No one, and I mean no one, enjoys the manual slog of digging through SEC filings. It’s a rite of passage for every analyst, investor, and finance student. The late nights, the gallons of coffee, the endless CTRL+F search for that one tiny footnote buried in a 200-page 10-Q that could change everything. It’s tedious. It’s soul-crushing. And it’s a part of the job I’ve always wished a robot would just do for me.

Well, it seems someone was listening. I've been seeing more and more AI-powered tools pop up, all promising to make our lives easier. Most are… okay. They scrape data, but they lack context. They find numbers, but they don't understand the story. So when I stumbled upon FinDataQuest, which claims to use ChatGPT for both data and context, my inner cynic and my inner tech nerd got into a heated debate. I had to give it a try.

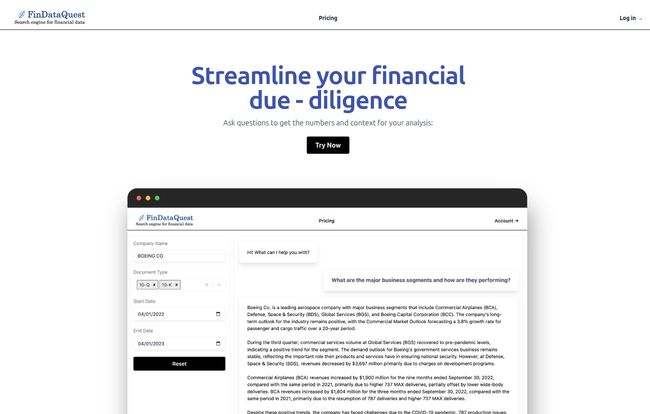

So What Exactly is FinDataQuest?

Think of it as a specialized search engine for corporate filings. But instead of just typing in keywords and getting a list of documents, you ask it a question like you would a human assistant. For instance, you could ask, "What were Boeing's major business segments and their performance last year?" and instead of just pointing you to the 10-K, it reads it for you and spits out a summarized answer.

It's built on top of ChatGPT, which gives it that natural language processing power. The whole idea is to streamline financial due diligence—to get you the numbers and the narrative behind them without you having to go full-on detective mode in a PDF. It’s a pretty compelling pitch, I have to admit.

A Quick Spin: My First Financial Query

The interface is clean. Almost deceptively simple. You plug in a company name (I used Boeing Co., just like in their demo), select the document type (like 10-K or 10-Q), and a date range. Then, the magic box: "What can I help you with?"

I asked it a pretty straightforward question about business segments. The response came back in seconds. It broke down Boeing’s main divisions—Commercial Airplanes (BCA), Defense, Space & Security (BDS), and Global Services (BGS)—and even gave a brief summary of their performance, citing challenges like the 737 MAX grounding and the impact of COVID-19.

Visit Findataquest

But here’s the part that really caught my attention. Below the summary, it listed the sources with links directly to the filings. And—get this—a button to "Download financial data below". This is the good stuff. The ability to pull tabular data directly into an Excel sheet is, frankly, a game-changer for anyone who's ever had to manually copy-paste tables from a PDF. We’ve all been there, and it’s a special kind of misery.

The Real-World Usefulness of FinDataQuest

Where It Absolutely Shines

The speed is the first thing that hits you. What would have taken me at least 15-20 minutes of scanning and reading, FinDataQuest did in about 15 seconds. It's a fantastic tool for getting a quick overview of a company you're not familiar with. It's like having a junior analyst on standby 24/7.

I’ve always felt the true story of a company lies in the blend of numbers and narrative. This tool gets that. It pulls both quantitative and qualitative info. You can ask for revenue figures for a specific segment and then follow up with, "What are the main risks cited by management?" That contextual switching is powerful. The direct Excel download is just the cherry on top, saving you from the mind-numbing task of data entry.

The Big Caveat: The AI in the Room

Okay, let's not get carried away. As cool as this is, it's still an AI. Its effectiveness is completely tethered to the quality of ChatGPT's responses and its interpretation of the source material. We've all seen AI go off the rails and 'hallucinate' facts. For financial analysis, that's not just a funny quirk; it's a catastrophic flaw.

This is where your own expertise has to come in. You cannot, and should not, blindly trust the output. Think of FinDataQuest as an incredibly efficient research assistant, not the final word. The fact that it provides source links is its saving grace. My personal workflow would be: ask the question, get the AI summary, then immediately click the source link to verify the information. Always. Check. The. Source. Some might argue that this extra step negates the time saved, but in my experience, knowing where to look is half the battle. This tool points you directly to the right page, and that alone is a huge win.

How Much Does This AI Assistant Cost?

This is where things get interesting. FinDataQuest operates on a message-based credit system. As of right now, their pricing is pretty straightforward:

- Free: You get 20 messages for $0. A great way to kick the tires and see if it fits your workflow.

- Basic: $10 for 40 messages.

- Standard: $50 for 225 messages.

- Premium: $100 for 500 messages.

Now for the quirky part. The paid plans—Basic, Standard, and Premium—are all listed as "Coming Soon." So right now, everyone is on the free plan. My advice? Jump on it while you can. Get your 20 free queries and put it through its paces. It's a no-risk way to see if this kind of tool could make a dent in your workload.

Is FinDataQuest the Future of Financial Research?

Look, tools like this aren't going to replace skilled financial analysts. Not by a long shot. The critical thinking, the strategic insight, the ability to read between the lines of management's carefully crafted prose—that's still a human skill. At least for now.

But what it will do is change the nature of our work. It automates the grunt work. It’s a force multiplier. It frees up our time from the tedious data-gathering phase and allows us to spend more time on what actually matters: analysis, interpretation, and strategy. It turns the initial research phase from a multi-hour slog into a 15-minute sprint. And for that, I am incredibly grateful.

My Final Thoughts

FinDataQuest is a promising, genuinely useful tool that I'll be keeping a close eye on. It’s not perfect, and the reliance on AI means you have to keep your guard up. But as a way to rapidly accelerate the most boring part of financial analysis, it’s a clear winner. It’s a prime example of AI being used not to replace us, but to make us better, faster, and more efficient at our jobs.

It's definitely worth signing up for the free account. Go ahead, ask it a tough question about your favorite stock. The worst that can happen is you save yourself a few hours of tedious reading.

Frequently Asked Questions about FinDataQuest

- Is the information from FinDataQuest accurate?

- It's as accurate as the source document and ChatGPT's ability to interpret it. The tool is designed to summarize information from official filings. However, because it's an AI, you should always use the provided source links to verify the data before using it in any serious analysis.

- Can I use FinDataQuest for private companies or international stocks?

- Currently, the tool appears to focus on publicly traded U.S. companies that file with the SEC (e.g., 10-Ks, 10-Qs). It's not designed for private companies or most international firms that don't file with the SEC.

- How does this compare to a Bloomberg Terminal or Refinitiv Eikon?

- They are different beasts. A Bloomberg Terminal is a comprehensive, institutional-grade data firehose with endless functionality that costs thousands per year. FinDataQuest is a highly specialized, affordable tool designed to do one thing very well: quickly query and summarize information from specific documents using natural language. It's a scalpel, not a Swiss Army knife.

- What happens when I run out of my 20 free messages?

- Once you've used your 20 free messages, you'll need to upgrade to a paid plan to continue using the service. Since the paid plans are currently listed as "Coming Soon," you'll have to wait until they are officially launched.

- Is my data and my queries private?

- As with any online tool, especially one using a third-party AI like ChatGPT, you should be mindful of privacy. It's always a good practice to review the platform's privacy policy and avoid inputting sensitive or proprietary information. For general research on public filings, it should be fine.