Nobody likes tax season. For years, it’s been this annual ritual of dread. You either spend a weekend wrestling with confusing DIY software that feels like it was designed in 1998, or you hand over a shoebox of receipts to a local CPA and pray the final bill doesn’t require a second mortgage. It’s a choice between a headache and a heart attack. I've been in the digital marketing and business world for years, and I've seen it all.

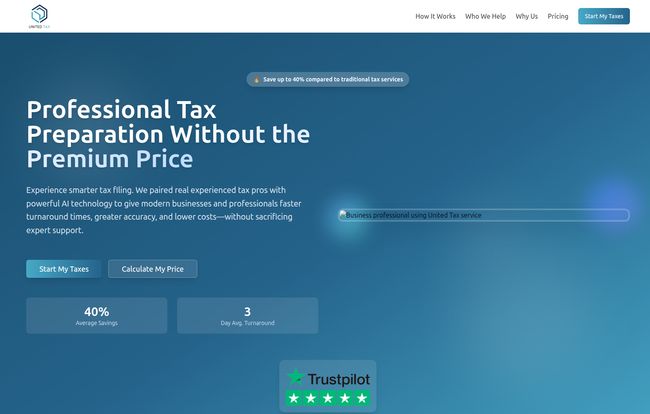

But what if there was a third option? Something that blended the affordability and speed of tech with the actual brainpower of a real, live human being. That’s the promise of platforms like UnitedTax.AI, and I have to admit, I was intrigued. They’re talking about pairing AI with experienced tax pros to make the whole process faster, cheaper, and more accurate. Sounds great, but does it actually deliver?

So, What is UnitedTax.AI, Really?

Think of it like this: UnitedTax.AI isn't just another tax software. It’s a hybrid service. It’s not a robot filing your taxes, and it's not a traditional accountant charging by the hour. It’s a Cyborg CPA. The AI does the heavy lifting—sifting through thousands of tax rules, flagging potential deductions, and organizing everything with frightening efficiency. But then—and this is the important part—a licensed tax professional reviews everything before it gets filed. You get the best of both worlds: machine speed and human oversight.

They’re specifically targeting the folks who often get stuck in the middle: small business owners, freelancers, tech employees with funky equity compensation, and real estate investors. The people whose taxes are too complicated for a simple 1040-EZ, but maybe don't require a massive, old-school accounting firm. It’s a smart niche.

Visit UnitedTax.AI

A Tax Process That Actually Makes Sense

Their whole process is broken down into three steps, and honestly, the simplicity is a huge selling point. It cuts out the noise and the back-and-forth that drives everyone crazy.

- The Quick Start: You log in, answer some basic questions, and securely upload your documents (W-2s, 1099s, expense reports, etc.) to your private portal. This part takes minutes. No scheduling an appointment three weeks out.

- The Waiting Game (but a short one): Their team—the AI and the human experts—gets to work. They claim an average turnaround of just three days. In the world of tax prep, that’s basically light speed, especially during peak season.

- Review and Relax: Once your return is ready, you get a notification. You just have to review it, sign it electronically, and they e-file it for you. Done. Fast, accurate, and complete.

Who Is This Platform Actually Built For?

UnitedTax.AI is pretty clear about who they can help the most. It's not a one-size-fits-all solution, and that's a good thing. Specialization means they understand the specific pains of their target users.

Small Business Owners and Freelancers

If you run an LLC or S-Corp, or you're a contractor juggling 1099s and business expenses, you know the struggle. Maximizing deductions is everything. UnitedTax.AI’s AI is designed to catch every possible business expense, from home office deductions to software subscriptions. This is their bread and butter. Just look at this quote from one of their users:

"UnitedTax.AI saved me thousands in deductions I would have missed while cutting my tax prep costs in half. Their AI found business expenses I forgot about, and my tax professional answered all my questions promptly. Best tax experience I've had in 10 years of running my business."

- Sarah J., Small Business Owner, Atlanta

Tech Employees with Stock Options

Oh, the joy of equity compensation. RSUs, ISOs, ESPPs... they’re awesome until you have to figure out the tax implications. This is where most off-the-shelf software falls flat, and many traditional CPAs who don’t specialize in tech can get it wrong. UnitedTax.AI specifically calls out their expertise in RSU vesting tax strategy and ISO calculations, which is a massive green flag for anyone in the tech industry.

Real Estate Investors

Another group with uniquely complex taxes. Depreciation schedules, property-related deductions, and the holy grail of 1031 exchanges are not for the faint of heart. Having a service that understands the nuances of real estate investment can make a huge difference in your final tax bill.

Let's Talk Money: The UnitedTax.AI Pricing

Here’s where things get interesting. One of the biggest complaints about accountants is the surprise bill at the end. UnitedTax.AI aims to fix that with transparent, flat-rate pricing. It’s refreshing.

| Plan | Base Price | Best For |

|---|---|---|

| Personal | $250 | Individuals & freelancers with single income sources. Covers W-2s, 1099s, state + federal filing, and refund maximization. |

| Business | $550 | Business owners, LLCs, S-Corps, C Corps & multi-income sources. Includes deduction optimization, quarterly tax planning, and year-round support. |

Now, they call it a "base price." In my experience, that usually means very complex situations—like if you're running a multinational crypto-mining operation out of your basement—might cost more. But for the vast majority of their target users, this flat fee is likely what you'll pay. It's a huge step up from the opaque billing practices of the past.

A Glimpse Into What's Coming Next

A company's roadmap tells you a lot about their long-term vision. UnitedTax.AI isn't just stopping at tax prep. They have a "Coming Soon" section that hints at a much bigger financial ecosystem. They’re planning to launch:

- Ledger IQ: An AI-powered bookkeeping tool.

- RSU Tracker: For simplified management of stock grants and options.

- AI Rental Property Manager: To help with financial tracking and management for property owners.

This tells me they’re not just a one-trick pony. They're building a suite of tools to be a year-round financial partner, which adds a lot of value and inspires confidence.

My Honest Take: The Pros and The 'Could-Be-Betters'

Alright, so after digging through everything, here’s my take. I really like the model. The speed, accuracy, and lower cost are obvious wins. The combination of AI for deduction maximization and a human expert for the final review is the secret sauce here. It provides peace of mind that you just dont get from DIY software.

On the flip side, it's a growing platform. The fact that services like Ledger IQ and the RSU Tracker are "coming soon" means you're not getting a fully integrated financial suite today. Also, the "base price" structure means there's a small chance your super-duper-complex tax situation could cost more, though I suspect that’s a rare exception. These aren't deal-breakers, just realities of a new and evolving service.

Final Thoughts: Is UnitedTax.AI Worth It?

For the right person, absolutely. If you’re a small business owner, a freelancer, a tech professional with equity, or a real estate investor who is tired of the old way of doing taxes, UnitedTax.AI presents a compelling alternative. It’s modern, it’s efficient, and it’s transparently priced.

It strikes a fantastic balance. You’re not alone, clicking through endless software menus, but you’re also not paying exorbitant hourly fees for routine work. It’s like having a hyper-efficient assistant who preps everything perfectly before the boss—your dedicated tax pro—gives the final approval. In the ever-changing world of business and finance, this kind of smart, streamlined service is exactly where things are headed.

Frequently Asked Questions

- Is UnitedTax.AI safe to use with my financial information?

- Yes. According to their site, they use a secure platform with bank-level encryption and security protocols to protect all your sensitive data.

- Can I use UnitedTax.AI if I'm just a freelancer with a single 1099?

- Absolutely. The Personal plan, starting at $250, is designed specifically for individuals and freelancers, including support for 1099s and business expense deductions.

- What if my tax situation is extremely complicated?

- The base pricing covers most scenarios for their target clients. If you have a particularly unique or complex situation, your best bet is to schedule a quick chat with their team to get a clear quote before you start.

- How is this different from a service like TurboTax?

- The key difference is the human element. While TurboTax has options for expert help, UnitedTax.AI includes a review by a licensed tax professional in its core service. It's less of a DIY tool and more of a done-for-you service.

- How long does the tax filing process actually take?

- They advertise an average turnaround time of just 3 days from when you submit your documents to when your return is ready for review. This is significantly faster than many traditional CPAs, especially during the busy tax season.