How many Saturday mornings have you lost staring at a QuickBooks report, eyes glazing over, wondering what the heck it all really means for your business? I’ve been there. You see the numbers—revenue, expenses, profit—but the story behind them? The 'why'? That's a whole other beast. You know you should be making strategic, data-driven decisions, but most of the time you're just trying to keep the ship from hitting an iceberg you can't even see.

For years, the answer was to hire a pricey fractional CFO or spend a fortune on consulting. But the tech world is always churning, and lately, the buzz is all about AI. I've seen a dozen platforms promising to revolutionize business finance, and frankly, most are just prettier spreadsheets. So when I came across Financial Fusion, my inner skeptic raised an eyebrow. An "AI-Powered CFO" in a box? Sure. But I decided to pop the hood and see what’s really going on. And I have to say, I'm intrigued.

What Exactly is Financial Fusion, Anyway?

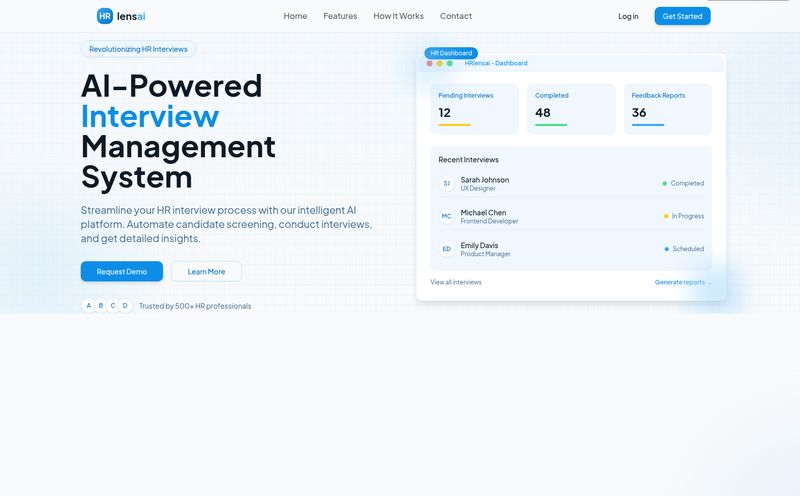

Let's get this out of the way: Financial Fusion isn't just another dashboard that shows you your profit and loss. The idea here is to act as a financial co-pilot. It connects directly to your accounting software (the usual suspects like QuickBooks, Xero, and Sage are all there) and instead of just spitting numbers back at you, it uses AI to interpret them. Think of it less as a calculator and more as a translator—it translates your raw financial data into plain English and, more importantly, into actionable advice.

It’s designed to spot trends, highlight what’s working, and flag what’s not. So instead of you needing to be a financial wizard to spot a worrying cash flow trend three months out, the platform is built to tap you on the shoulder and say, “Hey, look at this.” That’s the promise, at least.

My First Impressions and the 5-Minute Setup Promise

The website claims you can get set up in under five minutes. This is a bold claim in a world where "quick setup" can often mean a three-hour technical support call. But the process they lay out is dead simple: connect your accounting platform, run the AI CFO report, and get your insights. For any small business owner, accountant, or franchise manager, the idea of ditching manual data entry is a dream. The biggest bottleneck in financial analysis has always been getting clean data into the system. By integrating directly, Financial Fusion sidesteps that whole mess.

Visit Financial Fusion

This seamless integration is probably its most critical feature. If you have to export CSVs and manually upload them, the tool is dead on arrival for 90% of business owners. The fact that it plays nice with the major accounting players is a massive green flag for me.

The Core Features That Actually Matter

A platform is only as good as its features. So what's Financial Fusion packing under the hood?

The AI-Powered CFO Feature

This is the headline act. The "AI CFO" isn't just a marketing gimmick; it's the core of the product. It generates AI-driven recommendations and provides insights you might expect from a human analyst. It looks at your performance and provides suggestions for strategic moves. I've always felt that the best tech doesn't just give you data; it gives you direction. This feature aims to do just that, moving you from reactive problem-solving to proactive strategy. It’s a pretty big leap from just looking at a balance sheet.

Deep Dives with Comprehensive Reviews

The platform offers a thorough financial review, digging into your income statement, balance sheet, and cash flow statements. But it presents them in a way that’s easy to digest with visual charts and clear summaries. It tells you what’s good, what needs work, and what the clear next steps should be. This is where the magic is supposed to happen—transforming complex financial statements into a clear, understandable health check for your business.

Seamless Integration (Without the Headaches)

I mentioned it before, but it's worth repeating. The ability to hook directly into QuickBooks, Xero, and Sage is huge. This ensures the data is timely and accurate without you having to lift a finger. It also speaks to security and reliability, which are non-negotiable when you’re dealing with sensitive financial information. Any tool that saves me from spreadsheet hell gets a gold star in my book.

Who is This Tool Really For?

Financial Fusion is clearly targeting a few key groups: Small and Medium Businesses (SMBs), Accountants, and Franchises. And it makes sense.

- For SMBs, it’s like getting access to a high-level financial strategist without the six-figure salary.

- For Accountants, this could be a powerhouse tool for client management. Imagine being able to generate these in-depth, actionable reports for all your clients in minutes. It adds a ton of value to your service.

- For Franchises, it offers a standardized way to monitor the financial health of multiple locations, spot outliers, and share best practices.

In my opinion, the sweet spot is for the business owner who is ambitious and growth-focused but isn't a financial expert themself. They know they need better insights but don’t have the time or expertise to dig them out of raw data.

The Good, The Bad, and The Bottom Line

No tool is perfect. Let's weigh the pros and cons based on what we can see. As Alex J., a small business owner quoted on their site, says, "The transformative insights have democratized our financial decision-making." That really gets to the heart of the good stuff. This tool can make high-level financial strategy accessible. The time-saving aspect is undeniable, and the reports are designed to be immediately useful, not just filed away.

However, there are a few potential hurdles. The biggest one is that the insights are only as good as the data you feed it. If your bookkeeping is a disaster zone, Financial Fusion isn't a magic wand; it's a mirror reflecting that chaos. Garbage in, garbage out, as they say. There might also be a slight learning curve for users who are completely new to financial metrics, though the tool seems designed to minimize this. And, of course, it’s a SaaS platform, which almost certainly means a recurring subscription fee.

What's the Damage? A Look at Financial Fusion's Pricing

This is the million-dollar question, isn't it? As of writing this, the website doesn't have a public pricing page. This is a common strategy for B2B SaaS companies, often indicating that pricing is tailored to the business size, number of users, or specific needs. It could mean a tiered subscription model (e.g., Basic, Pro, Enterprise) or a custom quote after a demo. While I always prefer transparent pricing, the lack of it suggests you'll need to reach out to their team directly for a number. My advice? Go into the demo with a clear idea of your budget and needs.

My Final Verdict: Is Financial Fusion Worth a Shot?

So, what's my final take? I’m cautiously optimistic. In an industry flooded with so-called 'smart' tools, Financial Fusion appears to be tackling a genuine, painful problem for businesses. It’s not just about data visualization; it’s about interpretation and action. It’s for the business owner who wants to graduate from guessing to knowing.

Is it going to replace a seasoned human CFO? No, and it doesn't claim to. But can it serve as an incredibly powerful, affordable, and insightful co-pilot to guide your financial strategy? Absolutely. For the right business, a tool like this could be the difference between stagnating and scaling. If you feel like you're flying blind with your finances, getting a demo of Financial Fusion seems like a no-brainer.

Frequently Asked Questions (FAQs)

So what is Financial Fusion in simple terms?

Think of it as an intelligent layer on top of your accounting software. It takes all your financial data and uses AI to give you actionable advice, find hidden trends, and help you make smarter business decisions without you needing a degree in finance.

How does the AI CFO feature actually work?

It analyzes your P&L, balance sheet, and cash flow data to identify patterns, strengths, and weaknesses. Then, instead of just showing you a chart, it generates written recommendations and strategic insights, much like a human financial consultant would.

Is my financial data secure with Financial Fusion?

While you should always check the latest security protocols of any financial tool, its integration with major, trusted platforms like QuickBooks and Xero implies a strong focus on security and data protection using modern encryption and security standards.

What accounting software can I connect to Financial Fusion?

The platform seamlessly integrates with the big three: QuickBooks, Xero, and Sage. This covers a huge portion of the small and medium business market.

Will this tool replace my human accountant?

Nope. It’s a tool to empower you and your accountant. It automates the heavy lifting of data analysis, freeing up your accountant to focus on higher-level strategic advice, tax planning, and compliance. It makes your human experts even more efficient.

How long does it really take to get the first insights?

According to Financial Fusion, the setup and initial report generation can be done in under 5 minutes. Once your accounting software is connected, the AI can run its analysis very quickly, providing you with your first comprehensive report almost instantly.

Conclusion

Look, navigating business finance is tough. Tools like Financial Fusion represent a significant shift, putting the power of AI-driven analysis into the hands of business owners who need it most. It’s about moving beyond just seeing your numbers to truly understanding them. If you’re ready to stop guessing and start building a more predictable, profitable business, exploring a tool like this is a very smart move. It might just be the clarity you’ve been looking for.

Reference and Sources

- Financial Fusion Official Website - All information and images were sourced directly from the platform's homepage.