In the world of SEO and digital marketing, you see a lot of new tools pop up. Every single day, there's a new AI this, or a revolutionary that, promising to change your life. Most of them are just noise. But every now and then, a concept catches my eye. One that feels different. That was Finance Rants for me.

The idea of an AI-driven platform that doesn't just track your spending but actually helps you understand your financial personality? That's my kind of nerd catnip. We're all a bit of a mess with money, right? The promise of a tool that acts like a digital financial therapist, offering personalized advice based on your unique psychological quirks, sounded fantastic. So, I did what any curious blogger would do: I went to check it out. And that’s where our story takes an… unexpected turn.

So, What Is Finance Rants Supposed to Be?

Before I get to the drama, let's talk about the promise. Based on the info I could dig up, Finance Rants isn't your typical budgeting app. Forget just linking your bank account and seeing a pie chart of how much you spent on coffee. That's been done. This platform claims to go deeper by integrating AI with principles of financial psychology.

The centerpiece is a financial personality quiz. Think of it like a Myers-Briggs test but for your wallet. Are you a ‘Nervous Saver,’ hoarding every penny out of fear? An ‘Impulse Artist,’ treating your credit card like a magic wand? Or maybe a ‘Contented Coaster,’ who just doesn't think about it much at all? By identifying your core financial behaviors, the platform is supposed to provide:

- A personalized AI assistant to guide you.

- Tailored financial education that actually speaks to your hangups.

- Interactive tools to build better spending, saving, and investing habits.

Essentially, it’s designed to tackle the ‘why’ behind your money decisions, not just the ‘what’. And as someone who has seen countless people (including myself, let's be honest) make the same financial mistakes over and over, that approach feels right.

Visit Finance Rants

The Big Red Flag: My Attempt to Actually Use the Site

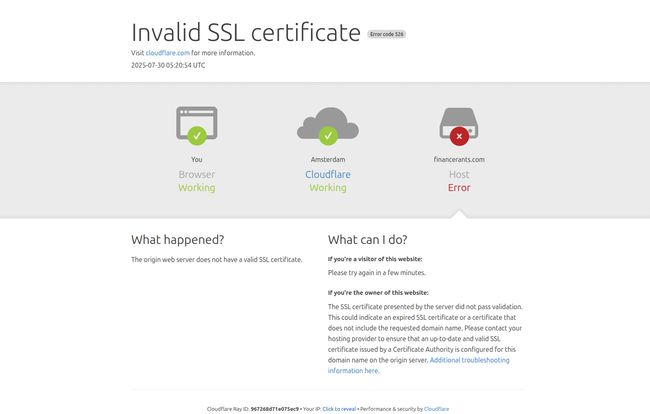

This is the part of the review where I’d normally walk you through the signup process, the dashboard, the user experience. But I can't. Why? Because when I navigated to `financerants.com`, I was greeted by this:

Invalid SSL certificate

Oof. For the non-techies in the room, an SSL certificate is the basic security layer that encrypts the data between you and a website. It’s what gives you that little padlock icon in your browser's address bar. It’s the difference between a secure, trustworthy site and one your browser screams at you to avoid. Seeing an SSL error on any site is a problem. Seeing it on a finance site that wants you to input personal financial information? That’s not just a red flag; it’s a giant, flashing, neon-lit billboard of "DO NOT PROCEED".

It's 2024. A valid SSL certificate is table stakes. It's the digital equivalent of a bank having locks on its doors. For a platform positioning itself as a guide to financial stability, this is a pretty major misstep. It immediately tanks all trust.

What Could Be Going On Here?

I didn’t just give up after one try. I checked back a few times. Still the same error. So what gives? In my experience, this usually points to one of a few things:

- It's a Pre-Launch Site: They might be in development and just haven't configured the live server correctly. A rookie mistake, but a possible one.

- It's an Abandoned Project: The idea was floated, a landing page went up, but the project lost funding or steam. The domain is left to expire, a ghost ship of a good idea.

- A Technical Glitch: Maybe their certificate just expired and no one's noticed yet. It happens, but it doesn't inspire confidence in their attention to detail.

Whatever the reason, the front door is effectively locked and barred.

Let's Judge the Book by Its Cover Anyway

Even though I couldn't get inside, the concept of Finance Rants is worth discussing. The pros are genuinely compelling. Having AI-driven personalized advice could democratize financial planning, offering guidance that was once only available to the wealthy. Focusing on both financial well-being and personal growth is a holistic approach that the fintech space desperately needs. It encourages sustainable habits, which is a far cry from the ‘get rich quick’ nonsense polluting the internet.

However, the potential cons are just as significant. The platform's effectiveness hinges entirely on how well its AI can capture human nuance—a tall order. Can an algorithm truly understand the emotional weight of a sudden job loss or a medical bill? And of course, its success depends on you, the user, actually engaging with the advice. It's not a magic pill. And the biggest hurdle, especially given the current SSL issue, is trust. You have to be willing to hand over incredibly sensitive financial data to a relatively unknown platform.

And What About the Price?

Unsurprisingly, there’s no pricing information available. The pricing page URL is blank, which, combined with the security error, adds to the air of mystery. If it does launch, I’d expect a subscription model, maybe in the $10-$20 per month range, or perhaps a freemium offering to get you hooked. But for now, it's all just speculation.

My Verdict on Finance Rants… For Now

Here's my final thought. Finance Rants is a brilliant idea wrapped in a currently inaccessible and insecure package. The concept of a financial personality quiz and AI-driven psychological advice is a 10/10. It’s exactly the direction fintech should be heading. The execution, however, is currently a 0/10.

I am genuinely rooting for this tool. I hope it’s just a pre-launch hiccup and that the team behind it resolves the glaring security issue soon. If they do, I'll be the first in line to give it a proper test drive. But until that little padlock symbol appears, I have to advise everyone to stay away. Protect your data first.

Frequently Asked Questions

- Is Finance Rants safe to use?

- As of this writing, no. The website has an invalid SSL certificate, which means any data you share is not securely encrypted. You should not enter any personal or financial information on a site without a valid SSL certificate.

- What is a 'financial personality'?

- A financial personality refers to your underlying attitudes, behaviors, and emotions towards money. Finance Rants claims to identify this through a quiz to understand if you're naturally a saver, a spender, risk-averse, or something else, in order to provide better advice.

- How is Finance Rants different from budgeting apps like YNAB or Mint?

- Traditional budgeting apps focus on tracking your income and expenses—the 'what' and 'where' of your money. Finance Rants aims to focus on the 'why' by using psychology to help you understand and change your core financial habits.

- Who would be the ideal user for Finance Rants?

- Theoretically, it would be perfect for people who feel stuck in a rut with their finances and want to understand their behavior on a deeper level, rather than just tracking transactions. It's for the person who knows they should save more but can't figure out why they keep overspending.

- Is Finance Rants free?

- There is currently no pricing information available for Finance Rants. The website is not fully functional, so details on cost, subscriptions, or free tiers are unknown.

A Final Thought

The digital world is full of half-started projects and brilliant ideas that never quite make it. I sincerely hope Finance Rants isn't one of them. The potential is there. For now, we wait and watch. I’ll keep this post updated if the digital doors finally and securely open. Until then, stay savvy out there.

Reference and Sources

- What is an SSL Error? - An explanation from Cloudflare, the service flagging the error on the site.

- What Is Financial Psychology? - An article from NerdWallet on the growing field that underpins the concept of Finance Rants.