Let’s talk. If you’ve ever spent a Tuesday night staring into the abyss of a 150-page 10-K, with your eyes glazing over and Ctrl+F as your only trusted companion, you know the pain. It’s a rite of passage for anyone serious about investing or equity research. We do it because we have to. We’re hunting for that one sentence, that one number in a footnote, that changes everything. But honestly? It's a grind.

For years, we've had powerful, and eye-wateringly expensive, terminals. We've had data aggregators. But the actual process of reading and digesting the source documents hasn't changed all that much. It's still a brute-force activity. At least, it was. The new wave of AI is starting to knock on the doors of Wall Street, and I’ve just stumbled upon a new tool called Unlevered that’s making some pretty big promises. It’s still in beta, but what I’m seeing has me… intrigued.

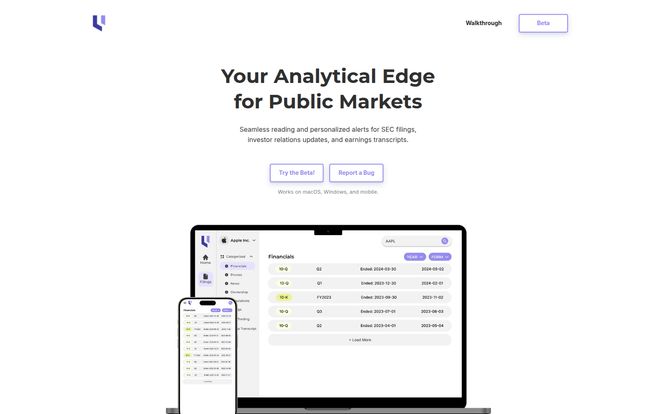

What Exactly is Unlevered?

In short, Unlevered is positioning itself as your analytical sidekick for the public markets. It’s an AI-powered platform designed to make reading SEC filings, earnings transcripts, and investor updates not just easier, but smarter. The headline on their site is bold: save equity researchers hundreds of hours monthly. That's a claim that makes you sit up and pay attention.

Visit Unlevered

The core idea isn’t to replace the analyst. I think that's a common fear. Instead, it’s about augmenting them. It’s about taking the most time-consuming, soul-crushing parts of due diligence and automating them, so you can spend more of your brainpower on actual analysis and critical thinking. Think of it less as a self-driving car and more as the best darn GPS system you’ve ever used. It gives you the map and points out the traffic jams, but you're still the one driving.

The Features That Actually Matter

A tool is only as good as its features, right? A slick landing page is nice, but I want to know what it does for me when I’m deep in the weeds of a quarterly report. Unlevered breaks it down into a few key areas that directly address the pain points I mentioned earlier.

Taming the 10-K with AI Summaries

This is the big one. Unlevered says its in-house LLM can take that dense financial jargon and turn it into “digestible bullet points.” This is the holy grail for me. It’s not about dumbing it down, but about cutting through the clutter. If the AI can accurately pull out the key risks, the new business developments, or the major shifts in financial position, it transforms your workflow. You go from searching for a needle in a haystack to having the needle presented to you on a silver platter. Well, hopefully.

Playing Spot the Difference, But for Filings

Okay, this is clever. The platform has a feature to compare financial filings year-over-year and detect subtle language changes. Anyone who's done this manually knows that's where the story often lies. Why did they change the wording from “significant competition” to “intense competition”? Why was a specific risk factor added or removed? Manually comparing two 100+ page documents is a nightmare. Automating it is a genuine game-changer, assuming the AI is sharp enough to catch the nuances.

A Smarter Ctrl+F for Your Research

The keyword search is a basic but essential function. Unlevered’s version lets you search across all of a company's filings and specified time periods. So instead of opening 12 different PDFs to search for “supply chain disruption,” you can do it in one go. It’s a simple quality-of-life improvement that adds up to a lot of saved time.

Alerts and Screeners So You Don’t Miss a Thing

This is where the tool gets proactive. You can set up alerts for new filings from companies you follow, or even for specific keywords. Imagine getting a ping the moment a competitor mentions your company’s new product in their 10-Q. That's powerful stuff. The sector screeners let you do the same for entire industries, which is great for thematic research. You're not just reacting to news; you're getting the source material the second it drops.

Keeping an Eye on the Insiders

The platform also offers insights into insider trading. While this data is publicly available through Form 4 filings, having it integrated and easy to parse within the same ecosystem you’re using for other research is a definite plus. It helps you build a more complete picture of what's happening inside a company.

The “Coming Soon” Hype Train

Now, two of the most interesting features are still listed as “Coming Soon”: AI Search and AI Alerts. This is where things could get really futuristic. AI Search promises to understand context, not just keywords. So you could theoretically ask, “What are the company’s biggest challenges in the European market?” and it would understand the intent of your question. AI Alerts would go beyond simple keyword matches, alerting you to concepts and topics relevant to your interests. This is ambitious, and I’m both excited and a little skeptical. Getting this right is incredibly difficult, but if they pull it off… wow.

My Honest Take on Unlevered (The Good and The Not-So-Good)

So, let's get down to it. No tool is perfect, especially one in beta.

On the plus side, the potential for time-saving here is immense. It's a tool built by people who clearly understand the drudgery of financial research. The focus on simplifying jargon, comparing documents, and providing intelligent alerts addresses real, tangible problems. It’s not just tech for tech's sake. The interface looks clean and modern, which is more than I can say for some of the legacy systems out there.

However, there are caveats. It's in beta, which means you should expect some bugs. The “Report a Bug” button is front and center for a reason. More fundamentally, you are placing a degree of trust in an AI. An LLM can hallucinate or misinterpret complex legalese. You can't outsource your critical thinking. This tool is a powerful assistant, but you're still the boss. You have to verify the output, especially on crucial decisions. Don't let your AI assistant turn into HAL 9000 and lock you out of the pod bay doors because it misunderstood a footnote about debt covenants.

So, How Much Does This Magic Cost?

This is the million-dollar question, isn't it? As of right now, there is no public pricing page. I clicked around and even found a “No such page” error, which tells me they're likely still figuring it out while it’s in beta. My educated guess? This won’t be free forever. Given the target audience of equity researchers and serious investors, I expect a monthly or annual subscription model. It will need to be priced competitively, somewhere well below a Bloomberg terminal but reflecting the serious value it provides. For a solo analyst or a small fund, a few hundred dollars a month for a tool that saves dozens of hours would be an absolute bargain.

Who is Unlevered Actually For?

I don't think this is for the casual investor who buys a few shares of Apple based on a news headline. This is for the people in the trenches. The professional equity analyst at a hedge fund or an investment bank is the obvious user. But I also see a huge market with the 'prosumer' retail investor—the type of person who runs their own concentrated portfolio and does their own deep-dive research. If you’ve ever found yourself happily lost in the SEC EDGAR database on a weekend, then yeah, this tool is probably for you.

In the end, Unlevered is a really promising development. It’s tackling a genuine, long-standing problem with modern technology. The move from manual, repetitive data gathering to AI-assisted analysis feels inevitable, and Unlevered is an exciting early contender. I’m eager to see it evolve out of beta and watch how those “Coming Soon” features pan out. It might just become the new must-have tool in the serious investor’s arsenal.

Frequently Asked Questions About Unlevered

- What is Unlevered?

- Unlevered is an AI-powered software platform designed to help investors and analysts read, search, and understand SEC filings, earnings transcripts, and other financial documents more efficiently. It uses AI to summarize complex text, compare documents, and provide personalized alerts.

- Is Unlevered free to use?

- Currently, Unlevered is in a public beta phase, which you can try. However, there is no long-term pricing information available yet. It is likely that it will become a paid subscription service after the beta period ends.

- How does Unlevered's AI work?

- The platform uses an in-house Large Language Model (LLM), a type of artificial intelligence trained on vast amounts of text, to understand and process the language in financial documents. It's specifically tailored to parse the unique jargon and structure of things like 10-K and 10-Q reports.

- Can I trust the AI summaries completely?

- While the AI is designed to be highly accurate, it should be used as an assistant, not a replacement for human judgment. As a best practice, especially for critical investment decisions, you should always treat AI-generated summaries as a starting point and verify the information by checking the source document.

- What makes Unlevered different from just searching EDGAR?

- The SEC's EDGAR database is a fantastic repository of documents, but it's just that—a database. Unlevered adds a layer of intelligence on top. It doesn't just store the files; it helps you search across all of them at once, compares them for changes, summarizes key sections, and alerts you to new information automatically, saving significant manual effort.

- Is Unlevered suitable for beginner investors?

- While it could certainly help a beginner understand complex documents, its feature set is geared more towards serious individual investors, financial professionals, and equity analysts who regularly perform deep due diligence on public companies.