Let’s have a little chat. You and me. If you’ve ever tried to do serious due diligence on a public company, you know the pain. The sheer, soul-crushing agony of downloading a 150-page 10-K document, your eyes glazing over as you CTRL+F for keywords like “risk factors,” “revenue recognition,” or “litigation.” It feels like you're trying to find a single, specific needle in a barn full of needles. And you have to do it for every single company you’re tracking.

It’s the grunt work of investing. The part nobody talks about in the flashy YouTube videos. For years, I’ve accepted it as a necessary evil. A rite of passage. But lately, the buzz around AI tools has me wondering… what if it didn’t have to be this way?

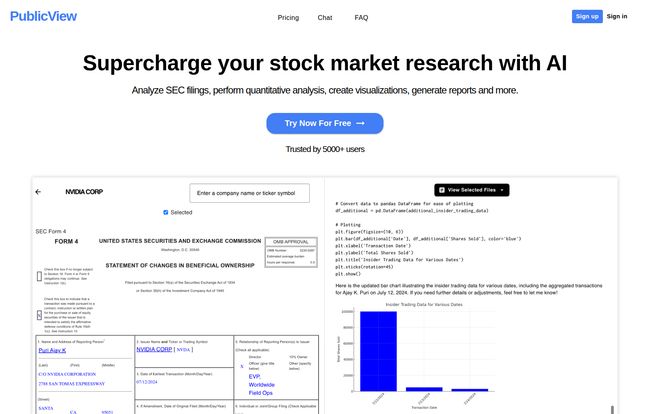

That’s what led me down the rabbit hole to a tool called PublicView. The tagline is bold: “Supercharge your stock market research with AI.” A lot of tools make that claim. So, I decided to kick the tires, pop the hood, and see if this thing is actually a new engine for analysis or just a shiny new paint job on an old concept. This is my real, no-fluff take.

What Exactly is PublicView? (And Why Should You Care?)

At its core, PublicView is an AI-powered platform designed to make sense of the mountain of documents public companies release. We're talking SEC filings (the infamous 10-Ks and 10-Qs), earnings call transcripts, news articles, and press releases. Instead of you reading them, you… talk to them.

Think of it like having a conversation with a company's entire paper trail. It's less like a search engine and more like an interrogation. You can load up several documents at once—say, the last three quarterly reports for NVIDIA—and just start asking questions. “What were the main drivers of revenue growth in the Data Center segment?” or “Summarize the key risks mentioned across these three filings.”

It's built for everyone from the professional analyst at a big firm to the serious retail investor who wants to look smarter than the folks on WallStreetBets. And with a claim of being “Trusted by 5000+ users,” it’s clearly got some traction. The idea is to take hours of manual work and condense it into minutes of pointed questions. A pretty compelling pitch, I have to admit.

Visit Publicview

The Core Features That Actually Matter

Okay, let's get into the nitty-gritty. A platform is only as good as its features, right? Here’s what stood out to me during my time with PublicView.

Chatting with Filings: The AI Interrogation Room

This is the star of the show. The ability to upload a document (or just enter a company's ticker symbol) and chat with it is, frankly, incredible. It felt like I had a junior analyst on call 24/7. I tested it on a few tech companies, asking about executive compensation changes and specific financial covenants. The responses were fast and, most importantly, often pointed me to the exact section of the document the information came from. This isn't just a summary; it's an annotated conversation. Being able to compare statements across multiple quarters without having four PDFs open and a headache is a genuine game-changer.

From Numbers to Pictures: Natural Language Visualization

I can wrestle with Excel and Google Sheets, but I wouldn't say I enjoy it. Creating compelling charts to spot trends takes time and a lot of clicking. PublicView has a fascinating solution: you just ask for a chart. I typed something like, “Create a bar chart of insider trading data for various dates” (inspired by their own example) and it just… did it. This is huge. It lowers the barrier for visual analysis, letting you spot trends and anomalies without needing to be a spreadsheet guru. This is the kind of stuff that makes data feel less intimidating and more intuitive.

Getting Your Hands Dirty with Code

Now, this part got my inner geek excited. PublicView has a feature where you can perform quantitative analysis using code that looks a heck of a lot like Python with the `pandas` library. For the uninitiated, `pandas` is the gold standard for data manipulation in the data science world. This feature is clearly for the power users. It means if the standard chat or visualization tools aren't enough, you can write your own custom scripts to analyze the data. This elevates it from a simple Q&A tool to a genuine analytical workbench. Most people might not use it, but for those who do, it's a massive plus.

Exporting Your Findings

A small but critical feature. Your research is useless if it's trapped inside the platform. PublicView lets you export your generated reports, charts, and data to standard formats like Excel, Docx, and PDFs. This is essential for building your own models, sharing insights with a team, or just keeping a clean, offline record of your due diligence. Simple, effective, and necessary.

My Honest Take: The Good, The Bad, and The "Hmm..."

No tool is perfect. Let's be real. After the initial “wow” factor, I started looking for the cracks. Here’s how I feel it all stacks up.

The biggest pro, and it’s a big one, is the time savings. It’s almost impossible to overstate this. The process of pulling key information from dense legal and financial documents is brutally slow. PublicView turns it into a rapid-fire Q&A session. What might have taken me a full afternoon of reading, I could get the gist of in about 20 minutes of smart questioning. It’s not about being lazy; it’s about being efficient. It lets you focus your brainpower on interpreting the information, not just finding it.

However, and this is a big “however,” you have to approach the AI with a healthy dose of skepticism. The platform itself warns you to verify the accuracy of the responses. This is the classic AI problem—sometimes, they “hallucinate” or misinterpret context. I've always felt that AI is a phenomenal assistant, but a terrible boss. You are still the one in charge. You have to take the AI's output and cross-reference it. Think of it as a massively powerful search tool, not an infallible oracle. You wouldn’t trust a random blog post without checking its sources, right? Same principle applies here.

Another point to consider is coverage. The platform may not support every single publicly traded company or fund out there, especially smaller-cap or international stocks. This is a common issue with data providers, so it's not a dealbreaker, but something to be aware of. Always check if the companies you follow are available before you get too invested.

What's the Damage? A Look at PublicView's Pricing

Here’s the million-dollar question: what does it cost? Well, at the time of writing this, PublicView is playing its cards close to the chest. There isn’t a public pricing page listed on their site. Instead, you see prominent buttons for “Try Now For Free” and “Get Started For Free.”

This usually points to a freemium model. My guess is you get a certain number of queries, reports, or document analyses for free. After you hit that limit, you’ll be prompted to upgrade to a paid plan. These plans are likely tiered for individual investors, professionals, and maybe even enterprise teams. It's a smart strategy, as it lets you properly test the platform’s value proposition before pulling out your wallet. My advice? Sign up for the free trial. It's the only real way to know if it's worth a potential subscription for your specific needs.

Frequently Asked Questions about PublicView

How does PublicView work?

It uses sophisticated AI models that have been trained to read and understand financial documents. When you ask a question, the AI scans its indexed versions of these documents (like SEC filings) to find the most relevant information and synthesizes an answer for you in natural language.

What file formats can I export data to?

You can export your work—like generated reports, data tables, and charts—into common formats including Microsoft Excel (.xlsx), Microsoft Word (.docx), and PDF. This makes it easy to integrate with your existing workflow.

How can I verify the accuracy of the responses?

This is crucial. You should always treat the AI's answer as a starting point. A good practice is to ask the AI to cite its source within the document. Then, go to that section in the original filing yourself and confirm the information. Never trust, always verify, especially when money is on teh line.

I can't find the company or fund I'm looking for. What should I do?

While coverage is extensive, it may not be 100% comprehensive. If you can't find a specific company, it's worth checking their FAQ or reaching out to their support team. They may be able to provide information on when that company might be added.

Is PublicView better than just using a generic AI like ChatGPT?

In my opinion, yes, for this specific task. General-purpose AIs are amazing, but they lack the specialized focus. PublicView is purpose-built for financial analysis. It's directly integrated with a database of filings and designed to handle financial queries and data visualization, which is something a generic chatbot can't do with the same reliability or integration.

The Final Verdict on PublicView

So, is PublicView the revolution it claims to be? I'd say it's a significant evolution, for sure. It doesn't eliminate the need for human intelligence or critical thinking—far from it. What it does, and does remarkably well, is eliminate the most tedious, time-consuming parts of financial research.

It transforms the monologue of reading a filing into a dialogue. It empowers investors who are serious about their research but perhaps not data scientists to perform sophisticated analysis. It's a powerful assistant that can help you connect dots faster and spend more time thinking and less time searching.

If you're someone who regularly finds themselves knee-deep in financial reports, I think you owe it to yourself to give the free version of PublicView a spin. It might just be the most productive conversation you have all day.

Reference and Sources

- PublicView Official Website

- SEC EDGAR Company Filing Search

- McKinsey & Company: The state of AI in 2023