How often do you really look at your investment portfolio? I don’t mean just glancing at the total value on your brokerage app and either sighing in relief or mild panic. I mean, really look at it. Do you know your exact asset allocation? Are you secretly overexposed to the tech sector because you just love those flashy stocks? And what about those sneaky fees that eat away at your returns like a moth in a cashmere sweater?

For years, I’ve managed this stuff with a clunky spreadsheet I built myself. It’s a monstrosity of VLOOKUPs and conditional formatting that I’m simultaneously proud of and terrified to touch. It kind of works, but it doesn’t tell me the whole story. It tells me the what, but not the so what?

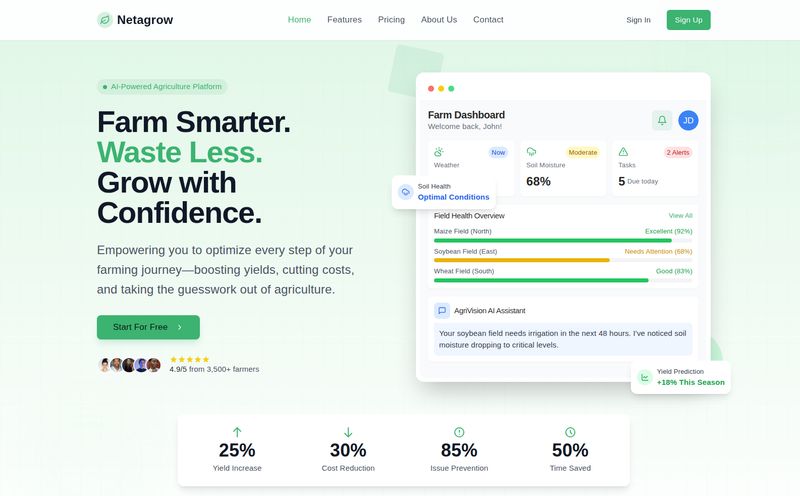

So when I stumbled upon a tool called Insightfolio, which promised to make my portfolio “finally explained,” my inner SEO and data nerd sat up straight. An AI-powered tool that provides a deep analysis of your investments without the headache? Okay, you have my attention. I decided to take it for a spin, and well, the results were… illuminating.

What on Earth is Insightfolio, Anyway?

Think of Insightfolio as a translator. It takes the often-impenetrable language of finance—full of jargon like ‘standard deviation’ and ‘beta’—and translates it into plain, simple English. You show it your portfolio (a list of your stocks and funds and their weights), and it generates a comprehensive report that’s like a full-body health check-up for your money.

It’s designed to give you a crystal-clear picture of your portfolio's health, covering everything from risk and diversification to past performance and even future projections. The whole point is to replace uncertainty with clarity. And let’s face it, in the world of investing, a little more clarity can go a long, long way.

Visit Insightfolio

My First Encounter: The Onboarding Experience

Getting started was surprisingly simple. I navigated to their portfolio creation page, and there were no hoops to jump through. No demand for my credit card upfront, which is always a good sign.

The process is straightforward:

- Choose your region. I selected the United States.

- Input your holdings. You can search by ticker symbol (like AAPL for Apple) or the more formal ISIN. You then specify the percentage weight each holding has in your portfolio.

- Choose your report style. And this… this is where I grinned. You get two options: “Regular” and “Roast me 🔥”.

The “Roast me” option is pure genius. In an industry that often takes itself far too seriously, this little bit of personality was a breath of fresh air. It promises a more direct, no-holds-barred critique of your portfolio. Obviously, I had to try it.

One thing to note is that the feature to connect your brokerage account directly is still in the works. For now, you have to input your holdings manually. A bit of a drag? Maybe. But it also forces you to actually look at what you own, which I’d argue is a good thing in itself.

Breaking Down the Report: What Insightfolio Actually Shows You

After a few moments, my report was ready. It’s a detailed document, but it’s laid out in a way that doesn’t feel overwhelming. Here’s a rundown of the good stuff inside.

Gauging Your True Risk and Diversification

This was the first section I jumped to. Insightfolio gives you a clear risk profile (mine was “Growth,” which sounds about right) and a diversification profile. It shows you if you’re properly spread across different asset classes, sectors, and geographic regions. It’s one thing to think you’re diversified; it’s another to see a chart showing that 60% of your equity is tied up in North American tech. A real eye-opener.

Performance Check-up and Future Projections

The report digs into your portfolio’s historical performance, which is standard. But the cool part is the Future Projection. Insightfolio uses a Monte Carlo simulation—a fancy statistical method that runs thousands of potential market scenarios—to project a range of possible outcomes for your portfolio over time. It's not a crystal ball, and the tool is very clear about that. But it does give you a probabilistic look at what your financial future might hold, which is infinitely more useful than just crossing your fingers.

Exposing the Hidden Gremlins: Costs and Fees

This, for me, is a huge selling point. Fees are silent portfolio killers. Insightfolio analyzes the expense ratios of your ETFs and mutual funds and tells you exactly how much you’re paying in costs each year. Seeing that dollar amount laid bare is powerful motivation to shop around for lower-cost alternatives. It’s like turning on the lights in a dusty room and finally seeing where all the dirt is.

The AI-Powered 'So What?' Factor

Throughout the report, AI-powered insights explain why things matter. It doesn’t just say “Your portfolio has a high concentration in the technology sector.” It says something like, “Your portfolio has a high concentration in the technology sector, which has driven strong returns recently but could pose a risk during a market downturn affecting tech valuations.” It connects the dots for you, which is something my poor, overworked spreadsheet could never do.

Who is This Tool Really For?

So, who should be rushing to get their first free report? In my opinion, Insightfolio hits a sweet spot for a few types of investors:

- The Confident DIY Investor: If you manage your own portfolio, this is an incredible tool for a second opinion or an annual check-up. It can validate your strategy or poke holes in it you hadn't considered.

- The Anxious Beginner: If you’re new to investing and find it all a bit intimidating, this tool is a fantastic educational resource. It simplifies complex topics and builds confidence.

- The Set-it-and-Forget-it Investor: If you're the type who rebalances once a year, running a report through Insightfolio is a quick, cheap, and effective way to make sure your allocation hasn’t drifted wildly off course.

However, it’s not for everyone. If you’re a heavy crypto investor or trade derivatives, you're out of luck for now, as the platform doesn't currently support them. Day traders who need real-time data also won't find what they need here. This is a tool for long-term strategic analysis, not high-frequency trading.

Let's Talk Money: The Price of Clarity

Okay, the all-important question: what’s this going to cost? This is where Insightfolio really shines, especially for people hesitant to commit to expensive subscriptions.

| Plan | Price | Best For |

|---|---|---|

| Starter Option | $0 | Everyone. Your first report is completely free, with no credit card required. It's a no-risk way to test the waters. |

| Investor Packages | $2.49 per report | Ongoing analysis. Perfect for running reports after rebalancing or comparing different portfolio strategies. |

The pricing is incredibly fair. The fact that your first report is genuinely free is a massive plus. And at $2.49 for each additional report, it's cheaper than a fancy cup of coffee. For the level of detail you get, I’d say that’s a steal.

The Final Verdict: Is Insightfolio Worth Your Time?

After spending time with the tool and my own “roasted” report, I can confidently say yes, Insightfolio is absolutely worth it. It’s not a financial advisor, and it won’t tell you precisely what to buy or sell. That's not its job. Its job is to be an impartial, data-driven mirror, showing you an unbiased reflection of your own investment strategy.

It successfully bridges the gap between overly simplistic brokerage dashboards and terrifyingly complex financial software. It empowers you with knowledge, highlights potential blind spots, and does it all with a user-friendly interface and a dash of personality.

Will it replace my beloved, monstrous spreadsheet? It just might. Or at the very least, it's going to become its new best friend and trusted consultant.

Frequently Asked Questions

Is Insightfolio safe to use with my financial data?

Yes. You're not connecting your brokerage accounts yet, so you're only inputting ticker symbols and allocations, not account numbers or passwords. The platform states it uses state-of-the-art encryption to protect the data you do provide.

Does Insightfolio give me financial advice?

No, and this is an important distinction. Insightfolio is an analysis tool, not a registered financial advisor. It provides data-driven insights and explanations but does not give buy or sell recommendations. It's designed to help you make more informed decisions, not to make decisions for you.

What kind of investments can I analyze?

Insightfolio supports a wide range of publicly traded stocks, ETFs, and mutual funds. Currently, it does not support cryptocurrencies or derivatives like options and futures.

How accurate is the 'Future Projection' feature?

The projection is based on a sound statistical model (Monte Carlo simulation) that uses historical data to model thousands of potential future outcomes. However, it is a projection, not a guarantee. Past performance and statistical models are not indicators of future results. Think of it as an educated guess on a massive scale.

Is the first report really free?

Yep. I went through the process myself. You can generate your first full portfolio analysis without entering any payment information. It’s a genuine free trial of their core product.

Who is behind Insightfolio?

Insightfolio is a product from a team that seems passionate about making investment analysis accessible. Their goal is to empower individual investors by translating complex data into actionable insights, helping them align their investments with their personal financial goals.