I swear, if I have to listen to that tinny hold music one more time while waiting for a simple banking question, I might just lose it. We’ve all been there, right? Stuck in a customer service queue, bouncing between departments, only to get a generic, unhelpful answer. It’s the kind of experience that makes you question all your life choices. For years, the promise of AI chatbots was that they would save us from this misery. And for years, most of them… well, they kind of sucked.

They were clunky, misunderstood basic questions, and usually ended with the dreaded, “I’m sorry, I don’t understand. Let me connect you to a human agent.” Thanks, I was already trying to do that for 20 minutes.

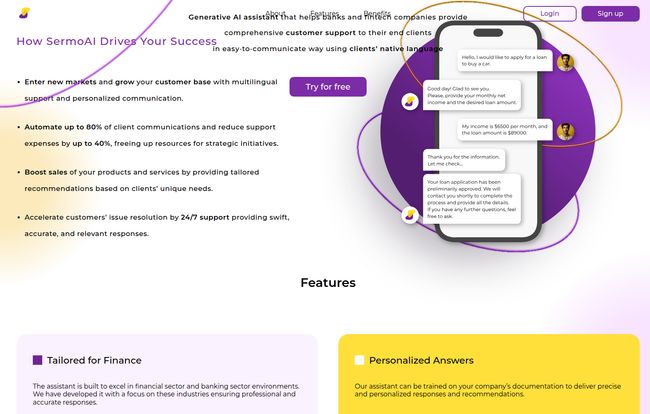

But the game is changing. Fast. I've been watching the AI space with a mix of excitement and healthy skepticism, and every now and then, a tool pops up that feels different. It feels specialized. That’s the feeling I got when I stumbled upon SermoAI. This isn’t just another general-purpose bot; it's an AI assistant built from the ground up specifically for the complex world of banking and fintech. And frankly, it's about time.

So, What's the Big Deal with SermoAI?

Think of it like this: you wouldn't ask your family doctor to perform open-heart surgery. You'd want a specialist, someone who lives and breathes cardiovascular health. In the same way, SermoAI positions itself as the specialist for financial customer interaction. It’s designed to understand the jargon, the regulations, and the unique needs of banking clients. It’s not just about answering, “What’s my account balance?” It’s about handling nuanced queries regarding loans, investments, fraud alerts, and international transfers, all without breaking a sweat.

It’s a generative AI assistant that aims to be the new front line for banks and fintech companies, freeing up human agents for the truly complex stuff while giving customers instant, accurate answers. A lofty goal, for sure. Let's see if they pull it off.

Visit SermoAI

The Features That Actually Matter

Any platform can throw a list of features on a landing page. But as someone who's seen hundreds of these, I've learned to cut through the noise and look for what will genuinely move the needle. SermoAI has a few that caught my eye.

Breaking the Language Barrier with True Multilingual Support

This, for me, is the showstopper. In our increasingly global world, having a customer base that speaks multiple languages isn't a niche scenario; it's the norm. SermoAI doesn't just offer a clunky Google Translate integration. It’s built to provide native-language support, allowing for comfortable and clear communication. Imagine a customer in Germany getting instant, fluent support in German about their mortgage application from an American bank. That's not just good service; that’s a massive competitive advantage. It builds trust in a way that “English-only” support never can.

Personalization That Isn't Creepy

Personalization is a word that gets thrown around a lot, often as a euphemism for targeted ads. Here, it’s about providing genuinely helpful, context-aware responses. The platform claims it can be trained on a bank’s specific documentation and product offerings. This means it could potentially do more than just answer questions. It could analyze a customer's profile (with permission, of course) and say, “Based on your savings history, you're pre-qualified for our new high-yield savings account. Would you like to learn more?” That’s how you boost sales of financial products organically, not by being pushy, but by being genuinely helpful.

Playing Nice with Your Existing Tech Stack

Nobody wants to rip out their entire IT infrastructure to accommodate one new tool. SermoAI seems to get this. They highlight custom integrations with messengers, CRMs, and analytical tools. This is huge. It means the chatbot isn't an isolated island; it’s a connected part of the larger customer service ecosystem, feeding data back into the CRM and pulling information when needed. This is a practical, must-have feature for any serious enterprise.

The Two Paths: Cloud Convenience vs. Fortress Security

This is where things get really interesting and show that SermoAI understands its target audience. They don’t offer a one-size-fits-all solution. Instead, they present two distinct deployment models, which they call “Two Paths to Excellence.”

The Quick Start: Public AI Models

This path is perfect for a nimble fintech startup or a regional bank that wants to get up and running quickly without a massive upfront investment in infrastructure. It uses powerful, trusted large language models (LLMs) like Llama and Claude. It’s cost-effective, highly accurate, and can be integrated swiftly. It’s the modern, cloud-native approach that prioritizes speed and efficiency.

The Fort Knox Approach: On-Premise Solution

For the big, established financial institutions, data sovereignty isn't just a buzzword; it's a legal and ethical mandate. This is where the on-premise solution comes in. By partnering with heavyweights like NVIDIA and Databricks, SermoAI offers a version that can be deployed on a bank’s own servers or in a private cloud. This gives the institution full, unshakeable control over its customer data. No information ever leaves their secure environment. It's the ultimate peace of mind for CISOs and compliance officers everywhere.

This flexibility is, in my opinion, one of SermoAI’s strongest selling points. It shows they understand that the needs of a scrappy startup are vastly different from those of a multinational banking giant.

The Million-Dollar Question: What's the Price Tag?

Alright, so I was all geared up to check out their pricing. I navigated to the pricing page, clicked the link, and… I was greeted by a friendly 404 error. Womp womp.

Now, my gut tells me this isn't just a broken link. This is a classic enterprise SaaS move. When you don't see a pricing table, it usually means the cost is highly customized. Given the two deployment paths (cloud vs. on-premise), the level of integration required, and the volume of customer interactions, a fixed price just wouldn't make sense. It’s not like buying a coffee; it’s more like commissioning a custom suit.

So, while I can't give you a number, the process is clear: you'll need to interact with their bot or book a demo to get a personalized quote based on your specific needs. Honestly, for a tool this specialized, that's what I'd expect.

A Few Practical Considerations

No tool is perfect, and it’s important to go in with your eyes open. Based on their own documentation, there are a couple of things to keep in mind.

- It’s Not Magic, You Have to Train It. For the bot to give truly personalized and accurate answers about your specific products, you need to feed it your company documentation. This is a good thing—it's how the AI learns—but it means there's an initial setup and training phase.

- On-Premise Means You Hold the Keys. Opting for the enhanced security of an on-premise solution also means your team is responsible for maintaining that environment. It's the classic trade-off: more control comes with more responsibility.

These aren't really 'cons' so much as practical realities of implementing powerful AI. It’s not a plug-and-play gadget; it's a core piece of business infrastructure.

My Final Verdict on SermoAI

After digging in, I’m genuinely impressed. SermoAI isn't trying to be everything to everyone. It has chosen a challenging, high-stakes niche—banking and fintech—and has built a solution that directly addresses the industry's biggest pain points: language barriers, security concerns, and the need for specialized knowledge.

The dual-path approach is brilliant, and the partnerships with NVIDIA and Databricks lend it some serious technical cred. For any financial institution feeling the pressure to modernize its customer experience while cutting support costs (which, let's be real, is all of them), SermoAI looks like a very, very compelling option. It's one of the few tools I've seen that seems ready to finally deliver on the long-awaited promise of AI in customer service.

Frequently Asked Questions

- What makes SermoAI different from a general chatbot like ChatGPT?

- SermoAI is a specialist. It's specifically designed for the banking and fintech sectors, meaning it's pre-tuned to understand financial jargon, products, and security requirements. It also offers specific deployment models like on-premise for data sovereignty, which general-purpose bots don't.

- Is SermoAI secure enough for banking data?

- Yes, security seems to be a top priority. Their on-premise solution, developed in partnership with Databricks and NVIDIA, allows a bank to keep all customer data within its own secure infrastructure, ensuring maximum data security and compliance.

- How long does it take to set up SermoAI?

- The "Quick Start" path using public AI models is designed for rapid deployment. The on-premise solution will naturally take longer due to the need for integration with existing private infrastructure. The exact timeline would depend on the institution's specific requirements.

- Can SermoAI really handle multiple languages fluently?

- This is one of its core advertised features. The platform is built to provide support in customers' native languages to ensure clear and comfortable communication, going beyond simple, clunky translation.

- Do I need a large technical team to manage the on-premise version?

- While the on-premise solution offers greater control, it does require internal resources for maintenance. You would likely need an IT or DevOps team to manage the private cloud or server environment where the AI is hosted. SermoAI would likely provide support during the initial setup and integration.

Conclusion

In a world where a single bad customer experience can send someone switching banks, the old ways just don't cut it anymore. Waiting on hold is a relic of the past, or at least, it should be. Tools like SermoAI are not just a 'nice to have' innovation; they represent a fundamental shift in how financial institutions will interact with their customers. It's a move toward efficiency, personalization, and inclusivity. And if you ask me, that's a future worth investing in.

Reference and Sources

- SermoAI Official Website

- NVIDIA AI Solutions

- Databricks Data + AI Platform

- Forbes Advisor: The Importance of Customer Service in Banking