Finally, A Financial Tool That Speaks F.I.R.E.

Let's be real for a second. If you're even remotely interested in personal finance, you've probably danced the spreadsheet tango. You know the one. You download a template, spend hours linking cells, inputting transactions, and creating pivot tables that would make a CPA weep. You feel like a financial wizard for about a week… and then you forget to update it. Life happens. Before you know it, that beautiful spreadsheet is just another dusty file in your Google Drive, a monument to your good intentions.

I've been there more times than I care to admit. As someone who lives and breathes this stuff—SEO, traffic, trends—I'm always looking at the data. But managing my own financial data? It's often felt like a chore. Especially when you're chasing a goal as ambitious as F.I.R.E. (Financial Independence, Retire Early). The F.I.R.E. movement isn't just about saving money; it's about optimizing your entire financial life into a well-oiled machine. And my spreadsheet was, well, less of a machine and more of a sputtering lawnmower.

So when I stumbled upon Opesway, my professional curiosity was piqued. It calls itself a “free, personalized F.I.R.E. platform.” A bold claim. The fintech space is littered with the ghosts of apps that promised to simplify our lives, most recently the much-lamented Mint. Could this one actually deliver? I decided to sign up and kick the tires.

So What Exactly is Opesway?

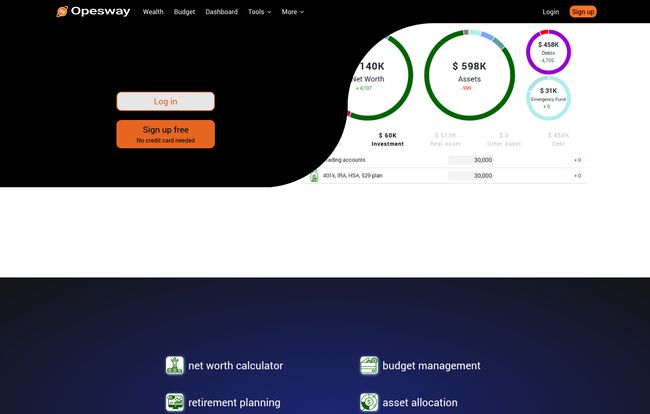

Think of Opesway as a central command center for your money, built specifically for people whose goal isn't just “saving a little” but achieving financial freedom. It's an all-in-one platform that aims to consolidate your net worth tracking, budget planning, and retirement forecasting. Killing the spreadsheet is the white whale for a lot of these companies, but Opesway seems to have it squarely in its sights.

But here’s the bit that made me lean in closer. They mention that their forecasts and analyses are provided by actual financial professionals, including CFA charter holders. For those not in the weeds, a CFA (Chartered Financial Analyst) charter is one of the most rigorous and respected credentials in the finance world. This isn't just an algorithm guessing; there's some serious human brainpower behind the strategic suggestions. That's a huge differentiator from a lot of the purely automated tools out there.

Visit Opesway

My First Impressions and Getting Started

Signing up was straightforward. The free tier is genuinely free, no credit card required, which I always appreciate. It lowers the barrier to entry to basically zero. The dashboard is clean, maybe a little spartan, but I prefer that to a screen cluttered with a million widgets and ads screaming for my attention.

It walks you through connecting your accounts and setting up your initial goals. It’s designed to give you that 30,000-foot view of your financial world right from the get-go. No steep learning curve. It just… works.

The Core Features That Actually Matter

A platform can have a hundred features, but only a handful ever get used. Here’s my breakdown of the Opesway tools that I think move the needle.

Tracking Your Net Worth (The Ultimate Scoreboard)

For me, net worth is the most important number in personal finance. It’s the ultimate scoreboard. It cuts through the noise of income, expenses, and market fluctuations to tell you one thing: are you moving forward or backward? Opesway’s net worth calculator is front and center. It aggregates all your linked accounts—checking, savings, investments, IRAs, even debts like credit cards and loans—into one, glorious number. There’s a certain thrill, and maybe a little terror, in seeing it all laid out so clearly. It’s the kind of radical transparency you need to make real progress.

Budgeting Without The Drudgery

I have a confession. I hate manual budgeting. I’ve tried apps where you have to log every single coffee and pack of gum. It’s soul-crushing. This is where the Opesway Plus tier starts to shine. It has an automatic budget feeding feature that pulls transactions directly from your linked bank accounts and categorizes them. This isn't just convenient; it's transformative. It turns budgeting from an active, painful chore into a passive, review-and-adjust process. You're no longer a data-entry clerk; you're the CFO of your own life, making decisions based on data that magically appears for you.

Forecasting Your F.I.R.E. Future

This is the heart of the platform for its target audience. The retirement planning tools are more than just a simple “if you save X, you’ll have Y” calculator. Opesway lets you play with variables. What if you retire at 50 instead of 55? What if you increase your savings rate by 3%? It projects your wealth forward, showing you a visual forecast of your path to F.I.R.E. It’s motivating, to say the least. It turns an abstract goal into a tangible timeline. Of course, any forecast is only as good as the data you put in and the assumptions it makes, but as a directional guide, it’s incredibly powerful.

Your AI Chatbot Sidekick

The personalized AI chatbot is another Plus feature. I was skeptical, I'll admit. Most chatbots are frustratingly dumb. But this one is surprisingly decent. I asked it things like, “What’s the impact on my retirement date if I pay off my car loan early?” and it gave me a coherent, data-driven answer based on my own numbers. It’s like having a little financial nerd on call 24/7 to run scenarios for you. Pretty cool.

Let's Talk About The Price Tag

So, how much does this all cost? This is where Opesway makes a very compelling case.

Their pricing structure is simple and transparent:

- Opesway Free: This plan is surprisingly robust. You get assets & net worth tracking, budget planning, custom financial goals, the money flow chart, and even the basic retirement readiness insight. For many people just starting, this is more than enough to get a solid grip on their finances.

- Opesway Plus: This is the premium tier, priced at $14 per month (with a 14-day free trial). This unlocks the power features: the optimized asset allocation and debt-free strategies, the powerful wealth & budget forecasting, the automatic bank account linking and budget feeding, and the personalized AI chatbot.

Is the Plus plan worth it? In my opinion, yes. For $14—less than the cost of two visits to a fancy coffee shop—you automate the most tedious parts of financial management and get access to much more powerful forecasting. The time and mental energy it saves you is worth the price alone, especially if you’re serious about a goal like F.I.R.E.

The Good, The Bad, and The... Plaid?

No tool is perfect. After spending some time with it, here's my honest take.

The Good: The free version is one of the most generous I've seen. The tight focus on the F.I.R.E. community is a huge plus, as the features are tailored for that goal. And the human-backed analysis from CFAs provides a layer of credibility that’s hard to find elsewhere.

The Not-So-Good: Naturally, the best features are locked behind the subscription. And like any forecasting tool, its predictions are based on your inputs and market assumptions—they're not a crystal ball. Garbage in, garbage out, as they say.

The Plaid in the Room: Okay, let's talk about connecting your bank accounts. Opesway, like virtually every other modern fintech app, uses Plaid to do this. Some people get nervous about this, and I get it. The idea of giving a third-party app access to your financial data can feel sketchy. But it’s important to understand how it works. Plaid is an industry-standard, secure middleman. You use your bank login to create a secure, encrypted token that allows Opesway to read your transaction data. Opesway itself never sees or stores your bank password or PIN. It's the same technology used by apps like Venmo, Chime, and Empower. While no system is 100% risk-free, it's about as secure as it gets in the online world.

Frequently Asked Questions About Opesway

- Is Opesway really free?

- Yes, the base version of Opesway is completely free and offers a fantastic set of tools for tracking net worth and planning budgets. The more advanced automation and forecasting features are part of the Opesway Plus subscription for $14/month.

- Is Opesway safe to use with my bank accounts?

- Opesway uses Plaid, a leading financial data-transfer network, to connect to your accounts. This is the industry standard for security. Opesway doesn't see or store your bank login credentials, making the connection secure and read-only.

- Who is Opesway best for?

- It's ideal for anyone serious about the F.I.R.E. movement or anyone who wants a powerful, all-in-one dashboard to replace their messy financial spreadsheets. If you want to actively track your progress towards financial independence, this tool is built for you.

- Can Opesway replace a human financial advisor?

- Not entirely. While the insights are backed by CFA charter holders, the platform provides strategic guidance and forecasting, not personalized, one-on-one advice for complex situations like estate planning or intricate tax strategies. It's a phenomenal tool to complement, or even delay the need for, a traditional advisor.

- How accurate are teh retirement forecasts?

- The forecasts are as accurate as the information you provide. They use sophisticated models, but they are still projections based on your savings rate, expected market returns, and inflation. Think of them as a highly educated GPS route—the destination is clear, but you might hit some unexpected traffic along the way.

My Final Verdict on Opesway

After digging in, I've gotta say, I'm impressed. Opesway has carved out a fantastic niche for itself. It's not trying to be everything to everyone. It's a sharp, focused tool for a specific, motivated audience: the F.I.R.E. community.

It successfully bridges the gap between overly simplistic, ad-supported apps and overly complex, expensive financial software. The combination of a powerful free tier and an affordable, high-value premium plan makes it accessible to almost anyone.

If you're still wrestling with a spreadsheet or feeling overwhelmed by the sheer number of accounts you need to track to see your F.I.R.E. number, I'd strongly suggest giving Opesway a try. Sign up for the free version. Connect an account or two. Play with the calculators. What have you got to lose? Except, maybe, a dozen messy spreadsheets. And that sounds like a pretty good trade to me.