If you're in finance, fintech, or anything even remotely touching a regulated industry, you know the feeling. That little knot in your stomach when you hear about a new directive from the EBA or a fresh piece of legislation coming down the pipeline. Compliance isn’t just paperwork; it’s a full-blown, multi-headed hydra, and every time you chop off one head, two more seem to grow back. I've spent years watching companies, big and small, throw people and money at this problem, and it's a battle that never seems to end.

It's a constant fire-drill. Someone on the team spends their days doom-scrolling through dense, jargon-filled regulatory portals, trying to translate legalese into actionable business rules. It’s tedious, it's expensive, and honestly, it’s prone to human error. A missed update or a misinterpreted clause can lead to some seriously hefty fines. We've all seen the headlines.

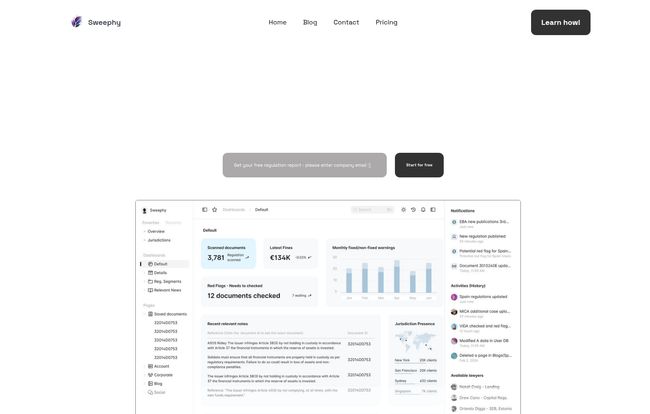

So, when I came across a platform called Sweephy, my inner SEO-slash-tech-nerd sat up and paid attention. They’re making a bold claim: using AI to automate the whole messy process. But is it just another fancy dashboard with a bunch of buzzwords, or is there something genuinely useful here? Let's get into it.

So, What on Earth is Sweephy?

Think of Sweephy as a super-smart research assistant who's had way too much coffee and can read thousands of pages of regulatory text without getting bored or needing a bathroom break. It’s a SaaS (Software as a Service) platform designed to pull in, clean up, and make sense of data, with a special focus on the delightful world of regulatory compliance.

In their own words, it’s a no-code platform that uses machine learning and natural language processing (the same kind of tech behind things like ChatGPT) to monitor regulatory changes in real-time. It’s specifically built for folks in the trenches: Fintechs struggling to keep up with rules across the EU, small banks who don’t have a 50-person compliance department, and even stock traders who know that a regulatory shift can make or break a portfolio.

Basically, instead of you having to check 27 different EU regulatory portals, Sweephy does it for you. It's a watchdog, an interpreter, and an alarm system all rolled into one slick package.

Visit Sweephy

The Features That Actually Move the Needle

A feature list is just a list until you understand how it solves a real-world problem. Sweephy has a bunch of them, but a few stand out to me as being the core of its value.

The AI-Powered Watchdog: Constant Regulation Monitoring

This is the big one. Sweephy’s “Regulatory Crawling” feature is its eyes and ears. It continuously scans official sources for new documents, updates, and amendments. For anyone who's ever had to manually check the BaFin or AMF websites daily, this alone is a huge deal. It’s like having an automated sentinel guarding you from surprise attacks. The platform taps directly into the data sources, so you're not getting second-hand information; you're getting it straight from the horse’s mouth, just… faster.

Turning Bureaucratic Gobbledygook into Actionable Insight

Okay, so it finds the documents. So what? A 300-page PDF of impenetrable legalese is still a 300-page PDF of impenetrable legalese. This is where the “Regtech LLM Powered Analysis” comes in. It uses AI to read and understand the content. It’s designed to flag key changes, identify obligations, and summarize the important bits so you don't have to. It transforms a wall of text into, “Hey, this new rule applies to you, and here’s what you need to do.” That's a powerful shift from reactive panic to proactive strategy.

Your Personal Compliance Alarm System

Information is useless if it arrives too late. Sweephy’s custom notifications and “Instant Red Flag Alerts” are designed to prevent just that. You can set it up to ping you about the specific regulations that matter to your business. Is there a new capital requirement rule affecting small banks? Ping. A change in cross-border payment processing for fintechs? Ping. It turns the firehose of information into a targeted stream, delivered right to you when it happens. No more discovering a critical update a week after the fact.

My Honest Take: The Good, The Bad, and The... Opaque

Alright, no tool is perfect. As someone who's seen more than his fair share of SaaS platforms, I'm always a little skeptical. Here's my breakdown of Sweephy.

What I really like is the sheer simplification of it all. The core idea is brilliant because it tackles one of the most painful, un-glamorous, and critical parts of running a financial business.

The user interface, from what I can see in the demos, looks clean and intuitive. It's not some clunky, early-2000s enterprise software that requires a PhD to operate. It presents complex information in a digestible way with dashboards and alerts, which is exactly what you want. The direct integration with regulatory sources provides a layer of trust that’s absolutely critical. And the real-time nature of the alerts is, without a doubt, a massive advantage.

However, there are a couple of things that give me pause. The first and most obvious is the pricing. It’s nowhere to be found on the website. But we'll get to that in a second.

The other concern is more philosophical. There's a risk of becoming too reliant on a tool like this. An AI is a powerful assistant, but it’s not a substitute for an experienced human compliance officer. You can't just set it and forget it. You still need someone who understands your business context to interpret the AI’s findings and make the final call. It's a classic conundrum in the world of automation—it makes experts more efficient, but it doesn't replace them. Anyone who thinks otherwise is in for a rude awakening.

The Elephant in the Room: What's the Price Tag?

So, you click on the “Pricing” page, ready to see the standard three-tiered options... and you get a nice, clean, and completely empty page that says, “Choose the plan that’s right for your business” before prompting you to “Contact Us.”

Ah, the classic enterprise SaaS move. While it can be a bit frustrating for someone just trying to scope things out, it’s not surprising. The lack of public pricing usually means a few things:

- It's not cheap. Let's just be upfront about that. Tools that solve high-value problems (like avoiding million-euro fines) command high-value prices.

- Pricing is highly customized. The needs of a two-person fintech startup are vastly different from a medium-sized regional bank. Sweephy likely tailors its packages based on the number of users, the specific jurisdictions you need to monitor, and the level of support required.

- They want to talk to you. This model forces a sales conversation, allowing them to demonstrate the value of the platform before you get sticker shock. It's a valid strategy, but it means you'll have to invest some time in a demo to get a number.

My guess? You're looking at a subscription that probably runs into the hundreds or thousands of dollars per month, depending on your scale.

Your Sweephy Questions, Answered

Is Sweephy a complete replacement for my compliance team?

Absolutely not. And anyone who tells you an AI can replace your legal or compliance team is selling you snake oil. Sweephy is a force multiplier. It empowers your experts by handling the grueling, time-consuming data gathering and initial analysis, freeing them up to focus on strategic implementation and nuanced decision-making.

What specific regulations does Sweephy cover?

Based on their site, the primary focus is on the regulatory portals for 27 EU countries, which is a massive footprint. They specifically call out solutions for fintechs and small banks, so think things like PSD2, MiCA, anti-money laundering (AML) directives, and capital requirements regulations. Since they offer custom solutions, they can likely target other jurisdictions as well.

Is it hard to get started with Sweephy?

It's positioned as a “no-code” platform, which is industry-speak for “you don’t need to be a developer to use it.” The goal of platforms like this is to be as user-friendly as possible. I would expect a guided onboarding process to help you set up your custom alerts and dashboards.

How do I know the information from Sweephy is accurate?

This is a crucial question. Sweephy's main selling point is its use of “Regulatory Crawling,” which means it connects directly to the official regulatory bodies' websites and portals. This direct line to the source is the best way to ensure the data is authentic. The AI's job is to analyze and summarize that authentic data.

Why dont they just list their prices?

It's almost certainly because their pricing is custom. The cost for a small stock trading advisor monitoring one country's regulations will be very different from a multinational fintech monitoring all 27 EU states. A “Contact Us” model allows them to build a quote that matches the customer's specific needs.

So, is Sweephy the Future of Regtech?

Look, the world of RegTech is blowing up for a reason. The old way of doing things—manual checks, spreadsheets, and endless meetings—is breaking under the weight of modern regulation. It's slow, inefficient, and risky.

A tool like Sweephy represents the path forward. It’s not magic, and it’s not going to solve all your problems with the click of a button. But it automates the most soul-crushing part of the process, allowing smart people to do smarter work. It’s about shifting from a defensive, fearful stance on compliance to an offensive, informed one.

If you're in a position where regulatory changes can make or break your quarter, then exploring a platform like Sweephy isn't just a good idea; it's probably a necessity. It’s an investment in sanity, security, and staying ahead of the curve. And in this industry, staying ahead is the only way to play the game.

Reference and Sources

For more information directly from the source, you can visit the official website:

- Sweephy Official Website: https://sweephy.com/