If you've been in the forex game for more than five minutes, you know the drill. You're glued to your charts, mainlining coffee, and trying to decipher whether that candlestick pattern is a genuine reversal or just the market messing with you again. It’s a grind. A thrilling, sometimes profitable, but always demanding grind.

So, naturally, the idea of 'passive income' through automated trading gets thrown around a lot. It’s the holy grail, right? Making money while you sleep, or fish, or finally watch that series everyone's been talking about. I’ve seen countless forex bots promise the world—usually with flashy, unverifiable results. Most of them are junk. There, I said it.

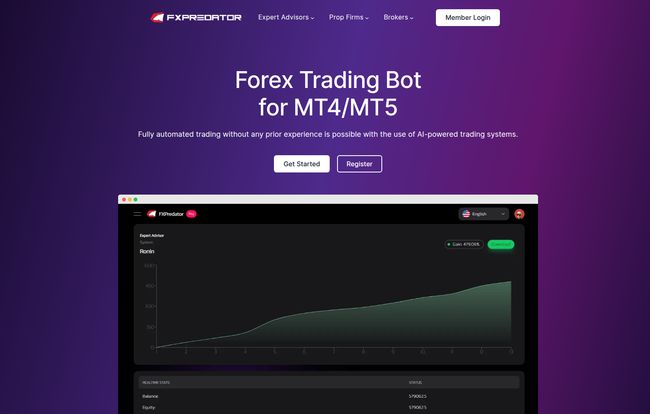

But every so often, something catches my eye. A tool that doesn’t just scream “GET RICH QUICK!” but instead talks about things like transparency, technology, and support. That’s what led me down the rabbit hole with FXPredator. The name is aggressive, but the mascot is a surprisingly dapper polar bear in a suit. I was intrigued.

So, What Exactly is FXPredator?

At its core, FXPredator is a forex trading bot, or what we old-timers call an Expert Advisor (EA). It's a piece of software you plug into your MetaTrader 4 or MetaTrader 5 (MT4/MT5) platform. Once it's set up, it takes over. It analyzes the market using its AI-powered brain, looks for trading opportunities based on a mountain of historical data, and then executes the trades for you. All of them. Buys, sells, stop-losses... the whole shebang.

The whole point is to remove the two biggest liabilities in trading: human emotion and human error. No more panic-selling during a dip or getting greedy and holding a position too long. The bot just follows its programming, cool as a... well, as a polar bear I suppose.

Visit FXPredator

The Million-Dollar Question: Does It Deliver?

This is where 99% of trading bots lose me. They show you a graph that only goes up and to the right, with no way to verify it. It’s marketing fluff. FXPredator, to its credit, takes a different path. They push their transparency hard.

The platform's performance is tracked and verified through Myfxbook. If you're not familiar, Myfxbook is a third-party analytical tool that connects directly to a trading account and tracks its performance in real-time. You can't fake these results. It shows the wins, the losses, the drawdown—everything. For an old cynic like me, this is a massive green flag. It’s them putting their money where their mouth is, and it builds a heck of a lot more trust than a photoshopped screenshot ever could.

They claim proven performance, and by linking to a verified account, they’re giving you the tools to decide for yourself if that performance meets your standards. That’s how it should be done.

Getting Your Paws on the Predator: The Setup

Let's say you're interested. What does it actually take to get this thing running? It's pretty straightforward, but there are a couple of key things to know.

Compatibility and a Quick Start

The bot is designed for the big leagues: MT4 and MT5. These are the industry-standard platforms, so chances are your broker already supports one or both. Once you make the purchase, they say you get instant access to download the EA. No waiting around for days. You buy it, you get it, you can start setting it up.

The VPS Requirement (And Why It’s a Good Thing)

Okay, the site and the docs are clear: you need a Virtual Private Server (VPS) to run this thing properly. Some people might see this as a hassle or an extra cost, but honestly? It's a sign of professionalism. A VPS is basically a remote computer that’s on 24/7. Your EA runs on the VPS, not your home computer.

Why does that matter? Because the forex market doesn't sleep, and your bot shouldn't either. Running it on your Dell laptop is a recipe for disaster. What if your internet cuts out? What if Windows decides to do a mandatory update in the middle of a critical trade? A VPS ensures your bot is always online, always connected, and always executing its strategy without interruption. It’s not a bug, it’s a feature for serious traders.

Not Just a Black Box

One of my initial fears was that this would be a total “black box” system where you have zero control. I was pleasantly surprised to see they offer customization choices. You can adjust settings based on your personal risk tolerance and financial goals. This is crucial. It means you're not just handing over the keys blindly; you're setting the ground rules for your automated trading partner. You can decide to be more conservative or more aggressive, which is a level of control I really appreciate.

The Financials: Capital and Cost

Now for the nitty-gritty. What's this all going to cost?

Starting Capital

The FAQ on their site wisely dodges giving a single number for minimum capital. And they’re right to do so. The amount of capital you need is directly tied to your risk management strategy. Starting with a tiny account and high risk is a quick way to zero. They encourage you to understand the relationship between your capital, lot sizes, and risk. My advice? Never trade with money you can’t afford to lose, and start smaller to get a feel for the bot's behavior before scaling up.

The Price of the Bot Itself

This is the one area where the website is a bit coy. There’s no public pricing page that I could find. This is pretty common for specialized EAs. It often means the price can vary, or they prefer to have a conversation with potential customers first. You’ll likely need to click 'Get Started' or contact their support to get the current price. While I always prefer transparent pricing, the lack of it isn't necessarily a red flag in this niche.

The Good, The Not-So-Good, and The AI

No tool is a magic wand. Let’s break it down with some honest pros and cons from my perspective.

On the plus side, the appeal is obvious. It’s fully automated trading, which is a godsend for people without the time or, let's be honest, the emotional fortitude for manual trading. The verified performance on Myfxbook is a huge plus, as is the excellent customer support they tout. An established track record and customization options round out a pretty compelling package.

However, you have to go in with your eyes open. The reliance on a VPS is a necessity, but it is an extra step and cost. The biggest thing to wrap your head around is that you are putting your faith in an AI algorithm. While it's built on historical data, the market is a chaotic beast. Past performance is not a guarantee of future results—a mantra we should all have tattooed on our forearms. The AI won't be right 100% of the time. There will be losing trades. The goal of a good EA isn't to never lose; it's to be profitable over the long run.

Frequently Asked Questions About FXPredator

Is this forex bot suitable for beginners?

Yes, it's designed for all levels. Since it's fully automated, you don't need prior trading experience to run it. However, I’d still recommend learning the basics of forex so you understand what the bot is doing and can manage your risk appropriately.

How long does it take to get the Expert Advisor?

Delivery is instant. After you complete the purchase, you should receive a download link immediately.

Can I trust the AI to manage my trades?

Trust is built on performance. The key is to look at their verified Myfxbook records. The AI is a tool, not a fortune teller. It operates on logic and probability, not emotion, which is a big advantage. But it's not infallible.

What brokers can I use with FXPredator?

It should work with any broker that offers the MT4 or MT5 platform. They seem to partner with or recommend brokers like IC Markets, Axi, and Eightcap, which are all well-regarded in the industry.

Is automated trading really a source of passive income?

It can be, but it’s not “set it and forget it forever.” You still need to monitor the performance, manage your account, and stay informed. It dramatically reduces your daily time commitment, turning hours of charting into minutes of checking in. So, yes, it's about as passive as trading gets.

My Final Verdict on FXPredator

So, do I think this AI polar bear can really hunt for pips in the wild forex market? My takeaway is a cautiously optimistic yes.

FXPredator seems to be doing a lot of things right. They focus on transparency, use standard industry platforms, and offer a level of customization that respects the trader's intelligence. They aren't selling a dream; they're selling a tool. A sophisticated tool, but a tool nonetheless.

This isn't for the person looking to turn $100 into a million overnight. This is for the serious individual who understands the risks of forex but wants to leverage technology to gain an edge and free up their time. If you're tired of the emotional rollercoaster of manual trading and are looking for a transparent, automated solution, FXPredator is absolutely worth a closer look. Just remember to do your own due diligence, start smart, and let the bot do the heavy lifting.