If you're a DIY investor like me, you probably have a... system. Mine used to be a horrifyingly complex spreadsheet, a collection of bookmarks to various brokerages, and a Mint account that was trying its best. It felt like I was herding cats. Cats made of money. I could see what was in each pen, but getting a bird's-eye view of the whole farm? A total nightmare.

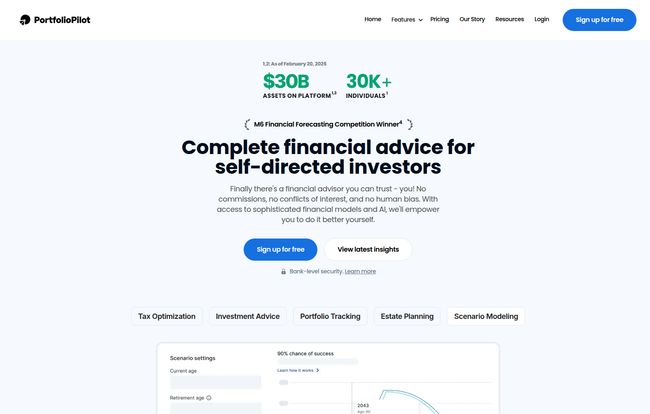

We're in an age where AI is writing poems and creating bizarre works of art, so I always wondered when it would really come for our finances in a meaningful way. Not just another robo-advisor that puts you in a bucket of ETFs. I mean something smarter, something that gives you the power tools without taking away the keys. And that's when I stumbled onto PortfolioPilot.

It claims to be a complete financial advisor for self-directed investors, using ex-hedge fund tech. Big words. So, naturally, I had to see if it was just another shiny object or the real deal. Let's get into it.

Visit PortfolioPilot

So What is PortfolioPilot, Really?

At its core, PortfolioPilot is an AI-powered platform designed to bring all your investment accounts into one place and give you a ridiculously detailed analysis of what's going on. Think of it less like a financial advisor who takes your money and manages it for you, and more like a brilliant co-pilot sitting next to you. You're still flying the plane, but this co-pilot has access to insane amounts of data and can point out things you'd never see on your own. It connects to over 12,000 institutions, so chances are your accounts will link up.

It's built for the person who enjoys being in control but wants institutional-grade insights. You know, the kind of stuff you'd think only a Wall Street hotshot has access to. It's not about handing over control; it's about making your control more informed.

Diving In: My First Impressions and Key Features

Getting started was surprisingly straightforward. You connect your accounts via a secure service (they use Plaid, the industry standard) and the platform starts crunching the numbers. The first time my complete net worth popped up on a single, clean dashboard... I’m not gonna lie, it was a moment of pure zen.

The All-Seeing Dashboard and Portfolio Analysis

This is the command center. PortfolioPilot pulls in your stocks, ETFs, crypto, and other assets, giving you a holistic view. But it’s not just a pretty pie chart. The platform immediately gets to work, analyzing your portfolio's health. It scores your portfolio and shows you potential risks and opportunities. I found it pointing out I was a bit too concentrated in one tech sub-sector—something my own spreadsheets never screamed at me about.

Your Personal AI Financial Guru

This is where things get interesting, especially with the paid plans. The AI doesn't just show you data; it gives you actionable recommendations. For instance, it might suggest specific trades to improve diversification or reduce risk based on your current holdings. It's all based on sophisticated financial models, including Monte Carlo simulations, which is a fancy way of modeling thousands of potential future outcomes to see how your portfolio holds up. It's like having a quant on call.

Tackling Taxes Before They Tackle You

One of the most valuable features for me, and something often overlooked by DIY folks, is the tax optimization. The Gold plan offers continuous tax-loss harvesting suggestions. It identifies losing positions you can sell to offset gains elsewhere in your portfolio, potentially lowering your tax bill. This isn't just a once-a-year thing in December; the AI keeps an eye on it for you. Given that a single smart tax move can pay for a year's subscription, the value proposition here is pretty strong.

How Much Does PortfolioPilot Cost? The Three Tiers

Alright, let's talk money. The platform has a tiered structure, which I appreciate. You can get a feel for it without opening your wallet.

| Plan | Price | Who It's For |

|---|---|---|

| Free | $0 / month | The curious investor. Great for getting all your accounts in one dashboard, basic portfolio analysis, and net worth tracking. Honestly, it’s a powerful tool even at this level. |

| Gold | $29/mo (or $20/mo annually) | The serious DIY investor. This unlocks the personalized AI recommendations, tax-loss harvesting, and the AI Assistant for asking specific questions. This is the sweet spot for most active investors. |

| Platinum | $99 / month | The pro-level investor or data junkie. This adds advanced AI equity research tools. It’s for those who want to do deep dives on individual stocks and get the most advanced features. |

The Good, The Bad, and The AI

No tool is perfect, right? After spending some time with it, here's my unfiltered take.

The biggest pro is the empowerment. The insights are incredible and genuinely give you a professional-grade overview without the professional-grade fees. A human advisor can cost 1% or more of your assets under management per year. For a $200k portfolio, that's $2,000 a year. PortfolioPilot's Gold plan is $240 annually. The math isn't hard. Plus, the security is bank-level, and crucially, they don't manage your money. You are always in control, they just provide the map.

On the flip side, the fact that they don't manage your money can be a con for some. You still have to log into your brokerage account and make the trades yourself. It requires you to be engaged. Also, the really juicy personalized advice is behind the Gold paywall. The free plan is fantastic for monitoring, but the advising part costs money. Fair enough, but something to be aware of. Finally, the most advanced tools are on the priciest Platinum plan, which might be overkill for many.

Is PortfolioPilot the Right Move For You?

So, who should sign up?

In my opinion, PortfolioPilot is a near-perfect fit for the engaged, self-directed investor who feels they've outgrown basic tracking apps. If you find yourself juggling multiple brokerage tabs and trying to make sense of it all in a spreadsheet, this will feel like a massive upgrade. If you're looking for smarter ways to manage risk, find opportunities, and be more tax-efficient, the Gold plan is a fantastic investment in your... well, investments.

If you're someone who wants a completely hands-off, set-it-and-forget-it solution where someone else does all the work, this probably isn't it. This is a tool for the person who wants to be a better pilot, not a passenger.

Frequently Asked Questions

How does PortfolioPilot actually work?

It uses a secure third-party service, Plaid, to connect to your financial institutions in a read-only mode. It then pulls your holdings data and runs it through its proprietary AI and financial models to provide analysis, scores, and recommendations. It never has access to move your money.

Is the advice from PortfolioPilot considered fiduciary?

This is a great question. According to their site, Global Predictions Inc. (the company behind the tool) is a registered investment adviser with the SEC. This means they have a fiduciary responsibility to act in their clients' best interests when providing advice, which is a big deal and a definite point in their favor.

Does PortfolioPilot manage my money directly?

Nope. And for many, that's a feature, not a bug. It's a pure advisory and analytics tool. You maintain 100% control of your assets in your own brokerage accounts. PortfolioPilot gives you the flight plan; you do the flying.

How secure is my financial data with PortfolioPilot?

They take security very seriously. They use bank-level encryption (AES-256) and partner with Plaid for account connections, so your login credentials are never stored on PortfolioPilot's servers. This is the industry standard for fintech apps.

What's the main difference between the Free, Gold, and Platinum plans?

The Free plan is for monitoring and basic analysis. The Gold plan adds the personalized AI advisor, actionable recommendations, and tax-loss harvesting. The Platinum plan is for power users who want deep AI-driven equity research tools.

My Final Word

Look, the world of investing is getting more complex, not less. Tools that can simplify that complexity while giving us better insights are worth their weight in gold. PortfolioPilot feels like one of those tools. It's a step up from basic net worth trackers, offering a level of analytical depth that was previously out of reach for most individual investors.

It's not a magic button that will make you rich overnight. But it is an incredibly powerful co-pilot that can help you navigate the markets with more confidence and data on your side. For the modern DIY investor, that’s a pretty compelling proposition.