The world of investing has gotten... weird. And wonderful. And overwhelmingly complicated. A decade ago, the conversation was mostly about stocks, bonds, and maybe a mutual fund if you were feeling spicy. Today? My inbox is a chaotic mix of crypto airdrops, fractional art ownership, investing in litigation funding, and even buying shares in a plot of farmland. It's a lot.

It feels like you need a full-time research assistant just to keep up. I've always been a sucker for tools that try to simplify this beautiful chaos, which is why MoneyMade recently landed on my radar. It promises to be an AI-powered guide to find your next investment. But does it actually work, or is it just another shiny object in an already crowded space? I decided to take a look.

So, What is MoneyMade, Really?

First thing's first: MoneyMade is not a bank. It's not a brokerage. It won't take your money and invest it for you. Thank goodness, because I have enough logins to remember as it is.

Think of MoneyMade as an intelligent discovery engine. It’s like a super-knowledgeable friend who has spent way too much time exploring every investment platform on the internet—from the mainstream to the wonderfully obscure—and is ready to give you the rundown. Its main goal is to introduce you to different platforms and opportunities based on what you’re curious about.

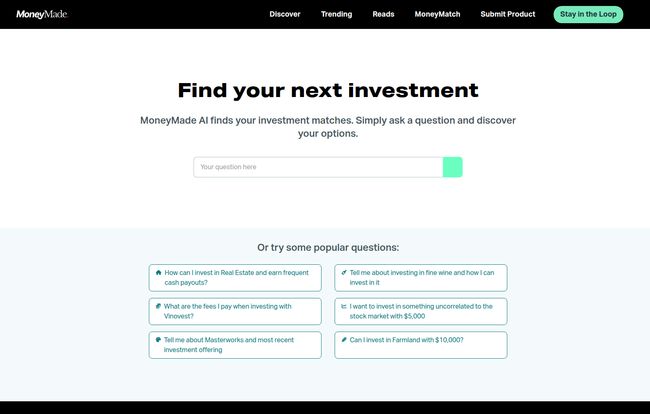

The centerpiece of the whole thing is its AI chat function, called MoneyMatch. You literally ask it a question, just like you would with ChatGPT, but focused on investing.

Visit MoneyMade

The AI Matchmaker for Your Money

The user experience is refreshingly simple. The homepage presents you with a question bar and a few pre-filled thought-starters like, "Tell me about investing in fine wine and how I can access it" or "Can I invest in art with $10,000?" This immediately tells you we're not just talking about Vanguard ETFs here.

How MoneyMatch Actually Works

You type in your query, and the AI goes to work, pulling together relevant platforms and information. It's designed to be conversational. Instead of just getting a list of blue links like a Google search, you get a curated response that points you toward platforms that fit your request. For instance, ask about art, and it will probably bring up Masterworks. Ask about wine, and you'll likely see Vinovest. It’s a direct line from curiosity to potential solution.

Exploring Beyond the S&P 500

This, for me, is the coolest part. I know how to buy stocks. What I don't have time for is vetting the dozens of new platforms for alternative investments. MoneyMade puts them all in one place. They have categories for real estate, venture capital, collectibles, farmland, and more. It’s a playground for anyone who believes diversification means more than just owning both US and international stocks. It's a genuine attempt to make the 'alts' market more accessible, which is a trend I've been watching for years.

Is It Just a Glorified Search Engine Though?

I can hear the skeptics already. "Can't I just Google this stuff?" And yes, you could. But you'd be swimming in a sea of paid ads, biased reviews, and endless forum threads. What MoneyMade does is add a layer of curation and education.

Alongside the AI tool, the platform is packed with articles, guides, and reviews. They have lists like "4 Best Copy Trading Platforms" and explainers on passive income. This provides valuable context. So, you're not just discovering a platform's name; you're getting some background on why it might be a good fit, how it works, and what to look out for. It's the difference between being handed a phone book and being given a curated list of top-rated restaurants with sample menus.

The Good, The Bad, and The All-Important Fine Print

No tool is perfect, of course. Not even the ones powered by fancy AI. After spending some time on the site, here's my honest breakdown.

The Big Wins for MoneyMade

The sheer breadth of options is a huge plus. It’s a one-stop-shop for discovery. The AI-driven matching is also genuinely helpful for narrowing down the field, especially if you're just starting to explore a new asset class. I also appreciate the "Trending" section on their homepage, which gives you a quick pulse on what other users are looking at. It's a nice bit of social proof.

A Few Things to Keep In Mind

Now for the reality check. And this is important. MoneyMade states this clearly in their footer, but it bears repeating: They are not a registered broker-dealer or investment advisor. This is not financial advice. They are a source of information. A very good one, in my opinion, but you are still the CEO of your own money. You have to do your own due diligence before jumping into any platform they feature.

They also, quite rightly, point out that information accuracy isn't guaranteed and that past performance doesn't predict future results. That’s standard investment talk, but in an age where people can get hyped up about a new platform in minutes, it's a critical reminder to slow down and think.

So, What's the Catch? What Does it Cost?

This is the question I always ask. In a world of freemium models and hidden fees, what's the deal here? As far as I can tell, MoneyMade is free for users.

There's no pricing page, no subscription prompt. This strongly suggests they operate on a partnership or affiliate model. When you click through to an investment platform like Wealthfront or Masterworks from their site and sign up, MoneyMade likely gets a referral fee. This is a super common business model for content and discovery platforms, and I'm perfectly fine with it. It keeps the tool free for us, the users, while funding their research and development. Win-win.

Who is MoneyMade Actually For?

So, who should be adding this to their bookmarks? In my view, the ideal MoneyMade user is the Curious Investor.

- You're comfortable with the basics of investing but want to know what else is out there.

- You hear terms like "private credit" or "art investing" and your interest is piqued, but your research time is limited.

- You want a starting point for due diligence, not a robot to make decisions for you.

If you're a hyper-advanced quant trader with a multi-screen setup running custom algorithms, this probably isn't for you. But if you're a savvy individual looking to broaden your portfolio's horizons beyond the public markets, MoneyMade is an excellent launchpad.

Final Verdict: A Guide, Not a Guru

After kicking the tires, I'm genuinely impressed with what MoneyMade has built. It’s a sleek, modern answer to a very modern problem: choice overload. It successfully lowers the barrier to entry for discovering alternative investments without making irresponsible promises.

Think of it as a Waze for your investment journey. It can show you the conventional highways, the scenic backroads, and the interesting shortcuts you never knew existed. But at the end of the day, you're the one who still has to check the gas, look at the map, and actually drive the car. And for any smart investor, that's exactly how it should be.

Frequently Asked Questions

Is MoneyMade safe to use?

Yes, in the sense that it's an informational and discovery platform. You don't connect your bank accounts or transfer any money directly to MoneyMade. It's a research tool that then refers you to external, regulated investment platforms.

Do I have to pay to use MoneyMade?

No, the platform appears to be completely free for users. It is likely supported by referral partnerships with the investment platforms it features.

Can MoneyMade manage my investments for me?

Absolutely not. MoneyMade is very clear that it is not a registered investment advisor or a broker. It provides information and suggestions, but it cannot and will not manage your portfolio.

What kind of investments can I find on MoneyMade?

You can find a wide range, from traditional options available through robo-advisors to a large variety of alternative investments, including fine wine, art, venture capital, real estate, collectibles, and farmland.

How is MoneyMade different from just searching on Google?

MoneyMade offers a curated, focused experience. Instead of a messy list of search results, it provides structured comparisons, educational content, and an AI chat feature specifically designed to match your investment interests with vetted platforms.

Reference and Sources

- MoneyMade Official Website

- Masterworks (An example of a platform featured on MoneyMade)

- Vinovest (Another example of a platform featured on MoneyMade)