I've been in the SEO and traffic game for years, and if there's one thing I understand, it's patterns. Trends. Data. So naturally, the world of algorithmic trading has always called to me. The idea of setting up a system, based on data, to work for you while you sleep? That’s the dream, isn't it?

But then reality hits. You open a tutorial for a Python trading script and your eyes glaze over. `pip install pandas`, `import backtrader as bt`... it feels like learning a new language just to ask a simple question. I’ve been there, staring at a wall of code, thinking, “There has to be an easier way.”

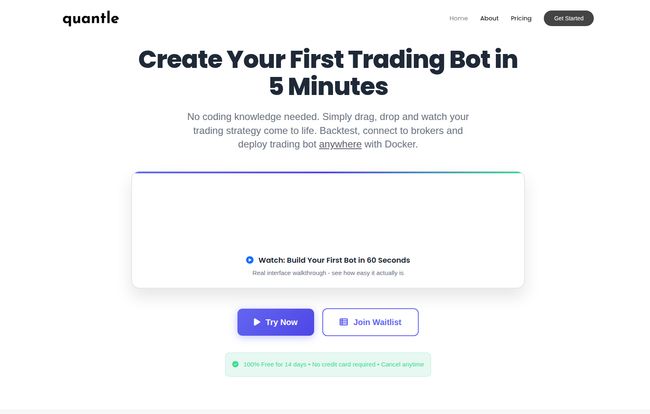

The no-code movement has been changing the game in web design and app building for a while now. And it seems that wave is finally, properly crashing into the shores of finance. A few platforms have popped up, but one that recently caught my eye is Quantle. Their big, bold claim? “Create Your First Trading Bot in 5 Minutes.”

Five minutes? Seriously? My morning coffee takes longer than that. So, naturally, I had to see if this was just slick marketing or if they were actually onto something.

So, What is Quantle, Really?

At its heart, Quantle is a playground for aspiring algo traders. It’s a platform that lets you build, test, and deploy automated trading strategies using a drag-and-drop interface. Think of it like building with financial Legos. Instead of writing lines of code to define an entry condition like “buy when the 50-day moving average crosses above the 200-day,” you drag a “Moving Average Cross” block, set your parameters, and connect it to a “Buy” block. It’s visual. It’s intuitive.

And it’s not just for newbies who are scared of code. I can see seasoned traders using this to quickly prototype and test a new idea without having to build out a whole new script. Time is money, after all. Why spend hours coding a simple test if a tool can give you an answer in minutes?

Visit Quantle

The Features That Actually Matter

A pretty interface is nice, but it doesn't make you money. The engine underneath is what counts. Quantle seems to be focusing on a few core things that any trader, new or old, would care about.

The Drag-and-Drop Builder: Your New Sandbox

This is the main event. The builder is where you piece together your strategy. You can pull in different indicators, set logical conditions (IF this AND that, THEN do this), and define your risk management rules like stop-losses and take-profits. The “5-minute bot” promise? I think for a basic strategy, like the moving average crossover I mentioned, it’s entirely plausible. You could absolutely piece that together and start a backtest in less time than it takes to get through the Starbucks drive-thru.

Backtesting Without the All-Nighter

Anyone who's tried to do this manually knows the pain. Getting reliable historical data, cleaning it, and running a test without introducing look-ahead bias is a massive chore. Quantle claims to offer backtesting on over 50 markets. That’s a huge plus. The ability to quickly see how your brilliant idea would have performed over the last five or ten years is… well, it’s everything. It’s the difference between gambling and making an educated bet. An idea that seems great in your head can fall apart spectacularly when faced with real historical data.

A Little Help from AI?

Quantle sprinkles in “AI-Powered Analytics” and “AI Optimizer.” Now, I’m always a bit skeptical of the term “AI.” Sometimes it's just marketing speak for a decent algorithm. But here, it seems to be used for two things: analyzing your backtest results to point out weaknesses (like, “your strategy performs poorly on Tuesdays”), and optimizing your strategy's parameters. The optimizer can take your strategy and test hundreds of variations—what if my stop-loss was 3% instead of 2%?—to find a more robust configuration. That's a powerful feature that saves an incredible amount of manual work.

How Does Quantle Stack Up?

The world isn't empty. You have two main alternatives: toughing it out with code or looking at other no-code platforms. In one of their own graphics, Quantle compares themselves to both.

Against Hard Coding, it's a clear trade-off. Code gives you infinite flexibility. If you can dream it, you can build it. Quantle, by its nature, will always be limited to the blocks and integrations they provide. But for 90% of the strategies most retail traders will ever conceive, Quantle’s toolkit is probably more than enough. It's the difference between a custom-built race car and a really, really good Porsche 911. One is more tunable, but the other will get you where you need to go incredibly fast and with a lot less fuss.

Against Other No-Code Tools, the competition is more direct. From what I can see, Quantle is betting on its user-friendly interface, the breadth of its backtesting markets, and its AI features to stand out. The pricing also seems competitive, which is always a big factor.

Let’s Talk Money: The Quantle Pricing Structure

Alright, this is often the make-or-break moment. A great tool is only great if you can afford it. Quantle’s pricing seems to be in a state of evolution, with several early-access and waitlist options, which is common for a new platform. Here’s a breakdown of what I could piece together.

| Plan Name | Price | Key Features |

|---|---|---|

| Free Alpha/Waitlist | Free | Basic builder access, limited markets, community support. A great way to test the waters. |

| Bronze | $29 / month | Full No-Code Builder, Access to Historical Data. |

| Silver | $49 / month | Everything in Bronze, plus the Strategy Optimizer. |

| Gold | $89 / month | Everything in Silver, plus customizable reports, priority support, and early feature access. |

Note: They also mention an "Early Bird" offer for $249 which seems like a one-time payment for significant perks. It's worth checking their site directly for the latest deals.

My take? The pricing is pretty reasonable. It's in line with, or even slightly cheaper than, other specialized software in the trading space. The fact you can start for free is a huge vote of confidence from them.

The Good, The Bad, and The Realistic

No tool is perfect. Let's be real. After digging in, here’s my honest breakdown.

The Good: It smashes the biggest barrier to entry in algorithmic trading—the coding requirement. This opens up a whole world of systematic trading to people who have great ideas but not teh technical chops. It's fast, visual, and the backtesting engine appears powerful. It's a massive step towards democratizing quantitative finance for the little guy.

The Not-So-Good: You are playing in their sandbox. This means you're dependent on their platform. If Quantle disappears tomorrow, your bots go with it. You're also limited by the indicators and features they choose to build. If you need some obscure indicator or a super-complex order type, you might be out of luck. And, of course, it's another monthly subscription to add to the pile.

My Final Take: Is Quantle Worth Your Time?

So, we come back to the big question. Should you give Quantle a shot?

In my opinion, absolutely. Especially if you fall into one of these camps:

- You're a manual trader with a solid system who wants to automate it to save time and remove emotion.

- You're a total beginner fascinated by algo trading but terrified of code.

- You're a professional analyst or coder who wants a tool for rapid prototyping before committing to a full build.

Who is this NOT for? Probably large-scale hedge funds or high-frequency traders who need millisecond execution and complete control over their software stack. But that’s not who Quantle is for, and that's okay.

This platform isn’t a magic box that prints money. You still need a good, well-thought-out, and properly tested strategy. What Quantle does is remove the enormous technical hurdle that stops most people from even trying. It gives you the tools to test your ideas quickly and efficiently. And for that alone, it's a very interesting development in the world of retail trading.

Frequently Asked Questions About Quantle

- Can I use Quantle with zero trading experience?

- You can use the tool, yes. But the tool doesn't provide the strategy. It's highly recommended you understand basic trading principles like market structure, indicators, and risk management before trying to build a profitable bot. Quantle gives you the car, but you still need to learn how to drive.

- Does Quantle connect directly to my brokerage account?

- The platform roadmap and features like "Safe & Seamless Deployment" and "Strategy to Bot" strongly suggest that direct brokerage integration for automated execution is a core part of their plan. You'll want to check their site for the current list of supported brokers.

- Is no-code trading actually profitable?

- The code (or lack thereof) doesn't determine profitability—the logic of the strategy does. A winning strategy will be profitable whether it's written in Python or built with drag-and-drop blocks. The advantage of a no-code platform is that it lets you test more ideas faster to find what works.

- What happens to my bots if I cancel my subscription?

- Typically with platforms like this, if you cancel a paid subscription, your strategies would be deactivated or you'd revert to a free tier with limited functionality. Your intellectual property (the strategy idea) is still yours, but you would no longer be able to run it on their platform.

- How secure is my trading strategy on Quantle?

- This is a valid concern for any cloud-based platform. Reputable companies use strong encryption and security protocols to protect user data and intellectual property. The "Trade Securely & Confidently" point on their homepage suggests they take this seriously, but it's always good practice to review the privacy policy of any service you use.

The Future is Visual

Tools like Quantle represent a significant shift. For years, the powerful tools of quantitative finance were locked away in an ivory tower, accessible only to those with computer science degrees and deep pockets. Now, the walls of that tower are starting to crumble. By making strategy development visual and intuitive, Quantle is giving more people a seat at the table. It's exciting, it's powerful, and it might just be the future of how many of us interact with the markets.

Reference and Sources

- Quantle Official Website: https://quantle.net/

- Quantle Pricing Page: https://quantle.net/billing/pricing/