Investing can feel like you're trying to drink from a firehose. A firehose of data, opinions, jargon, and outright noise. You've got talking heads on TV screaming about the next big thing, financial reports that read like legal documents, and a market that seems to move on a whim. For years, the big hedge funds with their armies of analysts and fancy algorithms had an undeniable edge. The rest of us? We were left trying to piece it all together from scraps.

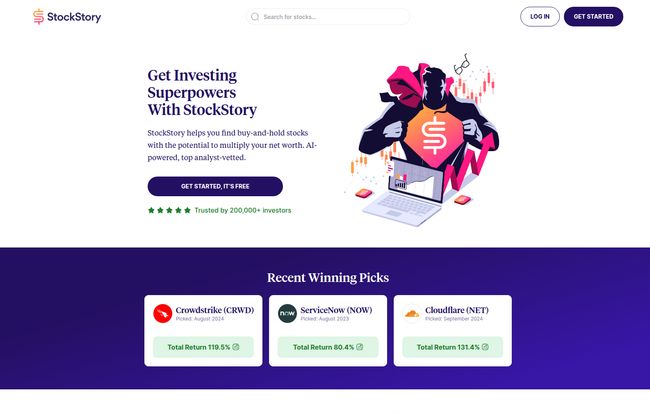

Every now and then, a tool comes along that claims it can level the playing field. I’ve seen dozens over my career in the digital space. Some are revolutionary. Most are just repackaged noise. So, when I stumbled upon StockStory, my professional curiosity—and my personal investor skepticism—was piqued. Their whole pitch is about using AI and expert analysis to give regular folks like you and me that 'hedge fund' advantage. A bold claim. Let’s see if they can back it up.

So, What Exactly is StockStory?

At first glance, you might think StockStory is just another financial news aggregator. It does provide clean, simple summaries of company earnings reports. I saw breakdowns for big names like Walmart and Deere, showing their revenue and profit figures against what the analysts were expecting. That’s useful, sure. It saves you from having to read a 40-page PDF, which is a win in my book.

But that's just the tip of the iceberg. The real core of StockStory is its 'Stockstory Edge' service. This is an AI-powered investment research and stock-picking platform. Think of it less as a newspaper and more as a research assistant with a Ph.D. in finance. They use their technology to sift through the market, identify what they believe are high-quality, undervalued companies, and then present those ideas to their subscribers. The goal isn’t just to inform you; it’s to give you actionable ideas.

The Jaw-Dropping Claim: Can It Really Beat the Market?

Okay, let's address the big number on their homepage. StockStory claims their 'High Quality Stocks' picks have returned 183% over 5 years, while the S&P 500 returned 102% in the same period. Whoa. As anyone who follows the market knows, consistently beating the S&P 500 is the holy grail of investing. Most professional fund managers fail to do it. So, a claim like this requires a closer look.

My inner cynic immediately asks, 'What's the catch?'. Are these cherry-picked results? Is the methodology sound? While I can't independently verify every single pick, the claim itself sets a very high bar. It tells me they are confident, maybe even a little cocky, about their system. And frankly, in the investing world, you need that confidence. They aren't just promising modest gains; they're promising significant outperformance. It's an audacious marketing hook, and it definitely got my attention.

Peeking Under the Hood of the StockStory Edge

So if you subscribe, what do you actually get? It’s more than just a list of tickers. Their platform seems to be built around providing context, the one thing most retail investors are starved for.

Hand-Picked Monthly Stocks

The main event is the monthly stock picks. These are presented as high-conviction ideas that their system has flagged and their human analysts have vetted. For someone who doesn’t have 40 hours a week to research companies, getting a few curated ideas is a massive time-saver. It turns the giant haystack of the stock market into a few promising needles.

Visit StockStory

The 'Why' Behind the Buy

This, for me, is the most critical part. A stock tip is useless without understanding the reasoning behind it. StockStory promises in-depth, actionable research on every pick. They don't just say 'Buy Apple,' they explain why they think it's a good buy now. They also have a feature called 'Real-time 'Why It Moves' Alerts'. Did a stock suddenly drop 5%? They aim to send you an alert explaining what's happening in plain English. This is a brilliant feature for combating the panic-selling that so often hurts individual investors.

Earnings Reports, Made Simple

We circle back to their original feature, but its important. The ability to get a quick, understandable summary of a company's quarterly performance is incredibly valuable. It helps you keep tabs on the companies you own without getting bogged down in accounting jargon. It's the difference between knowing your company made more money and knowing exactly how their Gross Margin on Product Revenue shifted year-over-year. One is useful; the other is… well, it’s for accountants.

The Human Touch: It's Not Just an Algorithm

Here’s what made me lean in a little closer. StockStory makes a point of saying their Lead Analyst, Anthony Lee, and his team of analysts (including an ex-Hedge Fund analyst) personally vet every single AI-generated pick. Even better? They claim to 'Stock Our Stock Picks With Our Own Money.'

This is what the industry calls 'skin in the game.' It's one thing for an analyst to recommend a stock. It's another thing entirely for them to put their own hard-earned cash into it. It aligns their interests with their subscribers'. If you lose money, they lose money. That simple fact builds a layer of trust that a faceless algorithm just can’t replicate. It tells me they truly believe in their own research, which is a powerful signal.

So, Who Is StockStory Really For?

I don't think this tool is for everyone. If you're a high-frequency day trader or a quantitative analyst who wants to build your own models from raw data, this probably isn’t for you. It’s too simplified.

But if you fit one of these profiles, it might be a perfect match:

- The Busy Professional: You have a good income and want to invest for the future, but you don’t have time to do deep research. You need a trusted source to curate ideas and keep you informed.

- The Confident Beginner: You've learned the basics of investing, but you're overwhelmed by the sheer volume of choices. You want a guide to help you find your footing with solid, long-term companies.

- The Seasoned Investor Seeking New Ideas: You know your way around the market, but you're stuck in your ways. You're looking for a fresh perspective or ideas in sectors you don't normally follow.

Essentially, it’s for the massive group of people in the middle—the serious, long-term DIY investor who could use a little help from a pro.

The Elephant in the Room: The Price

Here's my main gripe. As of my review, the pricing for the 'Stockstory Edge' service isn't listed publicly on their main landing page. You have to enter your email to find out. This is a pretty common marketing tactic to get leads, but as a consumer, I find it a bit frustrating. I want to know what I’m getting into upfront. I would imagine the pricing is competitive with other premium investment newsletters, which typically run from a couple of hundred to a few thousand dollars per year, depending on the level of service. I just wish they were more transparent about it.

A Balanced Look at StockStory

No tool is perfect. Based on their site and the info I could find, here’s my honest breakdown.

| The Good Stuff | Room for Improvement |

|---|---|

| Strong 'skin in the game' philosophy with analysts investing their own money. | Lack of transparent pricing on the main page. |

| Blends AI-power with human oversight, which is a great combo. | The basic earnings summaries might be too simple for advanced users. |

| 'Why It Moves' alerts provide much-needed context during market volatility. | Bold performance claims need to be continuously monitored by users. |

Final Thoughts: Is StockStory a Worthy Co-Pilot?

So, we circle back to the main question: Is StockStory legit? In my opinion, yes, it appears to be a serious and well-designed platform. It’s not a magic money-making machine—nothing is. Investing always carries risk. But StockStory isn’t selling magic. It's selling a process. It's selling research, curation, and context. Its a tool designed to cut through the noise, not add to it.

The combination of AI-driven discovery and expert human validation, especially with the 'skin in the game' element, is compelling. If you're a retail investor who feels like you're constantly a step behind the big institutions, StockStory could be the tool that helps you finally catch up.

Frequently Asked Questions

- Is StockStory suitable for complete beginners?

- I'd say it's best for a 'confident beginner.' Someone who understands basic concepts like what a stock is but needs help with the 'what to buy' part. The educational content and clear explanations make it very accessible.

- How is StockStory different from The Motley Fool?

- They operate in a similar space of providing stock recommendations. StockStory seems to place a heavier emphasis on its AI-driven approach and the 'Why It Moves' alerts for ongoing context, while The Motley Fool is more known for its long-standing brand and specific investment philosophies like 'Rule Breakers'.

- Can I get a free trial for StockStory?

- Their website focuses on getting you to sign up for their newsletter to receive information. They do mention a 30-day money-back guarantee in some of their copy, which serves as a risk-free trial period.

- Do I have to invest in every stock they recommend?

- Absolutely not. The picks should be treated as well-researched ideas. You should always do your own due diligence and decide if a particular investment fits your personal financial goals and risk tolerance.

- How do they make their AI?

- The website doesn't go into the granular details of their algorithms (which is proprietary, of course), but they state it's a 'cutting-edge AI' designed to identify factors that have historically led to outsized stock returns, which is then vetted by their team.

Conclusion

Navigating the stock market alone can be a lonely and costly affair. Tools like StockStory are emerging to act as a co-pilot, providing data, insights, and a clear point of view. While no service can guarantee returns, one that offers a transparent process, a blend of tech and human expertise, and puts its own money where its mouth is... well, that’s a story worth listening to.

Reference and Sources

- StockStory Official Website

- Yahoo! Finance (Mentioned as a publication where StockStory is featured)