How many browser tabs do you have open right now? If you’re an active investor, I’m guessing the answer is somewhere between ‘too many’ and ‘my computer fan is starting to make a funny noise.’ You've got Yahoo! Finance in one, a few news sites in others, maybe a stock screener, and probably a Reddit or Twitter feed for the “on the ground” sentiment.

It’s a chaotic process. Trying to piece together a coherent picture of a company from this digital shrapnel can feel like being an archaeologist, detective, and fortune teller all at once. I’ve personally lost entire weekends going down research rabbit holes, emerging pale and blinking into the Monday morning sun, armed with a mountain of data but not much real clarity.

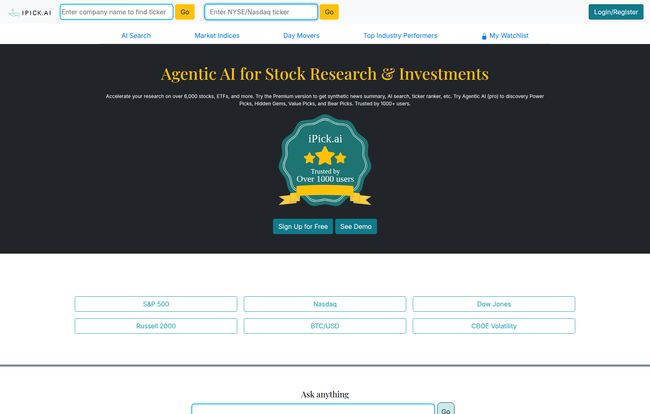

So when I heard about a platform called iPick.ai, which claims to be a sort of super-intelligent version of Yahoo! Finance, my curiosity was definately piqued. An AI that does the grunt work? A conversational search that just… answers your questions? It sounded almost too good to be true. So I had to check it out.

So, What is iPick.ai, Anyway?

In a nutshell, iPick.ai aims to be your personal AI research assistant for the US stock market. The platform’s big claim is that it uses “Agentic AI” and a massive knowledge base (they say it pulls from over 100,000 sources) to give you high-quality, synthesized insights.

Think of it this way: instead of you having to read ten different news articles, three analyst reports, and a dense SEC filing, iPick.ai’s AI agents do it for you. They then present you with a summary of what you actually need to know. It’s designed to cut through the noise, not add to it. A very welcome proposition.

Visit iPick.ai

My First Impressions Navigating the Platform

Landing on the homepage, it feels clean and uncluttered. There are no flashing ads or sensationalist headlines vying for your attention. Front and center is a simple search bar with the prompt, “Ask anything.” I like that. It’s direct.

Below that, you’ve got the major market indices like the S&P 500 and the Dow Jones, which is standard but useful. It’s a familiar, comfortable starting point for anyone who’s spent any time on a financial site. The design gets straight to the point: either search for a specific company or start exploring market movers. No fluff.

The Standout Features That Caught My Eye

This is where things get interesting. It’s not just another stock data site. The tools here are designed to change the workflow of research.

Conversational Search: Just Ask a Question

This is the feature that really got me excited. For years, we’ve been trained to search with clunky keywords like “AAPL Q4 earnings risks.” iPick.ai wants you to ask questions like a normal human. So, I could theoretically type in, “What are the main growth drivers for Microsoft’s cloud business next year?” or “Summarize the pros and cons of investing in Ford right now.”

This is a fundamental shift. It turns research from a scavenger hunt into a conversation. It’s the difference between looking up ingredients in a cookbook and just asking a chef for the recipe. This alone could be a massive time-saver, helping you get to the core of an investment thesis faster than ever.

Synthetic News Summaries: Cutting Through the Noise

We've all been there. A company releases its quarterly earnings, and within minutes, there are dozens of articles about it. Some are bullish, some are bearish, and most just rehash the press release. Who has time to read them all? The idea of “synthetic news” is that the AI reads everything for you and generates a single, coherent summary. It’s designed to pull out the most important bits—the revenue beats, the misses, the guidance for the next quarter, and what the CEO actually said on the call. This is like having that junior analyst I’ve always wanted.

The Ticker Ranker and Top Performers

Okay, so what if you don't have a specific company in mind? The “Top Industry Performers” tool is pretty slick for idea generation. In the screenshot, for example, it shows top-performing stocks in the “Advertising Agencies” sector over the past year. Seeing a stock like AIBT5 up 861.0% immediately grabs your attention. It’s a great way to spot momentum and find companies in hot sectors you might not have been watching. It's a starting point for your research, not an endpoint, but a very powerful one.

Who Is This Tool Really For?

Let's be clear, this probably isn't for my dad, whose investment strategy is to buy a few blue-chip stocks and check on them twice a year. And that’s fine. iPick.ai feels specifically built for the active and engaged investor.

If you're a swing trader, a serious hobbyist who manages your own retirement portfolio, or even a day trader looking for an edge, this tool could fit right into your workflow. It’s for the person who enjoys the process of discovery and analysis but is drowning in data. If you value your time—and I mean, who doesn’t?—the efficiency gains here are obvious.

“It’s for the person who enjoys the process of discovery and analysis but is drowning in data.”

The Elephant in the Room: Pricing and Potential Downsides

So, what’s the catch? Well, first, the pricing. I went looking for a dedicated pricing page, but the link seemed to be broken when I checked—just a “Not Found” error. It’s a small hiccup, happens to the best of us, especially with newer platforms. However, the service is promoted as “Sign Up for Free” with a “Premium version” to get synthetic news and other advanced features. This suggests a classic freemium model, which makes sense. You get a taste for free, and if it becomes indispensable, you pay for the full toolkit.

Beyond that, there are a couple of things to keep in mind. First, you're placing a lot of trust in an AI's algorithm, which is a bit of a “black box.” You don't know exactly how it's weighing sources or coming to its conclusions. Second, and this is crucial, it’s a tool, not a crystal ball. It can give you synthesized data and insights, but it can’t predict the future or replace your own critical thinking and due diligence. Reliance on any single tool, AI or not, is a risky strategy.

Here’s a quick rundown of what I see as the main pros and cons:

| What I Liked | What Gives Me Pause |

|---|---|

| Massive time-saver on research | Potential for a costly premium subscription |

| Conversational search feels futuristic | The AI algorithms aren't transparent |

| Great for discovering new stock ideas | Not a substitute for your own judgment |

| Personalized watchlist is a nice touch | Might not suit a passive investment style |

Final Thoughts: Is iPick.ai Worth Your Time?

After playing around with it, I'm genuinely optimistic. The world of retail investing is noisy and complex, and any tool that brings a little more signal and a little less noise is a win in my book. iPick.ai isn’t about replacing the investor; it’s about empowering them. It’s a powerful research amplifier, a way to do in minutes what used to take hours.

Will it find you a guaranteed 10-bagger? No, of course not. But it will give you a more organized, intelligent, and frankly, more enjoyable way to find and analyze potential investments. For any serious investor struggling with information overload, giving iPick.ai’s free version a spin seems like a no-brainer. It might just be the smart research partner you’ve been looking for.

Frequently Asked Questions about iPick.ai

- 1. Is iPick.ai a stockbroker? Can I buy stocks through it?

- No, iPick.ai is purely a research and analysis platform. It provides AI-driven insights to help you make decisions, but you cannot execute trades directly on the site. You would still need to use your own brokerage account like Fidelity, Schwab, or Robinhood to buy or sell stocks.

- 2. How is iPick.ai different from something like Yahoo! Finance?

- While both provide stock data, Yahoo! Finance is more of a traditional data portal. iPick.ai’s key difference is its use of AI to synthesize information. Its conversational search and AI-generated summaries are designed to provide direct answers and insights, rather than just raw data and news links.

- 3. Can I trust the AI's stock picks and analysis?

- You should treat the AI's output as a highly sophisticated starting point for your own research. While it can process vast amounts of data to identify trends and summarize information, it's not infallible and doesn't have true understanding or foresight. Always cross-reference its findings and use your own judgment before making any investment.

- 4. Is iPick.ai suitable for beginners?

- It can be. The conversational search feature could make it easier for beginners to get answers to their questions. However, the platform is probably most valuable for those who already have a basic understanding of stock market concepts and are looking to do more efficient, in-depth research.

- 5. What kind of information does the AI use for its analysis?

- According to the platform, it processes information from over 100,000 sources. This would likely include SEC filings, news articles from major financial outlets, press releases, analyst reports, and possibly even social media sentiment, though the exact mix is proprietary.