Alright, let’s have a real chat. If you’ve been in the investing game for more than five minutes, you know the landscape has gotten… weird. One minute, you’re trying to decipher a P/E ratio, and the next, you're being told by a 19-year-old on TikTok that a company selling novelty socks is the next Amazon. The noise is deafening.

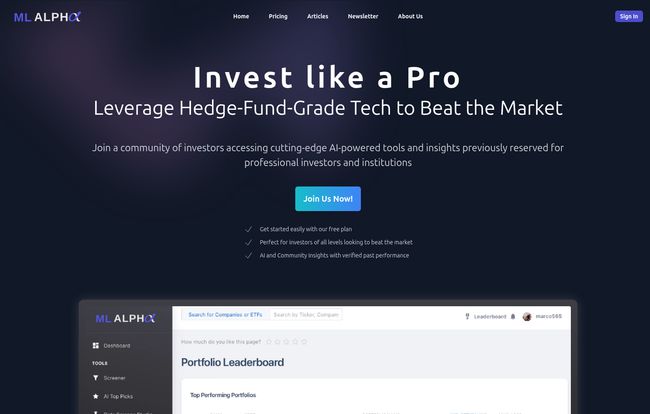

For years, the pros at hedge funds have had these secret weapons—teams of quants, insane computing power, and proprietary algorithms—that gave them a massive edge. They were playing chess while most of us were fumbling with the checkers box. But the winds are changing. I’ve been hearing a lot of buzz lately about platforms aiming to democratize these high-level tools, and one name keeps popping up: ML Alpha.

Their claim? To give you access to hedge-fund-grade AI and top-tier portfolios. A bold claim. So, I did what I always do: I rolled up my sleeves, pushed past the marketing fluff, and took a hard look under the hood. Is this just another overhyped fintech app, or is there some real meat on these bones?

So What Exactly is ML Alpha, Anyway?

Let's get this straight first. ML Alpha isn’t a brokerage. You don’t buy or sell stocks directly on the platform. Think of it more like a high-powered intelligence hub or a strategic command center for your investments. At its core, it’s a marketplace. But instead of handmade crafts, you’re browsing top-performing stock portfolios created by data scientists and seasoned investors.

It’s a fascinating concept. It bridges the gap between people who are brilliant with data and algorithms but maybe don't want to manage a fund, and retail investors who are smart but don't have the time or skills to build their own machine learning models. It’s like a GitHub for stock market strategies, where the code is a live, breathing portfolio you can follow and learn from. The whole point is to help you find and generate alpha—that elusive beast of market returns that outperform a standard index like the S&P 500.

For me, this immediately felt different. It’s not just another screener with a few extra filters. Its a whole ecosystem built around data-driven performance.

Visit ML Alpha

A Look at the Key Features

When I first logged in, I was struck by the clean, data-centric dashboard. It's dark mode, which my eyes appreciate, and it doesn't try to bombard you with flashy, unnecessary graphics. It gets straight to the point. Here’s a breakdown of the tools that caught my attention.

The Marketplace Leaderboard

This is the heart and soul of ML Alpha. It's a transparent, no-fluff leaderboard of portfolios managed by other users—the “AI investors” and quants. You can see their real-time and historical performance, their top holdings, and their strategy's stats. The transparency here is key. You're not just taking someone's word for it; the data is right there. You can subscribe to the portfolios you find compelling, getting alerts on their trades and insights. It's a powerful way to see what's working for others without the biased spin you get on social media.

The Data Science Studio

Okay, this part is not for everyone, and that's fine. The Data Science Studio is for the serious power users. The data nerds. The folks who hear “backtesting” and get a little giddy. Here, you can build your own custom machine learning models to create your own unique portfolio strategies. ML Alpha provides the data and the tools; you provide the brains and the creativity. Once you’ve built something you're proud of, you can even publish it on the Marketplace and potentially get paying subscribers. It’s a pretty brilliant way to let talent rise to the top and get rewarded for it.

AI-Powered Screener and Portfolio Insights

Of course, there are tools for your own DIY analysis too. The AI-powered screener goes beyond simple metrics like market cap or dividend yield. It brings in AI-driven signals to help you uncover stocks that might be overlooked by traditional screeners. You can also create and track your own portfolios, and the platform will provide its own AI insights and scoring on your picks. It’s like having a quant analyst looking over your shoulder, offering a second opinion based on pure data.

The Good, The Bad, and The Realistic

No tool is perfect. As an SEO and traffic guy, I know that what works wonders for one person can be a total dud for another. It's all about fit. So let's get into the nitty-gritty.

What I genuinely like is the access. This platform rips down the walls that have kept sophisticated analytical tools in the hands of a select few. The ability to follow and learn from investors who back their claims with verifiable data is huge. And for those with the skills, the chance to monetize their expertise without needing millions in startup capital is a game-changer. The transparency is a breath of fresh air in an industry filled with smoke and mirrors.

Now for the reality check. And this is important. An AI prediction is not a crystal ball. The platform itself is upfront about this, but it bears repeating. These tools are based on historical data, and as the old saying goes, past performance is not an indicator of future results. The world can change on a dime (hello, 2020), and no algorithm can predict a surprise global event. Also, for my international readers, a significant limitation is that it currently only supports US stocks. And finally, the lack of direct trading integration means there’s an extra step. You find an insight on ML Alpha, then you have to go to your own broker to place the trade. It's a minor friction point, but it's there.

Breaking Down the Cost: ML Alpha's Pricing

Alright, let's talk about the price of admission. ML Alpha has a tiered structure that seems pretty well thought out, catering to different levels of commitment.

First up is the ML Alpha Starter plan, which is Free. And I mean actually free, no credit card required. This gets you in the door. You can manage up to 3 portfolios, get a taste of the Marketplace, and see up to 25 AI Top Picks. Frankly, this is the perfect starting point. You can poke around and see if the platform’s vibe even resonates with you without spending a cent.

Next is the ML Alpha Pro plan at $29.97 per month. This feels like the sweet spot for most serious investors. It unlocks more screener data, lets you subscribe to 10 portfolios, gives you more backtesting credits, and—crucially—allows you to sell your own portfolio on the Marketplace. If you’re actively using the insights and maybe have a strategy of your own to share, this is likely the tier for you.

Finally, there's the ML Alpha Guru plan for $59.97 per month. This is the all-you-can-eat buffet. Unlimited everything: AI insights, portfolio subscriptions, backtesting, the works. This is for the true power user, the aspiring quant, or the professional who lives and breathes this stuff.

The pricing feels fair for the value provided, especially when you consider how much a single good investment idea could be worth. The free tier makes it a no-brainer to at least try.

My Final Take: Is ML Alpha Worth the Hype?

After spending some quality time with ML Alpha, I'm cautiously optimistic. It's not a magic money-printing machine—nothing is. But it is a powerful, well-designed tool that puts sophisticated data analysis into the hands of everyday people. It’s a thinking investor’s platform.

I see it as a fantastic counterbalance to the chaotic, narrative-driven world of meme stocks and finfluencers. Instead of chasing hype, you’re looking at data. Instead of following loud personalities, you’re following proven performance. It encourages a more disciplined, analytical approach to investing, which is something I will always get behind.

It won't make decisions for you. But it can be an incredible copilot, a high-powered weather satellite for the often-stormy seas of the stock market. If you're tired of the noise and want to add a layer of quantitative rigor to your process, then yes, I think ML Alpha is absolutely worth a look. Start with the free plan. You have nothing to lose and a whole lot of insight to gain.

Frequently Asked Questions

- Can I buy and sell stocks directly through ML Alpha?

- No, not at this time. ML Alpha is an analytics and insights platform. You would use the information you gather here to make informed decisions and then place trades through your own separate brokerage account like Fidelity, Schwab, or Robinhood.

- Are the AI-generated stock predictions a guarantee of success?

- Absolutely not. It's critical to understand that AI insights are based on historical data and probabilities, not certainties. They are powerful tools for analysis, but they cannot predict the future. Think of them as sophisticated suggestions, not infallible commands.

- Is ML Alpha suitable for complete beginners?

- It can be. A beginner can get immense value from following top-performing portfolios in the Marketplace and learning from the strategies of experts. However, to get the most out of the platform, a basic understanding of stock market concepts is definitely helpful.

- Can I actually earn money by sharing my portfolio?

- Yes. If you subscribe to the ML Alpha Pro or Guru plan, you can publish your own data-driven portfolio to the Marketplace. You set your own monthly subscription price, and if other users choose to follow you, you get paid. It's a direct way to monetize your investment acumen.

- Why is the platform limited to only US stocks?

- This is likely due to the complexity and cost of sourcing reliable, clean financial data for international markets. Many platforms start with a US focus before expanding globally. It's a current limitation to be aware of if you invest in multiple markets.