If you're a financial advisor, you probably didn't get into this business because you love paperwork. You got into it to help people, to strategize, to see that lightbulb moment when a client finally understands their path to financial freedom. But the reality? It’s often buried under mountains of data entry, chasing down documents and spending hours on tasks that feel... well, repetitive.

I’ve been in the SEO and digital trends space for years, and I’ve seen AI go from a sci-fi buzzword to a practical tool in almost every industry. Finance is no exception. So when I came across Parthean AI, which claims to be an AI-powered platform for advisors, my curiosity was definitely piqued. Another tool promising to revolutionize everything? Maybe. Or maybe it's just another shiny object. I decided to take a closer look.

What is Parthean AI, Anyway?

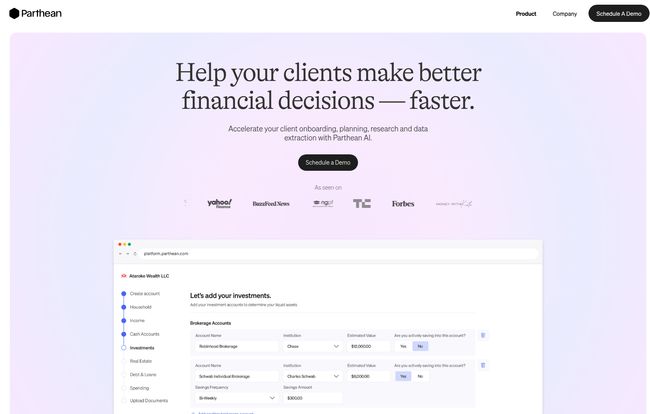

First off, let’s clear the air. Parthean AI isn't another robo-advisor aiming to cut you out of the picture. Thank goodness. Instead, it positions itself as a co-pilot. A digital assistant. Its goal, from what I can see, is to handle the grunt work so you can do more of the human work. Their own site even says it, loud and clear: “AI won’t replace you. It will enhance you.” That’s a message I can get behind.

At its core, Parthean is a platform designed to accelerate pretty much every tedious part of your workflow. We're talking about client onboarding, financial planning, research, and pulling data from all sorts of documents. It's built to be the engine humming quietly in the background, making your entire practice run smoother and faster.

The Best Features That Actually Matter

A platform is only as good as its features, right? Here’s where I think Parthean really tries to make a difference in an advisor's day-to-day grind.

Streamlining the Dreaded Client Onboarding

We’ve all been there. Getting a new client is exciting, but then comes the endless back-and-forth of information gathering. Parthean tackles this with customizable form logic. This means you can build a slick, digital onboarding process that guides clients through providing their information seamlessly. It’s like having a perfect, patient assistant who collects all the necessary details before the client even sits down with you. Less chasing, more advising.

Say Goodbye to Manual Data Entry

This one got my attention. One of the platform’s standout features is its ability to use AI to extract information directly from documents. The example they show is a Last Will & Testament—a notoriously dense document. The idea that you can just upload a PDF and have the AI pull out the key details, beneficiaries, and asset information is... well, it's a bit of a dream. Think of the hours saved not having to manually type in data from statements, tax forms, or legal documents. It’s like using a sledgehammer to crack a nut, but in the best way possible.

AI Paraplanning on Tap

Once the data is in, what’s next? This is where the “AI paraplanner” comes into play. Parthean can analyze the client's entire financial picture—assets, liabilities, investments—and help you generate insights and recommendations. From optimizing tax-efficient strategies to analyzing a portfolio, it provides a solid foundation for the plan you build. It does the initial number-crunching and scenario-modeling, freeing up your brainpower for high-level strategy and client communication. It’s your research assistant, analyst and data monkey all rolled into one.

Visit Parthean AI

Keeping Clients in the Loop

Here’s a nice touch: Parthean isn’t just for you. It includes a client-facing mobile app. This gives your clients on-the-go access to their financial plan and your advice. In a world where everyone manages their life from their phone, this is huge for client engagement and retention. It makes your advice feel more tangible and accessible, rather than something they only see in a quarterly review meeting. It keeps you top-of-mind and adds a layer of modern professionalism to your service.

Okay, But What's the Catch?

Look, no tool is perfect. And as an SEO guy, I’m naturally skeptical. Based on the information and my experience with similar AI tools, here are a few things to keep in mind. These aren't necessarily deal-breakers, but you should be aware of them.

First, it's still AI. It's powerful, but it's not a sentient financial genius. You absolutely need to maintain human oversight. You’re the expert, the one with the license and the relationship with the client. The AI provides data and suggestions; you provide the wisdom and the final sign-off. Second, the output is only as good as the input. The old “garbage in, garbage out” principle applies. If the data provided by the client is incomplete or inaccurate, the AI's analysis will be, too. Finally, there’s likely a bit of a learning curve. It looks intuitive, but any powerful new software requires some time to integrate into your workflow. Just be prepared to invest a little time upfront.

How Much Does Parthean AI Cost?

Ah, the million-dollar question. Or, hopefully, a lot less. Currently, Parthean does not list its pricing publicly on its website. This is pretty standard for B2B SaaS platforms targeting professional firms. The price often depends on the size of your firm, the number of users, and the specific features you need.

To get the details, you’ll have to do what has become a tech industry ritual: “Schedule a Demo.” This is actually a good thing in my opinion. It gives you a chance to see the platform in action, ask specific questions about your own practice, and make sure it’s a good fit before you talk numbers.

Who is Parthean AI Really For?

After digging in, I have a pretty clear picture of the ideal Parthean user. This platform is tailor-made for the modern, tech-forward financial advisor or RIA (Registered Investment Advisor) who is looking to scale their practice efficiently. If you find yourself bogged down by administrative tasks and want to spend more time on client strategy and growth, this could be a perfect fit.

Who is it not for? If you're staunchly old-school, and the idea of letting an AI touch your client data gives you hives, this probably isn't your cup of tea. And that's okay! But for those ready to embrace technology as a partner, Parthean seems incredibly promising.

My Final Verdict: Is It a Game-Changer?

So, is Parthean AI the future? I think it’s a very strong glimpse of it. The idea of an AI co-pilot for advisors isn't just a gimmick; it addresses real, painful bottlenecks in the industry. The ability to automate data collection and initial analysis is, frankly, a massive value proposition.

It won't make a bad advisor a good one. But it could make a good advisor a great one—or at least a much more efficient one. By handling the tedious work, it allows you to focus on the irreplaceable human elements of your job: empathy, trust, and sophisticated, personalized advice. And in this business, that’s everything.

Frequently Asked Questions

- What exactly is Parthean AI?

- Parthean AI is a software platform for financial advisors that uses artificial intelligence to streamline and accelerate tasks like client onboarding, data extraction from documents, financial analysis, and plan generation. It acts as a digital assistant or co-pilot for the advisor.

- Is Parthean AI trying to replace financial advisors?

- No, quite the opposite. Its stated goal is to enhance the capabilities of human advisors, not replace them. It automates repetitive tasks to free up advisors to focus on high-value client interaction and strategy.

- Who is the ideal user for Parthean AI?

- Tech-savvy financial advisors, wealth managers, and RIA firms who want to improve their operational efficiency, scale their practice, and enhance their client service with modern tools.

- Can I trust AI with sensitive client financial data?

- This is a critical question. Platforms like Parthean that handle sensitive financial information typically employ bank-level security and encryption protocols. However, you should always confirm the specifics of their data security and privacy policies directly with them during a demo.

- How does Parthean AI help with client communication?

- Parthean offers a client-facing mobile application where clients can view their financial plan and access their advisor's advice on-the-go. This helps improve engagement and makes financial planning a more continuous, accessible process.

- Is there a free trial for Parthean AI?

- The website doesn't mention a free trial. The primary call-to-action is to schedule a personalized demo, where you can likely inquire about trial periods or pilot programs for your firm.