If you run a SaaS platform for small business owners, you know the grind. You build an amazing product, you get users in the door, and then you face the two-headed monster that keeps every founder up at night: churn and Lifetime Value (LTV). You can run CPC campaigns until you're blue in the face, but if you're not keeping users around and growing their value, you're just treading water. It's a constant battle to become indispensable.

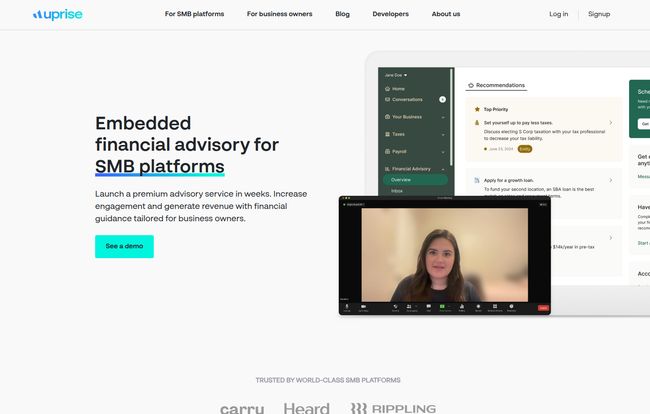

For years, we've tried to solve this with more features, better UI, slicker onboarding. And that all helps. But what if the answer isn't another feature, but a deeper relationship? I stumbled across a company called Uprise recently, and their approach got the gears in my old SEO brain turning. They're not selling another plugin; they're selling a way to embed a full-blown financial advisory service right into your own platform. Think of it as giving every one of your SMB users their own financial co-pilot.

It sounds ambitious, maybe a little too good to be true. So, I did what I do best: I dug in. Is this the future of SMB platforms or just another fancy gimmick?

So, What is Uprise, Really?

At its core, Uprise gives you the tools to offer high-quality financial planning to your customers, under your own brand. It’s designed for platforms that serve the people who are the backbone of our economy but are often the most underserved financially: freelancers, creators, restaurant owners, real estate agents, you name it. These aren't Wall Street suits; they're people juggling inventory, clients, and their own family’s finances, often from the same bank account.

Uprise allows your platform to become their central hub for not just running their business, but for managing their entire financial life. And that, my friends, is sticky. When you're helping someone plan for retirement, optimize their investments, and save on taxes, they aren't going to churn over a $20/month price increase.

The “AI + Human” Secret Sauce: Is It Just Hype?

Okay, here’s the part that caught my eye. We’ve all seen the rise of robo-advisors. They're cheap, scalable, and… well, robotic. They're great for basic stuff but fall apart with the beautiful messiness of a small business owner's life. On the flip side, a human Certified Financial Planner (CFP®) is the gold standard, but they're expensive and can only handle so many clients.

Uprise’s entire model is built on what they call a “human+AI” approach. Their tagline for it is refreshingly simple:

“AI generates the first draft. We add a human touch.”

I love that. It’s not promising some magical AI that understands human emotion. It’s positioning AI as what it is: an incredibly powerful tool for efficiency. The AI does the heavy lifting—analyzing data, running projections, and flagging opportunities. Then, a real, living, breathing CFP® comes in to review the plan, add nuance, and actually talk to the business owner. This hybrid model seems to be the sweet spot, a way to provide personalized, high-quality advice at a scale that was previously impossible.

Visit Uprise

It's a smart answer to a long-running industry debate. You get the scale of tech without sacrificing the trust and expertise that only a human can provide. Frankly, for something as personal as money, I’m not sure I’d ever be comfortable with a purely algorithmic advisor making the final call.

The Tangible Benefits for Your Platform

This all sounds great for the end-user, but what about for you, the platform owner? This is where the business case gets really interesting.

Unlocking Genuinely New Revenue Streams

This isn't about upselling another tier with more reports. This is about offering a new, premium service. According to Uprise’s site, platforms that use their service see users paying 3-4x more, with an average revenue per user of around $2,000. Let that sink in. That's a game-changer for most SaaS business models. It turns your platform from a simple tool into a high-value partnership.

Making Your Product Stickier Than Gorilla Glue

We already touched on this, but it’s worth repeating. Churn is the silent killer of SaaS. By embedding financial advisory, you're weaving your product into the very fabric of your customer's financial life. You're no longer just “the invoicing software” or “the booking platform.” You're the place they go to make their most important financial decisions. Good luck to any competitor trying to poach a customer that integrated.

The Power of a Truly Holistic View

Uprise allows you to see a customer’s full financial picture, including assets they hold on other platforms. This is huge. It means the advice isn't given in a vacuum. It also opens the door for smarter, more relevant cross-selling. Instead of just blasting your user base with an offer for a business loan, you can present the offer at the exact moment their financial plan shows they need capital to grow. That's not just selling; it's problem-solving.

How Does The Integration Actually Work?

“This sounds complicated,” I hear you say. And I had the same thought. The thought of dealing with financial regulations and complex APIs is enough to give me a migraine. But Uprise seems to have anticipated this. They offer two main paths:

- A White-Labeled Solution: This is the fast track. You can essentially launch their solution with your branding on it in a matter of weeks. It's a pre-built experience that you can plug right in.

- Custom APIs: For those who want more control (and have the dev resources), you can use their APIs to build a completely custom experience. You can pick and choose the components you want and integrate them natively into your existing UI.

Crucially, they claim to handle the security and regulatory overhead. As someone who has dipped a toe in the fintech world, I can tell you this is a massive, massive value-add. Navigating that world of compliance is a full-time job in itself, and offloading that is a huge win.

Let's Be Real: The Potential Quirks and Considerations

No review is complete without looking at the other side of the coin. No service is perfect, and from my digging, here are a few things to keep in mind.

First, the tax preparation services are facilitated by Uprise but actually handled by third-party accountants. This isn’t necessarily a bad thing—it's often better to have specialists—but it’s a detail worth knowing. It's not an all-in-one shop in that specific regard. Same goes for investment advice, which is technically provided by a related but legally separate entity, Uprise Advisers LLC. This is pretty standard stuff in the financial world for compliance reasons, but it’s good to be aware of the structure.

The other thing is pricing. It's not listed on their site. This is typical for enterprise or B2B solutions, as the price likely depends on your scale and needs. But it does mean you can’t just window shop; you have to get on a call to get the numbers. A minor annoyance in the grand scheme of things.

My Final Take on Uprise

So, where do I land? I'm genuinely intrigued. In a world where every SaaS company is scrambling for a competitive edge, Uprise is offering a path that's less about features and more about fundamental value. The idea of moving from a simple tool provider to a trusted financial partner is powerful.

The hybrid AI-and-human model feels right for the moment—pragmatic, scalable, and trustworthy. For the right kind of platform, one that serves a community of small business owners, this could be more than just a new revenue stream. It could be a transformation of the entire business model.

Is it for everyone? Probably not. But if your goal is to build deep, long-lasting relationships with your users and you're looking for your next big move, getting on a call with these folks seems like a pretty smart use of an hour.

Your Uprise Questions, Answered

Is Uprise a direct financial advisor?

Not exactly. Uprise is a technology company that provides the software and service for other platforms (like yours) to embed financial advisory into their own offerings. The advice comes from their team, but it's delivered through your platform.

Who actually provides the financial advice?

The advice is generated by a combination of Uprise's AI technology and then reviewed, refined, and delivered by human Certified Financial Planners (CFP®s).

How much does Uprise cost?

Uprise does not publish its pricing publicly. It’s a B2B solution, so pricing is likely customized based on your platform's size and needs. You’ll need to schedule a call with their team to get a quote.

Can I customize the look and feel to match my brand?

Yes. They offer a white-labeled solution for quick deployment that uses your branding, as well as a more flexible API for building a fully custom and native integration.

Does Uprise handle my customers' taxes?

Uprise facilitates tax preparation through a network of unaffiliated third-party accountants. So while they connect your customer to the service, they don't provide the tax prep directly.

Is Uprise secure for my customers' financial data?

According to their website, Uprise handles the security and regulatory compliance overhead associated with offering financial advice, which is a major component of their service.

Reference and Sources

- Uprise Official Website

- Certified Financial Planner Board of Standards, Inc. (CFP Board)

- Fintech's Final Frontier: The End of Standalone Fintech (a16z)