I’ve been in the SEO and data game for a long time. Long enough to remember when getting your hands on clean, reliable financial data was a nightmare. You either had to pay an arm and a leg for a terminal that looked like it was from the movie WarGames, or you spent your weekends trying to scrape buggy websites, only to end up with a CSV file that needed a team of data scientists to decipher. It was a mess.

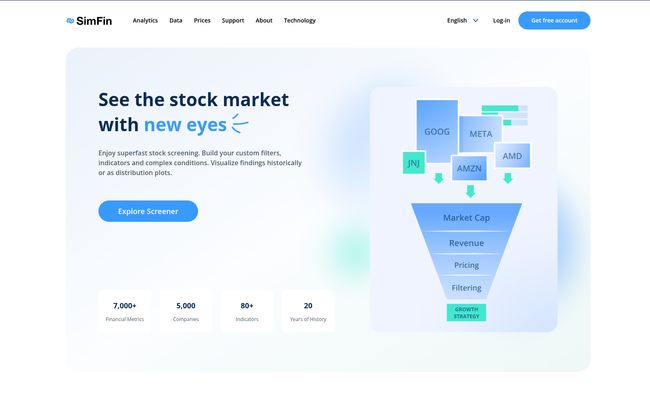

Let's be real, the phrase 'free financial data' usually makes my inner skeptic raise a very prominent eyebrow. It often means outdated info, a clunky interface, or a data set so limited it's practically useless. So, when a colleague mentioned SimFin, a platform promising to make fundamental financial data freely available, I was intrigued but cautious. Their whole pitch is about using automation and machine learning to provide quality data for everyone from students to seasoned pros. Could this be the one? The tool that finally bridges the gap?

I decided to roll up my sleeves, sign up, and see if SimFin lives up to the hype. This is my unfiltered take on what I found.

So, What Exactly is SimFin?

At its core, SimFin is a financial data and analytics platform. But that's a bit of a dry description. Think of it more like a Swiss Army knife for the modern investor. Their mission is to automate the ridiculously tedious process of collecting and standardizing financial statements from thousands of companies. This means you get access to data that is not only broad but also clean and consistent across different companies and time periods. For anyone who's tried to compare Apple's and Microsoft's R&D spending over ten years using raw SEC filings, you know what a gift that is.

They offer a whole suite of tools built on top of this data, including:

- A powerful Stock Screener to find companies that match your specific criteria.

- A Backtesting engine to see how your investment strategies would have performed in the past.

- A Data API that lets you pull data directly into Python, Excel, or whatever you're using.

- Tons of pre-calculated Financial Metrics and Stock Analytics.

- Easy-to-understand Data Visualizations.

It's an ambitious project, covering over 5,000 stocks and aiming to level the playing field. But does it work in practice?

Visit SimFin

My First Impressions: Digging into the Core Features

Signing up for the free account was painless—no credit card required, which is always a good sign. The dashboard is clean, maybe a little spartan for some, but I appreciate the lack of clutter. It feels like it was built by data people, for data people. Function over fluff.

The Stock Screener: More Than Just a Basic Filter

The first place I went was the stock screener. This is often the make-or-break feature for me. A good screener is like a powerful search engine for the stock market. SimFin's is impressive. Even on the free plan, you get a decent number of filters, from basic stuff like market cap and P/E ratio to more specific industry metrics. You can start filtering for those undervalued gems you've been reading about.

Where it gets really interesting is on the paid tiers. You unlock a whole new level of granularity, letting you screen for things like year-on-year revenue growth, debt-to-equity ratios, and other metrics that are crucial for deep fundamental analysis. It's fast, responsive, and the data feels solid. It’s a serious step up from the free version of Finviz, for example.

The Backtesting Engine: Putting Strategies to the Test

Ah, backtesting. The art of looking backward to try and see forward. It’s essential for any serious investor. A great idea on paper can fall apart spectacularly in the real world, and a backtester is your first line of defense. SimFin’s backtesting tool is integrated right into the platform. You can build a strategy using the screener—say, "buy companies with a P/E below 15 and consistent dividend growth"—and then run it against historical data to see how it would’ve performed.

The free plan limits the number of backtests you can run, which is fair. But it’s enough to get a feel for its power. The results are presented clearly, showing you performance against a benchmark like the S&P 500. It's a fantastic way to poke holes in your own theories before you put real money on the line.

The Data API: For the Quants and Coders

Okay, this is where I geeked out a bit. As someone who spends a lot of time in Python scripts and Google Sheets, a good API is everything. SimFin’s Data API is a thing of beauty. It’s well-documented and lets you pull that clean, standardized data directly into your own projects. The thought of not having to manually clean financial data anymore... it's almost emotional.

They provide wrappers for Python and have straightforward access for Excel and CSV downloads. The API credits system is generous on the paid plans, allowing for some serious data-crunching. This feature alone makes SimFin a strong contender for anyone building custom models or doing academic research.

Let’s Talk Money: SimFin's Pricing Structure

Nothing is ever truly free, right? While SimFin has one of the most genuinely useful free tiers I’ve ever seen, the real magic happens when you start paying. They have a pretty clear pricing ladder, and I appreciate that they cater to different types of users.

| Plan | Price (Billed Annually) | Who It's For |

|---|---|---|

| FREE | $0 | Beginners, students, or anyone wanting to test the waters. |

| START | $15 / month | Hobbyist investors and analysts needing more data history and features. |

| BASIC | $35 / month | Serious investors who need unlimited backtesting and more API power. |

| PRO | $71 / month | Professional analysts, quants, and small funds needing the full dataset and priority support. |

Plus, a huge shoutout for their 50% student discount. That’s a fantastic move to support the next generation of investors.

The Good, The Bad, and The Data

No review is complete without a bit of critical perspective. So here’s my honest breakdown.

The Good Stuff I Found

The data quality is the biggest win. It's clean, standardized, and you can see exactly where it comes from. This transparency builds a lot of trust. Second, the generosity of the free tier is almost unheard of. It’s not just a demo; it’s a genuinely useful tool. Finally, from what I've seen and what testimonials suggest, their support is responsive. They seem like a team that actually cares about its users.

Where It Could Improve

My main gripe is the current focus on US stocks. While they have some international coverage, if you're a heavy investor in European or Asian markets, you might find the selection a bit thin for now. I hope they expand this soon. It's also clear that some of the most powerful features are still in development, like custom indicators. This isn’t necessarily a bad thing—it shows they’re growing—but it’s something to be aware of. And of course, the best features are behind a paywall. But given the quality, I can't really fault them for charging for their work.

Who is SimFin Actually For?

So, who should be rushing to sign up? In my opinion, it breaks down like this:

- Students and Researchers: Stop what you're doing and sign up now. The free account and student discount make this an absolute no-brainer. This is the resource I wish I had in college.

- The Hobbyist Investor: This is your new best friend. The Free or Start plan will give you more than enough firepower to make smarter, data-driven decisions without breaking the bank.

- The Professional Analyst or Quant: This is a more nuanced decision. The Pro plan is very compelling and costs a tiny fraction of a Bloomberg Terminal. If you're a one-person shop or a small fund, SimFin offers incredible value. You'll want to compare its data coverage to your specific needs, but it's a serious contender against more expensive providers.

Frequently Asked Questions About SimFin

What type of accounts does SimFin offer?

SimFin offers four main tiers: a FREE plan for beginners, a START plan for hobbyists, a BASIC plan for serious investors, and a PRO plan for professional analysts. They also offer a 50% discount for students.

Are there more US than European stocks listed?

Yes, currently the platform has a stronger focus on the US market, with over 5,000 listed stocks. While they do have some international data, investors focused primarily on European or other global markets might find the selection more limited for now.

What is backtesting of investment strategies?

Backtesting is a method for seeing how an investment strategy would have performed in the past. You define a set of rules (e.g., "buy stocks with a certain P/E ratio"), and the backtester simulates applying those rules to historical market data to calculate hypothetical returns. It's a way to test an idea before risking real capital.

How good is the SimFin data quality?

Very good. This is one of SimFin's main strengths. They automate the collection and then standardize the data, which means it's clean, consistent across different companies, and reliable. They are also transparent about their data sources.

Can I cancel my subscription at any time?

Yes, according to their site, you can manage and cancel your subscription at any time. This is standard practice for modern software-as-a-service (SaaS) platforms.

Is the Free account really free forever?

Yes, the free account is genuinely free. You don't need a credit card to sign up, and you can use its features, albeit with some limitations on data history and tool usage, for as long as you like. It's a great way to fully experience the platform's potential.

My Final Verdict

After spending some quality time with SimFin, I'm genuinely impressed. It delivers on its promise to make high-quality financial data more accessible. Trying to find good data for free used to feel like panning for gold in a river of mud; SimFin feels like someone just handed you a pretty decent metal detector.

Is it perfect? Not yet. The international coverage could be broader, and some features are still maturing. But it represents a massive step in the right direction. For students, individual investors, and even many professionals, SimFin provides incredible power at an extremely fair price point—starting with free. It has definitely earned a permanent spot in my browser's bookmarks, and I'll be watching their progress very closely.

Reference and Sources

- SimFin Official Website

- SimFin Pricing Page

- Benzinga - A SimFin Partner and Financial News Source