Alright, let’s talk. You know that feeling, right? You finally pull the trigger on that new pair of headphones or that sleek carry-on bag you’ve been eyeing for weeks. You feel good. Responsible, even. Then, three days later, you get a promotional email from the exact same store announcing a 25% off flash sale. And your new toy is front and center.

The pain is real. It's a unique flavor of buyer's remorse that sends you down a rabbit hole of checking the store's price adjustment policy, digging for the digital receipt, and drafting a polite-but-firm email to customer service. Most of the time, I just sigh and tell myself, “Well, I needed it anyway.” The hassle just isn’t worth the 15 bucks.

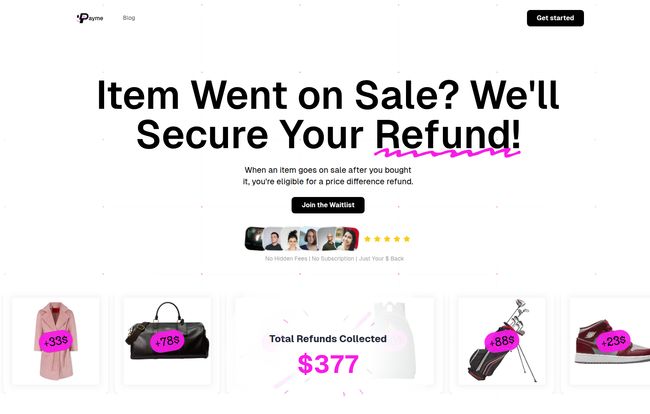

So, when a tool like Payme lands on my radar, my professional curiosity—and my inner cheapskate—both perk up. Their headline is bold: "Item Went on Sale? We'll Secure Your Refund!" It promises to do all that annoying work for you, using AI. Color me intrigued.

What Is Payme and How Does It Supposedly Work?

At its core, Payme is a set-it-and-forget-it service. It’s designed to be your personal, digital bloodhound for bargains after you’ve already bought something. The concept is built on a retail secret that many shoppers either don't know about or don't have the energy to use: price adjustment policies. Many large retailers will refund you the difference if an item you purchased goes on sale within a certain timeframe (usually 14-30 days).

Instead of you manually tracking this, Payme automates the whole shebang. Here's the gist:

- You sign up and connect your email account (looks like it primarily works with Gmail for now, which is pretty standard for these services).

- Payme's AI scans for purchase receipts from supported online stores.

- It then keeps an eye on the prices of the items you bought.

- If it detects a price drop within the policy window, it springs into action.

The "Magic" Is in the Follow-Through

This is where it gets interesting. Payme doesn’t just notify you of a price drop. It claims to handle the entire refund process. That includes automatically submitting the refund request and, get this, even calling customer service on your behalf if needed. You literally do nothing. The next time you hear from them is when a refund has been successfully clawed back from the retail gods and is on its way to you.

Honestly, the idea of an AI bot sitting on hold with customer service for me is almost worth the price of admission alone. That’s a future I can get behind.

When I first landed on their site, I had a good chuckle. The example savings were... optimistic. A $935 refund on a shirt? A $789 refund on a duffel bag? Unless that shirt was spun from gold and the bag was a Birkin, those numbers are pure marketing fluff. But hey, I’ve been in this game long enough to know you have to grab attention. The more realistic figure of '$377 Total Refunds Collected' shown nearby felt a lot more grounded. Still, it made me smile.

Visit Payme

Let's Talk Money: The Real Cost of Payme

"Free" is a word that makes any seasoned online marketer suspicious. And yes, Payme is free to sign up. There are no monthly subscriptions or hidden fees, which is a massive plus in my book. So, how do they keep the lights on?

Their model is simple and, in my opinion, pretty fair:

Payme takes a 20% commission on the refund amount they successfully secure for you.

Think about that. You keep 80% of money you wouldn't have had otherwise, all for zero effort. If they find you a $20 refund, they keep $4, and you get $16. If they find you nothing, you pay nothing. It’s a purely performance-based model. It's found money, and they just take a small finder's fee. I've seen far worse deals.

The Good, The Bad, and The AI-Powered

No tool is perfect, and it's my job to be skeptical. After digging around, here's my breakdown of the highs and lows.

The Upsides

The main advantage is obvious: effortless savings. It's a true background process that requires almost no input after the initial setup. You're basically outsourcing the tedious task of price tracking to a robot who never sleeps or gets bored. For busy people or frequent online shoppers, this could easily add up to hundreds of dollars a year in found money. It turns the frustration of seeing a sale into a pleasant surprise notification that you’ve got cash back coming your way.

Potential Hurdles to Consider

First, the 20% commission. While I think it's fair, some people might balk at giving away any portion of their refund. To them I'd say, would you have gotten that 80% on your own? Be honest. Probably not.

The bigger consideration for many will be privacy. To work, Payme needs access to your email inbox to find receipts. This is the same model used by services like the original Paribus (which was so good Capital One bought them). You have to be comfortable with an AI scanning your messages for commercial transactions. Payme states they only focus on receipts, but it's a permission you have to be willing to grant.

Lastly, it won't work with every single store. Its success is tied to major retailers with clear, established price adjustment policies. Your purchase from a small Etsy shop or a local boutique probably won't be covered.

Who Should Sign Up for Payme?

So, is this tool for everyone? Nah, probably not. But for a certain type of person, it's a no-brainer.

You're a perfect candidate for Payme if:

- You do a significant amount of your shopping online at major retailers (think Amazon, Target, Best Buy, major clothing brands, etc.).

- You're busy and value your time more than the potential 20% commission.

- You're comfortable with the email-scanning model for the benefit of automatic savings.

- You love the idea of getting money back without lifting a finger.

If you primarily shop in-person or at small, independent stores, this tool won't offer much value. But for the dedicated digital consumer, it could quickly become an indispensable part of their money-saving toolkit.

Frequently Asked Questions About Payme

I've seen a few questions pop up, and their site has a small FAQ, so let's tackle the big ones.

How exactly does Payme make its money?

They operate on a contingency fee. They only get paid if you get paid. They take a 20% cut of any refund they successfully recover for you. If there's no refund, there's no charge.

Is it safe to connect my email account?

This is a personal comfort question. The service needs access to find receipts. Reputable services in this space use secure connections and have strict privacy policies focused only on commercial emails. However, you should always review the privacy policy of any service you connect to your email.

What if Payme doesn't find any refunds for me?

Then nothing happens! You don't pay a cent. It just means none of your recent purchases had a qualifying price drop at a supported retailer. You can just let it keep running in the background until it finds one.

Does this work for in-store purchases?

Generally, no. These services rely on the digital trail of an email receipt. If you got a paper receipt in-store, Payme won't see it and can't track it.

Does Payme work with every single online store?

No, and it's important to understand that. It works with a list of supported retailers that have price adjustment policies. While this covers many of the big names, it won't cover every purchase you make online.

My Final Verdict: Is Payme Worth a Shot?

Yeah, I think so. For the right person, Payme falls into the category of “what have you got to lose?”

The risk is incredibly low. You don’t pay unless it works, and the potential reward is... well, money you didn't have before. It tackles a genuine, relatable pain point for online shoppers. While the privacy aspect of email scanning is a valid consideration for every individual, it's a standard practice for this type of savings tool.

In a world of complex subscription models and paid-upfront services, a simple, performance-based tool is refreshing. It's a clever application of AI that provides real, tangible value. Give it a shot, let it run in the background for a few months, and see what it shakes loose. You might be pleasantly surprised by an email telling you a refund is on its way.

Reference and Sources

- Capital One Shopping: Price Protection FAQs

- Payme Official Website (as analyzed for this review)