I’ve been in the SEO and digital marketing world for years, and if there’s one thing I’ve learned, it’s how to spot a trend. Right now, the biggest wave crashing over every industry, including finance, is Artificial Intelligence. We've all seen it. From chatbots to content generators, AI is everywhere. But when it comes to managing serious money, I’ve always been a bit of a skeptic. My dad’s idea of a hot stock tip came from his buddy Dave at the golf course, and my first 'financial advisor' was a guy in a cheap suit who basically just sold me whatever mutual fund gave him the best commission.

The whole world of asset management has always felt a bit… stuffy. Opaque. Dominated by old-school thinking, high fees, and strategies that feel like they were cooked up in the 80s. So when I started hearing whispers about platforms like SageFusion, which use AI to manage wealth, my curiosity was definitely piqued. Is this just another tech fad, or is it a genuine shift in how sophisticated investing is done? I decided to take a look for myself.

Visit SageFusion

So, What Exactly is SageFusion? (And Why Should You Care?)

Let's get one thing straight right away: SageFusion isn't your kid's robo-advisor app. This isn't about rounding up your spare change. It's an artificial intelligence asset management platform designed specifically for accredited investors and institutional clients. Think of it less as a simple app and more as a dedicated, AI-powered quantitative trading desk working on your behalf.

They claim to solve some of the oldest problems in the asset management industry: poor risk management, limited (and frankly, stale) investment strategies, and fees that eat away at your returns. Instead of relying on a single human manager's 'gut feeling', SageFusion's engine crunches a mind-boggling amount of data—from financial statements and market trends to, apparently, even social media sentiment—to make its moves.

Breaking Down the SageFusion Approach

So how do they do it? It’s not just about letting a robot run wild with your cash. Their methodology seems to be a thoughtful blend of new-school tech and old-school principles. After digging through their site and materials, a few things really stood out to me.

More Than Just an Algorithm

This isn’t just a black box. SageFusion talks about blending quantitative analysis (the hardcore numbers) with fundamental analysis (the 'why' behind a company's value). This approach feels more grounded than some 'pure AI' plays I’ve seen. It’s like having a super-fast, data-driven analyst working alongside a seasoned investment strategist. Their goal is to find opportunities and manage portfolios with an efficiency and speed that humans just cant match. And they're not shy about their goal: to outperform traditional benchmarks like the S&P 500 Index.

You Keep the Keys to Your Kingdom

This is a big one for me. One of the scariest parts of handing your money over to a firm is that… well, you're handing your money over. SageFusion has a pretty smart solution for this. Your assets—your actual stocks and funds—are held in your own name at Interactive Brokers, a well-known and respected brokerage firm. SageFusion is granted the authority to manage the trades, but they don't take custody of your assets. This separation is a massive trust signal. It means if SageFusion were to disappear tomorrow (unlikely, but hey, we plan for the worst), your money would still be safely sitting in your Interactive Brokers account. That's peace of mind you can't put a price on.

The 'Get Out of Jail Free' Card: No Lockup Periods

Anyone who's ever invested in a hedge fund or certain private equity deals knows the pain of lockup periods. Being told your money is tied up for a year, or three, or even longer, is a tough pill to swallow. SageFusion scraps that entirely. They operate with no lockup periods, giving you the flexibility to access your capital when you need it. In a world that changes as fast as ours does, that kind of liquidity is incredibly valuable.

A Risk Management Strategy I Haven't Seen Everywhere

Every investment firm talks about 'risk management', but it often feels like a vague buzzword. SageFusion gets specific. One of their standout features is a proprietary 5% options hedge. In simple terms, they use a small portion of the portfolio to buy options that can protect against significant market downturns. It's like buying insurance for your portfolio. It might create a small drag on returns in a bull market, but in a volatile or bear market, it could be the very thing that saves your bacon. It shows they're not just focused on chasing returns; they're actively thinking about protecting the downside. A very grown-up approach.

Okay, Let's Talk About the Price of Admission

Alright, time to address the elephant in the room. This platform is not for everyone. The typical minimum deposit to get started with SageFusion is $250,000.

Yeah, you read that right.

| Minimum Deposit | Client Type |

|---|---|

| $250,000 | Accredited Investors & Institutional Clients |

This immediately puts SageFusion in a specific league. It's designed for high-net-worth individuals and institutions who have crossed the 'accredited investor' threshold. While this high barrier to entry might be a bummer for smaller investors, it also signals the seriousness of their operation. They're not trying to be everything to everyone; they're focused on providing a premium service to a specific audience that requires this level of sophistication. For those who qualify, they also offer a free financial consultation to see if it's a good fit, which is a nice touch.

The All-Important Question: Does It Beat the Market?

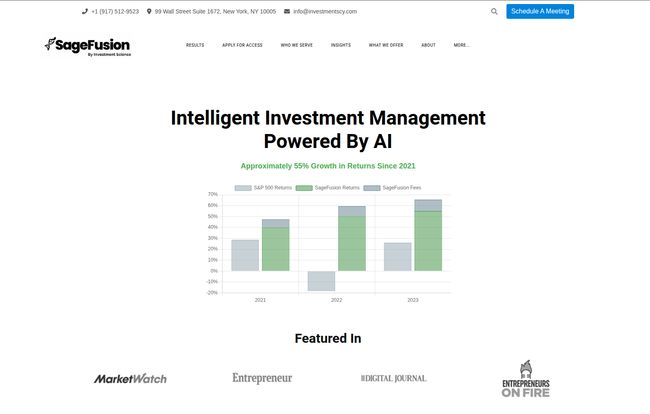

This is the million-dollar—or in this case, quarter-million-dollar—question. SageFusion has a chart on their site showing their performance against the S&P 500 Index from 2021-2023, and their line is comfortably above the benchmark. It's an impressive claim.

Now, as any seasoned pro will tell you, past performance is no guarantee of future results. A two- or three-year chart is a snapshot, not a feature film. But it does suggest that their methodology has been effective during a particularly weird and volatile period in the market. Beating the S&P 500 is the holy grail for most fund managers, and the fact that their AI-driven approach seems to be doing it is, at the very least, compelling evidence that something is working.

Final Thoughts From a Fellow Grinder

So, what's my final verdict? I think SageFusion is a fascinating example of where wealth management is headed. It's for a very specific person: the accredited investor who is tired of the old way of doing things, who understands the potential of technology, and who wants a sophisticated, data-driven approach without the traditional hedge fund headaches like high non-transparent fees and lockup periods.

The custody arrangement with Interactive Brokers is a huge plus, and their unique risk management strategy is a real differentiator. The high entry point is the biggest hurdle, but it also defines their market. This isn't a tool for the masses; it's a specialized instrument for serious players. If you're in that camp, SageFusion is absolutely worth a deeper look. It might just be the edge you've been looking for.

Frequently Asked Questions About SageFusion

- What is SageFusion in simple terms?

- SageFusion is an AI-powered asset management platform for accredited investors. It uses artificial intelligence to make investment decisions, aiming to provide better returns and superior risk management compared to traditional methods.

- What is the minimum investment for SageFusion?

- The typical minimum deposit to become a client is $250,000. It is designed for high-net-worth individuals and institutional clients.

- Is my money safe with SageFusion?

- Your assets are held in your own name at Interactive Brokers, a major third-party brokerage. SageFusion manages the trading but does not take custody of your funds, which adds a significant layer of security.

- How is SageFusion different from a regular robo-advisor like Betterment?

- Robo-advisors typically use simple algorithms to place you in a pre-set portfolio of ETFs based on a questionnaire. SageFusion employs much more complex AI and machine learning models for active asset management, including dynamic stock selection and advanced risk hedging, with the goal of outperforming market benchmarks.

- Are there any lockup periods for my investment?

- No, SageFusion prides itself on having no lockup periods, providing clients with full liquidity and flexibility over their capital.

- How transparent are the fees?

- The website states they have transparent and competitive fee structures. Specifics are likely discussed during the onboarding process and consultation, but the model is designed to be clearer than many traditional funds.

Conclusion

The world of investing is changing fast, and AI is no longer on the horizon—it's here. Platforms like SageFusion represent a significant evolution, moving beyond the stuffy, opaque world of traditional asset management. By combining AI-driven strategies with robust security measures like third-party custody and smart risk hedging, they are building a compelling case for a new way to manage wealth. While it's certainly not for the everyday investor due to its high entry point, for those who do qualify, SageFusion offers a peek into what very well might be the future of finance. A future that's smarter, more transparent, and a whole lot more interesting.