The amount of financial news, data, and hot takes thrown at us every single day is... a lot. It’s a firehose of information, and if you’re trying to intelligently invest your own money, it feels like a full-time job just to keep up. I spend my days swimming in data for SEO and traffic, and even I get overwhelmed by the sheer volume of stock market noise. You find a company that looks interesting, and suddenly you're drowning in a dozen tabs of SEC filings, analyst ratings, and week-old news that might already be irrelevant.

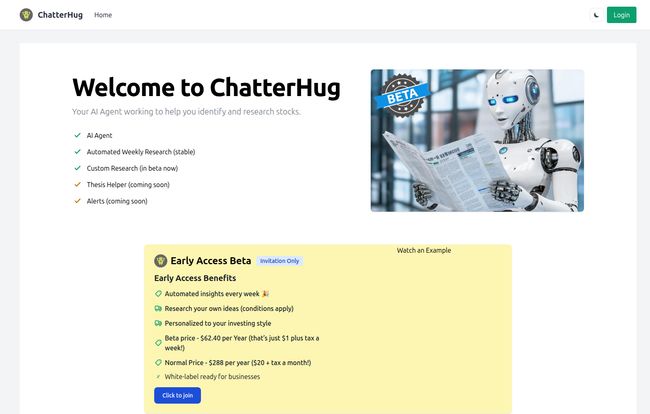

For years, the promise of AI in finance has been dangled in front of us. Mostly, it’s been about high-frequency trading bots for the big Wall Street firms. But now, we're seeing a new wave of tools aimed at regular people. Tools like ChatterHug. When I first heard about it—an AI agent that does your investment research for you—my skepticism alarm went off. Another magic black box promising to make me rich? Hard pass.

But then I looked a little closer. And what I found was... actually pretty interesting. This isn't about giving you stock picks. It’s about being your personal, tireless research assistant.

So, What Exactly is ChatterHug?

Think of it this way: instead of hiring a junior analyst to fact-check your investment ideas, you get an AI. ChatterHug is designed to automate the grunt work. It scans huge piles of stocks, market data, news stories, and corporate events to generate research reports. But here's the twist, and it's the part that got my attention: you define the rules. You give it your investment thesis, your criteria, the specific things you care about. It’s less of a stock-picking guru and more of a super-powered metal detector. You still have to decide where to point it, but it does all the heavy scanning for you.

Visit ChatterHug

The Big Idea: Finally Putting You in the Driver’s Seat

I’ve always been wary of generic financial advice. The “5 Stocks to Buy Now” articles are great for clicks, but they have no idea about my personal risk tolerance, my financial goals, or the fact that I might not want to invest in, say, fossil fuels or fast fashion. Your strategy is unique. My strategy is unique. So why should our research be one-size-fits-all?

This is where ChatterHug seems to be breaking from the pack. It’s built on the idea that the investor—that’s you—should be in control. Instead of passively consuming whatever research a publication decides to push that week, you're actively telling the AI, “Hey, go look for companies that fit this specific mold.” It’s a fundamental shift from being told what to think to having a tool that helps you think better. I gotta say, I really like that philosophy.

A Look Under the Hood: The ChatterHug Features

Alright, let’s get into what it actually does. The platform is still in its early days, so some of this is here now, and some is on the horizon.

Automated Weekly Research: Your Personal Scout

Right now, ChatterHug will automatically dig into emerging trends each week and send you the research. It’s a nice way to get some ideas flowing and see what the AI is capable of. The plan, they say, is to let users customize this down the line, so you can tell it to only focus on a specific sector or industry you’re passionate about. That’s when this feature will really shine.

Custom Research: The On-Demand Deep Dive

This is probably the most powerful feature, even in its current private beta state. Heard about a company from a friend? Saw a headline that piqued your interest? You can tell ChatterHug to perform a deep research dive on that specific stock. This moves it from a discovery tool to a validation tool, which is incredibly useful for cutting through the hype and getting to teh data.

The “Coming Soon” Crew: Thesis Helper & Alerts

I’m genuinely excited about the Thesis Helper. A lot of people struggle to even articulate their investment strategy. A tool that can help you build and refine your thesis could be a game-changer. The Alerts feature is more standard—notifications on stock price movements—but a necessary component for any serious investment tool.

My Honest Take: The Good, The Bad, and The Beta

Okay, no tool is perfect, especially one that’s proudly waving a “Beta” flag. So let’s break it down.

The biggest pro is the time it saves. Seriously. The hours I've lost down research rabbit holes... I'll never get them back. Handing that initial legwork over to an AI that works while I sleep is a massive value proposition. I also love, as I've mentioned, the user-in-control ethos. It empowers you rather than prescribing to you.

Now, for the reality check. It’s in Early Access Beta. That means you're not getting a perfectly polished, bug-free product. You're an early adopter. Some features are still on the roadmap, not in your dashboard. If you're someone who needs everything to work perfectly right out of the box, you might want to wait. But if you like being on the ground floor of new tech and are okay with a few bumps, this is the time to get in.

Let's Talk Money: The ChatterHug Pricing

Pricing is always the million-dollar question, isn't it? Or in this case, the sixty-two dollar question.

| Plan | Price | Description |

|---|---|---|

| Early Access Beta | $62.40 / Year | Invitation-only price for early adopters. Works out to about $5.20 a month. |

| Normal Price | $288 / Year | Standard price after the beta period. Works out to $24 a month. |

My take? The $62.40/year early access price is a fantastic deal. It's a very low-risk bet on a platform with a ton of potential. You're essentially locking in a 78% discount for life. The full price of $288/year puts it into a different category. At that price, it needs to have all its features fully built out and running smoothly to compete. But for sixty bucks? It feels like a bargain for the time it could save me in just one or two investment decisions.

So, Who is ChatterHug Actually For?

I don't think this tool is for everyone. If you're a complete beginner who doesn't know the difference between a P/E ratio and a dividend, this might be too much, too soon. It's a research tool not a school.

But I see a couple of people who would love this:

- The Time-Crunched Professional: You have a demanding job, maybe a family, and you have some money you want to invest smartly. You just don’t have 10-15 hours a week to dedicate to research. This tool does the heavy lifting for you.

- The DIY Investor Who Wants an Edge: You already know your way around the market. You have your own ideas and strategies, but you want to speed up your workflow and validate your theses with data-driven reports. This is your AI sidekick.

It's not for the day trader looking for millisecond advantages or the passive investor who just wants to buy an index fund and forget about it for 30 years.

Frequently Asked Questions

Is ChatterHug a robo-advisor that invests my money for me?

Absolutely not. It's a crucial distinction. A robo-advisor takes your money and invests it based on an algorithm. ChatterHug is a research tool. It provides you with data and reports based on your criteria, but you are 100% in control of buying or selling. It doesn't even connect to your brokerage account.

Does ChatterHug give financial advice?

Nope. And that's a good thing. It provides automated, data-driven research. The 'advice' comes from you, through the thesis you build and the companies you choose to investigate. All final investment decisions are your own.

How is this different from just using Yahoo Finance?

Yahoo Finance and similar sites are fantastic resources, but they are passive and manual. You have to go find the information. ChatterHug automates and personalizes the process. It actively pushes research to you based on your specific, pre-defined interests, saving you the manual searching.

Is the Early Access price worth it if some features are missing?

In my personal opinion, yes. If you fit the profile of a DIY investor who's short on time, paying the beta price is a small investment to lock in a huge future discount on a potentially powerful tool. You're betting on the team and their vision.

What kind of data does ChatterHug analyze for its research?

Based on their site, it scans a wide range of inputs including stock data, overall market data, financial news from various sources, and corporate events. The goal is to create a holistic picture, not just look at the stock price.

My Final Thoughts on ChatterHug

I'm cautiously optimistic. I’ve seen a lot of tech fads come and go, but the core idea behind ChatterHug feels solid. It’s not trying to be a magic bullet. It’s trying to be a better shovel. It’s a tool designed to help you dig more efficiently, guided by your own treasure map.

The success of ChatterHug will depend on how well it delivers on its promises, particularly the Thesis Helper and expanded customization. But for now, as an early-stage product with a compelling price point, it’s one of the more interesting new players in the retail investing space. I'll definitely be keeping an eye on this one.