerate them. Why spend six months trying to find the right person to talk to when a platform can connect you in six minutes? For serious players in the M&A and investment space, getting a demo seems like a no-brainer. It might just be the most valuable call you make this quarter.

Frequently Asked Questions about Dealstream

- What is Dealstream's main purpose?

- Dealstream is a deal sourcing platform designed to help entrepreneurs, investors, and M&A professionals find, connect, and close business deals, including business acquisitions, investments, and funding opportunities.

- How does Dealstream find its deals?

- It uses what it calls “proprietary social intelligence,” likely an AI-driven system, to scan the entire web for deal signals, going beyond traditional public listings to uncover opportunities.

- Is Dealstream just for buying businesses?

- No. While buying and selling businesses is a core function, it’s also a platform for finding investment opportunities, securing funding, and networking with over 100,000 other dealmakers in various industries.

- Are there really off-market deals on Dealstream?

- This is one of its main selling points. The platform focuses on uncovering opportunities in the private market that aren't publicly advertised, which is a significant advantage for its users.

- How much does Dealstream cost?

- Dealstream does not publicly list its pricing. This typically indicates a premium service where pricing is tailored to the user's needs, requiring you to contact them for a demo or a quote.

- Who should use Dealstream?

- The platform is best suited for serious professionals involved in high-stakes transactions, such as private equity investors, M&A advisors, corporate development teams, and entrepreneurs looking to buy, sell, or expand a business.

Conclusion

The world of deal-making is notoriously opaque and inefficient. It’s a space crying out for innovation. While no technology is a silver bullet, platforms like Dealstream are pushing things in the right direction. By combining smart data analysis with a powerful professional network, they're clearing a path through the jungle of modern commerce. If you're tired of the old grind, it might be time to see how a little bit of new-school tech can fuel your next big opportunity.

Reference and Sources

- Dealstream Official Website

- Forbes: Three M&A Trends To Watch In 2024

- Axial: Sourcing Off-Market Deals