If you’re a trader, you know the grind. The endless hours spent glued to a screen, eyes bleary, fueled by a questionable amount of coffee. You're hunting for that perfect setup, that one tiny blip on the radar that could signal the next big move. We've all been there, flipping between a dozen tabs, trying to correlate data, and fighting off a serious case of FOMO. It’s exhausting. Frankly, somedays it's just a massive headache.

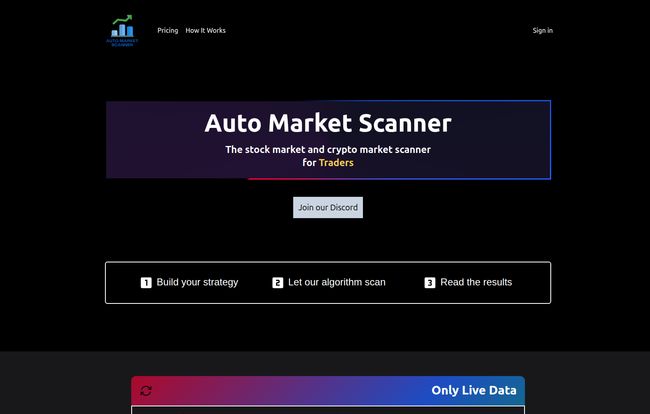

What if you could reclaim that time? What if you could have a tireless assistant scanning the crypto and stock markets for you, 24/7, based on your exact rules? That’s the promise of a new tool I’ve been playing with called Auto Market Scanner. And I have to say, I’m intrigued.

The Grind is Real and So Is The Burnout

Before we get into the nuts and bolts, let’s just sit with that pain point for a minute. The manual scanning process is… a lot. You’re not just looking at prices. You’re tracking volume, looking for specific candlestick patterns, checking RSI levels, maybe even cross-referencing news or social media sentiment. It’s a full-time job on top of your full-time job. And the worst part? You can do everything right and still miss an opportunity because you blinked. Or slept. How rude.

This is where trading automation tools come in. I’ve seen a bunch, from complex enterprise-level platforms to sketchy-looking scripts. Finding one that hits the sweet spot between powerful and user-friendly is the holy grail. So, does Auto Market Scanner deliver?

So, What Is Auto Market Scanner, Really?

In a nutshell, it’s an automated scanner for both stock and crypto traders. The premise is beautifully simple: 1. Build your strategy. 2. Let their algorithm scan. 3. Read the results.

You’re not handing over your portfolio or letting a bot make trades. You're using it as an advanced alert system. It's like having a team of tireless research interns who never sleep, never complain, and only drink electricity. They constantly scour the markets and just tap you on the shoulder when they find something that matches the exact criteria you laid out. Pretty cool, right?

Visit Auto Market Scanner

Live Data is a Non-Negotiable

Here’s the first thing that got my attention: Only Live Data. Their site states, "Our data is fetched every time a scan is made, no old data!" This is huge. In markets that move as fast as crypto, stale data is worse than no data at all. It leads to bad decisions and missed entries. Knowing that every scan is pulling fresh information is a massive confidence booster. They also mention a reliable Node.js backend for 100% uptime, which is the kind of nerdy detail I appreciate. It means they're serious about the tech.

Crypto and Stocks Under One Roof

I dabble in both worlds—swing trading some tech stocks and keeping an eye on promising altcoin projects. Usually, this means having two completely different sets of tools and browser tabs open. The fact that Auto Market Scanner supports both crypto and the stock market is a massive quality-of-life improvement. It simplifies the workflow immensely.

Building Your Strategy and The All-Important Pricing

This is where the rubber meets the road. A scanner is only as good as the strategies you can build with it. The platform allows you to create custom strategies and sub-strategies. This means you can get pretty granular, telling it to look for a specific set of conditions before it alerts you.

Of course, this power is tied to their pricing plans. Let's break it down, because this is where you'll decide if it's right for you. They offer a 7-day free trial on all plans, which is a great way to test the waters without commitment.

| Plan Name | Price per Month | Key Limits | Who It's For |

|---|---|---|---|

| Retail Trader | $10 | 3 Strategies, 3 Substrategies, 2 Scans/week | The casual trader or someone just starting out with automation. |

| Next Level Retail Trader | $30 | 10 Strategies, 10 Substrategies, 5 Scans/week | Serious hobbyists or part-time traders who need more frequent updates. |

| Market Insider | $50 | 10 Strategies, 10 Substrategies, 50 Scans/week | Active day traders or anyone who needs near-constant market intelligence. |

The main limitation here is clearly the number of scans per week on the lower tiers. Two scans a week on the base plan feels a bit light for active trading, but for a long-term investor looking for specific entry points, it might be perfectly fine. The jump to 50 scans/week on the 'Market Insider' plan is significant and clearly aimed at the power user. The pricing seems pretty reasonable across the board, especially when you calculate the value of the time you get back.

My Honest Verdict: Is It Worth The Subscription?

So, the big question. Do I think it's worth it? In my experience, yes, with a small caveat. The value of this tool is directly proportional to how much you value your time. If you’re a professional trader, the $50/month for the Market Insider plan is a drop in the bucket compared to the edge that 50 weekly scans could give you. It's a business expense, plain and simple.

For the rest of us, the $10 or $30 plans are very compelling. For less than the cost of a few oat milk lattes, you can automate the most tedious part of your trading process. That's a win. My one hesitation is the scan limit on the base plan—I'd personally spring for the $30 'Next Level' tier to get those 5 weekly scans. That feels like a much more usable frequency for staying on top of market movements.

I did notice the 'Manage' buttons on the pricing page are grayed out. This could just be a visual choice for the public-facing site to encourage sign-ups, or maybe it’s tied to the trial status. It's a minor quirk but one I noticed. Overall, though, the platform feels clean, focused, and built to solve one problem very, very well: saving you from the soul-crushing grind of manual market scanning.

Frequently Asked Questions

- What markets does Auto Market Scanner support?

- It supports both the crypto and stock markets, which is a major convenience for traders who are active in both.

- How often is the data updated?

- The platform prides itself on using only live data. A new pull of data is fetched every single time you run a scan, so you're not working with outdated information.

- Can I request a custom strategy implementation?

- The FAQ on their site suggests this is a possibility. For highly specific or proprietary indicators, it seems like you can reach out to their team to discuss implementation. This is a great feature for advanced traders.

- Is this tool good for beginners?

- I'd say yes. The "Build, Scan, Read" concept is very straightforward. While you need to understand the basics of what makes a good trading setup to build an effective strategy, the tool itself doesn't have a steep learning curve. The free trial is a perfect way for a new trader to experiment.

- Does the tool trade for me?

- No, and this is an important distinction. It's a scanner and an alert system, not an automated trading bot. It finds the opportunities for you; you still have the final say on whether to pull the trigger on a trade.

Final Thoughts on Reclaiming Your Time

At the end of the day, tools like Auto Market Scanner are about leverage. They allow you to multiply your presence in the market without having to be physically present for every tick of the chart. It's about working smarter, not harder. For me, anything that helps me step away from the screen more often, while still feeling confident I'm not missing out, is a massive win.

If you're tired of the chart-gazing grind, I'd genuinely recommend giving the 7-day trial a spin. Set up a simple strategy, let it run, and see what it finds. You might be surprised at how much peace of mind—and free time—it gives you back.