If you've ever worked in or around a finance department, you know the soul-crushing dread of 'month-end closing'. It’s a chaotic ballet of chasing down receipts, deciphering cryptic invoice line items, and wrestling with spreadsheets that seem to have a life of their own. For years, we've been promised a magic bullet, a tool that would finally slay this dragon. And for years, most have fallen short.

So when a platform like Yokoy comes along with its slick new branding and bold claims about AI-powered spend management, my inner SEO and tech cynic immediately sits up. Another one? But I have to admit, after digging into what they're doing, my curiosity is definitely piqued. They're not just talking about scanning receipts; they're talking about an entire ecosystem for company spending. Is it all just marketing fluff, or is there some real fire behind all that smoke? Let's get into it.

So, What Exactly is Yokoy Anyway?

At its core, Yokoy is an all-in-one spend management platform designed for midsize companies and large enterprises. Think of it less as a single tool and more as a digital nervous system for your company's finances. It’s built to handle the entire process, from the moment an invoice lands in an inbox or an employee pays for a coffee, to the final reconciliation in your accounting system.

The secret sauce here is what they call their “Three Powerful Technologies.” It’s not just one thing, but a combination:

- Artificial Intelligence: This is the brain. It reads invoices and receipts, verifies data against your company policies, and flags anything that looks fishy. The goal is to eliminate manual data entry. For good.

- Business Rules: This is the logic. You can build custom workflows and approval chains. Need all marketing spend over $5,000 to be approved by the CMO? You can set up a rule for that. It’s about automating your company's specific policies.

- Smart Data Capture: This is the efficiency engine. It pulls data from various sources, enriching the information so your finance team has the full picture without having to dig through emails and PDFs.

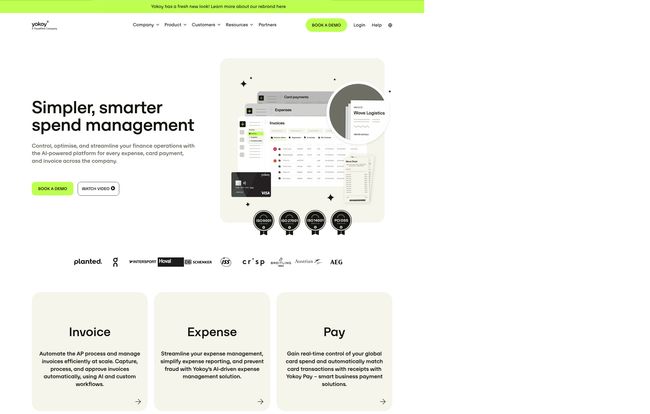

It’s this trio that lets Yokoy tackle the three main pillars of spend: Invoices, Expenses, and Payments. It's an ambitious scope, and honestly, it’s what's needed to solve the whole problem, not just a piece of it.

The Features That Actually Move the Needle

A feature list can be boring, I get it. But with a platform this comprehensive, it’s worth looking at what you actually get. This isn’t just about making things look pretty; it's about giving your finance team their sanity back.

Taming the Invoice Beast with Automation

I’ve seen finance teams with entire walls covered in paper invoices. It’s an organizational nightmare. Yokoy’s invoice automation aims to make that a distant memory. It automatically captures invoices from emails or uploads, uses AI to read all the relevant details (supplier, amount, VAT, you name it), and then routes it through your custom approval workflow. No more “Hey, did you approve this?” emails. The system just handles it.

Making Expense Reports Less… Painful

This is the one everyone can relate to. The dreaded expense report. With Yokoy, the process is ridiculously simple for the employee. You use their smart company cards or just snap a photo of a receipt with your phone. The AI does its thing, pulls the data, and pre-fills the report. It even checks it against policy in real-time. For an employee, this is a godsend. For finance, it means getting clean, compliant data from the start.

Visit Yokoy

Smart Payments and True Spend Analytics

This is where it all comes together. Because Yokoy handles invoices and expenses, it has a complete picture of your company's outgoing cash. The platform gives you end-to-end visibility. The analytics dashboards aren’t just historical reports; they're a live look at your company’s spending patterns. This is the kind of stuff that allows a CFO to move from being a financial historian to a strategic partner, spotting trends and optimizing budgets before the quarter even ends.

Custom Workflows and Seamless Integrations

Here’s a big one for any company with an established tech stack. A new tool is useless if it doesn’t talk to your existing systems. Yokoy was clearly built with this in mind. It has deep integrations with major ERPs like SAP, Oracle NetSuite, and Microsoft Dynamics 365. This means it’s not trying to replace your core accounting system; it's designed to make it more powerful by feeding it clean, verified, and approved data. That's a huge plus in my book and shows they understand the enterprise environment.

The Good, The Bad, and The AI: My Unfiltered Opinion

Alright, no tool is perfect. Let’s break down the real pros and cons based on my experience looking at these kinds of platforms.

The good stuff is pretty obvious. The AI-powered automation is a genuine game-changer. It’s like giving your finance team a crew of hyper-efficient assistants who never take a coffee break. The ability to create customizable workflows is also a major win. Every company has its own quirks and rules, and a rigid, one-size-fits-all system just doesn't work for a growing business. And that end-to-end visibility? It’s what finance leaders dream about.

But, let's talk about the other side of the coin. The first thing you'll notice is the reliance on AI. While powerful, it's not infallible. There's an inherent learning curve for the system, and in the beginning, you'll want to have a human-in-the-loop to double-check its work. Trust but verify, as they say. Also, a platform this powerful can have some initial complexity. It's not a plug-and-play app you download on your phone; it requires thoughtful setup and probably some team training to get the most out of it. This isn't a flaw, just the reality of enterprise-grade software.

Let's Talk Money: The Yokoy Pricing Model

If you're looking for a neat little pricing table with three tiers, you’re not going to find it. Yokoy uses a quote-based pricing model. You have to contact their team, do a demo, and they'll prepare a custom quote based on your company's specific needs—things like transaction volume, number of users, and the complexity of your integrations.

Now, I know some people get annoyed by this. “Just tell me the price!” But in the B2B SaaS world, especially for a platform this flexible, it actually makes sense. You're not paying for features you don't need, and the price is scaled to the value you're actually going to get. It’s a bit more effort upfront, but it often leads to a fairer price in the long run. My advice? Don't be shy. Book the demo and see what they have to say.

So, Who Is This Really For?

After looking everything over, it’s pretty clear who will get the most value from Yokoy. If you're a midsize company whose finance processes are starting to burst at the seams—held together by spreadsheets and sheer willpower—Yokoy could be the structured, scalable solution you need.

And for large, global enterprises, the appeal is in the standardization, compliance, and multi-entity support. Managing spend across different countries with different regulations is a Herculean task, and this is exactly the kind of challenge Yokoy is built to solve.

Who isn't it for? Probably the solo freelancer or the 5-person startup. The platform's power would likely be overkill, and a simpler, off-the-shelf expense tracker would do the trick.

Frequently Asked Questions about Yokoy

1. What does Yokoy do in a nutshell?

Yokoy is an AI-powered software platform that automates the entire spend management process for companies. It handles everything from invoice processing and employee expense reports to payments and spend analytics, all in one place.

2. How smart is Yokoy's AI?

The AI is designed to read and understand documents like invoices and receipts, automatically extracting key data. It also validates this information against your company's policies to flag duplicates, out-of-policy spend, and potential fraud. It gets smarter over time as it processes more of your company's data.

3. Can Yokoy connect to our existing finance software?

Yes, absolutely. Yokoy is built to integrate with a wide range of existing finance and ERP systems, including major players like SAP, Oracle NetSuite, Microsoft Dynamics 365, and more. This ensures a smooth flow of data into your central accounting system.

4. Is Yokoy secure for sensitive financial data?

Security is a core focus for Yokoy. The platform is designed with built-in security and privacy features to protect sensitive financial information, adhering to industry standards for data protection.

5. How much does Yokoy cost?

Yokoy uses a custom pricing model. There is no public price list; instead, you need to contact their sales team for a quote based on your company's specific size, transaction volume, and feature requirements.

Final Thoughts: Is Yokoy Worth a Look?

So, we come back to the original question. Is Yokoy the one? In my opinion, it's one of the most compelling contenders I've seen in the spend management space for a while. They're not just patching a small hole; they're trying to repave the entire road for finance teams. The combination of AI, deep customization, and a focus on the full spend lifecycle is genuinely powerful.

It won't be the right fit for everyone, and it demands a thoughtful implementation. But for the right company—one that's feeling the pain of manual processes and is ready to invest in true automation—Yokoy could be more than just a new tool. It could be a fundamental upgrade to how your business manages money. And that’s something worth getting excited about.