I’ve been in the digital marketing and trends game for years, and if there’s one thing I’ve learned, it’s how to spot a signal in the noise. We used to do it with keyword trends and search volume; now, the same logic applies to… well, everything. Including how we invest.

The whole ESG (Environmental, Social, and Governance) investing thing isn't new, but the way we get our data has been stuck in the dark ages. We’d get these massive, glossy annual reports from companies—usually months after the fact—telling us how great they were. It felt like trying to drive by only looking in the rearview mirror. Frustrating, right?

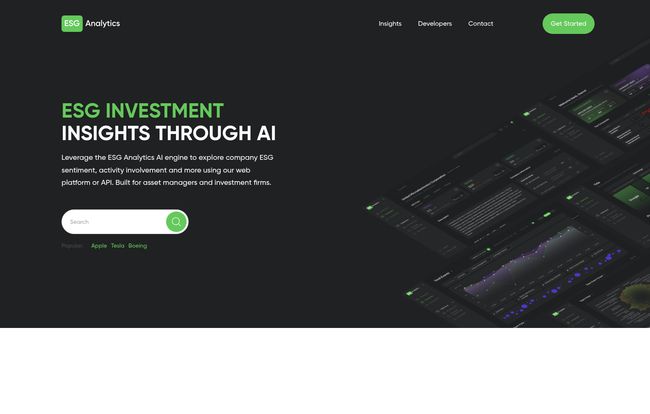

So, when a tool like ESG Analytics pops onto my radar, promising real-time, AI-driven insights, my inner data nerd sits up and pays attention. It claims to be the answer to the lag, the solution to the noise. But is it? Let's take a look together.

So, What Exactly Is ESG Analytics?

At its core, ESG Analytics is a data platform designed for asset managers and serious investors who want to go beyond the fluff. Instead of waiting for a yearly report, the platform’s AI engine is constantly scanning the web—news articles, financial reports, press releases, you name it—from a dizzying number of sources. It’s like having a team of a thousand junior analysts who never sleep, constantly reading and flagging anything that could impact a company’s ESG score.

It then crunches all this information to generate real-time ESG scores and ratings for over 15,000 companies across the globe. The goal is to give you a live, breathing picture of a company’s ethical and sustainable standing, not a static snapshot from last year.

Ditching the Lag: Why Real-Time ESG Data Matters

Let me tell you a quick story. A few years back, I was looking at a company that, on paper, had a stellar ESG report. Clean energy initiatives, great diversity numbers. Looked solid. Then, a small, local news outlet reported on a labor dispute that was brewing at one of their factories. It wasn’t on the front page of the Wall Street Journal, but it was a serious red flag in the 'Social' and 'Governance' departments. By the time the big financial news outlets picked it up and it was reflected in their official ratings, the stock had already taken a hit. I got out, but many who relied on the old data didn't.

That’s the exact problem ESG Analytics is trying to solve. An AI that monitors for ESG risks can catch that local news story, analyze the sentiment, and adjust a company's score almost instantly. In a market that moves at the speed of a tweet, that's not just an advantage; it's a necessity.

A Look Under the Hood at the Key Features

Okay, so the concept is solid. But what are you actually working with? The platform isn’t just a single number; it's a suite of tools that offer a few different ways to slice and dice the data.

The AI-Powered Sentiment Engine

This is the secret sauce, really. The AI doesn’t just see that a company was mentioned in an article about “emissions.” It analyzes the sentiment of that mention. Was it a positive piece about a new carbon capture technology, or a negative exposé on an unreported leak? This sentiment analysis provides a layer of context that a simple keyword search could never give you. It helps you understand the narrative forming around a company, which is often a leading indicator of future performance.

A Tale of Two Access Points: Web Platform vs. API

I really appreciate that they offer two distinct ways to get at the data, because it speaks to two different types of users. There's the Web Platform, which is your classic dashboard. It's perfect for the hands-on portfolio manager or the individual investor who wants to create watchlists, compare companies, and see charts and insights in a clean UI. It’s visual, it’s intuitive, you can get started right away.

Then there’s the API. This is for the quants, the data scientists, the firms that want to plug this firehose of ESG data directly into their own proprietary trading models and algorithms. It's more programmatic, more powerful, and lets you build custom solutions. It’s a whole other ballgame.

Drowning in Data (The Good Kind)

The platform boasts about aggregating data from a “vast number of sources,” and that’s not just marketing speak. To do what they do, they have to be comprehensive. This means they’re not just pulling from the big, obvious places. They’re scraping regional news, industry journals, and regulatory filings. This broad-net approach is what allows them to catch those early signals that others might miss.

Visit ESG Analytics

Let's Talk Turkey: The Pricing Structure

Alright, this is where the rubber meets the road for most people. Is it affordable? It depends on who you are.

For the Web Platform, you're looking at $79.99 per month if you pay monthly. If you commit to a year, that price drops to $59.99 per month (billed annually). For a professional tool offering real-time data on thousands of companies, this feels pretty reasonable, especially for a dedicated investor or small firm.

The API access is, as you’d expect, a bigger investment. It’s $350 per month on a monthly plan, or $250 per month if you pay annually. Now, that annual API plan is interesting—it comes with a free user license for the web platform and a generous 10,000 calls per day. Frankly, if you're serious enough to need the API, the annual plan seems like the most logical choice for the value it offers.

The Good, The Bad, and The AI-Generated

No tool is perfect, and it's important to walk in with your eyes open. Based on my analysis, here’s the breakdown.

The biggest strength is obviously the real-time data feed. It’s a massive leg up on traditional, static ESG reporting. The dual access via a user-friendly web platform and a powerful API is also a huge plus, catering to different workflows and technical skills.

On the flip side, the price point for the API might be a barrier for solo retail investors or very small startups. It's clearly aimed at professional asset managers. There’s also the inherent question of AI bias. While the AI is powerful, it's only as good as the data it’s trained on. An over-reliance on English-language news sources, for instance, could create blind spots in non-English speaking markets. Some might argue this is a risk, however, in my experience, a slightly biased fast signal is often better than a perfectly neutral one that arrives three months late.

Finally, you need to know a bit about ESG to really make this tool sing. It gives you the data, but you still need the wisdom to interpret it. It won’t tell you what to invest in, but it will give you a powerful new dataset to inform your decision.

So, Who Is This Tool Actually For?

I see a few key groups getting a ton of value here:

- Boutique Asset Management Firms: Small to mid-sized firms that want an edge in ESG without building an entire data science team from scratch.

- Quantitative Hedge Funds: Any fund using algorithmic trading could integrate the API feed as a novel signal for their models.

- Serious Retail Investors: For those who manage their own sizable portfolios and have a strong focus on ethical investing, the web platform could be a worthwhile investment.

- Financial Advisors: Professionals who want to offer more sophisticated, data-backed ESG advice to their clients will find the web portal incredibly useful.

Your Questions, Answered

What is ESG investing, anyway?

ESG stands for Environmental, Social, and Governance. It’s an investment strategy that looks beyond just financial numbers. It considers a company's impact on the planet (E), its relationships with employees, customers, and communities (S), and how it’s run internally (G). The idea is that companies that do well in these areas are often better, more resilient long-term investments.

How does ESG Analytics get its data?

The platform uses an AI engine to constantly monitor and aggregate data from a huge number of public sources. This includes major news outlets, financial publications, regulatory filings, company press releases, and more. It then analyzes this data for content and sentiment to generate its scores.

Is the API difficult to use for a developer?

From what I can see in their documentation (and based on industry standards), it looks like a fairly standard REST API. Any developer with experience integrating third-party data sources should find it straightforward. They provide an API key and documentation to get started.

Can I really use this for my personal portfolio?

Absolutely. The Web Platform plan seems designed for this exact purpose. If you are an active investor who takes ESG factors seriously, the monthly cost could easily be justified by helping you avoid just one bad investment or finding one hidden gem.

Is the yearly plan worth the commitment?

If you're going to use the tool seriously, then yes. The discount is significant—you basically get two months free on the Web Platform and a much lower monthly rate on the API. For the API, the added bonus of a free web license makes the annual plan a particularly good deal.

My Final Take on ESG Analytics

So, is ESG Analytics a magic crystal ball? No. But it might be the next best thing: a high-powered telescope pointed at the present. It doesn't predict the future, but it gives you a much, much clearer view of what's happening right now, which is more than most investors have.

For too long, ESG data has been a lagging indicator. Tools like this are changing the game by turning it into a live, actionable signal. It’s not a replacement for good old-fashioned due diligence, but it’s an incredibly powerful addition to the modern investor's toolkit. If you're serious about ESG, this is a platform you should definately be looking at.