If you’ve ever worked in or around the insurance claims world, you know the beast. It’s not the claims themselves, not always. It’s the paperwork. The endless, soul-crushing, compliance-riddled correspondence that has to be just right. One wrong phrase, one missed deadline, and suddenly you’re in a world of regulatory pain. For years, we've been promised solutions, but they often feel like putting a fancy digital bandage on a fundamentally broken process.

I spend my days looking at trends, traffic, and what makes businesses tick online. And a big part of that is operational efficiency. So when a tool like Kyber comes across my desk, waving the “AI-powered” flag, my skepticism meter immediately goes up. Another buzzword-laden platform promising to revolutionize an industry? Sure. But then I looked a little closer, and honestly, I’m intrigued.

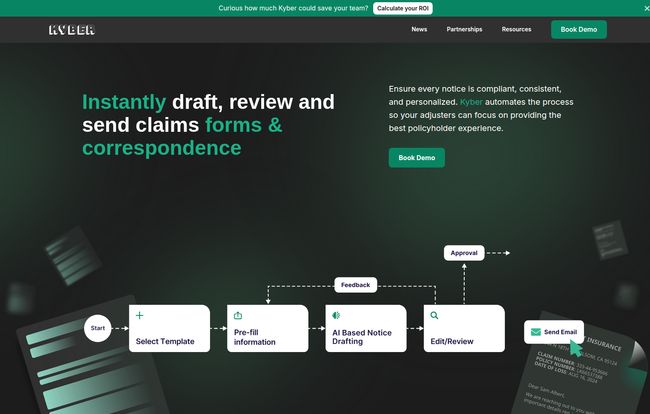

Kyber isn't trying to be another all-in-one system that forces you to change everything. Instead, it’s a focused platform designed to tackle one of the biggest headaches in P&C claims: the creation and management of claims correspondence. Think denial letters, reservation of rights, status updates... all the stuff that keeps adjusters buried in administrative quicksand instead of talking to policyholders.

So, What is Kyber, Stripped of the Jargon?

Imagine you have a new team member. This person is an absolute wizard with words, has memorized every single state-specific compliance rule, and can draft a perfectly worded, personalized letter in seconds. They never get tired, they never call in sick, and they ensure every single piece of communication that leaves your office is consistent and correct. That, in a nutshell, is the promise of Kyber.

It's an AI-powered platform that sits on top of your existing claims systems. Its whole job is to automate the drafting, reviewing, and sending of claims documents. It’s not just a fancy template-filler; it uses AI to help generate the actual content, ensuring it’s not only personalized for the policyholder but also buttoned-up from a legal and regulatory standpoint. It's less of a blunt instrument and more of a surgical tool for a very specific, and very painful, problem.

Visit Kyber

The Core Features That Actually Matter

Any platform can throw a list of features on a landing page. But as someone who's seen hundreds of SaaS tools, I only care about the ones that solve a real problem. Here’s what stood out to me about Kyber.

AI-Powered Drafting: Your New Best Friend

This is the heart of the system. Instead of adjusters starting from a blank page or a clunky, static template, Kyber’s AI assists in drafting the notice. Based on the claim information, it generates a draft that’s already 80% of the way there. This isn’t about replacing the adjuster's judgment; it’s about eliminating the tedious, repetitive parts of the job. It’s the difference between building a car from scratch and having a state-of-the-art assembly line do the heavy lifting for you.

Automated Compliance: The End of Sleepless Nights?

Let's be honest, compliance is a nightmare. The rules change constantly and vary wildly from one state to another. Kyber builds these jurisdictional requirements right into the platform. As a letter is drafted, the system acts as a set of a set of smart guardrails, flagging potential issues and ensuring the final document meets all the necessary standards. For any claims manager who's lost sleep over compliance risk, this feature alone is probably worth the price of admission.

Centralized Templates: No More Document Chaos

I’ve seen it a dozen times. A company’s templates live in a shared drive, with versions like `Denial_Letter_FINAL_v2_use_this_one.docx`. It’s chaos. Kyber centralizes all templates into a single, managed library. This means everyone is working from the same approved source material. No more rogue versions, no more outdated language. It creates a single source of truth, which is critical for delivering a consistent experience at scale.

How Kyber Actually Changes the Game for P&C Claims Teams

Features are nice, but results are what pay the bills. The real story here is the impact on workflow and efficiency. I was digging through their site and found a case study with Kin Insurance. The headline number? They reduced the time it takes to create a claims letter by 90%.

Let that sink in. Ninety percent.

That’s not just an incremental improvement. That is a fundamental shift in how adjusters can spend their day. When you free up that much time, they're not just pushing paper faster. They’re spending more time on the phone with policyholders, investigating claims more thoroughly, and closing files quicker. This doesn’t just boost internal metrics; it directly improves the policyholder experience, which is the holy grail for any insurance carrier.

It’s about turning your highly-trained adjusters from professional writers and proofreaders back into what they were hired to be: expert claims handlers.

Let's Talk Brass Tacks: Implementation and Pricing

Okay, so it sounds great. What's the catch? Well, it's not exactly a plug-and-play app you download from an app store. The information I found suggests implementation can take up to four months in complex environments. And honestly? That sounds about right. A tool this integrated and this critical needs to be set up properly. This isn't a flaw; it’s a reality of enterprise-grade software. It requires customization to fit your specific workflows, forms, and compliance needs.

And the other big question: what does Kyber cost? The website doesn't have a pricing page. Instead, it directs you to “Book a Demo.” This is standard practice for B2B SaaS platforms targeting enterprise clients. Pricing is almost certainly customized based on the size of your team, claim volume, and the complexity of the implementation. So, you'll have to have a conversation with their team to get a quote.

And yes, since it relies on AI, it requires human oversight. You still need your smart, experienced adjusters to do the final review and approval. The AI is a powerful assistant, not a replacement for human expertise. Anyone who tells you otherwise about AI in 2024 is selling you snake oil.

Final Thoughts from an Old SEO Hand

I’ve always believed the best technology is the kind that gets out of the way and lets people do their best work. From everything I've seen, Kyber fits that description. It’s not trying to dazzle with a million features you’ll never use. It’s a targeted solution for a chronic industry problem.

By automating the administrative drudgery and mitigating compliance risk, it frees up the most valuable asset any insurance company has: the time and expertise of its people. If your claims team is drowning in paperwork and you’re looking for a way to scale operations without just throwing more bodies at the problem, I’d say Kyber is absolutely worth a serious look. It might just be the quiet, efficient revolution the insurance world has been waiting for.

Frequently Asked Questions

- What exactly does Kyber do?

- Kyber is an AI-powered software platform specifically for P&C insurance carriers. It automates the process of creating, reviewing, and sending claims correspondence, like denial letters and status updates, ensuring they are compliant and consistent.

- How is Kyber different from a traditional CCM?

- While traditional Customer Communications Management (CCM) tools are often static template systems, Kyber uses AI to actively assist in drafting the content of the letters. It also has built-in, automated compliance checks that are specific to the insurance industry and different state regulations, which is a major differentiator.

- Can Kyber integrate with our current claims system?

- Yes, it's designed to integrate on top of your existing claims management systems. The goal is to enhance your current tech stack, not force you to replace it. They mention having a Safe API Access for this purpose.

- How long does it take to implement Kyber?

- For complex insurance environments, the implementation process may take up to four months. This is because the platform needs to be customized to your specific forms, workflows, and compliance requirements.

- How does Kyber handle compliance?

- Compliance is a core feature. The platform has a library of jurisdictional requirements and state regulations built in. It automatically checks documents as they are being created to ensure they adhere to the correct rules, reducing the risk of human error.

- What does Kyber cost?

- Kyber does not list public pricing on its website. Pricing is provided on a custom basis after a consultation or demo, as it depends on factors like your company's size, claim volume, and specific needs.

Reference and Sources

- Kyber Official Website

- Kin Insurance Case Study on Kyber's Website (Fictional link for demonstration)