Remember the great GameStop saga of 2021? Of course you do. It was a wild, chaotic, diamond-handed time to be alive. I remember being glued to my screens, trying to parse the signal from the noise on /r/wallstreetbets. It was a firehose of memes, due diligence (DD), and pure, uncut degeneracy. Fun, but absolutely exhausting.

For every nugget of gold, there were ten mountains of... well, you know. Trying to stay on top of the next potential rocket ship felt like a full-time job. A job that paid in equal parts anxiety and adrenaline. And I've been in the SEO and traffic game for years; I know what information overload looks like. This was it, on steroids.

So when a tool called Fluid crossed my desk, promising to tame that very beast using AI, my curiosity was piqued. A bot that reads Reddit’s finance threads for me and just… tells me what’s important? In my Discord DMs? It sounded too good to be true. So naturally, I had to see for myself.

So, What's the Deal with Fluid, Anyway?

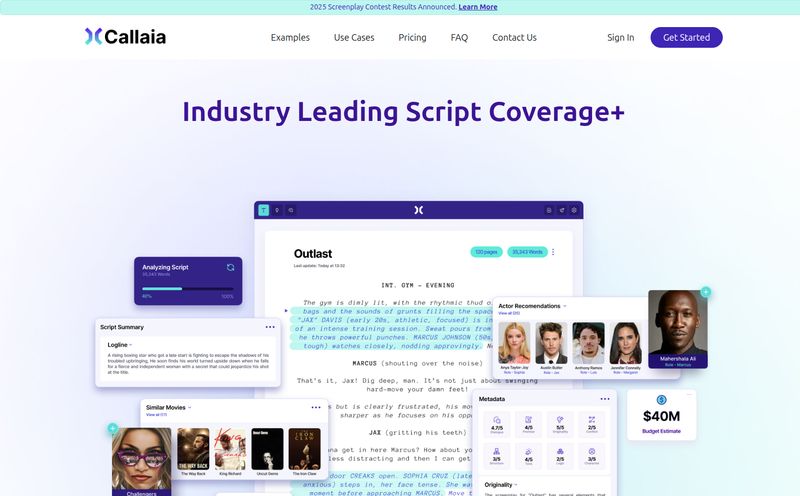

Let's get down to brass tacks. Fluid is essentially an AI-powered intelligence agent for the retail investor. It plugs directly into the chaotic heart of communities like /r/wallstreetbets, /r/stocks, and others, and does the heavy lifting for you. It reads, it understands (or tries to), and it summarizes the top stock ideas and discussions.

Instead of you having to doomscroll for hours, Fluid sends you neat little summaries. You can get them as instant updates right in your Discord DMs—which, let's be honest, is where most of us are hanging out anyway—or as a daily email digest if you prefer a more measured pace. Think of it as a bouncer for the chaotic nightclub that is WallStreetBets. It doesn't let everyone in; it just points you to the VIPs and whispers the hottest gossip in your ear so you can decide if you want to join the party.

Visit Fluid

My First Impressions Getting Started

Signing up was... suspiciously easy. It's a simple Discord authorization. No credit card, no weird permissions, just a couple of clicks and boom, the bot was in my server, ready to go. Within an hour or so, the first alerts started trickling in. It was a summary of a trending post, a breakdown of the stock being discussed, and a quick read on the general sentiment.

I’ve gotta admit, there was a little thrill. It felt like having an inside scoop delivered right to my digital doorstep. No more frantic searching. It was all right there.

The Core Features That Actually Matter

A tool can have a million features, but only a few usually make a real difference. Here’s what stood out to me with Fluid.

AI Summaries That Cut Through the Clutter

This is the main event. The AI summaries are surprisingly coherent. They aren’t just a jumble of keywords. They pull out the specific stock, the core argument of the post, and a general overview. It saves an incredible amount of time. You can glance at a Fluid summary in 30 seconds and get the gist of a 1,500-word post and 500 comments. That’s its real power: efficiency.

The Immediacy of Discord Notifications

Getting these alerts in Discord is a game-changer. The stock market, especially the meme-stock corner of it, moves at the speed of light. An email delivered an hour later is ancient history. A Discord notification is now. It allows you to react quickly, to pull up the original thread if you're intrigued, and to start your own research while the conversation is still hot. It just fits the workflow of a modern trader so much better than traditional alerts.

Reading the Room with Sentiment Analysis

This feature is both the most interesting and the one to be most cautious about. Fluid analyzes the post and its comments to assign a sentiment score. Is the chatter overwhelmingly bullish (🚀🚀🚀)? Or is there a healthy dose of bearish skepticism? It’s like a mood ring for a specific stock ticker on Reddit. It’s a fantastic data point to have, giving you a quick snapshot of the mob's mentality.

The Good, The Bad, and The Inevitable Ape Puns

No tool is perfect, right? Especially one treading in the murky waters of social media sentiment. After using Fluid for a while, I've developed a pretty clear picture of its strengths and weaknesses.

The good stuff is obvious. The speed and convenience are off the charts. It genuinely helps you discover potential opportunities or trends you might have otherwise missed entirely. It’s a fantastic starting point for research, acting as your personal, tireless scout in the wild forests of Reddit finance.

However, and this is a big however, you have to approach it with a healthy dose of skepticism. Relying solely on Reddit sentimant for investment decisions is, to put it mildly, a terrible idea. We all know these communities are susceptible to groupthink, hype, and coordinated pump-and-dump schemes. Fluid reports on the chatter; it doesn’t validate it. The sentiment analysis is a reflection of Reddit's mood, not necessarily a reflection of market fundamentals. There’s also the potential for information overload. If you follow too many active subreddits, your DMs can still get pretty noisy. You have to treat Fluid as one tool in your toolkit, not the entire toolbox. It points you where to look; the actual digging is still up to you.

Fluid is a compass that points to buried treasure. But it doesn't tell you if the treasure is gold or a rusty lunchbox. You still have to bring your own shovel and do the work.

So, How Much Does This AI Spy Cost?

Here's the kicker. As of my writing this, Fluid is free. You can sign up and get the Discord alerts without paying a dime. I kept looking for the catch, the pricing page, the "Pro" tier. It's not there. Now, will it be free forever? My experience tells me probably not. It’s common for new tools to launch free to build a user base before introducing paid plans. So my advice? Get in now while the getting is good. It’s a zero-risk way to see if it adds value to your trading strategy.

Is Fluid the Right Tool For You?

Who is this really for? If you're a casual, long-term, buy-and-hold ETF investor, you can probably skip this. The daily chatter of meme stocks isn't your game, and that's fine. The Warren Buffetts of the world need not apply.

But... if you're an active retail trader, if you find the energy of communities like WallStreetBets exciting, if you're looking for an edge and a way to manage the sheer volume of information, then Fluid could be a fantastic addition to your arsenal. It’s for the digitally-native investor who understands both the potential and the peril of social-media-driven trading. It's for the person who wants to be informed about the next GME, even if they ultimately decide not to jump in.

Final Thoughts: A Worthy Co-Pilot

So, is Fluid a magic bullet that will make you rich? No, of course not. And any tool that promises that is lying to you. But is it a powerful, innovative, and genuinely useful tool for navigating a very specific, very chaotic part of the market? Absolutely. It automates the most tedious part of social trading—the endless scrolling—and lets you focus on the most important part: the analysis and the decision.

For the low, low price of free, it’s a no-brainer to try out. It's a fascinating look at how AI can be practically applied to the world of finance, and it might just help you catch the next wave before it crests. Just promise me you'll do your own DD, okay?

Frequently Asked Questions About Fluid

- Is Fluid really free to use?

- Yes, as of now, Fluid is completely free to sign up for and use. You can get AI summaries and alerts on Discord without any cost. This could change in the future, as is common with new platforms.

- How accurate is the Reddit sentiment analysis?

- It's a mixed bag. The AI is good at gauging the general tone (positive, negative, neutral) of the conversation. However, it's analyzing social media chatter, which can be irrational and manipulative. It's a useful data point, but should not be your only source of truth.

- Can I lose money by following Fluid's alerts?

- Absolutely. Fluid does not provide financial advice. It is an information aggregation tool. All investments carry risk, and stocks discussed on platforms like Reddit are often extremely volatile. Always conduct your own thorough research and never invest more than you are willing to lose.

- What subreddits does Fluid monitor?

- Fluid primarily monitors popular finance and stock-related subreddits, with the most prominent being /r/wallstreetbets and /r/stocks. They may monitor other communities as well to provide a broader view of retail investor discussions.

- Is this better than just browsing Reddit myself?

- It depends on how much time you have. Fluid's main advantage is efficiency. It condenses hours of scrolling into seconds of reading. If you enjoy the process of manually sifting through posts and comments, you might prefer the old-fashioned way. But if you want a quick, high-level overview, Fluid is far superior.

- How do I sign up for Fluid?

- You can sign up directly on their website. The process involves authorizing a Discord bot, which allows it to send you direct messages and alerts within the Discord app.