If you’re an investor, your inbox is probably a warzone. Mine is, and I’m just in the traffic game. I can only imagine the deluge of “THE NEXT BIG THING” pitch decks you get every single day. Sifting through it all can feel like panning for gold in a river of mud. You know there are nuggets in there, but the sheer volume of silt and noise is exhausting.

For years, the process has been a grind. Scouring LinkedIn, attending endless networking events (with questionable canapés), and relying on your existing network. It works, but it’s slow. And you always have that nagging feeling… what am I missing? What incredible startup is just outside my bubble?

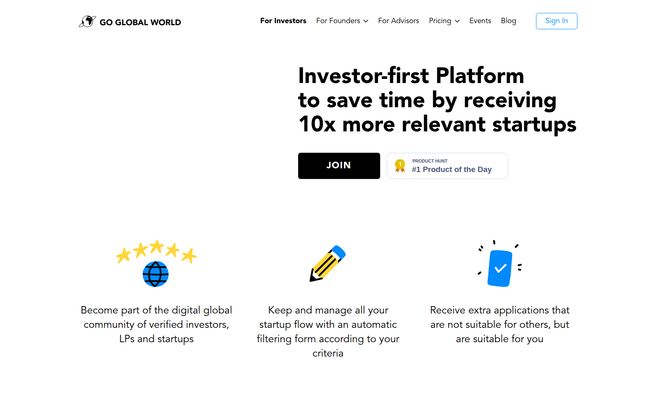

So when a platform pops up waving a big flag that says “AI-powered matchmaking,” my ears perk up. I’ve seen a lot of tools promise the world and deliver, well, a pamphlet. But Go Global World caught my eye. The claim? To use artificial intelligence to cut through the noise and deliver personalized, relevant startup deals right to your dashboard. A bold claim. Let’s see if they back it up.

The Headache of Modern Deal Flow

The core problem isn’t a lack of opportunities. It’s a lack of relevant ones. The classic spray-and-pray approach from founders means investors waste countless hours reviewing companies that are a terrible fit. Wrong stage, wrong industry, wrong geographical focus... you name it. It's a massive time sink, and in the world of venture capital, time is literally money.

This is where the idea of a curator, a sort of digital sommelier for startups, becomes so appealing. Something that understands your taste and only brings you the good stuff. That’s the space Go Global World is trying to own.

So, What is Go Global World, Anyway?

At its heart, Go Global World is a SaaS platform that acts as a bridge between investors and startups. But instead of just being a big, dumb database, it uses AI to make intelligent connections. Think of it less like a chaotic public market and more like a members-only club where a very smart concierge introduces you to people you’ll actually want to talk to.

The platform gets you to lay out your investment thesis—your target industries, funding stages, ticket sizes, and so on. The AI then churns through its network of vetted startups and serves up the ones that fit your specific criteria. The goal is to turn that firehose of deal flow into a manageable, high-quality stream.

How It Actually Works: The Core Features

It all sounds good in a press release, but what are you actually doing on the platform? Here’s the breakdown as I see it.

Your Personal Investment Thesis, Digitized

The whole thing starts with your profile. This isn't just a bio and a headshot. It’s a detailed breakdown of your investment criteria. The more specific you are here, the better the AI can do its job. It’s the foundational step, and from what I can tell, the platform really pushes you to be thorough. A half-baked profile will likely lead to half-baked matches.

The AI Matchmaker

This is the secret sauce. Once your profile is set, the system’s algorithms get to work. It automates the filtering process, screening startup applications and pushing the most relevant ones your way. You get a curated list of potential investments, saving you from that initial, soul-crushing triage of a thousand pitch decks. It’s about increasing the signal and dramatically reducing the noise.

Visit Go Global World

Keeping Track of It All

Anyone who's managed deal flow in a spreadsheet knows the pain. Go Global World includes a deal flow analytics dashboard. You can track your connections, follow startups to get updates, and see your pipeline in one place. It’s a much-needed organizational layer that a lot of investors try to build themselves with a messy combination of Trello, Excel, and sticky notes.

A Global Rolodex

The platform boasts a network of over 5,000 angels, VCs, corporate VCs, and family offices. For investors on the paid plans, this isn't just about finding startups; it's about connecting with other investors for co-investing opportunities or just expanding your network beyond your usual circles. They even have a Slack community, which is a nice touch for more informal networking.

What I Really Think: The Good, The Bad, and The Nitty-Gritty

Okay, let's get down to it. No platform is perfect. Here's my honest take.

On the plus side, the value proposition is crystal clear: time savings and relevance. In my world of SEO and traffic, I pay for tools that automate tedious work and surface key insights all the time. It’s a no-brainer. The same logic applies here. The time you save by not having to vet 100 irrelevant companies to find one good one is probably worth the subscription price alone. Access to a verified network is also a huge plus. It adds a layer of credibility that you just don't get from a cold email.

However, it’s not a magic wand. You need to put in the work to create a complete and accurate profile. If you're lazy with your criteria, don't be surprised if you get subpar matches. Some might also balk at a subscription model, but I've always been a firm believer that if you're not paying for the product, you are the product. The fee helps ensure a higher quality of user on both sides of teh marketplace. Also, it's worth noting some features are still being developed, so you're buying into a platform that's still growing.

Let's Talk Money: Go Global World Pricing

Pricing is always a big question, so here’s the scoop. They have a classic tiered approach for investors, which I've pulled from their plans page. It seems pretty straightforward.

| Plan | Price | Key Features |

|---|---|---|

| SCOUT | Free | Set up a profile, get limited matchmaking (10 connects/saves per day), access the dashboard, and direct messaging. A great way to test the waters. |

| INVESTOR | $249/mo (billed yearly) or $349/mo (billed monthly) | Everything in SCOUT, plus: Unlimited matchmaking and directory access, a verified badge for credibility, features in their newsletter, and access to an additional 5000+ investor network. |

| PREMIUM | Contact for Price | Everything in INVESTOR, plus: A dedicated personal manager who tailors your profile and handpicks deals for you. This is the white-glove service. |

My take? The SCOUT plan is a perfect free trial. You can kick the tires and see if you like the quality of the matches. But for any serious angel or VC, the INVESTOR plan is where the real value is. The unlimited connections and access to the expanded network are the whole point. The PREMIUM plan is likely for family offices or investment firms that want to essentially outsource their initial deal sourcing.

Who Is This Platform Really For?

This is for the investor who is data-driven and values efficiency. If you’re an Angel Investor, a partner at a VC firm, or managing a Family Office, and your biggest bottleneck is the sheer volume of inbound pitches, this is built for you. It’s for people who would rather spend their time on due diligence and building relationships with promising founders than on the administrative grind of sourcing.

Who isn't it for? Probably the old-school investor who genuinely loves the thrill of the chase—the serendipity of meeting a founder at a random coffee shop. There's nothing wrong with that, but this is a tool for a different, more systematic approach.

My Final Verdict

In an industry flooded with noise, Go Global World feels like a genuine attempt to create signal. It’s not just another list; it’s a smart system designed to respect an investor's most valuable asset: their time. The use of AI to personalize deal flow isn't just a gimmick; it’s a logical evolution for the venture capital space.

Is it a guaranteed path to finding a unicorn? Of course not. Investing will always involve risk, intuition, and deep diligence. But it can seriously stack the odds in your favor by making sure you're spending your time looking at the right opportunities. For me, that’s a powerful proposition.

Frequently Asked Questions

- What's the real difference between this and just using LinkedIn Premium?

- LinkedIn is a professional social network; Go Global World is a dedicated, curated investment platform. The key difference is the AI matchmaking and the verification process. GGW actively filters and suggests deals based on your thesis, whereas LinkedIn is a much more manual search-and-discover process.

- Is the 'INVESTOR' plan really worth the monthly fee?

- In my opinion, yes, if you're an active investor. Calculate the hours you spend each month sifting through irrelevant pitches. If the platform saves you even 5-10 hours a month, it has likely paid for itself. The access to the expanded, verified network is a significant bonus.

- What happens if my profile isn't complete or is inaccurate?

- Your results will suffer. The AI is only as good as the data you give it. An incomplete or inaccurate profile will lead to poor matches. The platform may even reject access if the profile isn't up to snuff, which is their way of maintaining quality in the network.

- What are the “GGW Sharks” Demo Days?

- From what I've seen, this looks like their version of a live pitch event, similar to a mini Shark Tank. It gives selected startups a chance to pitch directly to a panel of investors from the GGW community, offering a more dynamic way to see companies in action.

- How global is the network really?

- While I don't have exact geographical stats, the platform's name and mission are centered on being global. It aims to break down geographical barriers, connecting, for example, a US investor with a promising startup in Eastern Europe that they would have otherwise never found.

Is It Time to Let AI Co-Pilot Your Investments?

Look, the world of investing is changing. The lone wolf scouring the plains for deals is a romantic image, but it's not always the most effective. Tools that introduce efficiency, data, and intelligent filtering are the future. Go Global World seems to be a strong contender in this new era. It won’t make the tough decisions for you, but it might just put the right decision on your desk in the first place.