Ah, tax season. That magical time of year when coffee becomes a food group and the sun is a distant memory for most accountants. For years, we’ve been swimming against a tsunami of paperwork, complex tax codes, and ever-looming deadlines. We've built our workflows on grit, spreadsheets, and the sheer will to survive until April 16th. But what if I told you the cavalry is coming, and it's powered by algorithms?

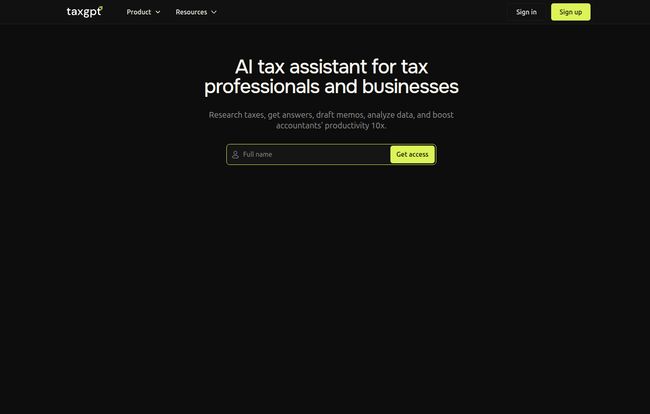

If you've spent any time online in the last couple of years, you've seen the AI boom. It started with tools like ChatGPT writing poems and essays, and now... well, now it’s coming for our 1040s. I’ve been in the SEO and traffic generation world for a long time, and I’ve seen firsthand how AI can transform an industry. So when I stumbled upon TaxGPT, a platform claiming to be an “AI tax assistant for tax professionals,” my curiosity was definitely piqued.

Is this just another piece of tech hype, or is it the digital co-pilot we've all been secretly wishing for? Let's get into it.

So, What is TaxGPT, Really?

At its core, TaxGPT is an AI-powered assistant designed specifically for the people in the trenches: accountants and tax pros. The big, flashy promise on their site is a 10x boost in productivity. A bold claim, for sure. As someone who tests tools for a living, I've learned to take claims like that with a grain of salt. But even if it only delivers a 2x or 3x boost... that’s a massive win when you’re buried in returns.

Think of it less as a robot taking your job and more as a super-smart intern who never needs to sleep, has read every IRS publication ever written, and can draft a client email in seconds. It’s designed to handle the grunt work—the research, the data analysis, the initial drafts—so you can focus on the high-level strategy and client relationships that actually make you money.

The Core Features That Caught My Eye

A tool is only as good as its features, right? TaxGPT seems to have a few aces up its sleeve.

Visit TaxGPT

Your AI Co-Pilot for the Daily Grind

The main event is the AI co-pilot. This is your go-to for tax research, drafting memos, and analyzing documents. Instead of spending an hour digging through tax law databases for a niche question about depreciation on, I don't know, a llama farm, you can just ask the AI. It’s meant to give you accurate, up-to-date answers, complete with citations. This alone could be a game-changer for firms that handle a wide variety of client situations.

Meet Agent Andrew, Your AI Audit Partner

Okay, this one sounds pretty cool. “Agent Andrew” is their name for an AI-powered tool that reviews and audits tax returns. After you've stared at a screen for ten hours straight, your eyes start to glaze over. It's easy to miss a misplaced decimal or an overlooked deduction. Agent Andrew is that second set of digital eyes, scanning for potential errors and—more importantly—tax savings opportunities. Finding an extra grand in savings for a client is how you turn a one-time customer into a lifelong advocate.

Beyond Research and Into Your Workflow

This isn’t just a fancy search engine. TaxGPT also includes client management tools and the ability to integrate an AI chatbot into your own systems. This shows they’re thinking about the entire firm's workflow, not just the research part. The goal seems to be creating a central hub that streamlines operations from client communication all the way to final review. That's the kind of thinking that separates a gimmick from a genuinely useful platform.

The Good, The Bad, and The AI

No tool is perfect. In my experience, it's all about whether the good outweighs the bad for your specific needs. So let's get real about TaxGPT's potential highs and lows.

Why You Might Just Love TaxGPT

The upside is pretty clear. The time savings on research and compliance are huge. Imagine cutting down the hours you spend on non-billable research. This tool also promises tailored responses based on a specific client's tax situation, which is far more useful than a generic Google search. By streamlining your entire process and helping you spot errors or savings opportunities, it could directly impact your bottom line and improve client satisfaction. It’s about efficiency, accuracy, and providing more value. Simple as that.

Some Potential Red Flags and Realities

Now, for the other side of the coin. The biggest concern I always have with AI is over-reliance. This is a powerful tool, but it's not a substitute for your professional judgment and experience. The answers it provides are only as good as the AI model and the data it was trained on. As the old saying goes, garbage in, garbage out. You still need to be the expert in the room who can sanity-check the AI's output. Some might argue that relying on AI could dull our critical thinking skills, a point I think is worth considering. We need to see these tools as partners, not crutches. Also, like many new B2B tools, it requires a work email for some features and may not be available in all regions yet—standard growing pains for a startup.

So, How Much Does This AI Magic Cost?

Here's the million-dollar question. Or, hopefully, the much-less-than-a-million-dollar question. As of writing this, TaxGPT's website doesn't have a public pricing page. This isn't uncommon for new, specialized SaaS platforms, especially those targeting professional firms.

My gut tells me they're likely operating on a "request a demo" model. They want to talk to you, understand your firm's size and needs, and then give you a custom quote. I'd expect to see a tiered pricing structure—maybe a plan for solo practitioners, a plan for small firms (per seat), and an enterprise solution for the big players. Without a price tag, it's hard to calculate ROI, but you can bet that's what their sales team is trained to help you do.

Who Is This Really Built For?

After looking at the features, I think TaxGPT is aimed squarely at the modern, tech-forward accounting firm. Whether you're a solo accountant trying to compete with larger operations or a mid-sized firm looking to scale efficiently, this tool seems designed to help you punch above your weight. If you're the kind of professional who feels like you're constantly drowning in compliance tasks and wish you had more time for strategic client advising, you are the target audience.

If you're still running your entire practice on paper and a calculator... well, this might be a bit of a leap. But for everyone else, it’s worth a look.

My Final Verdict on TaxGPT

So, is TaxGPT a revolutionary tool that will change accounting forever? It has the potential to be. I don't think we're at the point where AI is filing complex corporate returns on its own, and I don't think accountants need to worry about being replaced. Not yet, anyway.

The real power of a tool like TaxGPT is in augmentation. It’s here to take the repetitive, time-consuming tasks off your plate, freeing up your valuable brainpower for the work that matters. It's about turning hours of research into minutes of verification. It's about having an always-on assistant to help you deliver better, faster, and more accurate service to your clients. The AI overlords aren't here to replace us; they're here to make us better at our jobs. And I, for one, am ready to see what they can do.

Frequently Asked Questions about TaxGPT

What is TaxGPT in simple terms?

TaxGPT is an AI-powered software assistant for accountants and tax professionals. It helps with tax research, reviews tax returns for errors, drafts documents, and helps manage client communication to make tax preparation faster and more accurate.

Is TaxGPT secure for sensitive client data?

While their website doesn't detail their specific security protocols, any platform designed for tax professionals must prioritize data security. It's expected that they use robust encryption and security measures to protect confidential client information. Always confirm security standards before uploading sensitive data.

Can TaxGPT completely replace my accountant?

No, absolutely not. TaxGPT is a tool to assist tax professionals, not replace them. It can't provide the strategic advice, ethical judgment, or personalized client relationship that a human accountant can. Think of it as a very powerful calculator and research assistant, not the final decision-maker.

How does the AI stay updated with new tax laws?

This is a critical function. An AI tax tool is only useful if its knowledge is current. Platforms like TaxGPT must have a dedicated process for continuously training their AI models on the latest tax codes, IRS publications, and legal precedents to provide accurate and compliant answers.

Is there a free trial for TaxGPT?

The website currently directs users to a sign-up or demo request form rather than advertising a free trial. It's best to check their official site or contact their sales team directly to see what trial or demo options are available.

Conclusion

The world of accounting is changing, and technology is at the heart of that transformation. Tools like TaxGPT are no longer science fiction; they are practical solutions to age-old problems. By embracing AI, tax professionals have a real opportunity to not just survive, but to thrive, offering more value to their clients than ever before. It's not about working harder during tax season—it's about working smarter all year round.

Reference and Sources

- The official website for TaxGPT.

- An interesting perspective on AI in the industry: How AI Is Transforming The Accounting Industry via Forbes.