If you're a day trader, especially one who messes with the wild world of small-caps, your morning probably looks a lot like mine used to. A jolt of coffee, a pre-market scanner screaming a dozen tickers at you, and that familiar knot in your stomach. Is this the one? Is this ticker the one that's going to run to the moon, or is it another pump-and-dump that'll steal my lunch money before 10 AM?

We’ve all been there. Chasing a stock that gapped up 40% only to watch it face-plant moments after we buy in. It’s frustrating. It feels like you’re just guessing. For years, I've relied on a messy combination of screeners, Level 2 data, and pure gut feeling. But what if you could see a stock's rap sheet? What if you knew, based on cold, hard data, that 'Ticker XYZ' has a habit of running hard after a big gap, while 'Ticker ABC' almost always fizzles out?

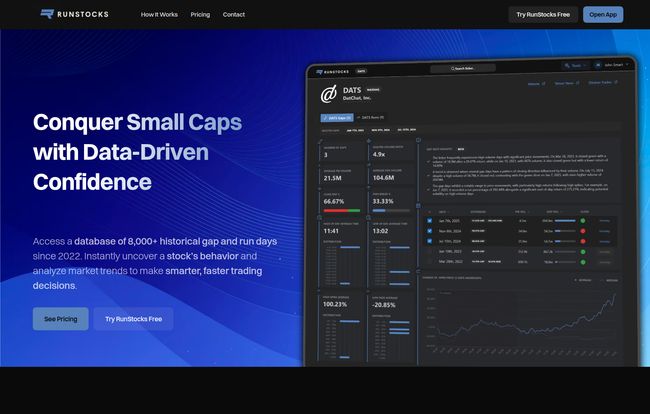

That’s the promise of a tool I’ve been kicking the tires on recently: RunStocks. It’s not trying to be everything to everyone. It has one job: to analyze the historical behavior of small-cap gappers and runners. And I’ve gotta say, it’s been pretty eye-opening.

So, What's the Big Deal About RunStocks?

Think of RunStocks as a specialized private investigator for small-cap stocks. It doesn't predict the future—no tool can—but it gives you an incredible amount of background information. Its entire focus is on stocks that have had a significant “gap” (opening 20% or more from the previous close) or a “run” (moving 50% or more) at some point since 2022.

It digs into the past performance of these specific stocks on the days they made those huge moves. It asks questions like:

- When this stock gaps up, does it tend to keep running, or does it sell off?

- What does the volume look like on its strongest days?

- Does it hold its gains into the close or give it all back?

By answering these, you move from gambling to making calculated decisions based on a stock’s established “character.” You’re separating the repeat offenders from the one-hit wonders. For a small-cap trader, this is gold.

Visit RunStocks

A Walkthrough of the RunStocks Method

The platform’s workflow is straightforward, which I appreciate. There's no steep learning curve. It basically guides you through a logical process of due diligence.

Searching and Checking the Basics

It starts simple: you pop a ticker into the search bar. Right away, you get the essential fundamental data. I'm talking market cap, float, outstanding shares—the stuff you'd normally have to open three other browser tabs to find. It’s all right there, which is a nice little time-saver.

Analyzing Historical Gaps and Runs

This is the heart and soul of RunStocks. Once you’ve got your ticker, the platform shows you every single time that stock has had a major gap or run since 2022. It’s not just a list; it’s a detailed breakdown of what happened next. You can see the price action, the volume, and how it behaved post-gap. This is where you start to see patterns. I looked up a few tickers that have burned me in the past, and yep, the data showed they had a nasty habit of selling off after the initial morning spike. If only I’d had this tool then. Hindsight, right?

Filtering and Anticipating What's Next

Based on all that historical data, you can start to anticipate possibilities. The platform even uses some AI-enhanced insights to point out key trends. It’s like having a research assistant who’s already done the initial legwork, pointing out, “Hey, 80% of the time this stock gaps up on high volume, it holds its gains.” That’s a powerful piece of information to have before you click the buy button.

My Favorite Features and Some Honest Truths

A few features really stood out to me during my testing.

The Daily Adjustments for Reverse Splits is a huge one. Anyone who trades small-caps knows how much of a nightmare reverse splits are for historical charts. They mess everything up. RunStocks adjusts its data daily to account for these, ensuring the historical context is actually accurate. This is a detail many other platforms overlook, and it shows the creators are actual traders who get it.

I was also pleasantly surprised by the Mobile-Optimized platform. It’s clean and works well on my phone. I’m not usually one to trade on the go, but for checking up on a stock or doing some quick research when I’m away from my main setup, it’s perfect.

But let’s be balanced. The data only goes back to 2022. For analyzing recent character, that’s perfectly fine. But if you’re a swing trader looking for patterns over a five or ten-year period, this isn’t your tool. Also, the promised API integration is still in the works. For algorithmic traders who want to plug this data into their own systems, you'll have to wait a bit longer.

Let's Talk Price: How Much Does This Edge Cost?

Pricing is always the big question. RunStocks has a pretty smart structure that lets you dip your toes in without commitment. I’ve laid it out in a simple table below.

| Plan | Cost | Key Features | My Take |

|---|---|---|---|

| Free | $0 / forever | Unlimited searches, 4 months of historical data per ticker, 7 days of market reports. | Perfect for getting a feel for the platform. No reason not to try it. |

| Premium - Monthly | $35 / mo | Full historical data (2022-Present), all reports, beta features, priority support. | Great for traders who want to go month-to-month or test the full features. |

| Premium - Yearly | $25 / mo (billed at $300/year) | Same as monthly, but at a significant discount if you commit for the year. | The best value for serious, dedicated day traders who know this is the data they need. |

Heads up: They're running a launch promotion with the code LAUNCH45 that gives a hefty discount on your first month or first year. So if you're on the fence, now is probably the time to check out the premium version.

Who Is RunStocks Actually For?

I want to be crystal clear about this. RunStocks is a specialist's tool.

This is for you if:

- You are a dedicated day trader who primarily focuses on small-cap or micro-cap stocks.

- You thrive on volatility and want a data-driven way to understand it.

- You believe that a stock’s past behavior can give clues to its future action.

- You want to save time on research and get straight to the actionable insights.

You should probably skip it if:

- You're a long-term, buy-and-hold investor in blue-chip companies like Apple or Microsoft.

- You exclusively trade large-cap stocks, forex, or futures.

- You're looking for an all-in-one platform with brokerage execution. RunStocks is purely for analytics.

- You need historical data stretching back a decade or more.

My Final Take on RunStocks

After spending a good amount of time with RunStocks, I'm genuinely impressed. It’s not a magic crystal ball that prints money. Trading will always carry risk. But it is a powerful, focused, and well-designed tool that provides a unique kind of edge in a very specific niche.

It’s like having a compass in the chaotic sea of small-caps. It doesn’t steer the ship for you, but it gives you a hell of a lot more information to choose the right direction. For the serious small-cap day trader, I think RunStocks could easily become an indispensable part of their daily routine. The free tier is a no-brainer to try out, and for those who see its value, the premium cost could easily pay for itself by helping you catch one good trade or avoid one bad one.

Frequently Asked Questions

- What does RunStocks do in simple terms?

- It analyzes the past performance of small-cap stocks on days they made huge moves (gapping up or running hard). This helps traders see if a stock has a history of continuing its run or selling off, helping them make more informed trades.

- Is RunStocks easy to use if I'm not a tech expert?

- Yes, absolutely. The interface is very clean and intuitive. If you can use a basic stock screener, you can use RunStocks. There's virtually no learning curve to get started.

- How often is the data updated?

- The data is updated daily to include the previous day's market action and to make any necessary adjustments for things like reverse splits. You're always working with fresh information.

- Can I use RunStocks for swing trading?

- While it's primarily designed for day traders, a swing trader could find value in understanding how a stock behaves after a major catalyst. However, the data history is limited to 2022, so it’s less suited for long-term swing strategies.

- Is there really a free version?

- Yes, there's a $0/forever free plan. It has some limitations on the amount of historical data you can see, but it’s more than enough to understand how the platform works and see if it’s a good fit for you. No credit card is required to sign up for it.

- Does RunStocks cover all stocks?

- No, it specifically focuses on small-cap stocks listed on major exchanges like NASDAQ and NYSE. It's a specialized tool and doesn't cover large-caps, OTC stocks, or other markets.