If you're in the lending game, you know the feeling. You get an application that’s so close. The person's got a decent history, a stable job, but they just miss your strict, traditional credit score cutoff. Denying them feels bad for them, and honestly, it’s bad for business. You lose a potential customer, and they walk away frustrated. It’s a classic lose-lose that we’ve all just sort of… accepted.

For years, the answer has been to either tighten the belt and deny more people, or take on more risk than the board is comfortable with. But what if there was a third option? I’ve been hearing the name Pagaya whispered in fintech circles for a while now, and it's getting louder. They claim to have an AI-powered network that lets you approve more of those “near-miss” loans without adding a single dollar of risk to your own books. Sounds a bit like magic, right? As a guy who's seen a million 'game-changing' platforms come and go, my curiosity was definitely piqued. So I dug in to see if it’s the real deal or just another piece of shiny tech vaporware.

So What Exactly Is Pagaya, Anyway?

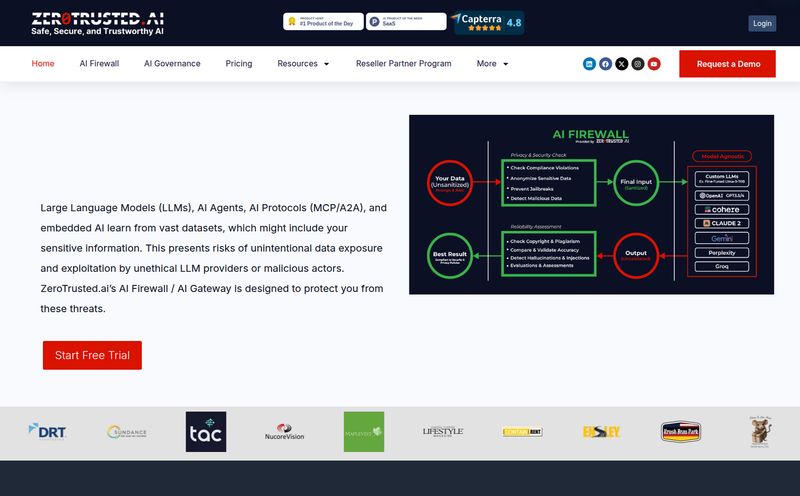

First off, let's clear something up. Pagaya isn't a direct lender. You don’t go to Pagaya.com to get a car loan. Think of them less as a bank and more as a highly intelligent, data-rich matchmaker. They've built a sophisticated AI network that plugs directly into a lender's existing system (we're talking banks, auto lenders, personal loan companies, the whole nine yards).

When a customer applies for a loan on your website and doesn't quite meet your internal criteria, your system doesn't just slam the door with a denial. Instead, it seamlessly passes the application to Pagaya's AI in real-time. This AI, trained on an absolutely staggering $2.7 TRILLION worth of loan application data, takes a second look. It analyzes thousands of data points, far beyond a simple FICO score, to see if the applicant is a good bet from a different angle. If Pagaya's model gives a thumbs-up, they connect the loan with one of their 135+ institutional investors who are ready to fund it. The result? The customer gets their loan, you keep the customer relationship, and the risk is held by Pagaya’s network, not you.

How the Pagaya Magic Happens

The process itself sounds deceptively simple, which is probably the point. It’s designed to be invisible to the end customer and low-lift for the lender. It breaks down into three main steps:

- Instant Submission: Your customer fills out one application, on your branded site. Nothing changes for them.

- AI-Powered Review: If your system flags the application as a 'no,' it's instantly and automatically sent to Pagaya's network via API. Their AI crunches the numbers in seconds.

- Seamless Approval: If Pagaya finds a fit, the approval comes through. Your customer is happy, and you’ve just deepened that relationship without taking on the loan yourself.

This whole concept of having zero balance sheet impact is, for me, the core of their value. It's like having a secondary underwriting department that costs you nothing and assumes all the risk. Pretty compelling stuff.

Visit Pagaya

The Good Stuff: Why Lenders Are Talking About Pagaya

Beyond the cool tech, what are the tangible benefits? Why would a lender bother integrating another piece of software into their already complex stack? Well, the upsides are pretty significant.

Say “Yes” More Often (Without Sweating Bullets)

The most obvious win is expanding your credit box. You get to approve a wider range of borrowers. This isn’t about reckless lending; it’s about smarter lending. It’s about finding the credit-worthy individuals that rigid, old-school models overlook. Turning a potential denial into an approval is a massive boost for both your conversion metrics and your brand reputation.

Keep Your Customers, Even the Ones You Can't Fund Directly

Customer acquisition cost (CAC) is no joke. You spend a fortune on marketing and ads to get that person to your application page. To deny them and have them go straight to a competitor is just painful. Pagaya lets you keep that customer in your ecosystem. They still see you as the one who helped them. This is huge for long-term customer value and retention. As Mike Shepard, a partner cited on their site, put it, they help serve clients who “don't fit within our traditional client parameters.” That's the whole ballgame right there.

The “Set It and Forget It” Integration

Okay, maybe not totally set-it-and-forget-it, but the integration is designed to be seamless. It works through an API that plugs into your existing loan origination system (LOS). Once it's set up, it works automatically in the background. Compared to some of teh legacy system integrations I’ve had to deal with in my career, the promise of a modern API is a breath of fresh air.

Let's Be Real: The Potential Downsides

No tool is a silver bullet. I’ve been in this industry long enough to know that you always have to look at the other side of the coin. Being a professional skeptic is part of the job.

The Black Box Conundrum

My biggest hesitation? You have to place a lot of trust in Pagaya's AI. It's a proprietary model, a 'black box' of sorts. You feed it an application, and it spits out an answer. While it's trained on immense amounts of data, you don't get to see the inner workings of the algorithm. For lenders who pride themselves on their in-house underwriting expertise and want granular control, handing over that final decision, even for declined apps, can feel like a leap of faith.

Are You Building Dependency?

There's also the question of dependency. By integrating Pagaya so deeply into your workflow, you're making them a key partner. What happens if they change their business model five years from now? Or if their AI's risk appetite shifts? It's a strategic partnership, and like any partnership, you need to weigh the long-term risk of tying your approval overflow so closely to a single third-party network.

So, What's the Price Tag on This AI Power?

Here’s the million-dollar question—or maybe multi-million dollar, depending on your loan volume. Unsurprisingly, Pagaya doesn't list their pricing publicly. This is standard practice for enterprise-level B2B solutions in the financial world. You won’t find a neat little pricing table with 'Basic,' 'Pro,' and 'Enterprise' tiers.

My educated guess is that it’s not a flat SaaS fee. It’s more likely a partnership model based on revenue sharing or a fee generated from the institutional investors who fund the loans. The beauty of this model, if I'm right, is that they only make money when you make money (or, more accurately, when you successfully retain a customer with a funded loan). The best way to find out is to hit that “Let’s connect” button on their site and have a direct conversation.

Who Is Pagaya Really For?

Looking at their partner list—which includes heavy hitters like SoFi, Ally, and Visa—it's clear Pagaya is aimed at established lenders with significant application volume. If you're a small community credit union processing a handful of loans a week, this probably isn’t for you. But if you’re in personal loans, auto financing, or even point-of-sale credit and you're seeing a high volume of applications fall just outside your approval window, then you are squarely in their target demographic. You have the volume to make the AI's insights meaningful and the customer acquisition costs to justify seeking a retention solution.

Final Thoughts From an Old SEO Hand

So, is Pagaya the future of lending? I think it's a massive step in the right direction. For too long, lending has relied on surprisingly narrow sets of data. The idea of using AI to get a more holistic, and frankly more human, picture of an applicant's financial life just makes sense. It’s moving from a simple snapshot to a full-length movie.

The model is smart. It solves a real, expensive problem for lenders—customer retention and missed opportunities—without forcing them to upend their risk profiles. It's a classic "have your cake and eat it too" scenario. Of course, it requires trust and a willingness to partner with a third-party AI. But in an increasingly competitive market, the lenders who best use data are the ones who are going to win. Pagaya offers a powerful way to do just that.

Frequently Asked Questions

Is Pagaya a direct lender?

No, Pagaya is not a direct lender. It's a B2B financial technology company that provides an AI-powered lending network to its partners (like banks and other lenders) to help them approve more loan applications.

How does Pagaya make money?

While their exact model isn't public, it's understood that Pagaya generates revenue through fees from its network of institutional investors who fund the loans. This aligns their success with the success of their lending partners.

Is Pagaya secure and compliant?

Yes. Security and compliance are core to their offering. The platform is designed to integrate into highly regulated financial institutions and must adhere to strict data security, privacy, and consumer protection standards.

What kind of lenders use Pagaya?

Pagaya partners with a wide array of lenders, including those in the auto finance, personal loan, credit card, and point-of-sale (POS) financing spaces. Their partners are typically mid-to-large-sized institutions.

Does using Pagaya affect my company's balance sheet?

No, and this is a key benefit. Pagaya's network of investors funds the loans that your institution couldn't approve. This means you can facilitate more approvals with zero additional balance sheet impact or risk.

Is it difficult to integrate with Pagaya?

Integration requires technical resources as it works via an API that connects to your Loan Origination System (LOS). While Pagaya promotes it as "seamless," any API integration requires some level of development work from the lender's side.