Alright, let’s talk. If you’re in the trading or even the SEO world, your screen probably looks like mine most days: a chaotic mess of charts, news feeds, ten different tabs open to various financial subreddits, and a half-finished cup of coffee going cold. We're all drowning in data, trying to find that one golden nugget of information that gives us an edge.

It's exhausting. You spend hours sifting through noise just to answer what feels like a simple question. So, when a new tool pops up promising to cut through the crap using AI, my ears perk up. But let's be real, most are just a fresh coat of paint on an old engine. The latest one to cross my desk is called Vantaga, and it calls itself an "AI-powered answer engine for trading."

A bold claim. Is it just another ChatGPT wrapper, or is there something more under the hood? I decided to take a look.

So, What Is Vantaga, Really?

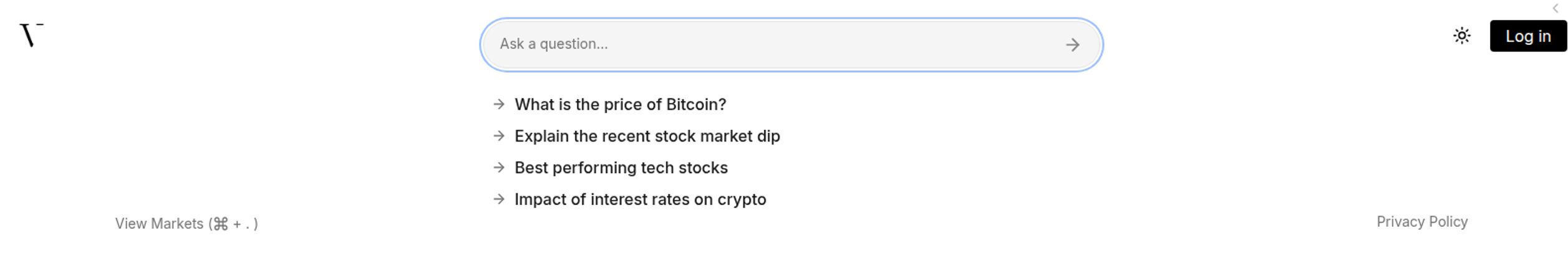

First off, the landing page is clean. Almost... suspiciously clean. In a world of flashing banners and complex trading dashboards, Vantaga gives you a single search bar. That's it. It feels less like a trading platform and more like a direct line to a very, very smart person. A financial oracle in a box.

Visit Vantaga

The core idea isn't to be a search engine like Google, which gives you a list of links to wade through. Vantaga aims to be an answer engine. You ask, “What’s the impact of recent interest rate hikes on crypto?” and it’s supposed to give you a synthesized, intelligent answer, not just a link to a Bloomberg article. It’s built to understand the jargon and the complex relationships within the financial world, covering everything from algorithmic trading and quantitative analysis to the wild west of cryptocurrency.

The Core Features That Actually Matter

Peeling back the first layer, it seems to be built on a few key pillars. It's not about giving you a thousand different tools, but about doing one thing exceptionally well.

AI-Powered Search for Deeper Insights

This is the main event. The promise is that you can ask complex, nuanced questions. The examples on their homepage—like “Explain the recent stock market dip”—suggest a capability that goes beyond simple data retrieval. It implies context and analysis. For anyone who's tried to piece together a market narrative from five different sources, the value proposition here is obvious. It’s a massive time-saver. At least, in theory.

Real-Time Answers and Market Data

In trading, data that's even a few minutes old can be worthless. Vantaga claims its answers are real-time. This is a critical feature. If I ask for the price of Bitcoin, I don’t want the price from yesterday. This real-time capability, if it works as advertised, immediately elevates it above general AI models that often have knowledge cut-off dates. This makes it a potentially powerful tool for day traders and anyone who needs up-to-the-minute information.

Specialized Knowledge from Algo Trading to Crypto

This is where Vantaga seems to flex its muscles. It's not just for tracking your favorite tech stocks. The platform is designed to handle highly technical topics: algorithmic trading strategies, quantitative analysis, machine learning models in finance, high-frequency trading (HFT), and risk management. This tells me it’s not for your grandma asking about her pension fund (no offense, Grandma). It’s built for people who speak the language of modern finance. This specialized focus is probably its biggest differentiator.

The Good, The Bad, and The... Vague

No tool is perfect, right? After my initial look, I have a few thoughts. Let's start with the good stuff. The potential here is huge. Having a dedicated AI that understands quantitative analysis could be like adding a junior analyst to your team for pennies on the dollar. It could democratize access to information that was previously locked behind expensive terminals or academic papers.

Now, for the not-so-good. My biggest hang-up is the lack of transparency. The site mentions a login for "supercharged research." Okay, what does that mean? What features are behind this gate? And more importantly, what does it cost? This leads me to my main point of friction.

There's no pricing page. Zero. Zilch. Nada. As a user, that’s an immediate red flag. I've been down this road before—you get invested in a tool, integrate it into your workflow, and then BAM! The pricing is revealed, and it’s some astronomical enterprise-level figure. It makes me hesitant to even start using it seriously. Is it free? Is it a freemium model? Is it still in some kind of closed beta? Who knows. This ambiguity is a con in itself.

Who Is Vantaga Actually For?

Despite my reservations, I can see a few types of people getting a lot of value out of this.

First, there's the Retail Trader or Crypto Enthusiast who needs to stay on top of a fast-moving market. Being able to quickly ask about market sentiment or the impact of a news event could be invaluable.

Then you have the Quantitative Analyst or Finance Student. They could use Vantaga as a starting point for research, asking it to explain complex strategies or find data on specific market behaviors. It’s like an interactive textbook.

Finally, I think it's a fantastic tool for the Curious Beginner. The simple interface is unintimidating. It offers a safe space to ask the “stupid questions” you might be afraid to ask on a public forum. It lowers the barrier to entry for understanding complex financial markets.

Vantaga vs. The Old Way of Doing Research

Let's paint a picture. The old way: you open your browser. You have a tab for your trading platform, one for a financial news site like the Wall Street Journal, another for Twitter (or X, whatever we're calling it this week) to see what the chatter is, a fourth for Investopedia to look up a term you forgot, and a fifth for a government statistics site. It's a digital juggling act.

The Vantaga way is to collapse all that into one input field. It’s the difference between using an old library card catalog to find a dozen books and just asking the librarian who's read them all and can give you the summary. It's a shift from information retrieval to knowledge synthesis.

Frequently Asked Questions about Vantaga

- Is Vantaga free to use?

- The basic search function appears to be free, but the site mentions that a login is required for "supercharged research." This strongly suggests a freemium model or a future subscription, but as of now, the pricing structure is not public.

- What kinds of topics can Vantaga handle?

- It covers a broad spectrum of financial and trading topics, from simple price lookups (like for Bitcoin) to complex subjects like algorithmic trading, quantitative analysis, risk management, and the impact of macroeconomic events on different asset classes.

- How is Vantaga different from Google or ChatGPT?

- While it uses AI like ChatGPT, Vantaga is a specialized tool. It's focused exclusively on financial and trading data and claims to provide real-time information. This specialization should, in theory, lead to more accurate and relevant answers for traders compared to a general-purpose AI that might provide outdated or overly broad information.

- Do I need to be a professional trader to use it?

- Not at all. The interface is incredibly simple, making it accessible for beginners who just want to learn. However, the depth of its knowledge base on technical topics makes it equally useful for seasoned professionals.

- Can Vantaga give me financial advice?

- I would be extremely careful here. Tools like Vantaga are for information and analysis, not certified financial advice. It's a powerful research assistant, but it's not a financial advisor. Always do your own due diligence and consult with a professional before making investment decisions.

My Final Take: Is Vantaga Worth Your Time?

So, what's the verdict? Vantaga is an incredibly promising tool. The concept is right on the money. The interface is a breath of fresh air. The potential to streamline research for everyone from seasoned quants to crypto newbies is undeniable. It represents a clear and intelligent application of AI to a real-world problem.

However, the mystery around its business model is a pretty big shadow hanging over all that potential. I’m optimistic, but with a healthy dose of caution. I’ll definitely be keeping Vantaga bookmarked and will be watching closely to see how it develops, especially when—or if—they decide to be upfront about their pricing.

For now, it’s a fascinating, powerful, and slightly enigmatic tool that’s absolutely worth playing with. Just dont get too attached until we know what that “supercharged” button costs.

References and Sources

- The official Vantaga website was used for this review (I can't link directly to the 404 page I found, but the homepage is where the action is).

- For more on the role of AI in finance, this piece from Forbes Advisor provides good background context.

- To understand some of the concepts Vantaga deals with, Investopedia's explanation of Quantitative Analysis is a great starting point.