The world of trading can feel like trying to drink from a firehose. You’ve got charts coming at you, news alerts pinging non-stop, and about a dozen different indicators all telling you conflicting stories. For years, I've seen countless traders—newbies and veterans alike—get absolutely buried under the weight of all that data. We're all just looking for an edge, some way to quiet the noise and focus on what actually matters.

Then, along came the AI revolution. Suddenly, it feels like every other app has some kind of artificial intelligence baked into it. And you know what? The trading world is no exception. We've gone from relying on gut feelings and old-school technical analysis to having AI-powered assistants that promise to be our partner in the markets. One of the latest tools to pop up on my radar is Lots AI, and I have to admit, it got my attention.

But is it just another shiny object, or is there some real substance here? I decided to take a closer look.

What Exactly is Lots AI? (More Than Just a Fancy Calculator)

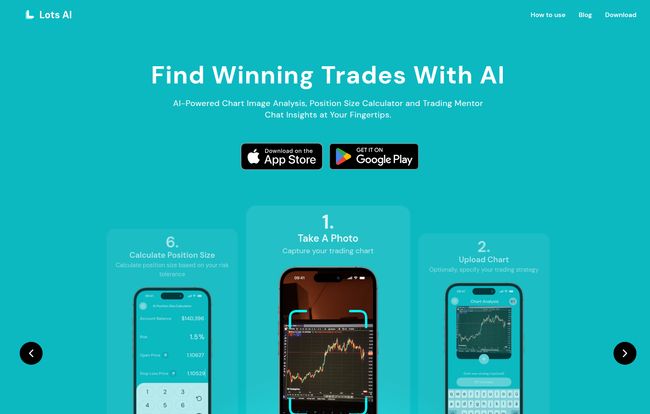

At its core, Lots AI bills itself as an AI-powered trading assistant. But what does that even mean? It's not a trading bot that executes trades for you—let's get that straight. Think of it more like a copilot or a super-smart analyst sitting next to you. Its main job is to take in complex information, like a chart or breaking news, and translate it into actionable insights you can actually use.

It's designed to help you optimize your strategy, get a handle on your risk (something 90% of traders ignore until it's too late), and generally trade with a bit more confidence. It’s like having that one friend who’s an absolute whiz at math and statistics on speed dial, 24/7. A pretty cool concept, right?

The Core Features That Caught My Eye

Alright, let's get into the nitty-gritty. A tool is only as good as its features, and Lots AI seems to focus on three key areas that are genuinely pain points for most traders.

AI Chart Analysis: Your Personal TA Guru?

This is the feature that really stands out. The idea is wonderfully simple. You see a chart you're interested in—could be on your laptop, someone's Twitter post, wherever—and you just take a photo of it with the app. You then upload it, and the AI gets to work analyzing it for you. It’s looking for patterns, potential support and resistance levels, and other technical signals that might take a human eye much longer to spot, especially if you’re new to chart reading.

Visit Lots AI

Now, I’ve been in the SEO and data game long enough to be skeptical of any AI that claims to be a crystal ball. And this is no different. The effectiveness here is going to ride entirely on the quality of its algorithms. But as a tool for getting a second opinion or spotting something you might have missed? That's where I see the real power. It’s a fantastic way to quickly validate (or question) your own analysis before you put any real money on the line.

The Trading Mentor: Chatting Your Way to Better Trades

This part feels very 2024. Beyond just static analysis, Lots AI has a chat-based “Trading Mentor.” Think of it like a specialized ChatGPT for your trading ideas. You can supposedly ask it questions about the chart you just uploaded, discuss your strategy, or get insights on market sentiment. Having a 24/7 sounding board is incredibly valuable.

How many times have you been staring at a chart at 11 PM, wishing you could just ask someone, “Hey, does this setup look crazy to you?” This feature aims to be that someone. It’s a place to refine your thoughts and challenge your own biases, which is a critical step in developing a solid trading psychology.

Precision Position Sizing: The Unsung Hero of Trading

Okay, I'm going to get on my soapbox for a minute. If there’s one thing that separates successful traders from those who blow up their accounts, it’s risk management. And the cornerstone of good risk management is proper position sizing. It’s not sexy, it’s not exciting, but it’s what will keep you in the game.

Lots AI includes a position size calculator that seems incredibly intuitive. You tell it your account size, how much you're willing to risk on a single trade (e.g., 1.5%), and your entry/stop-loss levels. It then does the boring math for you and tells you exactly how many shares or units to buy. This is more than a convenience; it's an emotional guardrail. It stops you from getting greedy on a “sure thing” or scared on a volatile day. For this feature alone, a lot of traders could probably benefit.

The Good, The Bad, and The AI-Dependent

No tool is perfect, and it's important to look at both sides. Based on what I've seen, here’s my honest take.

The good stuff is pretty obvious. Having instant chart analysis and a risk calculator in your pocket is a massive leg up. It’s fast, it’s accessible on iOS and Android, and it focuses on the things that actually matter for long-term success, like strategy and risk. It's democratizing access to analytical power that used to be much harder to come by.

On the flip side, there are a couple of potential hiccups. First, there’s likely a learning curve. To get the most out of a tool like this, you have to understand what it's telling you. You can't just blindly follow its suggestions. Second, and this is the big one, its usefulness hinges entirely on the accuracy of the AI. If the analysis is frequently off, it could do more harm than good. My personal philosophy with any AI tool, whether it's for writing SEO content or analyzing a stock chart, is to treat it as an assistant, not a boss. You are still the CEO of your trading account. The AI provides data; you make teh final call.

What's the Damage? A Look at Lots AI Pricing

This is the question on everyone's mind, isn't it? As of my writing this, there's no clear pricing page on their main website. This is pretty common for app-first platforms. Your best bet is to go directly to the Apple App Store or Google Play Store to see the current pricing structure. It could be a subscription model (monthly/yearly), a one-time purchase, or perhaps a freemium model with basic features for free and advanced ones behind a paywall. I'd expect a subscription, as that's the standard for services that require ongoing AI processing power.

Who is Lots AI Really For?

So, who should download this app? In my opinion, Lots AI isn't necessarily for the absolute beginner who doesn't know what a candlestick is. It's also probably not for the quant who has already built their own army of trading algorithms.

I think the sweet spot is the intermediate trader. You know your way around a chart, you have a few strategies, but you want to bring more structure, discipline, and data-driven insight into your process. It’s for the trader who has a full-time job and can't spend eight hours a day doing deep analysis but wants to make smart, well-managed trades. It’s for anyone who wants to improve their risk management game—which, frankly, should be everyone.

My Final Thoughts

So, is Lots AI the holy grail of trading? Of course not. No single tool is. But is it a genuinely useful and innovative assistant that could help a lot of traders make more disciplined, informed decisions? I think so. The combination of quick-fire chart analysis and a built-in risk management calculator tackles two of the biggest hurdles in trading.

The future of retail trading is undoubtedly intertwined with AI. Tools like Lots AI are just the beginning. As long as you remember that it’s a copilot, not an autopilot, it could be a powerful addition to your trading toolkit. It won't make you a profitable trader overnight, but it might just help you build the habits that do.

Frequently Asked Questions about Lots AI

- Is Lots AI a trading bot?

- No, it is not a trading bot. Lots AI is an analysis and assistant tool. It provides insights, chart analysis, and calculations, but it does not connect to your brokerage account or execute any trades for you. You are always in full control of your trading decisions.

- What markets can I analyze with Lots AI?

- The platform is designed to analyze any trading chart you can capture. This means you can theoretically use it for stocks, cryptocurrencies, forex, commodities, and indices. As long as it's in a standard chart format (like candlesticks or bar charts), the AI should be able to process it.

- Is Lots AI safe to use?

- From a security perspective, yes. Since the app doesn't link to your financial accounts or brokerage, there's no risk of it accessing your funds. It's a standalone analysis tool that works with images and user inputs.

- How accurate is the AI chart analysis?

- This is the million-dollar question. The accuracy of any AI depends on its training data and algorithms. It's best to view the analysis as a high-powered second opinion. Use it to confirm your own findings or to see a perspective you might have missed, but never follow it blindly without doing your own due diligence.

- Is there a free trial for Lots AI?

- Many apps offer a free trial or a freemium version to let users test the features. The best way to find out is to visit the official listing on the Apple App Store or Google Play Store, as these details are often listed there.

References and Sources

- Official Website: lots-ai.app

- Apple App Store: Lots AI on the App Store

- Google Play Store: Lots AI on Google Play