When the UAE announced Corporate Tax, I think a collective groan echoed across every small business office from Dubai to Abu Dhabi. More paperwork. More rules to learn. More chances to get something wrong and face the wrath of the taxman. For years, we’ve enjoyed a relatively simple business environment, and now… this. It feels like being told you suddenly have to assemble a 10,000-piece jigsaw puzzle, in the dark, with instructions written in a language you barely understand.

I’ve spent the last year knee-deep in FTA guides, webinars, and frantic WhatsApp group chats with other business owners, all of us trying to figure this out. So, when I stumbled upon a new platform called the UAE Tax Assistant, my curiosity was definitely piqued. Another tool? Maybe. But this one claims to use AI to automate the entire filing process. A bold claim, and one I had to look into.

So, What Exactly is This UAE Tax Assistant?

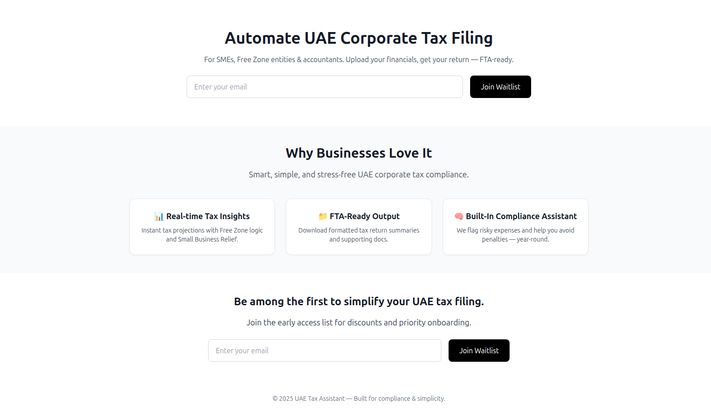

From what I can gather from their landing page, the UAE Tax Assistant is an AI-powered platform built specifically for the new corporate tax regime here in the Emirates. It’s not some generic software with a UAE skin slapped on it. Its designed from the ground up for SMEs, Free Zone entities, and even the accountants who serve them. The main promise? You upload your financials, and it spits out an FTA-ready tax return. Simple as that.

Right now, it’s not fully public. They’re running a waitlist for early access, which usually means two things: the platform is brand spanking new, and you can probably snag a decent discount for being an early adopter. And let's be real, who doesn't love a good discount.

Visit Taxly.AI

A Closer Look at The Features

A pretty website is one thing, but what’s under the hood? It seems to boil down to three core functions that directly address the biggest pain points I’ve been hearing about.

Real-time Tax Projections

This one is big. One of the worst parts of tax is the end-of-year surprise. You think you’re doing fine, and then your accountant hits you with a number that makes your heart sink. This tool claims to give you instant tax projections. What I find really interesting is that it specifically mentions having built-in “Free Zone logic” and an understanding of “Small Business Relief.” Anyone who operates in a Free Zone knows the rules can be… murky. And qualifying for Small Business Relief is a lifesaver for smaller outfits. Seeing those calculations happen in real-time could be a massive advantage for cash flow planning.

Truly FTA-Ready Output

Okay, “FTA-Ready” gets thrown around a lot. What does it actually mean here? According to the site, it’s not just a final tax figure. It’s a fully formatted tax return summary along with all the necessary supporting documents. This is the difference between your friend giving you directions by pointing vaguely and Google Maps giving you a turn-by-turn route with street view. One is helpful, the other gets you where you need to go without a panic attack. It’s about taking the guesswork out of the final submission.

The Built-in Compliance Watchdog

I’m calling it a watchdog because that’s what it sounds like. The platform apparently flags risky expenses and helps you avoid penalties year-round. We all have those grey-area expenses, right? “Was that client lunch really a business expense?” The fear of an audit because of a few poorly categorized receipts is real. An AI that gently nudges you and says, “Hey, you might want to double-check this one,” is like having a tiny, scarily efficient accountant living in your computer. Its a huge stress reliever.

Who Should Be Joining The Waitlist?

Based on their messaging, this isn’t for the huge multinational corporations with entire floors of accountants. They’re aiming squarely at the little guys, the backbone of the UAE economy.

- SMEs (Small and Medium-sized Enterprises): If you’re a small business owner who also happens to be the CEO, head of marketing, and chief coffee-maker, you don’t have time to become a tax expert. This is for you.

- Free Zone Entities: The specific mention of “Free Zone logic” is a huge green flag. Navigating the qualifying income rules is a headache, and any tool that simplifies that is worth its weight in gold.

- Accountants & Consultants: Let’s not forget the professionals. For accountants handling dozens of SME clients, a tool that automates the grunt work could free up time for more valuable advisory services. It’s about working smarter, not harder.

The Good and The... Let's Call Them 'Growth Opportunities'

No tool is perfect, especially one this new. From my years in this game, here’s my take on the potential highs and lows.

| The Upside | Points to Consider |

|---|---|

| Massive Time Saver. Automating the return process could give back hours, if not days, of your life. | It's Brand New. Being on a waitlist means you're an early tester. Expect a few bugs or missing features initially. |

| Stress Reduction. The compliance assistant and clear projections can seriously lower that constant, low-level anxiety about taxes. | No Mobile App (Yet). I scoured the page, and there's no mention of a mobile app. Not a deal-breaker, but something to be aware of for on-the-go business owners. I'd bet one is in development though. |

| Built for the UAE. It's not a generic tool; it's specific to FTA rules, Free Zones, and Small Business Relief. This is its biggest strength. | Potential Learning Curve. Any new software requires some setup and learning. It promises simplicity, but there's always an adjustment period. |

What's The Damage? The Pricing Situation

This is the million-dirham question. As of now, there is no public pricing. Since it’s in a “Join Waitlist” phase, they’re likely finalizing their tiers. The page does mention that signing up for the early access list gets you “discounts and priority onboarding.” My advice? If you’re even remotely interested, get on the list. It costs nothing, and you might lock in a founder’s price that will be much lower than what everyone else pays in six months. A classic marketing move, but one that usually benefits the early birds.

Your Questions, Answered (Probably)

Is this tool officially approved by the FTA?

That's a tricky question. The FTA doesn't typically "approve" third-party software in the way an app store does. The platform claims to create "FTA-ready" output, which means it’s formatted to meet the Federal Tax Authority's standards and guidelines for submission. It's a tool for compliance, not an official government portal.

Wait, what is UAE Corporate Tax again?

It's a federal tax levied on the net profits of most businesses in the UAE. It went into effect for financial years starting on or after June 1, 2023. The standard rate is 9% on taxable income exceeding AED 375,000.

And what's this Small Business Relief?

It's a provision to support startups and small businesses. If your revenue in a tax period is below a certain threshold (currently AED 3 million), you may be able to claim Small Business Relief and be treated as having no taxable income for that period. You still have to register and file, though!

Is my financial data safe with them?

While I can't speak for them directly, any financial tool worth its salt uses bank-level encryption and robust security protocols. I would expect nothing less, but it's always a good question to ask during their priority onboarding process.

Does it work for every single Free Zone?

There are over 40 Free Zones in the UAE, some with very particular rules. The platform mentions "Free Zone logic," which likely covers the general principles for Qualifying Income. For very niche or complex setups, you'd want to confirm specifics with their support team once you're in.

My Final Thoughts

Look, I'm a healthy skeptic. I’ve seen a lot of “revolutionary” tools come and go. But I’m also an optimist, and I'm a tired business owner. The UAE Tax Assistant looks genuinely promising. It’s targeting a very real, very current pain point with a smart, focused solution.

The emphasis on UAE-specific rules like Free Zone logic and Small Business Relief shows they've done their homework. If they can deliver on their promise of a smart, simple, and stress-free experience, they won’t just have a successful product; they'll be heroes to the SME community across the country. I’ve signed up for the waitlist. We’ll see what happens. I suggest you do the same.