If you've ever spent a Tuesday night staring at a 200-page Confidential Information Memorandum (CIM), slowly losing your mind while manually punching numbers into Excel, this one's for you. We've all been there. The data is dense, the formats are all over the place, and the deadline is, as always, yesterday. For years, this grueling, manual slog has just been... the cost of doing business in the investment world.

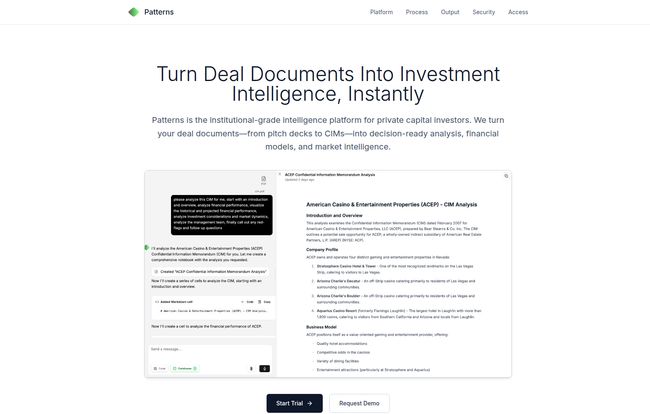

But what if it wasn't? I've been hearing whispers about a platform called Patterns, and the claim is pretty bold: turning mountains of deal documents into sharp, decision-ready intelligence. Instantly. As a guy who's seen countless 'game-changing' platforms come and go, my skepticism meter is always on. But this one... this one feels a bit different. So, I decided to do a proper deep dive.

So What Is Patterns, Really?

At its core, Patterns bills itself as an intelligence layer for institutional investors. Think of it like a brilliant, incredibly fast junior analyst that you can feed documents to. You give it a pitch deck, a CIM, or a folder of financial statements, and it doesn't just sit there. It gets to work.

It uses AI to read and understand these documents, pulling out the crucial financial data, normalizing it (goodbye, inconsistent formatting!), and then building out financial models, market analysis, and even a preliminary investment memo. It's designed to take that initial, soul-crushing 80% of manual work off your plate, so you can focus on the 20% that actually requires your brainpower: strategy, critical thinking, and making the final call.

Interestingly, some of the information I've found also describes it as a broader financial data automation platform for general finance teams, connecting to things like Quickbooks and Stripe. My take? It seems Patterns has a core AI engine for financial data analysis, and their primary, most refined application is for the investment lifecycle—deal screening, diligence, and portfolio management. Makes sense. You build a powerful engine, then aim it where the pain is most acute (and the pockets are deepest).

The Analysis Workflow: From Document Dump to Dazzling Data

The magic is in the process, which they've boiled down to four steps. And honestly, the simplicity is appealing.

- Submit Documents: This is the easy part. You securely upload your files. Pitch decks, messy financials, market research reports—the whole shebang.

- Automated Processing: Here’s where the AI kicks in. It scans everything, extracting financial metrics, KPIs, and all those golden nuggets of data that you’d normally have to hunt for yourself. It’s like a search-and-rescue mission for numbers.

- Model Generation: The platform doesn't just extract data; it starts building with it. It constructs comparative analyses, preliminary financial models, and even drafts out an investment memo. This is the part that raises eyebrows. An AI drafting a memo? More on that later.

- Review & Export: Finally, you get the finished package. You can review the AI-generated analysis, and—this is crucial—export it all to good ol' Excel. Because let's face it, we're not giving up our spreadsheets anytime soon. The ability to integrate with existing workflows is a massive plus in my book.

They even provide some typical processing times, which are… well, impressive.

| Document Type | Typical Processing Time |

|---|---|

| Standard CIM (150-200 pages) | 15-20 minutes |

| Pitch Deck (20-40 pages) | 5-10 minutes |

| Financial Statements | 3-5 minutes |

Processing a full CIM in less time than it takes to make a proper cup of coffee? Yeah, that got my attention.

Visit Patterns

Who Is This Platform Really Built For?

Based on everything I've seen, Patterns is aiming squarely at the finance pros who live and breathe deals. We're talking about:

- Private Equity Firms: To accelerate deal screening and due diligence.

- Venture Capitalists: For quickly vetting the financials of dozens of pitch decks a week.

- Investment Bankers & M&A Teams: To streamline the creation of models and presentations.

- Portfolio Managers: To monitor the performance of existing investments and identify new opportunities.

Basically, if your job involves turning a data room full of documents into a coherent investment thesis, this platform is speaking your language.

The Good, The Bad, and The AI

No tool is perfect. Let's break down what I see as the major pros and the necessary reality checks.

The Upside: More Time for What Matters

The most obvious win here is the automation of mind-numbing tasks. The time saved on data entry and normalization is enormous. This directly translates to more time for strategic analysis, for asking the why behind the numbers, not just the what. It also means your team can process a higher volume of deals without burning out, which is a significant competitive advantage. The platform also promises improved accuracy by reducing human error. We've all made a copy-paste mistake at 2 AM that throws a whole model off. The idea of minimizing that is… comforting.

The Considerations: A Healthy Dose of Realism

Okay, let's ground ourselves. First, a platform this powerful will require some initial setup and configuration to get it dialed into your specific workflows. It's not a magic wand you wave. Second, and this is the big one, you're relying on AI. While it's incredibly powerful, it's not infallible. The need for smart human oversight cannot be overstated. You still need an experienced analyst to review the output, question the assumptions, and catch the nuances that an AI might miss. This tool is a powerful assistant, not a replacement for a skilled professional. And that’s a good thing.

Security and Integrations Matter

When you're handling sensitive deal documents, security is non-negotiable. I was pleased to see that Patterns takes this seriously, advertising enterprise-grade security and compliance with standards like SOC2 Type II, GDPR, and CCPA. They detail how data is processed in-memory and isolated, which should help the security folks on your team sleep a little better at night.

On the integration front, while the investment focus is clear, the platform is built to connect with a wider ecosystem. The mention of integrations with Excel, SQL, Quickbooks, Brex, and Stripe suggests a robust backend that can play nice with the tools your finance department is already using. This is key for seamless adoption.

The Million-Dollar Question: What's the Price?

Ah, the part you've been scrolling for. As is common with enterprise-grade B2B SaaS platforms, Patterns doesn't list its pricing publicly. You'll have to contact them for a demo and a quote. This usually means the pricing is customized based on team size, usage volume, and specific needs.

However, they do offer a 14-day free trial. This is a great sign. It shows they're confident enough in their product to let you kick the tires before you commit. I always appreciate a try-before-you-buy approach, especially for a tool that promises to fundamentally change a core workflow.

My Final Verdict on Patterns

So, is Patterns the future of deal analysis? I think it's a very, very significant step in that direction. It's not about replacing analysts with robots. It's about augmenting them. It's about freeing up your smartest people from the drudgery of data wrangling so they can do the high-value work that drives real returns.

The speed is undeniable, and the potential to improve both the quantity and quality of deal flow analysis is massive. I'm cautiously optimistic and genuinely impressed. If you're in the investment space and feeling the pain of manual data processing, taking them up on their 14-day trial seems like a no-brainer. It might just be the best junior analyst you've ever hired.

Frequently Asked Questions

What is Patterns?

Patterns is an AI-powered platform designed for institutional investors. It automates the process of extracting and analyzing data from deal documents like CIMs and pitch decks to create financial models, market analysis, and investment memos.

Who should use Patterns?

The primary users are finance professionals involved in the investment lifecycle, including private equity firms, venture capitalists, investment bankers, and M&A teams who need to screen and analyze deals quickly and efficiently.

Is Patterns secure?

Yes, Patterns emphasizes its enterprise-grade security. It is compliant with major standards like SOC2 Type II, GDPR, and CCPA, and uses secure, isolated infrastructure to process sensitive financial data.

How fast can Patterns process documents?

It's very fast. According to their site, it can process a standard 150-200 page CIM in about 15-20 minutes and a pitch deck in 5-10 minutes, significantly reducing manual analysis time.

What does Patterns integrate with?

It can export to standard tools like Microsoft Excel. The underlying platform is also designed to integrate with a range of financial and operational systems like SQL databases, Quickbooks, Stripe, and CRMs.

How much does Patterns cost?

Pricing is not publicly available. You need to request a demo and get a custom quote. They do offer a 14-day free trial to test the platform's capabilities.