Getting into the stock market feels… well, it feels like trying to learn a new language by reading the dictionary. It’s overwhelming. You’ve got a thousand finance bros on TikTok telling you to YOLO your savings into the next meme stock, and then you have the traditional financial advisors who charge hundreds just to say hello. For most of us just trying to maybe buy a house one day, the whole thing is just... a lot.

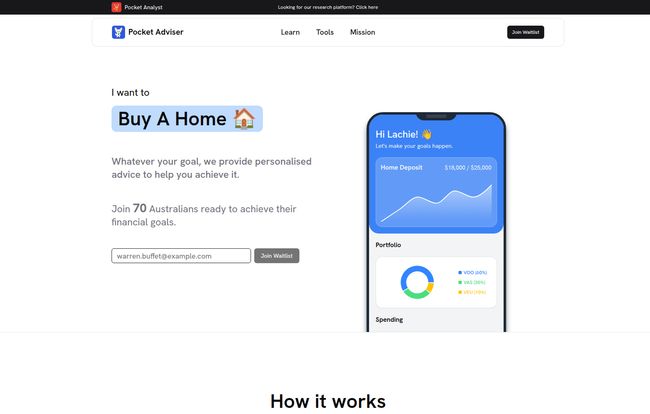

I've been in the SEO and traffic game for years, and I've seen trends come and go. The latest wave? AI everything. AI writing assistants, AI image generators, and now, AI financial tools. A whole new army of apps has sprung up, promising to be your personal finance guru. One that caught my eye recently is Pocket Adviser. Their pitch is simple: personalized financial advice, automated. But is it just another faceless robo-advisor, or is there something more going on here? I had to find out.

What Exactly Is Pocket Adviser?

At its core, Pocket Adviser is an AI-powered tool designed to help new investors get their feet wet. It’s not about complex day-trading charts or crypto speculation. Instead, it starts with a simple, almost shockingly human question: What do you want to achieve?

The whole process is built around you and your real-life goals. You tell the platform you want to buy a home, save for a big trip, or just build a rainy day fund. From there, it takes your financial situation and your comfort with risk into account to build out a custom plan. It’s a step-by-step guide to help you get from here to there. And it provides ongoing support to make sure you actually stay on track. Simple, right?

Visit Pocket Adviser

The Big Question: Can You Trust an AI with Your Money?

Okay, this is the elephant in the room. We’ve all seen the hilarious (and sometimes terrifying) mistakes that AI can make. The thought of an AI “hallucinating” my investment strategy gives me a cold sweat. But this is where Pocket Adviser did something that genuinely surprised me. On their site, there's this little pink box that says:

“No AI, no hallucinations, just advice you can trust. Our financial model was created by a cooperate-rated financial model -- not AI.”

Now, I'm pretty sure they mean “corporate-rated,” but the point stands. This is a brilliant move. They are using AI for what it's good at: the user interface, the 24/7 chat support, and sorting through market data. But the core engine, the thing that actually builds your financial plan, is based on a pre-vetted, human-approved financial model. It’s like having a super-smart, always-on assistant who gets all their final numbers approved by a seasoned accountant in the back room. This hybrid approach immediately calmed my biggest fears. It’s not a freewheeling creative writer playing with your nest egg; it’s a disciplined machine running on a proven system.

My Favorite Pocket Adviser Features

Digging in, a few things really stood out to me as being more than just marketing fluff. It’s the combination of these features that makes the platform feel different.

Truly Personalized Financial Planning

So many so-called “personalized” platforms just ask you to pick a risk level from 1 to 5 and then dump you into a generic bucket of ETFs. Pocket Adviser goes a layer deeper. Starting with your actual life goals—like that down payment for a condo—makes the entire plan feel more tangible and motivational. It frames investing not as an abstract numbers game, but as a direct path to the life you want. That's a powerful psychological shift, especially for beginners who need to see the 'why' behind the 'what'.

The 'Learn As You Go' Philosophy

I'm a big believer that you shouldn't invest in what you don't understand. I was really happy to see that Pocket Adviser isn't a "black box" system. They have a whole section of their site dedicated to educational content, with articles on market basics and common beginner mistakes. This shows a commitment to empowering their users, not just managing their money for them. It’s like giving you financial training wheels. The goal isn’t for you to use them forever, but for you to eventually feel confident enough to ride on your own.

Ongoing Support and Adaptation

The market zigs, your life zags. A plan you make in January might need a tune-up by June. The platform is designed for this, providing ongoing guidance and adapting your plan as things change. It analyzes market events and tells you what they mean for you. This is a huge leg up from the “set it and forget it” model that can leave you feeling lost when the market gets choppy.

Let's Talk Pricing: What's the Catch?

Alright, this is usually where the other shoe drops. Free tools are rarely free, and affordable tools are rarely good. But Pocket Adviser’s pricing structure is, in my opinion, very smart and very fair.

| Plan | Price | Key Features |

|---|---|---|

| Free | $0 Forever | AI investment research, data on 500+ stocks/ETFs, limited AI chats, limited educational content. |

| Early Adopter | $16/month (paid yearly) | Everything in Free, plus unlimited AI conversations, unlimited education, market updates, and a complimentary 1:1 with a qualified financial adviser. |

The Free plan is a perfectly good sandbox. You can poke around, get a feel for the tool, and access some basic research without ever pulling out your credit card. No complaints there.

But that Early Adopter plan… that’s where the magic is. For $16 a month, you get the full, unrestricted experience. But the real showstopper, the feature that made me sit up and say whoa, is this: a complimentary 1:1 with a qualified financial adviser. Let me repeat that. A one-on-one session with a real, breathing human expert. A single hour with a traditional advisor can easily cost $200-$400. Honestly, that one session alone could pay for an entire year of the subscription. This feature single-handedly bridges the gap between digital convenience and human trust. It's an incredible value proposition.

Where Pocket Adviser Shines (and Where It Could Improve)

No tool is perfect, right? After spending time with it, here’s my breakdown of the good and the areas with room for growth.

The Good Stuff

The biggest win is its accessibility. It’s taking the intimidating world of financial planning and making it affordable, understandable, and goal-oriented. The hybrid AI/human model is its secret sauce, offering the best of both worlds. You get the 24/7 availability of an app with the security of a vetted financial model and the priceless gut-check of a human expert. It's the perfect financial sherpa for someone just starting their climb.

The Room for Growth

First off, it's a new platform. It doesn't have the long track record of a giant like Fidelity or Vanguard. That's a fair consideration for anyone who's cautious. They’ll need time to build that history of trust. Also, while I love their hybrid AI model, some folks are just fundamentally skeptical of AI in any financial capacity. This tool might not be for them, and that's okay. Lastly, for the data nerds like me, I’d love a bit more transparency on the “corporate-rated financial model.” What does that mean exactly? Which model is it? A little more detail would build even more confidence.

Who Is Pocket Adviser Actually For?

So, who should sign up? After my review, the ideal user profile seems pretty clear.

This is a fantastic tool for:

- The overwhelmed beginner: If you've been stuck in “analysis paralysis” for months, this is the gentle push you need.

- The goal-oriented saver: If you're saving for something specific and want a clear roadmap to get there.

- The budget-conscious investor: Someone who wants professional-grade guidance without the sky-high price tag of a traditional advisor.

It might not be the best fit for:

- The seasoned day trader: If you live for candlestick charts and complex options trading, this tool will feel too simple for you.

- The ultra-high-net-worth individual: If your needs involve complex tax strategies and estate planning, you still need a dedicated human team.

- The staunch anti-AI purist: If you want 100% human interaction, 100% of the time, this hybrid model probably won't be your cup of tea.

Frequently Asked Questions

- Is Pocket Adviser safe to use?

- Pocket Adviser emphasizes security by using a vetted, corporate-rated financial model for its core advice, separating it from the conversational AI. This hybrid approach is designed to prevent AI errors in your financial plan. As with any financial tool, you should still do your own due diligence.

- How much does Pocket Adviser cost?

- It offers a $0 forever Free plan with limited features. The paid Early Adopter plan is $16/month (billed annually) and includes unlimited features plus a one-on-one session with a human financial adviser.

- Can I talk to a real person with Pocket Adviser?

- Yes! This is a major feature. The paid Early Adopter plan includes a complimentary 1:1 meeting with a qualified financial adviser to review your plan and answer your questions.

- What makes Pocket Adviser different from a robo-advisor like Betterment?

- While both automate investing, Pocket Adviser's main difference is its starting point. It focuses on your specific life goals (like buying a home) to build the plan, rather than just your risk tolerance. The inclusion of a 1:1 human consultation in its paid tier is also a significant differentiator from most standard robo-advisors.

- Is Pocket Adviser good for experienced investors?

- It's primarily designed for new to intermediate investors. An experienced investor might find the educational content too basic and the tools not advanced enough for complex strategies. However, the AI research assistant could still be a useful tool for anyone.

My Final Verdict

In a very crowded market of financial apps, Pocket Adviser has managed to carve out a really interesting and much-needed niche. It’s not just another robo-advisor, and it’s not trying to replace human advisors entirely. Instead, it’s building a bridge between the two.

It successfully tackles the biggest barrier for new investors: a clear, trustworthy, and affordable starting point. The smart separation of its AI interface from its core financial model, combined with that killer 1:1 human session, makes for a compelling package. In a world full of financial noise, a clear, goal-oriented, and encouraging voice is exactly what so many people need. I'm genuinely excited to see where they go from here. It's definitely one to watch.