If you’re an entrepreneur, a freelancer, or a small business owner, there’s one word that can send a shiver down your spine: bookkeeping. It's the necessary evil, the monster under the bed made of receipts, invoices, and spreadsheets. For years, I’ve seen countless founders—brilliant, creative people—get bogged down by the sheer drudgery of it all. It’s a time suck. It’s confusing. And if you mess it up, well, the tax man cometh.

We’ve all been there, right? That Sunday night panic, trying to categorize a year's worth of transactions. It’s the kind of work that makes you question your life choices. So when a tool comes along with a tagline like “Self-driving bookkeeping,” my inner skeptic and my hopeful entrepreneur-self both sit up and pay attention. That tool is Kick, and I’ve been digging into it to see if it’s just another piece of shiny software or if it can actually, truly, take the wheel.

So, What is This Kick Platform Anyway?

At its heart, Kick is accounting software designed for the modern business owner. It’s not trying to be a bloated, ten-thousand-feature behemoth like some of the old guards (you know who I’m talking about). Instead, its entire philosophy is built around one thing: automation. It connects to your bank accounts, credit cards, and payment processors like Stripe, and then it does the heavy lifting for you. It’s like having a little robot bookkeeper working 24/7.

But it's not just for the DIY-er. The platform is also “accountant approved,” with features that make it a solid tool for professional bookkeepers who want to streamline their own client work. It’s a fascinating approach, trying to serve both the business owner and the financial pro simultaneously.

The Big Promise of “Self-Driving” Bookkeeping

The “self-driving” metaphor is pretty spot on. Think of it like a Tesla. You can’t just hop in, take a nap, and expect to wake up at your destination. You still need to be aware, to provide direction, and occasionally take control. But for the long, boring stretches of highway? Autopilot is a lifesaver. That’s Kick.

It automatically pulls in your transactions and, using AI, categorizes them. That $5 coffee is a ‘Meals & Entertainment’ expense. That Adobe subscription is ‘Software.’ It learns your habits over time, and you can create custom rules to make it even smarter. For example, you can tell it to always categorize payments from a specific client as ‘Service Revenue.’ It seems simple, but the cumulative time saved is just staggering.

Visit Kick

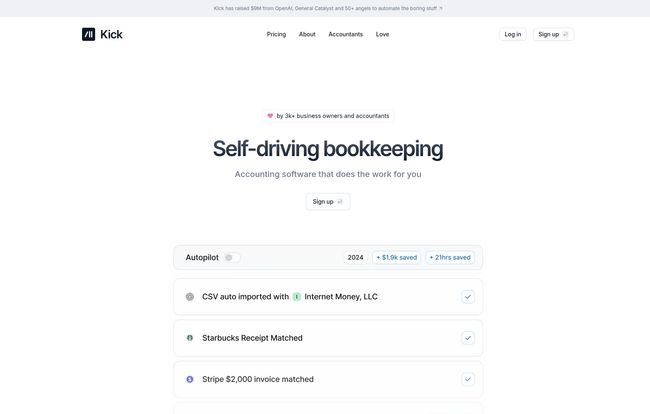

The real magic isn’t just categorizing, it’s matching. The image on their site shows it matching a CSV-imported expense to a Starbucks receipt and a Stripe invoice to a bank deposit. This reconciliation is the part that drives most people crazy, and Kick aims to make it a non-issue.

Features That Actually Help a Business Owner Sleep at Night

Finally, You Can Stop Worrying About Missed Deductions

This is a big one. How much money have we all left on the table because we weren’t sure if something was a deductible expense? Kick actively hunts for them. It flags potential write-offs for things like your home office, travel expenses, and even part of your phone bill. It gives you the confidence to claim what you’re owed without that nagging fear that you’re doing it wrong. For a freelancer or solopreneur, finding an extra few thousand dollars in deductions at year-end is massive.

Juggling Multiple Businesses? Not a Problem

I once had a client who ran three separate LLCs out of one master spreadsheet. It was a work of art, in a chaotic, terrifying sort of way. Come tax time, it was a nightmare to unravel. Most accounting platforms charge you extra for every single business entity you add. It's a huge hidden cost. Kick offers unlimited entities for no added cost. I had to read that twice. This is a game-changer for serial entrepreneurs, people with a day job and a serious side hustle, or anyone with a portfolio of projects. You can see the financial health of each business from one single dashboard. That alone is worth its weight in gold.

Insights That Aren't Just a Wall of Numbers

A profit and loss statement is great, but what does it mean? Kick focuses on giving you clear insights into your revenue and spending. You can quickly see where your money is coming from and, more importantly, where it’s going. Are you spending too much on software subscriptions? Is one client making up 80% of your revenue? These are the strategic questions that financial clarity helps you answer, and Kick puts those answers front and center.

Let’s Talk Money: A Breakdown of Kick’s Pricing

Alright, this is where the rubber meets the road. Is it going to cost an arm and a leg? Surprisingly, no. The pricing structure is one of the most logical I’ve seen in a while.

| Plan | Price | Who It's For |

|---|---|---|

| Basic | $0/month | The freelancer, solopreneur, or brand-new business. Genuinely free for core bookkeeping. |

| Plus | $35/month | The growing business that wants deduction help and audit support peace of mind. |

| Pro | $125/month | The established business that needs tax filing and payroll reconciliation handled. |

| Enterprise | $175+/month | Larger companies needing custom solutions and white-glove service. |

The Basic plan being actually free is incredible. You get the core self-driving bookkeeping, unlimited bank connections, and that amazing multi-entity support. For someone just starting out, this is all you need. The Plus plan at $35/mo feels like the sweet spot for many small businesses, adding the crucial deduction optimization and audit support. The jump to Pro at $125/mo is significant, but it also adds significant services like tax filing. When you compare $125 a month to the cost of a dedicated accountant handling your taxes and payroll books, it starts to look very, very reasonable.

My Honest Take: The Good, The Bad, and The Automated

No tool is perfect, and blind optimism is a fool’s game. After poking around and looking at what Kick offers, here's my unfiltered perspective.

The Good Stuff is Really Good

The time-saving potential here is obvious. Automating 80-90% of your bookkeeping is a massive win. The multi-entity feature is, frankly, class-leading for this price point. And the user testimonials really hit home. When Tyler Scionti says the tool is “laughably easy to use,” that catches my attention. Clunky, overwrought software is a pet peeve of mine, and a focus on simplicity is always a plus.

After using several bookkeeping platforms and getting stuck every time, Kick was a breath of fresh air. The platform and onboarding left me with a clear understanding of my business’s finances.

- Sandra Scalise, Entrepreneur

The Not-So-Good (or, The Reality Check)

My main hesitation is with the term “self-driving” itself. It can imply a level of set-it-and-forget-it that isn't quite true. Automation is a tool, not a replacement for oversight. You still need to review the categorizations, especially in the beginning, to make sure they’re right. A machine might not understand the nuance of a specific expense the way you do. So, you still have to be the CEO of your finances.

Also, the jump in price from $35 to $125 a month is quite a leap. I wonder if there’s a middle ground missing for businesses who need a little more than ‘Plus’ but aren’t quite ready for the full ‘Pro’ package. It's a small quibble, but one worth mentioning.

So, Who is Kick Really For?

I see a few perfect fits for Kick.

- The Modern Entrepreneur: If you have multiple projects, an e-commerce store, a consulting gig, and a SaaS idea, Kick is built for you. It handles the complexity without the cost.

- The Overwhelmed Freelancer: If you're great at your craft but terrible with numbers, the free Basic plan is a no-brainer. It will professionalize your finances and save you from year-end dread.

- The Forward-Thinking Accountant: Pros like Brett Honsa, CPA, are quoted on the site. He says, “Kick allows me to serve my clients more efficiently.” This signals that it's a serious tool for accountants who want to automate the tedious data entry and focus on higher-value advisory services instead.

The Final Verdict: Is It Time to Let Your Books Drive?

Look, Kick isn't a magic wand. It won’t automatically make your business profitable. But what it does do, it seems to do exceptionally well. It removes the single biggest administrative bottleneck for most small businesses: the sheer time and mental energy wasted on bookkeeping.

It turns a dreaded chore into a background process. It provides clarity. It saves money on professional fees and finds money in missed deductions. And with a genuinely free starting plan, the barrier to entry is non-existent.

My advice? Give the free plan a shot. Connect one bank account and let it run for a few weeks. See how it feels to have your books put on autopilot. You might just find that the scariest monster in your business wasn't so scary after all.

Frequently Asked Questions about Kick

- Is Kick a replacement for an accountant?

- For basic bookkeeping, yes. For complex tax advice, strategic planning, or major financial decisions, no. Kick is a powerful tool that makes your (or your accountant's) job much easier. The Pro plan does include tax filing, but having a human expert to talk to is always a good idea.

- How does Kick actually find tax deductions?

- It uses smart algorithms to analyze your spending and flag transactions that are commonly deductible for businesses, like software, home office utilities, travel, and professional development. It's designed to catch things you might overlook.

- Can I use Kick for my personal finances too?

- While it's designed for business, the multi-entity feature could theoretically be used to create a separate 'entity' for your personal finances to keep them separate but viewable in one place. However, its features are optimized for business accounting and tax rules.

- Is my financial data secure with Kick?

- Like any reputable fintech platform, Kick uses bank-level security and encryption to protect your data. They rely on trusted third-party services like Plaid for bank connections, which is the industry standard for security.

- How hard is it to switch from another software like QuickBooks?

- Kick allows for CSV imports, so you can typically export your transaction history from your old software and import it into Kick. For Enterprise customers, they offer white-glove data migration to handle the entire process for you.

Reference and Sources

- Kick's Official Website

- Journal of Accountancy: How AI is Changing Accounting (for context on automation in the industry)