I remember my early days as an analyst. The sheer volume of paper... well, PDFs. Mountains of them. Annual reports, quarterly earnings call transcripts, investor presentations. My eyes would glaze over, and my most-used keyboard shortcut wasn't copy or paste, it was CTRL+F. I’d spend hours, sometimes days, hunting for a single metric or a specific comment from the CFO about capital expenditure. It was a grind. A necessary one, but a grind nonetheless.

So when someone says, “Hey, there’s an AI that can do that for you,” my ears perk up. But I'm also skeptical. We’ve all seen AI tools that promise the world and deliver a glorified search engine. But every now and then, something comes along that genuinely feels different. Something that feels like a real step forward. I think Stock Alpha might be one of those things, especially if you’re focused on the Indian market.

What Exactly Is Stock Alpha?

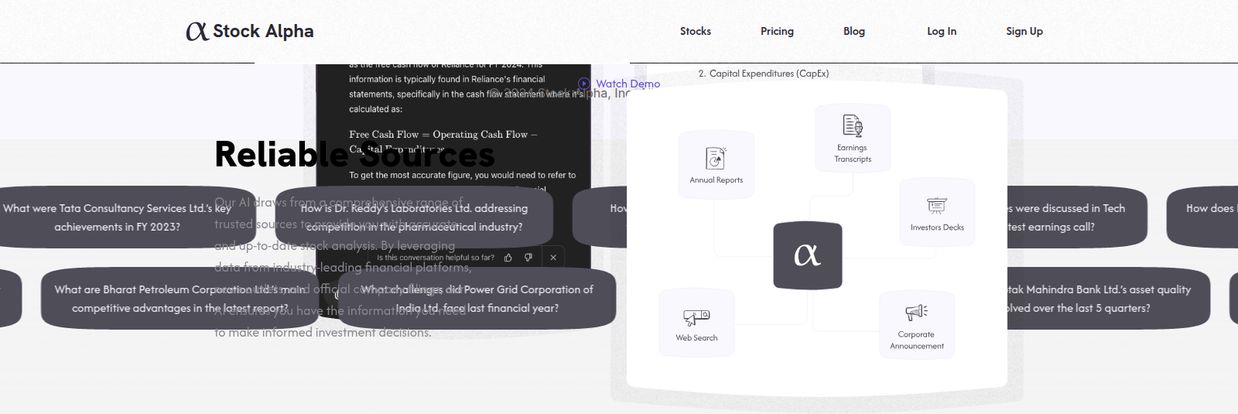

Let's cut through the jargon. Stock Alpha is an AI-powered research tool that lets you have a conversation with financial documents. Imagine being able to just ask a 300-page annual report, “Hey, what were the main drivers of revenue growth last year?” and getting a straight, concise answer with the source cited. That's the core idea here.

It plugs into the heavy, dense documents that matter most: annual reports, earnings transcripts, investor decks, and even corporate announcements. It’s designed specifically for the Indian stock market, covering over 100 of the big players, including the entire Nifty 50. This isn't a generic tool trying to be everything to everyone; it's a specialist. It’s like having a junior analyst who's a speed-reader, has a photographic memory, and is laser-focused on Dalal Street.

Visit Stock Alpha

My First Impressions and Getting Started

Logging into Stock Alpha for the first time is refreshingly simple. There’s no cluttered dashboard or a million menus to navigate. It's just a clean, minimalist chat interface. It feels familiar, like a messaging app, which immediately lowers the barrier to entry. You’re greeted with a search bar inviting you to pick an Indian company.

The platform seems to operate on a freemium model. My first visit gave me “3 free chats,” which is their way of letting you test the waters. It's a smart move. It’s just enough to see the magic happen and get you hooked. I decided to throw a real-world question at it, something I'd actually look for: “What were Bharat Petroleum Corporation Ltd's main competitive advantages mentioned in their latest report?” A few seconds later, it spat out a summarized answer, pulling key points directly from the source material. No fluff. Just the data. I have to admit, that was pretty cool.

The Real Time-Saver: Digging into the Features

Okay, a simple Q&A is nice, but where does it really add value? After playing around with it for a bit, a few things really stood out to me.

Asking the Right Questions

This is the heart of the tool. The ability to ask pointed, specific questions is a superpower for an investor. Instead of sifting through legalese, you can ask direct questions like, “How is Dr. Reddy's Laboratories Ltd. addressing competition in the pharmaceutical industry?” or “What did the management of Tech Mahindra say about client acquisition in the last earnings call?” The AI goes and finds the relevant snippets. It's not just keyword matching; it seems to understand the context, which is a big deal. This turns hours of research into minutes of inquiry.

From Raw Data to Readable Summaries

Let's be honest, nobody wants to read an entire annual report. We do it because we have to. Stock Alpha’s ability to generate summaries is a massive time-saver. It can give you the executive summary of an earnings call or the key takeaways from an investor deck. This is perfect for getting a quick overview of a company's recent performance before you decide if you want to go deeper. It's the difference between reading the whole book and getting a perfect, detailed synopsis from a friend who just finished it.

Generating Reports on the Fly

This is where I see huge potential for professional use. The tool can extract financial data and put it into structured tables. If you ask about revenue segmentation, it doesn't just give you a sentence; it can build a table with the numbers. This ability to generate custom reports on the fly is fantastic. You can essentially build your own mini-analysis by asking a series of questions and letting the AI compile the data for you. Its a huge step up from manual copy-pasting into Excel.

The Good, The Bad, and The Niche

Alright, let's get real. No tool is a silver bullet. Everything has its trade-offs, and Stock Alpha is no exception. Here’s my honest take.

The biggest pro is obviously the time saved. This can't be overstated. It automates the most tedious part of equity research. For a retail investor, this makes deep due diligence accessible. For a professional, it frees up time for higher-level analysis—the thinking part that AI can't do for you. It also simplifies incredibly complex information, making it easier to digest.

Now, for the other side of the coin. The most obvious limitation is its hyper-focus on India. If you're looking for information on Apple or a European bank, this is not the tool for you. But honestly, I see this as a strength. By focusing on one market, they can do it really, really well. It's a feature, not a bug, for its target audience.

Another point is that the truly advanced features, like automated financial modeling, might require a Pro subscription. The free version is a taster, a powerful one, but a taster. This is standard practice for software, so it's not a shock, but something to be aware of. Finally, the tool is only as good as its source documents. It's pulling information, not creating it. If there's an error in an annual report, the AI will faithfully report that error. You still need your own critical thinking cap on.

So, What About the Price Tag?

This is the million-rupee question, isn't it? The official site is a bit quiet on specific pricing tiers, which is pretty common for new platforms testing the market. What we know from the interface is the freemium approach: you get a few free queries to see how you like it.

Beyond that, there's a clear “Get Pro” button. This suggests a monthly or annual subscription for heavy users who want unlimited access and potentially more advanced features. I’d expect a price point that's a no-brainer for a small firm or a serious retail investor, but you’ll have to check their website for the latest numbers. My advice? Use the free trial. See if the time you save is worth the eventual cost. For many, I suspect it will be.

Who Should Actually Use Stock Alpha?

I see a few groups of people who would get a ton of value from this:

- The Serious Retail Investor: You're tired of relying on stock tips from your uncle or random forums. You want to do your own research on companies like Tata or Reliance but don't have 40 hours a week. This tool is your shortcut to intelligent due diligence.

- The Financial Analyst: You already know how to do the work, but you're looking for an edge. Stock Alpha can be your research assistant, handling the grunt work of data extraction so you can focus on modeling and strategy.

- The Finance Student or MBA Candidate: What an incredible learning tool! It gives you a direct line to understanding corporate-speak and dissecting financial statements without getting lost in the weeds. It’s a practical way to apply what you're learning in the classroom.

Final Thoughts on This Financial AI

So, is Stock Alpha going to replace human analysts? Absolutely not. A good analyst's value is in their judgment, their ability to read between the lines, and their understanding of the broader economic picture. An AI can't replicate that intuition or experience.

But is it a phenomenal co-pilot? Yes. It's a powerful tool that automates the most time-consuming, soul-crushing part of the research process. It empowers both professionals and individuals to make better-informed decisions by giving them direct access to the data, fast. For anyone invested in the Indian market, Stock Alpha is definitely worth a look. I'm genuinely excited to see how it grows and what new capabilities they add next.

Frequently Asked Questions

What is Stock Alpha?

Stock Alpha is an AI-powered tool designed to simplify equity research for Indian stocks. It allows users to ask questions in natural language and get answers directly from official documents like annual reports, earnings calls, and investor presentations.

Is Stock Alpha suitable for beginners?

Yes, it can be very helpful for beginners. While professional analysts can use it for speed, beginners can use it to understand complex financial documents without needing to read them cover-to-cover. It helps ask the right questions and makes financial data less intimidating.

Which stocks does Stock Alpha cover?

It focuses on the Indian market, covering over 100 stocks, which includes all the companies listed in the Nifty 50 index. It is not designed for researching international stocks.

Is Stock Alpha free to use?

Stock Alpha operates on a freemium model. New users typically get a limited number of free queries to test the platform. For unlimited use and access to all features, a “Pro” subscription is required.

How accurate is the information from Stock Alpha?

The tool pulls its information directly from the companies' official financial documents, so its accuracy is tied to the accuracy of those sources. It also cites where it found the information, allowing you to verify it for yourself.