If you've ever been in the trenches of a startup, managed a fund, or juggled a real estate portfolio, you know the chaos. Your financial life is a Frankenstein's monster of spreadsheets, a dozen different banking tabs, DocuSign for contracts, another tool for cap table management, and a prayer. It’s a mess. I've been there, trying to reconcile wire transfer details at 2 AM, and it’s not pretty.

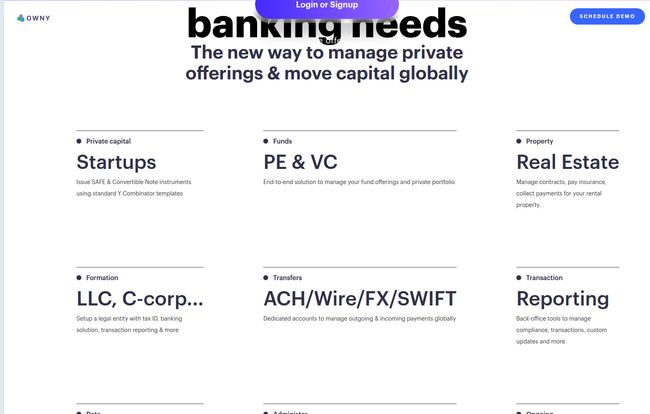

So when a platform like Owny comes along, flashing promises of a unified “financial stack” to manage capital, investors, and treasury all in one place, my interest is piqued. But my professional skepticism, honed by years of watching tools overpromise and underdeliver, also kicks in. Is this another piece of shiny, venture-backed software that looks good on a landing page but falls apart in practice? Or is it the real deal?

Let's take a no-fluff look at what Owny is, who it's actually for, and the super important details hiding in the fine print.

So, What Exactly is Owny? (Spoiler: It's Not a Bank)

First thing's first: Owny is a financial technology company. This is a critical distinction. They are not a registered bank or a broker-dealer. Think of them less as the vault holding the gold and more as the high-tech security system, logistics network, and command center that manages everything related to that gold. They provide the software layer—the financial stack—that connects all the disparate pieces of your business's financial operations.

Their whole game is about consolidation. Instead of one tool for issuing SAFEs, another for paying international contractors, and a third for updating your investors, Owny aims to bring it all under one roof. It’s an ambitious goal, because each of those things is a beast in its own right.

Who is Owny Built For? A Look at the Core Users

Owny isn't trying to be a one-size-fits-all solution, which is smart. Their landing page makes it pretty clear who they're targeting. You’ll probably see yourself in one of these buckets.

For the Scrappy Startup Founder

Ah, the early-stage hustle. You’re trying to build a product, find customers, and somehow raise capital all at the same time. Owny steps in with tools specifically for this whirlwind phase. They offer the ability to issue SAFE & Convertible Note instruments, even using standard Y Combinator templates. This is a huge time-saver and can potentially cut down on legal fees. They also handle company formation (LLC, C-corp), helping you get set up with a tax ID and the necessary banking infrastructure. It's about taking the administrative headache out of fundraising so you can focus on your pitch deck.

For the Venture Capital & Private Equity Pros

For fund managers, life is about managing LPs (Limited Partners), tracking portfolio performance, and deploying capital effectively. Owny offers an end-to-end solution for managing fund offerings and private portfolios. The idea is to have a single source of truth for investor information, capital calls, and reporting, rather than the classic—and often insecure—method of endless email chains and Excel files.

For the Real Estate Mogul

Property management has its own unique brand of chaos. Owny provides tools to manage contracts, pay insurance, and collect rent payments. For smaller firms or individuals managing multiple properties, this could be a major upgrade from Zelle requests and manual bookkeeping, especially when it comes to keeping clean records for tax time.

A Tour of Owny's Feature Toolkit

Okay, so we know who it's for. But what can it actually do? The features are pretty comprehensive, almost like a financial Swiss Army knife for businesses.

They’ve broken it down into a few key areas:

- Capital Movement: This is a big one. They offer dedicated accounts to manage global transfers, including ACH, Wire, FX, and SWIFT. Anyone who’s tried to pay a developer in Eastern Europe or receive an investment from Asia knows how painful and expensive this can be. Centralizing this is a powerful proposition.

- Administration & Reporting: This bucket includes creating and sharing contracts, streamlining closings, and managing payments. On top of that, they have back-office tools for compliance and custom transaction reporting. The analytics part of it lets you track interest and sales activity with interactive dashboards, which is way better than static reports.

- Ongoing Support: They promise a dedicated team of specialists. In my experience, the quality of support can make or break a platform like this. Is it just a generic helpdesk, or are these actual experts who understand the nuances of a Series A round or a property closing? That's the million-dollar question you'd want to ask during a demo.

Visit Owny

The Good, The Bad, and The "Read the Fine Print"

No platform is perfect, and it's my job to look past the marketing copy. Owny has a lot going for it, but there are some very important caveats you need to understand before you even think about booking a demo.

The Upside

The main advantage is obvious: integration. Having one system for legal entity formation, fundraising instruments, investor management, and global payments is incredibly compelling. It reduces the chance of errors, saves a ton of administrative time, and gives you a clear, real-time picture of your company's financial health. For a CFO or a busy founder, that's gold. The focus on specific niches is also a major plus. They're not just a generic business account; they have tools tailored for the unique struggles of startups and fund managers.

The Not-So-Hidden Caveats

Now for the fine print, which, to their credit, is right there at the bottom of their homepage. First, and I'll say it again, Owny is not a bank. They also state clearly that they do not provide legal, tax, or investment advice. This is not a knock on them; it's a legal and regulatory reality. But you need to go in with your eyes open. Owny is the platform, the facilitator. You still need your own lawyers and accountants.

More importantly, they rely on third-party registered investment advisors for advisory services. The fine print also mentions a potential conflict of interest, as Owny may be compensated by these investment advisers for referrals. This is a standard industry practice, but it's something to be aware of. You need to do your own due diligence on any adviser they might connect you with. Don't just take their word for it.

What's the Damage? A Look at Owny's Pricing

So, how much does this all-in-one financial command center cost? Well, that's the mystery. I scoured their site for a pricing page and—surprise, surprise—came up empty. I even hit a 'Page Not Found' error, which tells me it's either well-hidden or, more likely, non-existent.

This isn't necessarily a red flag. It's actually very common for sophisticated B2B SaaS platforms. The pricing is likely customized based on your company's size, transaction volume, and the specific features you need. A startup issuing its first SAFE note has vastly different needs than a $100M VC fund. Your path to a price tag is going to be through their "Schedule a Demo" button. Be prepared to talk about your business in detail to get a custom quote.

My Final Take: Is Owny Worth the Demo?

After digging in, I'm cautiously optimistic. Owny is tackling a genuinely painful and complex problem. For the right kind of company—a startup gearing up for a raise, a small to mid-sized fund, or a real estate business drowning in admin—the value proposition of a single, unified platform is massive.

The key is to manage your expectations. Don't mistake Owny for a replacement for your bank or your lawyer. It's a powerful operational tool designed to sit in the middle and make all those other pieces work better together. It’s the conductor for your financial orchestra, not the musicians themselves.

So, should you book that demo? If you see your company's challenges reflected in their services and understand their role in the ecosystem, I'd say yes. It's worth an hour of your time to see if they can truly tame your financial chaos. If your financial life currently looks like a dozen open browser tabs and a desperate hope that nothing falls through the cracks, it might just be the most productive call you make all week.

Frequently Asked Questions about Owny

- Is Owny a bank?

- No, Owny is a financial technology company, not a registered bank or broker-dealer. It provides a software platform to manage financial operations that connect with banking services.

- Can I get investment advice from Owny?

- No, Owny explicitly states that it does not provide legal, tax, or investment advice. It can connect you with third-party registered investment advisors, but is not one itself.

- Who is the ideal customer for Owny?

- The platform is designed for startups raising capital (e.g., via SAFEs), venture capital and private equity funds, and companies managing real estate portfolios.

- How do I find out Owny's pricing?

- Owny does not list pricing publicly on its website. To get a quote, you need to contact their sales team or schedule a demo to discuss your specific needs.

- Does Owny help with setting up a new company?

- Yes, one of its listed features is company formation services, helping you set up an LLC or C-corp with a tax ID and banking solutions.

- Can I use Owny for international money transfers?

- Yes, the platform supports global capital movement, including Wire, FX, and SWIFT transfers, through dedicated accounts.