Ever get that feeling you're late to the party? You see a stock pop 30% and then the news breaks about their killer new product. By the time you read about it in the Wall Street Journal, the smart money has already cashed out and is on to the next thing. It’s frustrating. For years, we've been told to pour over earnings reports and P/E ratios—and don't get me wrong, that's still crucial. But it’s like trying to drive a car by only looking in the rearview mirror. You see where you've been, but not where you're going.

This is where the game is changing. The secret sauce isn't just in the SEC filings anymore. It’s in what people are searching for on Google, complaining about on Reddit, or bragging about on TikTok. This is the world of "alternative data," and it's giving some investors a serious, almost unfair, advantage. And a platform like TickerTrends is aiming to put that power right at your fingertips.

What Exactly Is This "Alternative Data" Buzz?

Okay, let's cut through the jargon. "Alternative data" is basically any information that can give you a clue about a company's performance outside of its official financial statements. Think of it as the market's body language. It's the digital breadcrumbs we all leave behind.

- Social Media Mentions: Is a new skincare brand suddenly blowing up on TikTok?

- Web Traffic: Is footlocker.com getting way more visits this quarter? (Thanks, Similarweb!)

- Google Searches: Are searches for "electric vehicle charging stations" spiking in a specific region?

- Employee Satisfaction: Are reviews on Glassdoor suddenly tanking for a major tech company?

This isn't fluff. This is real-time, ground-level intelligence. It's the difference between knowing a restaurant had a great last quarter and knowing their tables are booked solid for the next three months. One is history; the other is a forecast.

A Closer Look at TickerTrends

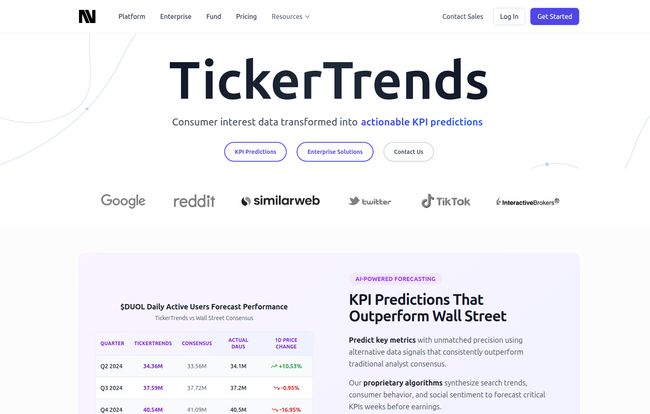

So, TickerTrends wades into this massive ocean of data and tries to make sense of it all. They call themselves a "search engine for consumer alternative data," which is a pretty apt description. Instead of just giving you a raw feed of gobbledygook, it's designed to connect the dots between online chatter and real-world company performance. It’s not just another charting tool with a few extra bells and whistles; it’s a fundamentally different way of looking at the market.

The Core Features That Actually Matter

You can get lost in feature lists, but a few things on this platform really stand out to me. The Universal Search is the heart of it all. You can type in a company, a product, or a theme, and it pulls data from all its sources—social, search, web traffic—into one place. It’s like having a team of a thousand interns constantly scouring the web for you.

Then there's the Exploding Trends feature. This is the fun one. It's designed specifically to spot those early-stage trends that are just starting to gain momentum. It’s the closest thing I’ve seen to a digital crystal ball for spotting the next big thing before it hits the mainstream. We're talking about finding the next Stanley cup craze before every influencer has one.

And for the real data nerds, the KPI Predictions are where the rubber meets the road. TickerTrends uses its data to forecast Key Performance Indicators—things like subscriber growth for Netflix or active users for Pinterest—before the company officially announces them. This is the kind of stuff that moves markets.

Visit TickerTrends

Where Does TickerTrends Get Its Intel?

A tool like this is only as good as its sources. You can have the fanciest algorithm in the world, but if you feed it garbage, you’ll get garbage out. TickerTrends seems to understand this. They pull from a pretty wide array of sources, including:

- Search Engines: Google Trends data to see what the world is curious about.

- Social Media: They tap into the zeitgeist of Reddit, X (yeah, I still want to call it Twitter), and TikTok.

- Web Analytics: Data from partners like Similarweb gives them a peek into website traffic patterns.

- Consumer Behavior: They also track signals related to consumer spending and market signals.

By blending these different streams, they create a much more textured picture than you'd get from just one source alone. It helps smooth out the noise and find the real signals.

So, Is TickerTrends a Crystal Ball or Just a Fancy Dashboard?

Alright, let's get real. No platform can predict the future with 100% accuracy. If it could, its creator would be on a private island, not selling subscriptions. So what’s the reality of using a tool like TickerTrends?

The Good Stuff and The Edge It Gives You

The biggest advantage is timeliness. You’re not waiting for a quarterly report to tell you that Peloton's sales are slowing down; you can potentially see the signals weeks or months in advance as social media chatter wanes and web traffic drops. It's about shifting from reactive to proactive investing.

I also appreciate that it brings institutional-grade analytics to a wider audience. For a long time, this kind of data was the exclusive playground of multi-billion dollar hedge funds. TickerTrends is part of a movement that's democratizing access. And honestly, the interface is pretty clean. It’s complex under the hood, but you dont need a Ph.D. in quantitative analysis to find your way around.

The Not-So-Good Stuff and The Reality Check

Now for the cold water. First, the price. We'll get to the specifics, but the Core plan is about a thousand bucks a year. That’s a non-starter for many casual investors. This is a tool for people who are serious, and have the capital to justify the cost.

Second, data can be messy. Social media sentiment can be manipulated by bots. A spike in search traffic could be for negative reasons. You still need a human brain to interpret the data and understand the context. This platform doesn't give you a simple "BUY" or "SELL" signal. It gives you evidence, and you have to be the detective. It requires a new skill set, and if you're not willing to learn how to analyze alternative data, the platform's value drops significantly.

Let's Talk About the Price Tag

Money talks. So what does access to this kind of insight cost? TickerTrends has a tiered structure that’s pretty common in the SaaS world.

| Plan Name | Price | Best For |

|---|---|---|

| Free Plan | $0 | A quick peek. It's a limited preview to see if the platform's vibe is for you. |

| TickerTrends Core | $998 / year or $98.70 / month | Serious individual investors or small teams who want the core trend-spotting tools. |

| TickerTrends Enterprise | Custom Pricing | Hedge funds, asset managers, and corporate clients needing full API access, team features, and dedicated support. |

My take? The free plan is a no-brainer to try out. The Core plan is a serious commitment. You'd need to be managing a decent-sized portfolio and have a strategy that can actually capitalize on these insights to make the ROI work. The Enterprise plan is clearly for the big leagues.

Who Should Actually Use TickerTrends?

This tool isn't for everyone, and that’s perfectly fine. I see a few key groups who could really get a lot of value from it.

- Hedge Fund Analysts and Quants: This is their bread and butter. They have the skills and the need for this kind of data.

- Serious Retail Investors: I’m not talking about someone who just bought a few shares of Apple. I mean someone who actively manages their portfolio, understands options, and has a thesis-driven approach to investing.

- Venture Capitalists: Spotting macro consumer shifts is critical for VCs looking for the next big industry to back.

- Corporate Strategy & Marketing Teams: Imagine being able to track your competitor's web traffic and social sentiment in real-time. It’s a powerful competitive intelligence tool, not just an investment one.

If you're a beginner just learning what an ETF is, this is probably overkill. Stick to the basics first. But if you’re looking for that next level of insight, this is a space worth exploring.

My Final Thoughts on TickerTrends

After spending time looking at TickerTrends, I'm genuinely intrigued. It represents a major shift in how market analysis can be done. It's moving the goalposts from analyzing the past to interpreting the present in real-time. It’s not a magic eight-ball, but it is a powerful compass.

It gives you the ability to form a hypothesis—"I think interest in at-home fitness is declining"—and then instantly test it with real-world data. That's a powerful thing. The catch, of course, is the cost and the learning curve. It’s a professional tool with a professional price tag. But for the right kind of investor or analyst, the edge it could provide might be well worth the investment. It’s a glimpse of the future, and for those ready to embrace it, the future looks pretty interesting.

Frequently Asked Questions About TickerTrends

Here are some common questions I've seen pop up about the platform.

What is TickerTrends in simple terms?

TickerTrends is an investment research platform that analyzes "alternative data" like social media buzz, Google searches, and web traffic to find investment opportunities before they become common knowledge.

Where does TickerTrends get its data from?

It aggregates data from a wide variety of public sources, including Google, Reddit, TikTok, and X (formerly Twitter), along with data from partners like Similarweb for web analytics.

How often is the information updated?

The platform is built on providing real-time financial intelligence, so the data is updated very frequently to reflect the current digital landscape.

Is there a free trial for TickerTrends?

Yes, they offer a free plan that provides a limited preview of the platform's capabilities. It's a great way to get a feel for the tool before committing to a paid plan.

Is TickerTrends a good tool for beginners?

In my opinion, probably not. It’s best suited for intermediate-to-advanced investors and professionals who understand how to interpret complex data sets and have a strategy to act on the insights.

Can I export data or integrate it with my own tools?

Yes, the TickerTrends Enterprise plan offers full API access, allowing you to pull their data into your own custom models and dashboards.

Conclusion

To wrap it all up, the era of relying solely on traditional financial reports is slowly but surely coming to an end. The market is a living, breathing thing, and its pulse can now be measured in clicks, shares, and searches. Tools like TickerTrends are the stethoscopes for this new age of investing. It’s not a replacement for sound financial judgment, but as a supplementary tool for finding an edge? It’s one of the most compelling options I’ve seen in a long time. For those willing to look beyond the balance sheet, there's a whole new world of information out there.