If you've ever been on the receiving end of customer service from a bank or insurance company, you know it can be... a mixed bag. Long wait times, repetitive questions, getting bounced between departments. It's a classic headache. And from the business side, it's a massive cost center. So, for years, we've been promised that AI would be the great savior, the thing that would finally fix this mess.

Most of the time, that "AI" has just been a glorified FAQ page masquerading as a chatbot. You know the type. Ask it a slightly complex question and it folds like a cheap suit, leaving you yelling "HUMAN!" at your screen.

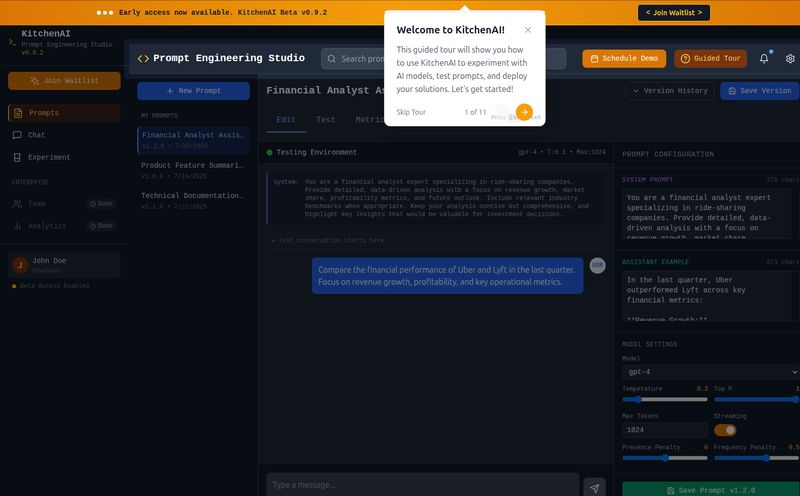

But every now and then, a tool comes along that makes me sit up and pay attention. Recently, that tool has been Moveo.AI. They're making some pretty bold claims, specifically for the notoriously complex world of financial services. So, I decided to put on my skeptic's hat, grab a coffee, and really dig in to see if it’s all sizzle or if there's some actual steak here.

So, What Exactly is Moveo.AI Anyway?

In a nutshell, Moveo.AI is a generative AI agent platform designed from the ground up for financial services. This isn't a general-purpose bot they've just slapped a "finance" label on. It’s built to handle the nitty-gritty of banking, insurance, lending, and even the delicate dance of debt collection.

Think of it less like a simple chatbot and more like a highly-trained, always-on, multilingual financial assistant for your entire customer base. You feed it your own data—we're talking chat logs, internal knowledge bases, your website content, product docs—and it learns. It then uses that knowledge to automate conversations, personalize interactions, and actually get things done. We're talking about increasing qualified leads and improving debt collection rates, not just answering "What are your hours?"

Visit Moveo.AI

The Big Promises: Can AI Really Do All That?

Okay, here’s where my ears perked up. Moveo.AI's website throws around some seriously impressive numbers. Let’s look at them:

- 75% reduction in support costs

- 80% improvement in debt collection

- A 50% boost in qualified leads

- A 90% automation rate

Those are not small figures. A 75% reduction in support costs is the kind of metric that gets CFOs to spill their coffee. But how? Well, it seems to come down to a few key philosophical differences in their approach. This isn't just reactive. The platform is designed to be proactive, using live data to engage customers at the right moment. It also features a “human-in-the-loop” system, which is critical. This means a real person can step in anytime, ensuring quality and handling the truly unique edge cases. It’s a smart hybrid model that builds trust.

A Peek Under the Hood: The Features That Matter

A fancy landing page is one thing, but the feature set is where the rubber meets the road. I was pleasantly surprised to see a focus on things that are genuine pain points for large organizations.

Purpose-Built for Financial Complexity

This is the big one. Finance is a minefield of regulations and security concerns. Moveo.AI seems to get this. They're not just cloud-based; they offer on-premise deployment. For a bank's IT department, that's huge. They also list enterprise-grade security and compliance standards like GDPR, SOC 2, and ISO 27001. They're speaking the language of corporate security, which shows they understand their target market.

More Than Just Keywords: Generative AI and NLU

The platform uses Generative Large Language Models (LLMs) and Natural Language Understanding (NLU). What does that mean in plain English? It means it understands context and intent. It has a feature called "Intent Disambiguation," which is a fancy way of saying if a customer asks something vague, the AI will ask clarifying questions to figure out what they really want. This is teh difference between a helpful conversation and a frustrating dead end.

Personalization That Actually Feels Personal

By integrating with your CRM and other data sources, the AI can have truly personalized conversations. It’s the difference between a bot saying "How can I help you?" and "Hi Sarah, I see your auto insurance payment of $85 is due next Friday. Would you like to pay that now?" That level of personalization is powerful for engagement and, let's be honest, for conversions.

Let's Talk Money: The Moveo.AI Pricing Tiers

Ah, pricing. The moment of truth. Moveo.AI has a tiered structure that seems pretty standard for a SaaS platform, but with a few interesting twists.

| Plan | Key Features | Best For |

|---|---|---|

| Pro | 1,000 conversations/mo, 2 agents, 30-day analytics | Smaller teams or those wanting to test the basic platform. |

| Growth | 5,000 conversations/mo, 5 agents, 90-day analytics, advanced branding | Growing businesses that need more capacity and customization. This is their "most popular" tier. |

| Enterprise | 10,000+ conversations/mo, unlimited agents, on-premise option, data isolation | Large financial institutions with strict security and scale requirements. |

What's interesting is that both the Pro and Growth plans have a "Start for Free" button, which likely means you can take those specific tiers for a spin with a free trial. I appreciate that. For the Enterprise plan, it's the classic "Contact Sales." I personally prefer transparent pricing, but for a solution this complex with variables like on-premise deployment, custom pricing is unavoidable. It makes sense.

The Other Side of the Coin: Potential Hurdles

No tool is perfect, and it would be dishonest to pretend otherwise. Based on my experience with similar platforms, there are a couple of things to keep in mind.

First, the old 'Garbage In, Garbage Out' principle is in full effect here. The effectiveness of Moveo.AI is going to depend almost entirely on the quality of the data you feed it. If your knowledge base is a mess, the AI will be a mess. It requires a commitment to clean, well-organized data.

Second, there's the data security elephant in the room. You're uploading sensitive information. While Moveo.AI has the certifications, the decision to upload customer chatlogs to any third-party platform (even a secure one) is a big one. The on-premise option is a fantastic answer to this, but that's an Enterprise-level feature. Finally, this isn't a simple widget you install in five minutes. There will be an initial setup and configuration process to get it dialed in just right.

My Final Verdict: Who is Moveo.AI Actually For?

After looking through it all, it's clear who this is not for. If you're a small business or a startup, this is likely overkill. But that's not who they're targeting.

Moveo.AI is for established, medium-to-large financial institutions. Think regional banks, credit unions, insurance carriers, fintech companies, and collection agencies that are feeling the squeeze of high customer service costs and see the writing on the wall. They're the ones who can truly benefit from the deep feature set, security assurances, and the potential for massive ROI.

For the right organization, this looks less like a cost and more like an investment in future-proofing their entire customer interaction model. The focus on finance-specific problems is what really sets it apart from the crowd of generic AI platforms.

Conclusion

The conversation around AI in customer service is shifting. It's no longer a question of if it will be transformative, but how to implement it effectively. Moveo.AI seems to have a very compelling answer to that question, especially for the high-stakes world of finance. By combining powerful generative AI with the specific security and functional needs of the industry, they’ve built something that feels both ambitious and incredibly practical. It might just be time for your company to have a real conversation about—and with—AI.

Frequently Asked Questions (FAQ)

- What is Moveo.AI?

- Moveo.AI is a specialized AI agent platform created for the financial services industry. It automates customer support, personalizes conversations, and helps improve processes like debt collection and lead generation by using your company's own data.

- Is Moveo.AI secure for financial data?

- Yes, it appears to be. The platform is compliant with major security standards like GDPR, SOC 2, and ISO 27001. For maximum security, they also offer an on-premise deployment option for their Enterprise clients.

- Can Moveo.AI be deployed on-premise?

- Yes, the on-premise deployment option is available for customers on the Enterprise plan. This allows a company to host the platform on its own servers for greater data control.

- What kind of results can I expect with Moveo.AI?

- Moveo.AI claims significant results, including up to a 75% reduction in support costs, an 80% improvement in debt collection rates, and a 50% increase in qualified leads.

- Does Moveo.AI offer a free trial?

- It seems so. The Pro and Growth plans both feature a "Start for Free" option, suggesting you can trial these tiers to see if the platform is a good fit for your needs before committing.

- How is Moveo.AI different from a standard chatbot?

- Unlike basic chatbots that follow rigid scripts, Moveo.AI uses Generative AI and NLU to understand user intent and context. It can handle complex queries, ask clarifying questions, personalize conversations with live data, and integrate deeply into business workflows.

Reference and Sources

- Moveo.AI Official Website

- Moveo.AI Pricing Page

- Forbes: How Generative AI Is Transforming The Financial Services Industry