If you've ever worked in or around the financial industry, you know the real currency isn't money—it's paperwork. Endless, soul-crushing mountains of it. We're talking PDF reports, new client forms, legal docs, due diligence files... it's a deluge. For years, the solution has been to just throw more people at the problem. More analysts, more compliance officers, more late nights fueled by lukewarm coffee, all trying to manually sift through this data swamp.

I’ve been in the digital marketing and traffic game for a long time, and I’ve seen countless tools promise to be the magic bullet for efficiency. Most fall flat. They're either too generic, too clumsy, or they just don't get the insane security and compliance demands of finance. So, when I stumbled upon a platform called Cape.ai, which claims to be “agentic AI for financial institutions,” my curiosity was definitely piqued. Could this actually be the one? The tool that tames the paper dragon?

What Exactly Is Cape.ai? (And Why Should You Care?)

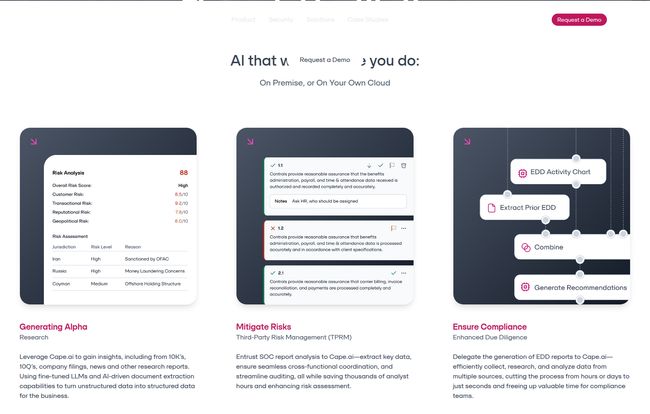

At its heart, Cape.ai is a data refinery. It takes all that messy, unstructured stuff—think of a 200-page PDF report on a potential investment or a scanned new account form—and transforms it into clean, structured, and, most importantly, usable data. It's built specifically for the high-stakes world of banking, investment, and insurance, where a misplaced decimal point or a missed red flag in a report can have massive consequences.

They call it “agentic AI,” which is a fancy way of saying it’s not just a dumb bot. It’s an AI system that can perform complex, multi-step tasks on its own. It doesn't just extract text; it understands context, validates information, and automates entire workflows that used to take a whole team days to complete. This isn't just about saving time, it's about fundamentally changing how financial operations work.

Ditching the Manual Grind: A Look at the Features

Okay, so it sounds cool, but what does it actually do? I took a look under the hood, and it’s pretty clear they’ve talked to people who actually do this work for a living. The use cases aren't theoretical; they're solutions to real, everyday pains.

Supercharging Your Due Diligence and Risk Mitigation

Anyone who's touched KYC (Know Your Customer) or AML (Anti-Money Laundering) processes knows the pain of Enhanced Due Diligence (EDD). You get a massive report on a company or individual and have to manually read through it, pulling out key data points, identifying beneficial owners, and looking for red flags. It’s tedious and incredibly prone to human error.

Cape.ai basically puts this process on autopilot. It can ingest those EDD reports and, within seconds, extract the critical info. The platform's demo shows it turning a multi-day compliance check into a task that takes less time than making a cup of tea. That's not just an improvement; it’s a total game-changer for risk and compliance teams.

Making Client Onboarding Actually... Pleasant?

The first impression a new client gets is often a clunky onboarding process where they fill out forms, and then someone on your end has to manually re-type all that information into your systems. It’s slow and a recipe for typos.

This tool automates that. It can read new account forms, pull out the data, verify it against other sources, and get it into your CRM or core systems without a human ever having to touch a keyboard. Faster onboarding means happier clients and a more efficient sales-to-operations pipeline.

Visit Cape AI

From Audit Nightmares to Automated Insights

Ah, the annual audit. Fun times. Instead of relying on random sampling and manual checks, Cape.ai can automate audit testing. It can analyze huge datasets to identify potential anomalies and control weaknesses that a human might miss. This leads to more thorough audits and, hopefully, fewer nasty surprises down the line.

The "Before and After" Is Pretty Stark

One of the most compelling things I saw on their site was a simple comparison graphic. It was a “Without CAPE” vs. “With CAPE” scenario for analyzing investment filings.

- Without Cape.ai: Manually reviewing 1,000+ filings a month, with over 85% of the process being manual. Ouch.

- With Cape.ai: Automating the data extraction, with manual review dropping to less than 10% and accuracy jumping to over 95%.

Those numbers speak for themselves. This is the kind of ROI that makes CFOs sit up and pay attention. You’re not just cutting costs; you're reallocating your most expensive resource—your people's time—from mind-numbing data entry to high-value strategic analysis.

Security & Deployment: Answering the CISO's Questions

Now, for the big one. The moment you mention “AI” and “financial data” in the same sentence, every security officer in a 10-mile radius gets hives. And for good reason. Sending sensitive client data to some random public cloud AI is a non-starter.

This is where Cape.ai seems to really get it. Their enterprise plan isn’t just a cloud service. They offer on-premise or private cloud (VPC) deployment. This means the entire system can run inside your own secure environment. Your data never has to leave your control. They even let you support your own fine-tuned models. This is a massive point of differentiation and shows they’ve built their platform for the realities of the financial world, not just a tech startup's ideal scenario.

So, What’s the Catch? And How Much Does It Cost?

No tool is perfect, right? Looking at this, I can see a couple of potential hurdles. First, this isn't a plug-and-play app you download from an app store. It's an enterprise system. There will be an initial setup and integration effort to get it connected to your existing workflows and data sources. Second, while the AI is impressive, it's not magic. You still need human oversight. The goal is to reduce manual work to a minimum for review and exceptions, not eliminate human expertise entirely.

As for the price? Well, you won't find a pricing table on their site. It’s all “Contact Us” for a demo and a quote. Don't let that scare you. This is standard practice for enterprise-grade B2B software. The cost depends entirely on the scale of your operation, the specific workflows you want to automate, and the level of support you need. It’s not going to be cheap, but when you weigh it against the cost of manual labor, compliance fines, and missed opportunities, the business case probably writes itself for the right kind of firm.

My Final Take as an SEO and Ops Guy

I’ve seen a lot of hype cycles, especially around AI. But Cape.ai feels different. It feels grounded. It's not trying to be everything to everyone. It's a specialized tool built to solve a very specific, very expensive set of problems for a very specific industry. The focus on security, compliance, and real-world financial workflows is what makes it stand out from the crowd of generic AI wrappers.

If you're at a financial institution and your teams are drowning in documents, I think getting a demo is a no-brainer. It seems like one of those rare tools that could deliver a 10x improvement in efficiency, not just an incremental one. And in today's market, that’s how you get a serious competitive edge.

Frequently Asked Questions

- What is Cape.ai?

- Cape.ai is an agentic AI platform designed for financial institutions. It specializes in automating workflows by extracting and structuring data from unstructured documents like PDFs, reports, and forms to enhance productivity and ensure compliance.

- Who is Cape.ai for?

- The platform is built for banks, investment firms, insurance companies, and other financial institutions that handle large volumes of documents for processes like client onboarding, enhanced due diligence (EDD), audit testing, and risk management.

- Is Cape.ai secure for financial data?

- Yes, security is a core feature. Cape.ai offers on-premise or Virtual Private Cloud (VPC) deployment options, which means an institution's sensitive data can remain within its own secure network, a critical requirement for the finance industry.

- How does Cape.ai handle unstructured data?

- It uses advanced AI and fine-tuned Large Language Models (LLMs) to read, understand, and extract specific information from complex documents. It can identify key data points, validate them, and format the output into structured data that can be used by other systems.

- What is the pricing for Cape.ai?

- Cape.ai follows an enterprise pricing model. There is no public price list; you need to contact their sales team for a demo and a custom quote based on your organization's specific needs and scale.

- Can I use my own AI models with Cape.ai?

- Yes, the enterprise plan allows for the support of your own models, offering greater flexibility and customization for firms with existing AI/ML capabilities.