Sharing finances with a partner can be… tricky. It often starts with a shared Google Sheet. You know the one. It’s got color-coded columns, complex formulas you copied from a finance blog, and one of you is definitely more diligent about updating it than the other. Before you know it, you’re having a “spirited discussion” over who paid for the Tesco shop three weeks ago. We’ve all been there.

For years, I’ve seen countless budget apps pop up, each promising to be the one-stop-shop for financial nirvana. Most are built for individuals, though. You end up trying to Frankenstein two separate accounts together, and it just gets messy. It’s like trying to solve a two-person problem with a one-person tool.

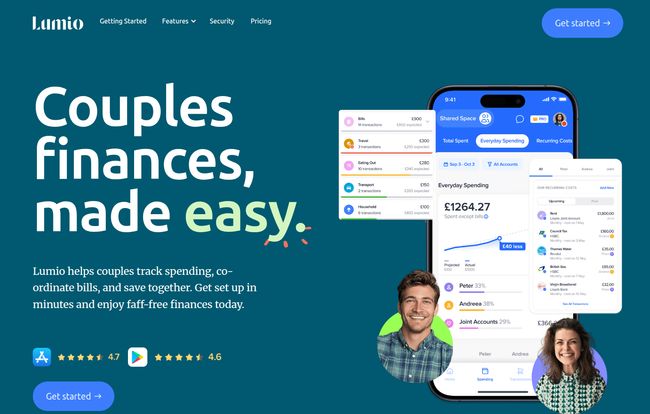

So when I heard about Lumio, an app built from the ground up specifically for couples, my interest was definitely piqued. Could this be it? The digital ceasefire for the household budget wars? I had to find out.

What Exactly is Lumio Anyway?

At its heart, Lumio is a smart money management app. But its secret sauce is its focus on shared finances. It uses AI to connect all your different bank accounts, credit cards, and savings pots into one single view. We’re talking current accounts, savings, credit cards, the lot. It does this using Open Banking, which is the super-secure, bank-level encryption technology that’s become the gold standard in the UK and Europe for fintech apps. So, no, they’re not just screen-scraping your password; it’s all properly regulated and safe.

The whole point is to give you and your partner a crystal-clear, real-time picture of your combined financial world. No more “I think I have about…” or “Did that direct debit go out yet?” It’s all right there.

Saying Goodbye to Awkward Money Moments (and Spreadsheets)

The real magic of any tool is whether it solves an actual, annoying problem. And Lumio seems to take aim at several of the big ones couples face.

All Your Finances in One Tidy Place

My partner and I have accounts with different banks. Trying to get a single view of our net worth used to involve logging into three separate apps and some quick mental math. Lumio pulls it all together automatically. You connect your accounts (and your partner connects theirs), and voilà, you see a total net worth, your combined spending, everything. It’s the 30,000-foot view that you just can’t get from a banking app alone.

Visit Lumio

Who Paid for What? The End of Financial Guesswork

This is the big one. The feature that probably saves the most arguments. Lumio tracks spending and lets you see who paid for what. There's even an IOU tracker built in. So when one person covers the big monthly grocery bill or pays for the holiday flights, it’s not just a forgotten transaction. It’s logged. This isn’t about being petty; it's about fairness and transparency. It turns a potential point of conflict into a simple, shared ledger. It's the financial referee you never knew you needed.

The Subscription Slayer: Taming Your Household Bills

Another huge win. The app automatically identifies your recurring bills and subscriptions. You know, that gym membership you forgot you had or the three streaming services you’re paying for. Lumio flags them, sends you price alerts, and makes it easy to see where your money is consistently going each month. In a world of 'free trials' that silently convert to paid plans, this feature alone could probably pay for the Pro subscription.

Is Lumio Actually Easy to Use? A Real-World Test

An app can have all the features in the world, but if it’s a pain to use, it’ll just gather digital dust. The user reviews I saw mentioned it was “super simple,” and I have to agree. The interface is clean, modern, and doesn’t feel cluttered. Connecting my bank accounts via Open Banking was surprisingly painless—it just redirects you to your banking app to authorize, and you’re done in a minute.

The real test is getting your partner on board, right? If it's too complicated, it’s a non-starter. But because the core benefit is so clear—“Hey, this will stop us bickering about money”—it’s a much easier sell than a generic, complex budgetting tool. It feels less like a chore and more like a team project.

Let's Talk Money: Lumio's Pricing Plans

Okay, the all-important question: what’s this going to cost? Lumio has a pretty straightforward pricing structure, which I appreciate. No hidden fees or overly complicated tiers.

| Plan | Price | Best For |

|---|---|---|

| Individual Free | Free | Individuals just getting started with tracking their finances. |

| Individual Pro | £3/month or £26.99/year | Individuals who want deeper analytics, bill reminders, and more control. |

| Couples Pro | £4.49/month or £39.99/year | The main event. Dual access for two people with all Pro features plus shared tracking. The annual plan is clearly the best value. |

In my opinion, the Couples Pro annual plan is the no-brainer here. For about £3.33 a month, you get the full suite of tools for two people. If it saves you from one argument or helps you cancel one forgotten £10/month subscription, it's already paid for itself. The free plan is fine for a test drive, but the real power for couples is unlocked in the Pro version.

The Not-So-Perfect Bits: What Could Be Better?

No tool is perfect, and it’s important to be real about that. A glowing review that ignores downsides isn’t helpful. So here are a few things to consider.

First, it requires buy-in from both partners. If one person is all-in and the other refuses to connect their accounts, you’re only getting half the picture. It’s a tool for teamwork, and it won’t work without the team.

Second, like any automated finance app, its accuracy depends on how well it categorizes transactions. Sometimes a payment to “SQUARE CoffeeShop” might get miscategorized. You may need to go in and manually correct a few things initially to train the AI. A minor annoyance, but common to all apps in this space.

Finally, if your financial life is exceptionally complex—maybe you run multiple businesses with convoluted cash flow or have offshore investments—this might be a bit too simple for you. Lumio is designed for the 95% of us: couples with personal bank accounts, credit cards, savings, and maybe a mortgage. It excels at that.

So, Should You and Your Partner Get Lumio?

After spending some time with it, my verdict is a pretty strong yes. If you are a couple that shares any kind of financial life—from splitting rent to saving for a house—Lumio is a genuinely useful tool that can lower stress and increase transparency.

It’s not just a budgeting app; it’s a communication tool. It takes the emotion and guesswork out of day-to-day finances, letting you focus on the big goals together. It replaces the messy spreadsheet and the awkward “you owe me for the pizza” texts with a clean, automated, and shared source of truth. For the price of a couple of coffees a month, I'd say that’s a pretty good deal for a little more financial harmony.

Frequently Asked Questions about Lumio

- Is Lumio safe to connect my bank accounts to?

- Yes. It uses Open Banking, which is a secure framework mandated by regulators. The app gets read-only access and can't move money. Your banking credentials are never shared with Lumio.

- Can I just use Lumio by myself?

- Absolutely. The Individual plans (both Free and Pro) are designed for solo users to manage their personal finances effectively.

- How much does Lumio cost for couples?

- The Couples Pro plan is £4.49 per month or a discounted £39.99 per year. The annual plan works out to be the best value for two users.

- What makes Lumio different from other budget apps?

- Its primary focus is on couples. Features like the IOU tracker, shared spending overview, and dual access are designed from the ground up to solve the specific financial challenges partners face.

- Will my partner see absolutely all of my personal spending?

- Yes, for the accounts you choose to connect. The app's philosophy is built on transparency between partners. The idea is to have a complete and open financial picture together, so you should both be comfortable with that level of sharing before you begin.

- Does Lumio work with all UK banks?

- It works with the vast majority of UK banks and financial institutions that support Open Banking. You can usually check on their site or in the app for a full list before you commit.

Wrapping It All Up

Managing money as a couple doesn’t have to be a source of stress. It’s just a thing you have to do, like taking the bins out. Having the right tool can make all the difference, transforming a chore into a simple, collaborative task. Lumio feels like that right tool. It’s well-designed, secure, and solves a real, nagging problem for millions of couples. If you’re ready to ditch the spreadsheet for good, it’s definitely worth a look.