If you're serious about investing, you know the grind. The endless hours spent poring over 10-K reports, the red-eyed nights trying to decipher the nuances of an earnings call transcript, the feeling that you're searching for one critical sentence buried in a 200-page document. It can feel like trying to find a specific needle… in a continent-sized haystack of other needles. I've been there. For years, my research process was a chaotic mess of browser tabs, spreadsheets, and way too much caffeine.

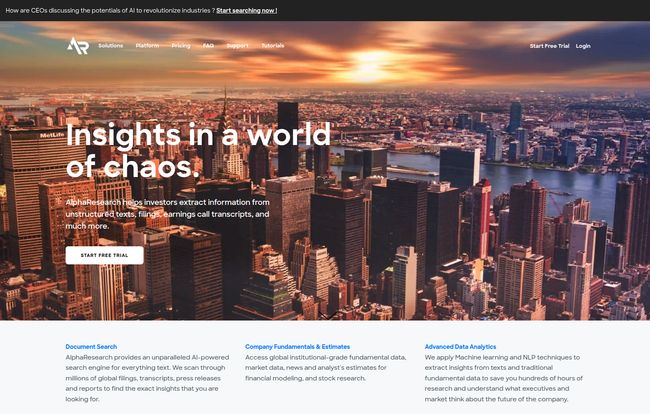

Then I started hearing whispers in the fintech world about a new breed of tools. AI-powered platforms promising to do the heavy lifting. One name that kept popping up was AlphaResearch. Their tagline is all about finding “insights in a world of chaos,” and honestly, that spoke to me on a spiritual level. So, I decided to take it for a spin. Is it just another overhyped AI gadget, or is it the real deal for generating alpha? Let’s get into it.

Visit AlphaResearch

So, What Exactly is AlphaResearch Anyway?

Think of AlphaResearch less like a traditional stock screener and more like a specialized search engine for investors. It's an AI platform designed specifically to read and understand the massive amounts of unstructured text that companies publish. We're talking SEC filings, press releases, global financial reports, and those all-important earnings call transcripts. It uses some pretty slick AI, machine learning, and Natural Language Processing (NLP) to scan millions of these documents in seconds.

The whole point is to cut through the noise. Instead of you manually reading an entire quarterly report to see how many times a company mentioned “supply chain issues,” you can just ask AlphaResearch. It’s designed to be that smart assistant who’s already done the reading for you. A true needle-finder in the haystack.

The Features That Actually Make a Difference

A platform is only as good as its tools. While AlphaResearch has a long list of features, a few really stood out to me as genuine game-changers for my workflow.

The AI-Powered Search is a Monster

This is the heart of the platform. The ability to search for specific keywords or concepts across a universe of documents is just… powerful. For example, before a recent tech investment, I wanted to see every time the CEO and their main competitors mentioned “AI integration” in their earnings calls over the last two years. A task that would have taken me an entire weekend of painstaking work took about 30 seconds on AlphaResearch. This is the core value proposition, and they absolutely nail it. It saves an insane ammount of time.

Sentiment Analysis Lets You Read Between the Lines

Okay, this is the cool part. The part that feels like a superpower. AlphaResearch's sentiment analysis tool doesn't just count keywords; it tries to understand the tone. It can detect changes in language during an earnings call, for instance. Did the CEO sound more or less confident when talking about future guidance compared to last quarter? It can also spot “sentiment divergence,” like when an executive is saying positive things, but the underlying data or analyst questions hint at trouble. It’s not foolproof, of course—AI is still learning nuance—but it’s an incredible tool for flagging areas that need a closer human look.

Beyond Search: Data, Collaboration, and More

While the search is the star, the supporting cast is strong. The platform pulls in company fundamentals and analyst estimates, so you have hard numbers right alongside the textual insights. There's also a surprisingly useful 'Notebook' feature. You can highlight snippets from documents, add your own notes, and share your findings with colleagues. It turns a solo research mission into a collaborative effort, which is a nice touch for teams.

Who is This Really For?

I’ve played with a lot of platforms, and it’s clear who gets the most out of this one. AlphaResearch is a fantastic fit for:

- Serious Retail Investors: If you've graduated from simply buying ETFs and want to do deep dives on individual stocks, this gives you institutional-grade power without the insane price tag.

- Financial Analysts & Portfolio Managers: The time-saving aspect alone is worth the price of admission. It automates the most tedious parts of the job.

- Corporate Strategists: Need to keep a close eye on competitors, track industry trends, or perform market research? This is a goldmine.

Who should probably skip it? If you're a brand-new investor who finds a P/E ratio intimidating, this might be overkill. It’s a professional-grade tool, and you need a solid foundation in financial concepts to really make it sing.

Breaking Down the Cost: AlphaResearch Pricing

Alright, let's talk about the price tag. The good news is, it's not a Bloomberg Terminal. You won't need to remortgage your house. They have a pretty straightforward pricing structure.

| Plan | Price | Key Details |

|---|---|---|

| Basic | $49.99 /month (Billed quarterly) | Best for individuals focused on the US market. Includes search for SEC filings, transcripts, alerts, sentiment analysis, etc. Comes with a 7-day free trial. |

| Enterprise | Custom Pricing | Designed for firms and teams. Includes global coverage (SEDAR, etc.), research reports, Excel/Sheets add-ons, and dedicated support. |

The one thing to flag: the free trial requires a credit card. It’s a common practice to reduce abuse, but it's something to be aware of. Set a reminder if you just want to test it out.

The Good and The Not-So-Good

No tool is perfect. After spending some time with it, here's my honest take:

What I loved was the sheer depth of the insights and the quality of the data. It genuinely reduces research time from days to minutes. The advanced analytics, especially the sentiment analysis, feel like you're unlocking a new level of research. Plus, having global market coverage on the Enterprise plan is a huge win for those of us who look beyond the S&P 500.

On the flip side, the Basic plan is limited to the US market. If your strategy involves international stocks, you’ll need to spring for the Enterprise plan. And naturally, the most powerful, game-changing features are behind that paywall. But honestly, that's to be expected. They've built a powerful engine here, and it's fair that they charge for it.

Frequently Asked Questions

- 1. In simple terms, what is AlphaResearch?

- It's an AI-powered search engine that reads financial documents like SEC filings and earnings calls for you, helping you find critical information and insights much faster than doing it manually.

- 2. Is AlphaResearch a good tool for beginners?

- It's probably best for intermediate to advanced investors. While it simplifies the research process, you still need a good understanding of financial concepts to interpret the results effectively.

- 3. How is AlphaResearch different from a Bloomberg Terminal?

- Think of it as a specialized, more accessible alternative. Bloomberg is an all-encompassing behemoth with a much, much higher price tag. AlphaResearch focuses specifically on excelling at textual search and analysis, offering a massive part of that value at a fraction of the cost.

- 4. Can I research international stocks on AlphaResearch?

- Yes, but you'll need the Enterprise plan, which provides global coverage including documents from exchanges like Canada's SEDAR and others.

- 5. Is the 7-day free trial really free?

- Yes, but it does require a credit card to get started. You can cancel before the trial ends to avoid being charged, which is a pretty standard industry practice.

The Final Verdict: Is AlphaResearch Worth It?

So, we circle back to the main question. Is AlphaResearch worth the investment? In my opinion, for the right person, absolutely. It's a powerful, well-designed tool that solves a very real and very tedious problem. It’s a force multiplier for research.

If you're a serious investor or analyst who understands that the real edge often lies hidden in the fine print, this platform could become your new best friend. It transforms the drudgery of data gathering into the exciting work of connecting the dots. It doesn't make the investment decisions for you, but it gives you a clearer, faster, and deeper perspective to make your own. And in a world of chaos, that clarity is worth its weight in gold.