If you've been in the trading game—whether it's crypto, forex, or good old stocks—you know the grind. The late nights staring at charts until they blur into a meaningless mess of green and red. The constant battle against FOMO and FUD. The feeling that you just missed the perfect entry or exit. For years, the promise of automated trading has been the light at the end of that tunnel. A way to take emotion out of the equation and let a tireless algorithm do the heavy lifting.

I've seen dozens of platforms come and go. Some were clunky, some were insanely expensive, and some were just...well, not very good. So when I stumbled across RobotaLife, my default setting was skeptical. Another platform promising the moon? But something about their approach, particularly their pricing, made me lean in a little closer. They call it the "future of automated trading." A bold claim. So I decided to put it through its paces.

Visit RobotaLife

So What Is RobotaLife, Exactly?

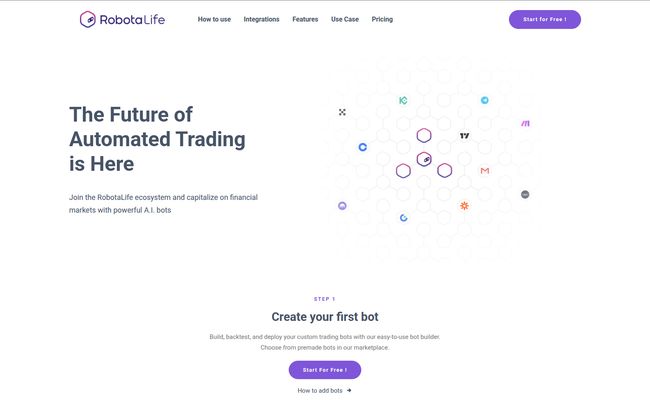

At its core, RobotaLife isn't just a single tool; it's more like a full-blown ecosystem for traders who want to automate their strategies. Think of it as a workshop. It gives you the parts and the instructions to build, test, and run your own army of trading bots across crypto and other financial markets. It’s designed to connect with the places you already are, like major exchanges and charting platforms, to turn your carefully crafted strategies into actual, automated trades.

The platform is built on a pretty straightforward four-step process, which I appreciate. No need to decipher a complex user manual just to get started. It’s all about creating, integrating, analyzing, and then connecting. Simple enough.

Breaking It Down: The Four Steps to Bot-Powered Trading

The whole user experience on RobotaLife seems designed to guide you from idea to execution. It’s less of a blank canvas and more of a paint-by-numbers, which is great for people who aren't seasoned developers.

Step 1: Actually Building Your Bot

This is where the magic starts. You can either build a custom bot using their builder or, if you're not ready to play mad scientist, you can pick a pre-made one from their marketplace. The idea is to build, backtest, and deploy without writing a single line of code. You configure the nuts and bolts, like your investment amount and leverage, to manage your risk from the get-go. This lowers the barrier to entry significantly. I’ve always believed that you shouldn’t need a computer science degree to get into algo trading, and it seems the folks at RobotaLife agree.

Step 2: Connecting to Your Trading Universe

A bot is useless if it's trapped in a cage. RobotaLife gets this. A huge part of its appeal is the integration with third-party apps. For me, the big one is TradingView. So many of us live and breathe on TradingView, building and testing strategies with Pine Script. RobotaLife allows you to connect those TradingView alerts directly to your bot. Your strategy spots a signal, fires an alert, and your bot executes the trade. It’s the kind of direct connection I’ve been looking for.

Beyond that, they've got webhooks for custom API connections and even integrations with Zapier and Make. This opens up a world of possibilities for the creative automator. You could create some wild workflows if you wanted to, linking signals from a Discord group, a Telegram channel, or even a Google Sheet directly to your trading bot. It’s like a set of automation LEGOs.

Step 3: The All-Important Performance Check

Here's a piece of advice I give to every new trader: never risk real money on an unproven strategy. RobotaLife seems to have built its platform around this principle. They push you to analyze your bot's performance and fine-tune it before letting it run wild with your capital.

The most important feature here is Paper Trading. It’s a virtual, risk-free environment where you can test your bot with fake money in real market conditions. You can see how your TradingView strategies perform, test signals from a provider you’re eyeing, and tweak everything until it's running smoothly. Don't skip this step. Seriously. This is your sandbox, play in it.

Step 4: Connecting Your Exchange and Going Live

Once you're confident in your bot's performance, it's time to connect to your exchange account. Currently, they support Binance (Futures & Spot) and KuCoin. This covers a huge chunk of the crypto market's liquidity and altcoin selection. They say more exchanges are on the way, which is good because that’s one of the current limitations. After connecting via API keys (the standard, secure way to do this), your bot can begin trading with your real capital.

The Pricing Model is the Real Story Here

Okay, let's talk about the most interesting thing about RobotaLife. It’s not the AI, it's not the integrations. It's the price tag. Or, rather, the lack of one upfront.

They operate on a model they call "Pay as You Profit." Here’s how it works:

"If you've made a profit on your exchange in the past 30 days, we charge you only 10% of your earnings to access the platform for the next 30 days."

Let that sink in. There’s a free trial to get you started, and after that, they only charge you if your bots are actually profitable. If you have a losing month, you don't pay. This is a massive vote of confidence in their own product. They are quite literally aligning their success with yours. In an industry filled with hefty monthly subscriptions that you pay regardless of performance, this is a breath of fresh air. It completely changes the risk calculation for trying out the platform.

A Frank Look: The Good, The Bad, and The Bot-ly

No platform is perfect, and a good review has to be balanced. After spending time with RobotaLife, here’s my honest breakdown.

What I'm Genuinely Impressed By

The Pay as You Profit model is, without a doubt, the star of the show. It’s fair, it builds trust, and it makes trying RobotaLife a no-brainer. The easy-to-use bot builder and the powerful integration with TradingView are also huge wins. They’ve successfully bridged the gap between complex strategies and simple execution. And I can't overstate the importance of the paper trading environment; it’s essential for responsible trading. All in all it's a solid offering.

Where It Has Room to Grow

The most obvious drawback is the limited number of exchanges. Binance and KuCoin are great, but traders on Bybit, OKX, or Coinbase will have to wait. They say more are coming soon, so I'll be watching that space. The 10% fee on profits is also something to consider. While it’s fair, you need to factor that into your profitability calculations. If your strategy has a slim profit margin, that 10% cut will feel significant. Finally, and this isn't a knock on RobotaLife specifically but on all bot trading, your success still depends entirely on the quality of your strategy. The bot is just a tool; it's not a magic money machine.

Who Should Give RobotaLife a Shot?

I see a few groups of people who could really benefit from this platform:

- The TradingView Power-User: If you already have strategies built in Pine Script, RobotaLife is the missing link to automate them without any fuss.

- The Aspiring Algo-Trader: For those who understand strategy but can't code, the bot builder is an incredible entry point into the world of automated trading.

- The Subscription-Fatigued Trader: If you’re tired of paying monthly fees for tools whether you win or lose, the pricing model here will be a revelation.

- Signal Followers: People who subscribe to Telegram or Discord signal groups can use RobotaLife to automate trades based on those signals, saving time and preventing missed opportunities.

My Final Verdict

So, is RobotaLife the future of automated trading? It's a contender. A strong one. It's not perfect yet, but its foundation is exceptionally solid. By removing the two biggest barriers to entry—complexity and upfront cost—they’ve created something genuinely compelling.

The combination of an intuitive bot builder, key integrations like TradingView, and that game-changing pricing model makes it a platform I can comfortably suggest people try. The risk is incredibly low, and the potential upside is your time back and a more disciplined approach to trading. And in this market, that’s an edge worth having.

Frequently Asked Questions

How much does RobotaLife cost?

RobotaLife offers a free trial to start. After that, it uses a "Pay as You Profit" model. You only pay a fee if your connected trading account was profitable in the last 30 days. The fee is 10% of your earnings for that period.

What exchanges can I connect to RobotaLife?

Currently, RobotaLife supports integration with Binance (both Spot and Futures) and KuCoin. The company has stated that more exchanges are planned for future updates.

Do I need to know how to code to use RobotaLife?

No, you do not need coding skills. The platform includes a user-friendly bot builder that allows you to create and configure trading bots through a visual interface. There is also a marketplace for pre-built bots.

Is it safe to connect my exchange account?

Yes. RobotaLife connects to your exchange account using API keys, which is the industry standard. Crucially, you should configure the API keys to grant trading permissions but disable withdrawal permissions. This ensures the platform can execute trades on your behalf but cannot access or move your funds out of the exchange.

What is Paper Trading?

Paper Trading is a simulated trading environment. It allows you to test your bots and strategies using real-time market data but without risking any real money. It's a crucial feature for testing and refining your approach before going live.

Can I connect RobotaLife to TradingView?

Yes, one of the key features of RobotaLife is its ability to integrate with TradingView. You can set up alerts in TradingView based on your custom strategies, and these alerts can trigger your RobotaLife bot to execute trades automatically.