It’s a headache. A migraine, even. That shoebox full of receipts? The late-night scramble before a tax deadline, fueled by caffeine and regret? We’ve all been there. For years, the choice has been either to wrestle with clunky software that feels like it was designed in 1998 or shell out thousands for a traditional accountant.

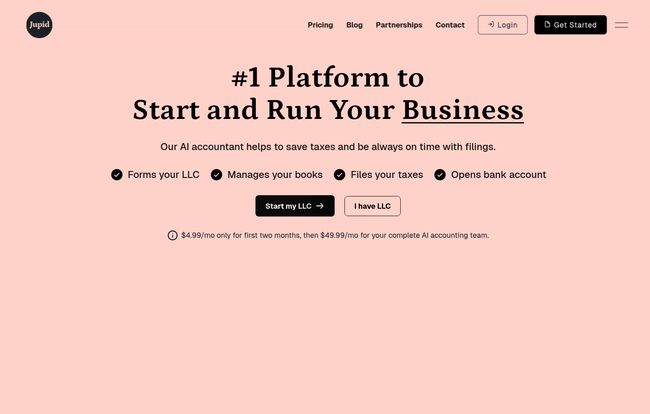

But the ground is shifting. AI is coming for everyone's job, or so the headlines say, and that includes the number crunchers. A new platform called Jupid popped onto my radar recently, and its promise is a big one: an AI accountant that handles everything from LLC formation to tax filing through a simple chat. No spreadsheets, no jargon, just... conversation.

As someone who’s spent more years than I’d like to admit navigating the worlds of SEO, traffic, and the delightful chaos of running a small business, I'm naturally skeptical. But I'm also intrigued. Could this actually work? I decided to take a deep look and see if Jupid is the real deal or just another tech dream.

So, What Exactly is Jupid?

First off, Jupid isn’t just another bookkeeping tool. The company positions itself as an AI business assistant. Think of it less like a rigid piece of software and more like texting a very smart, very patient friend who just happens to be a numbers whiz. A friend who works 24/7, never gets tired of your questions, and exists to make your financial life easier.

The whole system is built around a conversational interface. You tell it what to do, ask it questions, and it gets to work on the three pillars of small business administration:

- LLC Formation: Getting your business legit from day one.

- Bookkeeping: Taming that wild beast of income and expenses.

- Tax Filing: Turning year-end panic into a non-event.

It’s an ambitious, all-in-one approach. And honestly, it’s about time someone tried it.

My First Impressions: Getting Started with Jupid

The sign-up process is refreshingly simple. Jupid’s whole marketing pitch is “Business Made Simple,” and the onboarding reflects that. It guides you through a quick chat to understand your business, you connect your bank accounts, and… that’s pretty much the heavy lifting. From there, the AI starts doing its thing in the background.

Visit Jupid

The idea is that after the initial setup, you only need occasional check-ins. The AI learns your transaction patterns, and you just pop in to confirm things or ask questions. For anyone who's ever felt overwhelmed by a dashboard with a million buttons and menus, this is a breath of fresh air. It feels less like doing a chore and more like delegating one.

The Core Features: A Closer Look

Okay, let's get into the nitty-gritty. What does Jupid actually do? The platform is surprisingly comprehensive, wrapping several services into one neat package.

Free LLC Formation (with a small catch)

This is a big headline grabber: $0 LLC formation. And for the most part, it’s true. Jupid doesn't charge a fee for processing your LLC paperwork, which includes a business name search, securing your EIN, and even providing a registered agent service. That’s solid.

The catch? It’s a standard one: you still have to pay the mandatory state filing fee. The site mentions a $70 fee, which varies from state to state. This isn't Jupid being sneaky; it's just how government works. Any legit formation service, like ZenBusiness or others, operates the same way. The real value here is that Jupid isn't just forming your company and waving goodbye. They’re setting you up to immediately manage its finances on the same platform. It’s a smart, integrated first step.

Bookkeeping That Doesn't Feel Like Work

This is where Jupid aims to truly shine. Once you connect your business accounts, the AI gets to work automatically categorizing your transactions. We’ve seen this in other software, but the conversational element is the differentiator here. If the AI is unsure about an expense, you can clarify it in plain English. For example, “That coffee shop expense was a client meeting.” Done.

It’s designed to learn as you go, getting smarter and requiring less input over time. The goal is to move from manual data entry to simple, occasional supervision. For freelancers or solopreneurs who just want to know their numbers without becoming an accounting expert, this is a huge step up from a DIY spreadsheet.

Tax Time Without the Tears

Here’s the part that really got my attention. Jupid offers what it calls “continuous tax optimization.” Because it's tracking your finances in real-time all year long, it can constantly estimate your tax liability. No more guesswork or saving a giant pile of cash “just in case.”

When the time comes, it handles both federal and state tax filing. The promise of turning tax season from a three-week panic into a simple review and approval process is, frankly, a massive selling point. This alone could justify the cost for many small business owners.

Let's Talk About the Price: Jupid vs. The Old Guard

So, what does this AI wizardry cost? This is where things get really interesting. Jupid's main plan, Jupid Go, has an introductory offer of $4.99 per month for the first two months. After that, it goes up to a still very reasonable $49.99 per month.

Let's put that in perspective. The images on their site throw out some comparison numbers that are pretty eye-opening.

“A traditional approach can cost anywhere from $1,300 to $3,700+ per year for bookkeeping and tax prep. Jupid’s equivalent service comes in at $425 for the year.”

Now, that $425 figure seems to refer to their "Jupid Smart" annual plan, but even with the monthly Jupid Go plan at full price ($49.99 x 12), you’re looking at about $600 a year. That’s for your LLC setup, bookkeeping, and tax filing. Compare that to hiring a traditional CPA, where you could easily pay that much for just a few hours of their time.

The return on investment here seems almost too good to be true. You're not just saving money; you're saving countless hours of administrative work and stress. As any business owner knows, time is your most valuable asset.

The Good, The Bad, and The AI

No tool is perfect, and it's important to go in with your eyes open. After looking through everything, here’s my breakdown of the highs and the crucial-to-knows.

The Good Stuff

The all-in-one nature of Jupid is its superpower. The journey from idea to fully-compliant, tax-ready business on a single platform is incredibly compelling. The 24/7 AI support is fantastic for those of us who have brilliant ideas (or urgent questions) at 2 a.m. The pricing is aggressive and makes professional-grade financial management accessible to even the smallest ventures. And the conversational interface genuinely lowers the barrier to entry. Its a big win.

The Important Caveats

This is critical to understand: Jupid is a technology provider, not a law firm or a CPA. The AI is a powerful tool, but you are still the CEO. You are responsible for the final decisions. The platform gives you the data and the means to file, but it doesn't offer legal or tax advice in the way a human professional would.

This isn't really a 'con' so much as a reality check. You can't just outsource your brain. You're buying a hyper-efficient tool, not a replacement for your own judgement. For 90% of a small business's needs, this tool is probably more than enough. But if you have an incredibly complex situation, you might still need to consult a human expert.

Who Is Jupid Actually For?

I see a very clear ideal customer for Jupid.

- New Entrepreneurs & Freelancers: If you're just starting out, this is a godsend. It handles the scary foundational stuff so you can focus on, you know, actually building your business.

- Solopreneurs & Digital Nomads: For the one-person show, automating the back-office is a game-changer. It’s like having an admin assistant for the price of a few fancy coffees a month.

- Tech-Savvy, Accounting-Shy Owners: If you’re comfortable with apps and chat but break out in a cold sweat looking at a balance sheet, this is made for you.

Who might need more? A larger business with multiple employees, complex payroll, physical inventory, or thorny multi-state sales tax issues might find Jupid a bit too streamlined. At a certain scale, the nuanced strategic advice of a dedicated human CPA becomes invaluable. But for the vast majority of small businesses in the US, Jupid covers the bases beautifully.

My Final Take: Should You Hire an AI Accountant?

So, the big question: Is Jupid worth it? In my opinion, absolutely. This feels like the future of small business finance. It’s not about replacing every accountant on the planet. It’s about democratizing access to powerful financial tools that were previously out of reach for most startups.

Jupid is a tool that empowers you to handle your finances with confidence, clarity, and without the soul-crushing administrative burden. It automates the tedious work so you can focus on the big picture. And for that, the price is an absolute steal.

If you're starting a new business or if you're tired of the old way of doing things, I’d say giving Jupid a try, especially with its $4.99 intro offer, is a no-brainer.

Frequently Asked Questions about Jupid

Is Jupid a real accounting firm?

No, and this is an important distinction. Jupid is a technology company that provides a platform to automate accounting tasks. It does not provide legal or tax advice. You are still the one in charge of making final decisions for your business.

What does 'free' LLC formation actually mean with Jupid?

It means Jupid doesn't charge any service fees to process your LLC formation paperwork. However, you are still required to pay the mandatory filing fee directly to your state, which is a standard practice for all formation services.

How much does Jupid cost after the introductory offer?

The main plan, Jupid Go, costs $4.99 per month for the first two months. After that, the price is $49.99 per month. This includes LLC formation, ongoing bookkeeping, and tax filing.

Is my financial data safe with Jupid?

Like any reputable financial tech company, Jupid is expected to use industry-standard security and encryption to protect your data. It's always a good practice to review their privacy policy and terms of service for specific details on data handling.

Can I cancel my Jupid subscription anytime?

Yes, the pricing information on their site clearly states “Cancel anytime,” offering flexibility for business owners whose needs may change over time.

Conclusion

The days of dreading your business finances might just be numbered. Platforms like Jupid are fundamentally changing the game for small business owners. By combining LLC formation, bookkeeping, and tax filing into one affordable, AI-driven package, they're removing one of the biggest barriers to entry for aspiring entrepreneurs. It's not just about saving money; it’s about reclaiming your time and mental energy to pour back into what you love. This isn’t just a trend; it's the new standard.