If you’ve ever run a business, managed freelance finances, or done your own bookkeeping, you’ve faced The Beast. You know the one. It’s that pile of PDF bank statements that stares at you from your downloads folder, daring you to manually type each and every transaction into a spreadsheet. It’s a soul-crushing, error-prone task that I've spent more hours of my life on than I care to admit.

We’ve all been there, squinting at a screen, trying to decipher a cryptic vendor name, and praying we don’t mistype a number that will throw off our entire month-end reconciliation. It’s a necessary evil, or at least, it used to be. For a while now, I’ve been on the lookout for a tool that does more than just basic OCR (Optical Character Recognition). I wanted something smarter. Something that could act like a real assistant.

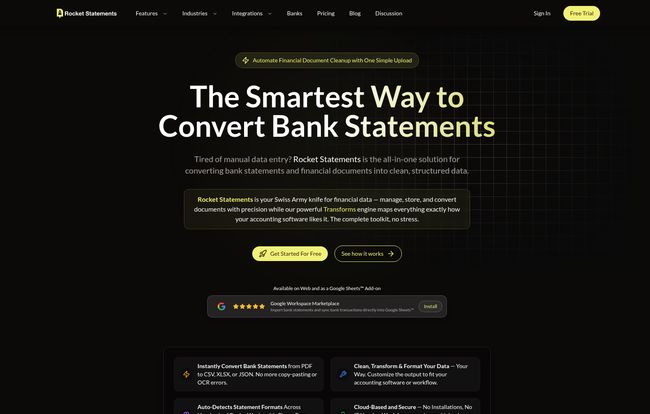

And that’s what led me down the rabbit hole to Rocket Statements. They call themselves the “Swiss Army knife for financial data,” and honestly, that’s not a bad description. This isn’t just another PDF converter. It’s an entire platform designed to take that messy, unstructured data and turn it into something clean, usable, and—most importantly—automated. So, let's get into it and see if it lives up to the hype.

So, What's the Big Deal with Rocket Statements?

At its core, Rocket Statements is a cloud-based tool that extracts data from your bank statements and financial documents. You upload a PDF (or even an image file), and it spits out a beautifully organized Excel, CSV, or JSON file. Simple, right?

But the real magic isn’t in the conversion itself. It’s in the intelligence behind it. It's built for folks who feel the pain of this process most acutely: accountants, bookkeepers, small business owners, and anyone managing finances for legal or real estate firms. The platform claims a staggering 99.9% accuracy rate in its data extraction, which, if true, is a huge step up from the copy-paste errors we’ve all made at 1 AM.

It’s not just about pulling numbers; it’s about making sense of them. It understands the difference between a debit and a credit, it identifies dates, and it tackles one of the biggest headaches of all: messy transaction descriptions.

Visit Rocket Statements

A Quick Walkthrough of the Process

I’m a big believer in a tool’s workflow. If it’s clunky or confusing, I don’t care how powerful it is. The process here seems refreshingly straightforward.

- Upload Your Statement: You start by dragging and dropping your file. It handles PDFs, which is standard, but also image files like JPGs or PNGs. This is great for those times you only have a photo of a document.

- Automatic Extraction: This is where the AI engine gets to work. It scans the document and, according to them, instantly identifies and pulls all the transaction data. No more manually highlighting and copying.

- Transform & Clean Your Data: This is my favorite part. It has tools to clean up the data before you export it. You know that charge that shows up as “AUTOPAY PMT -THANK”? Rocket Statements helps you rename it to something human-readable, like “Utility Payment.” You can categorize transactions, merge duplicates, and basically tidy everything up. A total game-changer. Seriously.

- Organize and Integrate: You can keep your files organized in folders and, more importantly, connect directly to software you already use. There’s a direct Google Sheets Add-on, which is fantastic for spreadsheet junkies like me, plus integrations for QuickBooks, Xero, and FreshBooks.

- Export Your File: Once everything is clean and tidy, you download your data in the format of your choice. Ready for your accounting software or financial model.

The Features That Genuinely Make a Difference

A long list of features can be overwhelming. Let’s cut through the noise and talk about what really stands out.

The Data Transformation Engine is the Star

I can’t stress this enough. The ability to transform your data inside the app is what separates Rocket Statements from a simple free online converter. Manually cleaning up vendor names and categorizing transactions is often half the battle. By doing this within the tool, you’re saving that second, equally tedious step. It’s like having an assembly line: the raw material (PDF) goes in one end, gets processed and refined in the middle, and a finished product (clean spreadsheet) comes out the other end.

Integrations That Actually Fit Your Workflow

The integrations with QuickBooks, Xero, and FreshBooks are table stakes for a tool like this, and it's good to see them here. It means you can potentially create a seamless flow from bank statement to bookkeeping entry. But the Google Sheets Add-on is particularly clever. For so many small businesses and freelancers, Google Sheets is the command center. Being able to pull financial data directly into a sheet, without a download-upload cycle, is a massive efficiency win.

A Serious Approach to Security

Okay, let’s talk about the elephant in the room. Handing over your financial documents to a third-party service can feel… unsettling. Security is non-negotiable. Rocket Statements seems to get this. They talk a big game about their security, and it’s reassuring. They mention using bank-level 256-bit encryption, the same standard your actual bank uses. All data is processed through secure channels, and their infrastructure is protected by multiple layers. It’s the kind of thing you expect, but it's critical to see it spelled out clearly.

Breaking Down the Rocket Statements Pricing

Alright, the million-dollar question. Or, in this case, the $8-a-month question. Is it worth the cost? The pricing is tiered, which I appreciate. It means you’re not paying for enterprise-level features if you’re just a one-person shop. Here’s a quick rundown, but remember to check their site for the most current details.

| Plan | Monthly Price | Key Features & Limits |

|---|---|---|

| Basic | $8 / mo | 100 Pages/month, 5 MB File Limit, 30 Days Data Retention. Good for getting started. |

| Essentials | $16 / mo | 500 Pages/month, 1 Connected Institution, 1 Year Data Retention. A solid choice for small businesses. |

| Business | $37 / mo | 1000 Pages/month, 5 Connected Institutions, 100 MB File Limit, 2 Years Data Retention. Built for teams. |

| Advanced | $58 / mo | 3000 Pages/month, 10 Connected Institutions, 500 MB File Limit, 5 Years Data Retention. For finance pros needing scale. |

The free trial is generous: 7 days with access to 500 pages, and no credit card is required. That’s a confident move, and I love to see it. It lets you properly kick the tires before you commit.

The Good, The Not-So-Good, and My Takeaway

No tool is perfect. After digging through everything, here’s my honest breakdown.

What I think is brilliant: The accuracy and the data cleaning tools are a powerful combination. It’s one thing to pull data, it's another thing to make it immediately useful. The support for over 100 global banks is also impressive, making it a viable option for businesses with international accounts. It feels like a mature, well-thought-out product.

Where you need to be mindful: The primary limitations are baked into the pricing tiers. The monthly page limits are something to watch. If you have a high volume of transactions, you’ll quickly outgrow the Basic plan. More importantly, pay attention to the data retention period. 30 days on the Basic plan isn’t very long. It means you need to have a good habit of exporting and saving your data promptly. For many, bumping up to the Essentials plan just for the 1-year retention will be worth the extra cost.

So, Is Rocket Statements the Right Tool for You?

In my opinion, if the time you spend on manual data entry from bank statements costs you more than a few dollars a month (and let's be real, it does), then Rocket Statements is absolutely worth a look. It's a specialized tool that solves a very specific, very annoying problem with surprising elegance.

It’s not just a time-saver; it’s an error-reducer and a sanity-preserver. For bookkeepers juggling dozens of clients or small business owners trying to wear all the hats, the efficiency gains could be substantial. It's about turning a dreaded chore into a quick, automated task so you can get back to, you know, actually running your business.

The future of finance is automation, and tools like this are paving the way. They're making powerful technology accessible, turning what was once a mountain of work into a molehill.

Frequently Asked Questions

- How does Rocket Statements actually convert a PDF bank statement?

- It uses a sophisticated AI engine combined with OCR technology. Unlike basic OCR that just pulls text, its AI is trained to understand the structure of a bank statement—it identifies columns, dates, descriptions, and amounts, and then organizes them into structured data fields.

- Is my financial data really secure?

- Security is a top priority for them. They use bank-level 256-bit encryption for your data, both when it's stored and when it's being processed. They also conduct regular security audits to ensure the platform remains protected against threats.

- Can it handle statements that are scanned or low quality?

- Yes, the platform is designed to handle not just clean, downloaded PDFs but also scanned documents and image files (like JPGs or PNGs). The AI is built to clean up and interpret these less-than-perfect sources, though the quality of the original scan can still affect accuracy.

- Why use this instead of my bank’s own “Export to CSV” feature?

- Great question. While many banks offer a direct export, it often comes with messy, unformatted data (like those cryptic vendor names). Furthermore, this feature is useless if all you have is a PDF statement, which is a common scenario when dealing with past records or statements from other parties. Rocket Statements shines by handling PDFs and cleaning the data before it even gets to you.

- Which banks does Rocket Statements support?

- They support over 100 banks worldwide, including major institutions in the US, Canada, UK, Singapore, and Australia. You'll find names like Chase, Bank of America, Wells Fargo, Royal Bank of Canada, and many more on their list.

- Is the free trial really free?

- Yes. It’s a 7-day trial that gives you a 500-page processing credit. Crucially, they do not ask for a credit card upfront, so you can test the full service without any risk of being charged if you forget to cancel.