Let’s have a little chat. You, me, and the soul-crushing dread of month-end accounting. You know what I’m talking about. That frantic scramble to reconcile transactions, the hunt for that one missing receipt, the cold sweat when you realize your cash flow projections were, shall we say, optimistic. For years, we've been told software would solve this. And it has, to a point. But it’s still work, isn’t it? It’s still a chore.

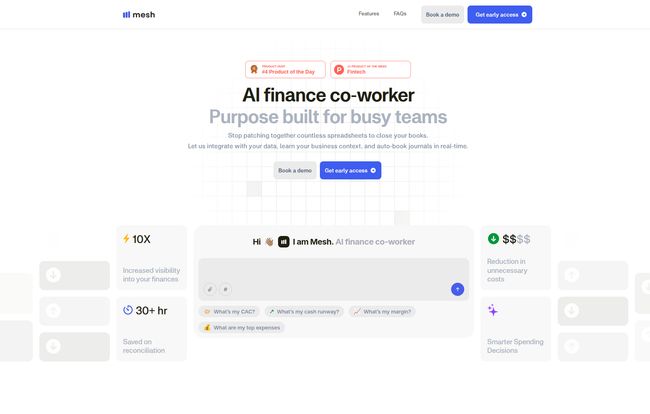

Then along comes a new wave of tools, not just as software, but as a “co-worker.” Today, I’m looking at one of them: Mesh. It popped up on Product Hunt, making some pretty bold claims about being an “AI finance co-worker.” My inner cynic, honed by years of sifting through marketing fluff, immediately perked up. A co-worker? Really? One that doesn’t steal your yogurt from the fridge? Color me intrigued.

So, What is Mesh, Actually?

At its heart, Mesh pitches itself as a new member of your team. Not just a dashboard you log into, but an intelligent agent that actively works on your finances. The whole idea is to move beyond passive data entry and into active, automated bookkeeping. Imagine having a junior accountant who never sleeps, never complains, and is powered by algorithms. That’s the dream Mesh is selling.

It’s designed for the people who are too busy building a business to get bogged down in the financial weeds—founders, small teams, the perpetually overwhelmed. It connects to your existing financial stack (your bank accounts, your Quickbooks, etc.) and gets to work, aiming to turn financial chaos into... well, organized chaos at the very least.

Visit Mesh

The Core Promises of This AI Bookkeeper

When you strip away the fancy “AI co-worker” branding, what are you actually getting? The Mesh site lays out a few key functions that, I have to admit, sound pretty darn good.

Clean Books, Zero Chaos

This is the big one. Mesh talks about “Continuous Reconciliation.” Instead of that month-end marathon, the AI supposedly reconciles transactions in real-time. A charge from “LYFT RIDES CA” comes in, and the AI knows it’s a travel expense. A payment from a client hits the bank, and it’s matched to the right invoice. It’s like having a tiny, diligent gnome living in your bank feed, tidying up as you go. This promises to save, according to their site, over 30 hours a month. That’s almost a full work week back in your pocket. For a founder, that’s not just time; its sanity.

Your Finances, On Demand

This part is genuinely cool and feels like a step forward. Mesh has a chat interface. Instead of running a complex report to figure out your burn rate, you can just… ask it. “What’s my cash runway?” or “What are my top expenses this month?” This changes financial data from something you have to dig for into something you can just converse with. It lowers the barrier to being financially informed, and for non-finance folks, that’s huge. It’s the difference between needing to learn a new language (accounting-speak) and having a personal translator.

Playing Nicely With Your Existing Tools

No one wants to rip and replace their entire system. Thankfully, Mesh seems to get this. The promise of “Seamless Integrations” is front and center. It’s meant to plug into the tools you already use, like your bank, credit cards, and accounting software like QuickBooks or Xero (I’m assuming the big names are covered). This is critical. A tool that creates another data silo is a step backward, not forward. The goal is to be the intelligent layer on top of your current setup, not another island of information.

The Real-World Benefits of an AI Accounting Tool

Okay, features are nice, but what does this mean for your actual business? Let’s translate this into tangible wins.

First off, the time savings on reconciliation are obvious. But it’s more than that. It's about reducing the cognitive load. You’re not just saving 30 hours of work; you’re saving 30 hours of dreaded work, freeing up mental space for things that actually grow your business. Second is the increased visibility. Being able to ask a simple question and get a straight answer about your finances is a superpower. It leads to smarter spending decisions because you're operating with up-to-the-minute data, not a report from three weeks ago. You can spot a rising subscription cost or an over-budget project before it becomes a five-alarm fire. This helps cut down on unnecessary costs and puts you in a proactive, not reactive, position.

“For a startup, cash flow isn’t just a metric; it's oxygen. Anything that gives you a clearer view of your oxygen tank is more than a convenience—it's a survival tool.”

But Let’s Be Real: The Hurdles and Hiccups

Now for a dose of reality. I’ve been around the block, and no tool is a perfect magic wand. There are always trade-offs and growing pains.

The Integration Hurdle

While “seamless integration” sounds lovely, it’s rarely a one-click affair. Getting a new system to talk to your bank, your accounting ledger, and everything else takes some setup. You have to grant permissions, map accounts, and make sure the data is flowing correctly. It’s a necessary evil, but something to be prepared for. It won’t just work out of the box with zero effort.

Trust, But Verify

The second point is about reliance on AI. As smart as these systems are getting, they aren’t infallible. An AI might miscategorize a unique expense or get confused by a complex transaction involving multiple currencies. You still need human oversight. Think of Mesh less as a replacement for a bookkeeper and more as a powerful assistant. You still need to be the boss, giving its work a final once-over. This isn’t a con, just a reality of where AI is in 2024.

A Little Roadblock…

And now for a bit of real-world feedback. As I was poking around their site, I clicked the “Book a demo” and “Get early access” buttons, eager to see more. And I was greeted by… a “Page Not Found” error. Whoops. Look, I get it. This is a new product, probably a small team, and things break. It’s a classic startup moment, and in a weird way, it’s almost endearing. It tells me they’re likely focused on building the core tech rather than perfecting every pixel of the website. Still, it’s a little bump in the road for a prospective customer.

So, How Much Does This AI Co-Worker Cost?

This is the million-dollar question, isn’t it? And right now, there’s no clear answer. The Mesh website doesn’t have a public pricing page. It’s all centered around getting early access. This is a pretty standard playbook for a new B2B SaaS tool. They’re likely refining the product with a select group of early adopters before rolling out tiered pricing to the general public.

My guess? It will probably be a monthly subscription fee, likely tiered based on transaction volume or the number of integrations. I wouldn't expect it to be cheap, but if it truly saves 30+ hours a month and prevents costly financial mistakes, it could easily provide a positive ROI for the right company.

Who Should Be Watching Mesh?

This tool isn’t for everyone. If you’re a large enterprise with a dedicated 20-person finance department and complex, bespoke systems, this probably isn't for you. But if you’re a…

- Bootstrapped or early-stage founder wearing all the hats.

- Small business owner who dreads bookkeeping more than anything.

- Fast-growing startup whose finances are getting messy, fast.

…then Mesh is absolutley a tool to keep on your radar. It’s built for the exact pain points these groups feel most acutely.

Frequently Asked Questions About Mesh AI

I saw a few questions on their site, and I’ve added a couple I think are important.

Is this a replacement for my general ledger like QuickBooks?

No, it doesn't seem to be. Mesh is designed to integrate with and work on top of your existing general ledger. It automates the work within your accounting system, but doesn't replace it.

What kind of questions can the Mesh AI answer?

Based on the examples, you can ask about key metrics like cash runway, margins, revenue (FA/R), and top expenses. Think of it as a conversational way to query your most important financial KPIs.

How is my financial data secured?

While their site doesn't go into deep technical detail, any financial tool worth its salt uses bank-level encryption and secure protocols. This is a standard and non-negotiable feature for any FinTech product today.

Can I use this even if I already have an accountant or bookkeeper?

Yes, and this might be a great use case. A tool like Mesh could handle the tedious, day-to-day reconciliation, freeing up your human accountant to focus on higher-level strategy, tax planning, and financial advice.

How long does it take to get started?

This will vary. The initial integration and setup could take a couple of hours, depending on the number of accounts you need to connect. Once it's running, the maintenance should be minimal.

Conclusion: Is Mesh the Future of SME Accounting?

Look, the verdict is still out. Mesh is clearly in its early stages (as evidenced by that 404 page!). But the idea is incredibly powerful. The shift from passive software to an active AI co-worker is a significant one. It represents a future where financial management is less about manual data entry and more about strategic oversight.

I’m optimistic. I think tools like Mesh are the next logical step in business finance automation. It has the potential to give founders one of the most valuable resources imaginable: time and clarity. I’ll definitely be keeping an eye on Mesh, and as soon as that “Get early access” button works, you can bet I’ll be first in line. For now, it’s a promising glimpse of a less stressful, more insightful financial future.

Reference and Sources

- The official website for Mesh (as reviewed): mesh.com

- For further reading on AI's role in modern accounting, check out this article from the Forbes Technology Council.